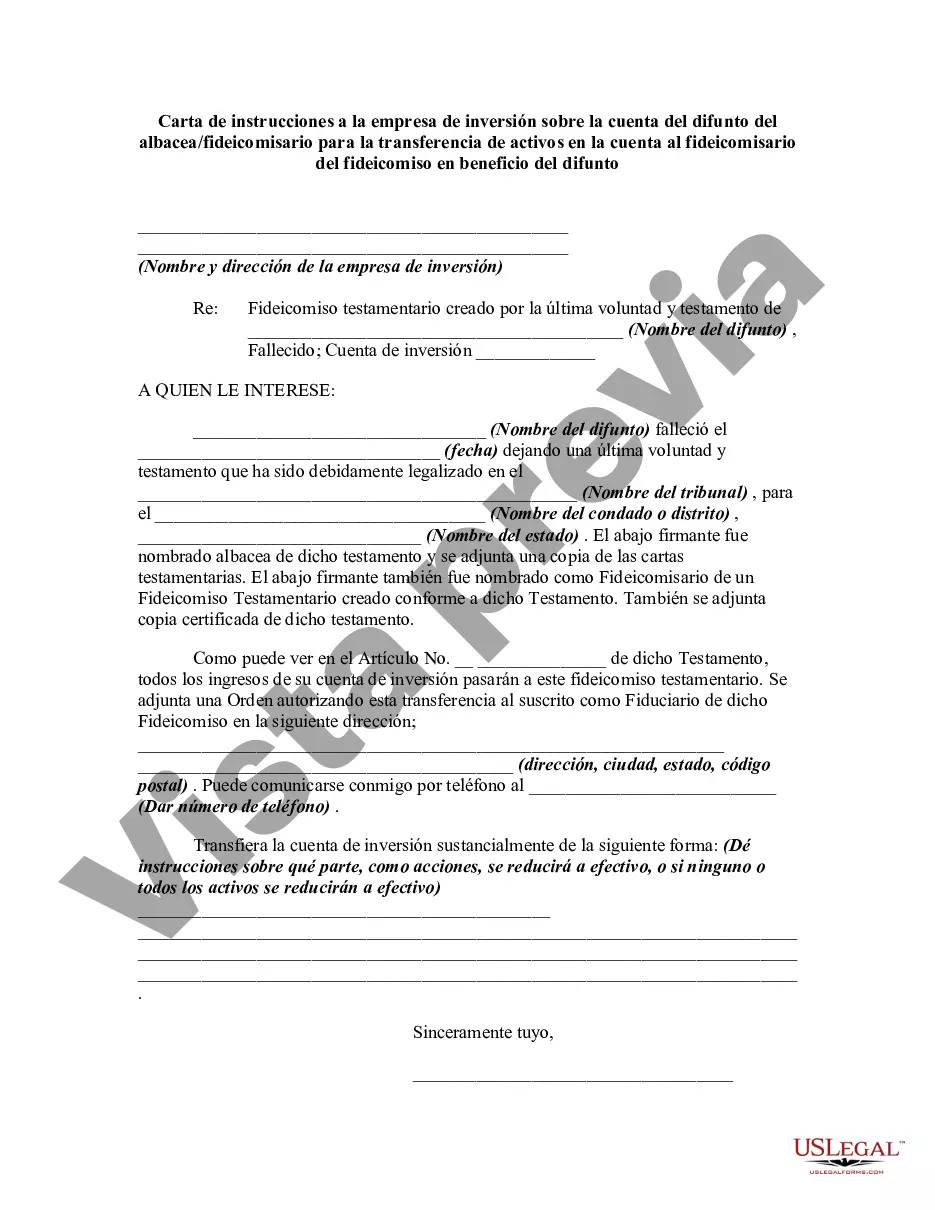

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

Title: Texas Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent Keywords: Texas, letter of instruction, investment firm, account of decedent, executor, trustee, transfer of assets, trust, benefit, different types Introduction: In Texas, when a loved one passes away, their assets and investments need to be handled and transferred appropriately. The Texas Letter of Instruction to an Investment Firm plays a crucial role in this process. This document acts as a clear and detailed guide for the executor or trustee to transfer the assets held in the account of the decedent to the trustee of the trust established for the benefit of the decedent. Let's explore the purpose, components, and potential variations of this important letter. Purpose of the Letter: The primary purpose of the Texas Letter of Instruction to an Investment Firm is to provide instructions to the investment firm handling the account of the deceased individual. It ensures that the executor or trustee can effectively and efficiently transfer the assets from the account of the decedent to the trustee of the trust. Components of the Letter: 1. Identification: — Executor/Trustee: Clearly state the full legal name, address, and contact information of the executor or trustee responsible for the transfer of assets from the account of the decedent. — Investment Firm: Provide the official name, address, and contact details of the investment firm managing the account. 2. Account Details: — Decedent's Account: State the full legal name of the deceased individual and provide their unique identifying account number held by the investment firm. — Trust Account: Specify the name of the trust established for the benefit of the decedent, along with the unique trust account number. 3. Instructions for Asset Transfer: — Asset List: Include a comprehensive list of assets held within the account, such as cash, stocks, bonds, mutual funds, or any other investments. — Transfer Direction: Clearly outline the steps required for the transfer of each asset to the designated trust account, highlighting any specific transfer instructions provided by the executor or trustee. 4. Legal Documentation: — Attachments: Enclose copies of legal documents necessary to validate the authority of the executor or trustee, such as the will, trust agreement, letters of administration, or any court orders relating to the administration of the decedent's estate. Different Types: While the general structure remains consistent, variations of the Texas Letter of Instruction may arise based on the specific circumstances, trust type, or investment firm requirements. Here are some potential types: 1. Letter of Instruction for Testamentary Trust: When the trust is established according to the terms specified in the deceased individual's will. 2. Letter of Instruction for Living Trust: If the trust is established during the individual's lifetime and remains revocable or irrevocable after their death. 3. Letter of Instruction for Special Needs Trust: In cases where the trust is designed to provide for the specific needs and care of a disabled beneficiary. 4. Letter of Instruction for Charitable Remainder Trust: If the trust is primarily aimed at supporting charitable organizations while providing for certain beneficiaries. Conclusion: The Texas Letter of Instruction to an Investment Firm plays a crucial role in facilitating the transfer of assets from an account held by a deceased individual to a trust created for their benefit. By providing a comprehensive set of instructions, this document ensures a smooth and accurate transfer process. Executors and trustees must customize the letter based on their specific circumstances, trust type, and investment firm requirements to ensure a legally compliant and successful