An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Title: Understanding Texas Demand for Accounting from a Fiduciary: A Comprehensive Guide for Executors, Conservators, Trustees, and Legal Guardians Introduction: In Texas, individuals in fiduciary roles, including Executors, Conservators, Trustees, and Legal Guardians, owe a duty to provide an accounting of their financial activities and decisions to interested parties. This article aims to examine the concept of Demand for Accounting from a Fiduciary in Texas, its importance, relevant keywords, and explore different types of demands that may arise in such situations. Keywords: Texas Demand for Accounting, Fiduciary, Executor, Conservator, Trustee, Legal Guardian Understanding the Texas Demand for Accounting: Texas law recognizes that fiduciaries occupy positions of trust and must act in the best interests of those they represent. As such, the law provides remedies when beneficiaries or interested parties suspect mismanagement of assets, breach of fiduciary duty, or want transparency regarding financial activities. One such remedy is the Demand for Accounting. Demands for Accounting from a Fiduciary: 1. Executor Demand for Accounting: When an Executor administers an estate, beneficiaries may request an accounting of financial transactions, including assets, liabilities, income, and expenses. This demand helps ensure transparency and accountability throughout the probate process and provides beneficiaries with a clear understanding of how their interests are being managed. 2. Conservator Demand for Accounting: A Conservator is responsible for managing the financial affairs and assets of an incapacitated individual. Interested parties, such as family members or other stakeholders, may file a demand for accounting to ensure the Conservator is fulfilling their fiduciary duties and properly managing the individual's estate. 3. Trustee Demand for Accounting: Trustees hold legal title over trust assets and are obligated to manage them for the benefit of the trust's beneficiaries. Beneficiaries who suspect mismanagement, lack of transparency, or breach of fiduciary duty may demand an accounting to understand how the trust's assets have been handled and ensure the Trustee's compliance with their fiduciary obligations. 4. Legal Guardian Demand for Accounting: When an individual lacks the capacity to make personal and financial decisions, a Legal Guardian is appointed to protect their interests. Interested parties, such as family members or the court, may seek a demand for accounting from the Legal Guardian to confirm that they are acting in the incapacitated person's best interests and utilizing their assets appropriately. Conclusion: Demand for Accounting is a vital tool in Texas for beneficiaries and interested parties to hold fiduciaries accountable and foster transparency in financial dealings. Executors, Conservators, Trustees, and Legal Guardians must be aware of the potential demands they may face and understand their obligations in providing an accurate and comprehensive accounting to safeguard the best interests of the individuals they represent.Title: Understanding Texas Demand for Accounting from a Fiduciary: A Comprehensive Guide for Executors, Conservators, Trustees, and Legal Guardians Introduction: In Texas, individuals in fiduciary roles, including Executors, Conservators, Trustees, and Legal Guardians, owe a duty to provide an accounting of their financial activities and decisions to interested parties. This article aims to examine the concept of Demand for Accounting from a Fiduciary in Texas, its importance, relevant keywords, and explore different types of demands that may arise in such situations. Keywords: Texas Demand for Accounting, Fiduciary, Executor, Conservator, Trustee, Legal Guardian Understanding the Texas Demand for Accounting: Texas law recognizes that fiduciaries occupy positions of trust and must act in the best interests of those they represent. As such, the law provides remedies when beneficiaries or interested parties suspect mismanagement of assets, breach of fiduciary duty, or want transparency regarding financial activities. One such remedy is the Demand for Accounting. Demands for Accounting from a Fiduciary: 1. Executor Demand for Accounting: When an Executor administers an estate, beneficiaries may request an accounting of financial transactions, including assets, liabilities, income, and expenses. This demand helps ensure transparency and accountability throughout the probate process and provides beneficiaries with a clear understanding of how their interests are being managed. 2. Conservator Demand for Accounting: A Conservator is responsible for managing the financial affairs and assets of an incapacitated individual. Interested parties, such as family members or other stakeholders, may file a demand for accounting to ensure the Conservator is fulfilling their fiduciary duties and properly managing the individual's estate. 3. Trustee Demand for Accounting: Trustees hold legal title over trust assets and are obligated to manage them for the benefit of the trust's beneficiaries. Beneficiaries who suspect mismanagement, lack of transparency, or breach of fiduciary duty may demand an accounting to understand how the trust's assets have been handled and ensure the Trustee's compliance with their fiduciary obligations. 4. Legal Guardian Demand for Accounting: When an individual lacks the capacity to make personal and financial decisions, a Legal Guardian is appointed to protect their interests. Interested parties, such as family members or the court, may seek a demand for accounting from the Legal Guardian to confirm that they are acting in the incapacitated person's best interests and utilizing their assets appropriately. Conclusion: Demand for Accounting is a vital tool in Texas for beneficiaries and interested parties to hold fiduciaries accountable and foster transparency in financial dealings. Executors, Conservators, Trustees, and Legal Guardians must be aware of the potential demands they may face and understand their obligations in providing an accurate and comprehensive accounting to safeguard the best interests of the individuals they represent.

