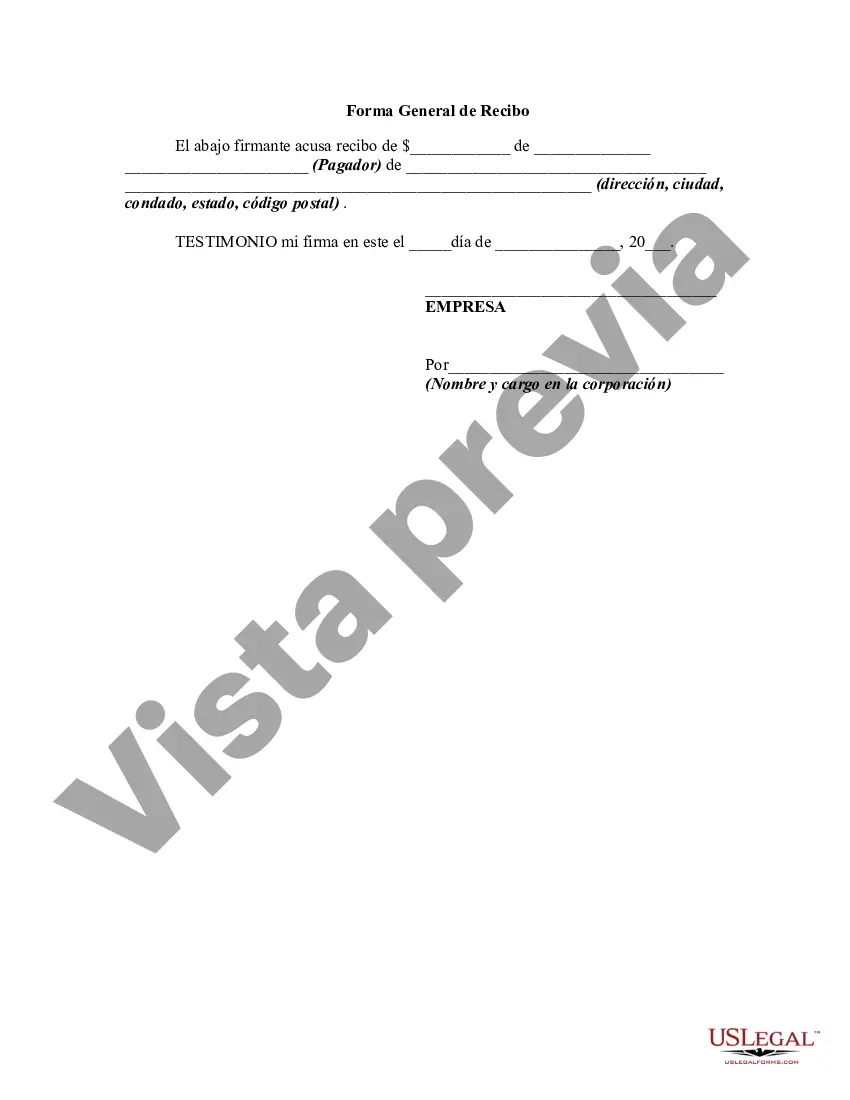

The Texas General Form of Receipt is a document commonly used in Texas for various purposes, serving as evidence of a transaction or exchange of goods or services. It is a legal document confirming that the payment or consideration has been made by one party and received by another. Key elements of the Texas General Form of Receipt include: 1. Heading: The receipt typically contains the title "General Form of Receipt" or "Receipt" at the top, clearly indicating its purpose. 2. Date and Location: The date of the transaction and the location where the receipt was issued are mentioned to ensure accuracy and reference. 3. Parties Involved: The receipt names the parties involved, identifying the person or organization making the payment (payer) and the person or organization receiving the payment (payee). 4. Details of the Transaction: The goods, services, or other consideration for which the payment is made must be clearly described in the receipt. It includes relevant information such as quantity, description, price, and any additional charges or discounts if applicable. 5. Payment Information: The receipt provides details about the payment made, including the payment method (cash, credit card, check, etc.), the amount received, any partial payments, and the currency used. 6. Signatures: Signatures of both the payer and the payee are essential to validate the receipt. This ensures that both parties acknowledge the transaction and their agreement on the specified terms. 7. Additional Terms and Conditions: Sometimes, the receipt may include specific terms and conditions pertaining to the transaction, such as warranties, return policies, or disclaimers, which are deemed necessary by the parties involved. Different types of Texas General Form of Receipt may include: 1. Sales Receipt: Used in retail businesses to confirm the purchase of goods or services by a customer. It details the items purchased, their prices, any taxes or discounts, and the total amount paid. 2. Rental Receipt: Provided by landlords or property managers to tenants as proof of payment for rent. It typically includes the due date, rental period covered, and any additional charges or deductions. 3. Service Receipt: Given by service providers such as plumbers, contractors, or repair technicians upon completion of their services. It includes details about the services performed, hours spent, rates, and any materials used or supplied. 4. Donation Receipt: Used by charitable organizations to acknowledge donations made by individuals or companies for tax or record-keeping purposes. It provides evidence of the contribution, including the amount, date, and the nonprofit organization's information. 5. Payment Receipt: Used in various scenarios where payment is made, such as settling debts, loans, or invoices. It states the purpose of payment, the amount paid, and any relevant details to facilitate accurate record-keeping. In conclusion, the Texas General Form of Receipt is a crucial document used to confirm transactions in various fields. Its flexibility allows it to adapt to different purposes, such as sales, rentals, services, donations, and payments. Complying with legal standards, it provides a comprehensive record of transactions for accountability and reference purposes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Forma General de Recibo - General Form of Receipt

Description

How to fill out Texas Forma General De Recibo?

You may invest several hours online attempting to find the legitimate papers format that suits the state and federal specifications you will need. US Legal Forms supplies a large number of legitimate varieties which are examined by pros. It is simple to obtain or produce the Texas General Form of Receipt from our assistance.

If you currently have a US Legal Forms bank account, it is possible to log in and then click the Acquire button. Following that, it is possible to total, revise, produce, or sign the Texas General Form of Receipt. Each legitimate papers format you acquire is your own property forever. To get one more copy of any acquired form, check out the My Forms tab and then click the related button.

Should you use the US Legal Forms web site initially, stick to the easy directions below:

- Initially, be sure that you have selected the proper papers format for that state/city of your liking. Read the form explanation to make sure you have picked the right form. If offered, take advantage of the Preview button to appear through the papers format as well.

- If you want to locate one more model of your form, take advantage of the Research field to get the format that fits your needs and specifications.

- Once you have located the format you need, just click Purchase now to proceed.

- Choose the prices prepare you need, enter your credentials, and register for your account on US Legal Forms.

- Full the transaction. You can utilize your bank card or PayPal bank account to pay for the legitimate form.

- Choose the format of your papers and obtain it to the product.

- Make alterations to the papers if possible. You may total, revise and sign and produce Texas General Form of Receipt.

Acquire and produce a large number of papers themes utilizing the US Legal Forms site, which provides the biggest variety of legitimate varieties. Use expert and express-distinct themes to tackle your small business or personal needs.