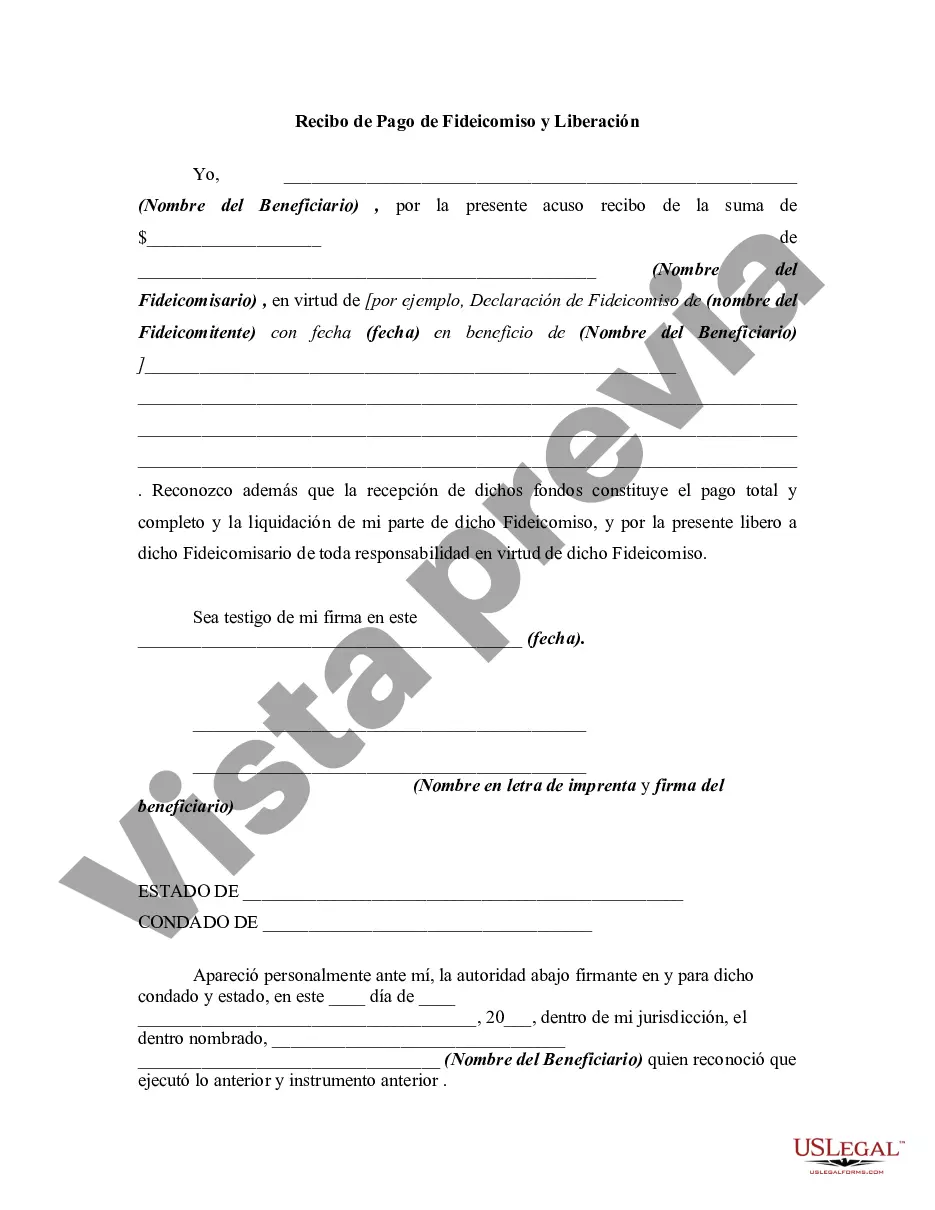

In this form, the beneficiary of a trust acknowledges receipt from the trustee of all monies due to him/her pursuant to the terms of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding Texas Receipt for Payment of Trust Fund and Release: Types and Explanation Introduction: The Texas Receipt for Payment of Trust Fund and Release is a crucial legal document used in a variety of financial and contractual transactions. This detailed description aims to provide clarity on the purpose, importance, and various types of Receipt for Payment of Trust Fund and Release documents commonly used in Texas. 1. Texas Receipt for Payment of Trust Fund and Release Explained: The Texas Receipt for Payment of Trust Fund and Release is a legally binding instrument that confirms the full and final discharge of a debt or obligation. It acts as evidence that a specified amount of money, assets, or property held in trust has been paid or released to the designated recipient, effectively releasing the payer from any further claims related to the payment. 2. Types of Texas Receipt for Payment of Trust Fund and Release: a. General Receipt for Payment of Trust Fund and Release: This type of receipt is used in situations where a trust fund is established to hold funds on behalf of beneficiaries. Upon fulfilling the terms of the trust, this receipt confirms the successful payment and release of funds to the entitled recipient(s). b. Construction Receipt for Payment of Trust Fund and Release: Commonly used in the construction industry, this receipt acknowledges the full payment of funds from a construction trust account to subcontractors, suppliers, or other parties involved in a construction project, ensuring their release from future claims. c. Real Estate Receipt for Payment of Trust Fund and Release: When purchasing real estate, this receipt ensures the payment and release of trust funds held by an escrow agent or attorney, guaranteeing that the appropriate funds have been disbursed to complete the real estate transaction. d. Legal Settlement Receipt for Payment of Trust Fund and Release: In legal settlements, this type of receipt documents the payment and release of trust funds to claimants, ensuring that the agreed-upon settlement has been fulfilled and releasing both parties from further financial claims. 3. Key Components of a Texas Receipt for Payment of Trust Fund and Release: a. Identification: The receipt should clearly state the names, addresses, and contact details of both the payer and the recipient. b. Date and Amount: The receipt must mention the date of payment and specify the exact amount or nature of assets transferred to the assignee. c. Trust Fund Details: If the payment is associated with a specific trust fund, it should provide a brief explanation of the trust and its purpose. d. Release Clause: The document should include a release clause stating that the payment releases the payer from any future claims related to the transaction. e. Signatures and Witnesses: The receipt should be signed by both parties involved in the transaction, with the inclusion of witness signatures if required by law. Conclusion: The Texas Receipt for Payment of Trust Fund and Release is an integral legal document that confirms the successful payment and release of trust funds, discharging the payer from any further claims. By understanding the various types and key components of these receipts, individuals and entities can ensure compliance with Texas law when engaging in financial transactions involving trust funds.Title: Understanding Texas Receipt for Payment of Trust Fund and Release: Types and Explanation Introduction: The Texas Receipt for Payment of Trust Fund and Release is a crucial legal document used in a variety of financial and contractual transactions. This detailed description aims to provide clarity on the purpose, importance, and various types of Receipt for Payment of Trust Fund and Release documents commonly used in Texas. 