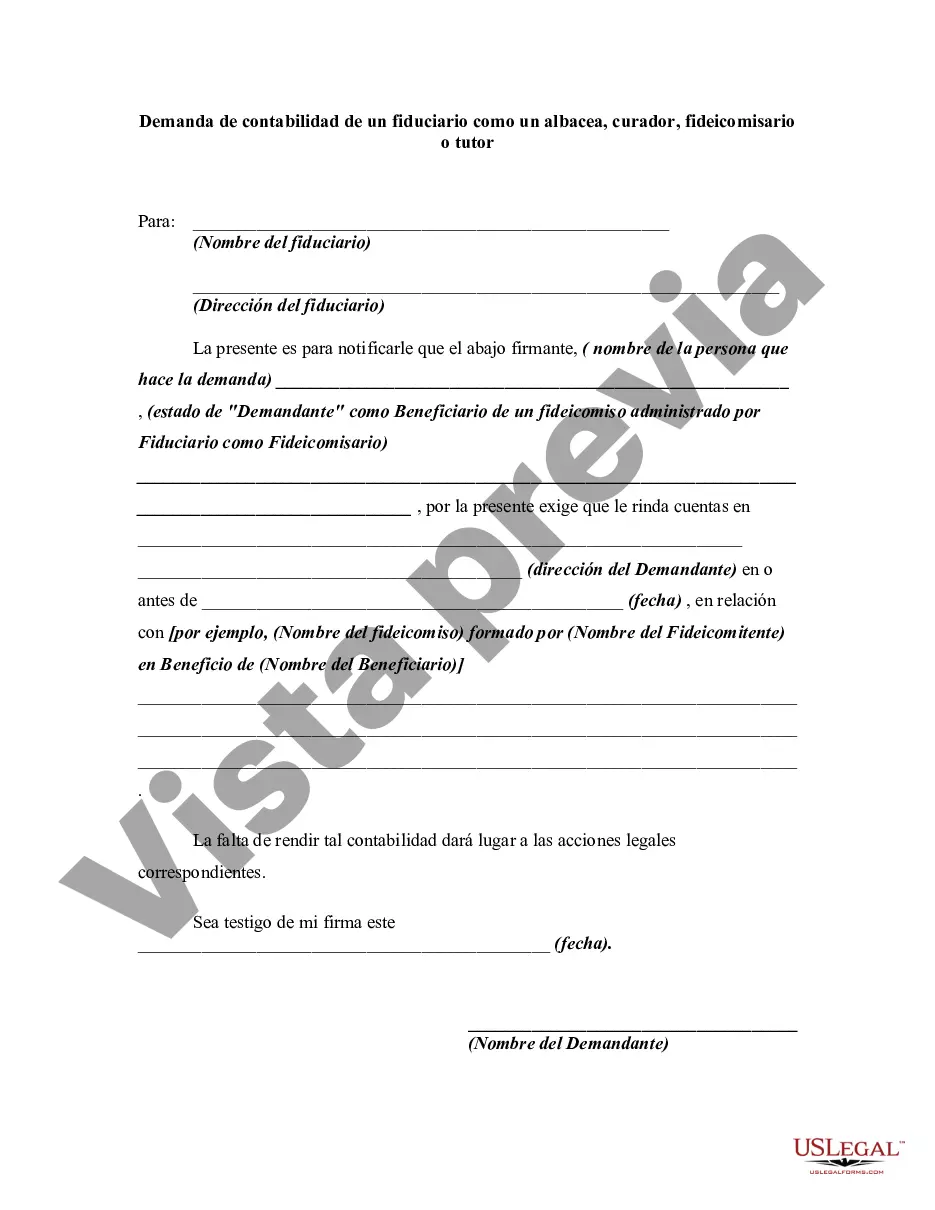

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.