transfer of assets.Title: Texas Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent Keywords: Texas, letter of instruction, investment firm, account of decedent, executor, trustee, transfer of assets, trust, benefit, different types Introduction: In Texas, when a loved one passes away, their assets and investments need to be handled and transferred appropriately. The Texas Letter of Instruction to an Investment Firm plays a crucial role in this process. This document acts as a clear and detailed guide for the executor or trustee to transfer the assets held in the account of the decedent to the trustee of the trust established for the benefit of the decedent. Let's explore the purpose, components, and potential variations of this important letter. Purpose of the Letter: The primary purpose of the Texas Letter of Instruction to an Investment Firm is to provide instructions to the investment firm handling the account of the deceased individual. It ensures that the executor or trustee can effectively and efficiently transfer the assets from the account of the decedent to the trustee of the trust. Components of the Letter: 1. Identification: — Executor/Trustee: Clearly state the full legal name, address, and contact information of the executor or trustee responsible for the transfer of assets from the account of the decedent. — Investment Firm: Provide the official name, address, and contact details of the investment firm managing the account. 2. Account Details: — Decedent's Account: State the full legal name of the deceased individual and provide their unique identifying account number held by the investment firm. — Trust Account: Specify the name of the trust established for the benefit of the decedent, along with the unique trust account number. 3. Instructions for Asset Transfer: — Asset List: Include a comprehensive list of assets held within the account, such as cash, stocks, bonds, mutual funds, or any other investments. — Transfer Direction: Clearly outline the steps required for the transfer of each asset to the designated trust account, highlighting any specific transfer instructions provided by the executor or trustee. 4. Legal Documentation: — Attachments: Enclose copies of legal documents necessary to validate the authority of the executor or trustee, such as the will, trust agreement, letters of administration, or any court orders relating to the administration of the decedent's estate. Different Types: While the general structure remains consistent, variations of the Texas Letter of Instruction may arise based on the specific circumstances, trust type, or investment firm requirements. Here are some potential types: 1. Letter of Instruction for Testamentary Trust: When the trust is established according to the terms specified in the deceased individual's will. 2. Letter of Instruction for Living Trust: If the trust is established during the individual's lifetime and remains revocable or irrevocable after their death. 3. Letter of Instruction for Special Needs Trust: In cases where the trust is designed to provide for the specific needs and care of a disabled beneficiary. 4. Letter of Instruction for Charitable Remainder Trust: If the trust is primarily aimed at supporting charitable organizations while providing for certain beneficiaries. Conclusion: The Texas Letter of Instruction to an Investment Firm plays a crucial role in facilitating the transfer of assets from an account held by a deceased individual to a trust created for their benefit. By providing a comprehensive set of instructions, this document ensures a smooth and accurate transfer process. Executors and trustees must customize the letter based on their specific circumstances, trust type, and investment firm requirements to ensure a legally compliant and successful transfer of assets.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.