1. Texas Receipt for Payment of Trust Fund and Release Explained: The Texas Receipt for Payment of Trust Fund and Release is a legally binding instrument that confirms the full and final discharge of a debt or obligation. It acts as evidence that a specified amount of money, assets, or property held in trust has been paid or released to the designated recipient, effectively releasing the payer from any further claims related to the payment. 2. Types of Texas Receipt for Payment of Trust Fund and Release: a. General Receipt for Payment of Trust Fund and Release: This type of receipt is used in situations where a trust fund is established to hold funds on behalf of beneficiaries. Upon fulfilling the terms of the trust, this receipt confirms the successful payment and release of funds to the entitled recipient(s). b. Construction Receipt for Payment of Trust Fund and Release: Commonly used in the construction industry, this receipt acknowledges the full payment of funds from a construction trust account to subcontractors, suppliers, or other parties involved in a construction project, ensuring their release from future claims. c. Real Estate Receipt for Payment of Trust Fund and Release: When purchasing real estate, this receipt ensures the payment and release of trust funds held by an escrow agent or attorney, guaranteeing that the appropriate funds have been disbursed to complete the real estate transaction. d. Legal Settlement Receipt for Payment of Trust Fund and Release: In legal settlements, this type of receipt documents the payment and release of trust funds to claimants, ensuring that the agreed-upon settlement has been fulfilled and releasing both parties from further financial claims. 3. Key Components of a Texas Receipt for Payment of Trust Fund and Release: a. Identification: The receipt should clearly state the names, addresses, and contact details of both the payer and the recipient. b. Date and Amount: The receipt must mention the date of payment and specify the exact amount or nature of assets transferred to the assignee. c. Trust Fund Details: If the payment is associated with a specific trust fund, it should provide a brief explanation of the trust and its purpose. d. Release Clause: The document should include a release clause stating that the payment releases the payer from any future claims related to the transaction. e. Signatures and Witnesses: The receipt should be signed by both parties involved in the transaction, with the inclusion of witness signatures if required by law. Conclusion: The Texas Receipt for Payment of Trust Fund and Release is an integral legal document that confirms the successful payment and release of trust funds, discharging the payer from any further claims. By understanding the various types and key components of these receipts, individuals and entities can ensure compliance with Texas law when engaging in financial transactions involving trust funds.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.