The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

The Texas Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document used in Texas in cases where a debtor seeks to negotiate with a creditor in order to settle or eliminate a past due debt. This affidavit presents a comprehensive overview of the debtor's financial situation, including their assets and liabilities. In this affidavit, debtors are required to disclose all relevant information regarding their financial status to provide creditors with an accurate picture of their ability to repay the debt. The information provided in this document enables creditors to make an informed decision regarding whether to compromise or write off the debt. Some key details included in the Texas Debtor's Affidavit of Financial Status may include: 1. Personal Information: The debtor's full legal name, address, contact information, and any relevant identification numbers. 2. Employment and Income: A detailed summary of the debtor's current employment status, including their occupation, employer's name, and contact information. Additionally, the debtor must disclose their monthly income from all sources, such as salary, bonuses, commissions, and any other regular income. 3. Assets: A comprehensive list of all assets owned by the debtor, including real estate properties, vehicles, investments, bank accounts, retirement funds, valuable possessions, and any other valuable assets. This section often requires the debtor to provide detailed information about each asset, such as estimated value, outstanding loans or liens, and ownership details. 4. Liabilities: A thorough overview of all outstanding debts and financial obligations. This section includes information about mortgages, loans, credit card debts, medical bills, taxes owed, and any other liabilities. Debtors must disclose the current balance, monthly payments, interest rates, and payment terms for each liability. 5. Monthly Expenses: An itemized breakdown of the debtor's monthly expenses, including but not limited to rent or mortgage payments, utilities, transportation costs, healthcare expenses, insurance premiums, groceries, childcare, and any other regular expenses. The Texas Debtor's Affidavit of Financial Status aims to provide creditors with a clear understanding of the debtor's financial capabilities and limitations. By disclosing this information, debtors aim to persuade creditors to consider settling the past due debt for a compromised amount or potentially write off the debt entirely. It serves as a tool for negotiation and helps both parties reach a mutually beneficial agreement. It is important to note that there may be variations or different types of Texas Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities, as different creditors or legal situations may require additional information or specific formats. Debtors should consult with legal professionals or reference local guidelines to ensure the accuracy and compliance of their affidavit.The Texas Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document used in Texas in cases where a debtor seeks to negotiate with a creditor in order to settle or eliminate a past due debt. This affidavit presents a comprehensive overview of the debtor's financial situation, including their assets and liabilities. In this affidavit, debtors are required to disclose all relevant information regarding their financial status to provide creditors with an accurate picture of their ability to repay the debt. The information provided in this document enables creditors to make an informed decision regarding whether to compromise or write off the debt. Some key details included in the Texas Debtor's Affidavit of Financial Status may include: 1. Personal Information: The debtor's full legal name, address, contact information, and any relevant identification numbers. 2. Employment and Income: A detailed summary of the debtor's current employment status, including their occupation, employer's name, and contact information. Additionally, the debtor must disclose their monthly income from all sources, such as salary, bonuses, commissions, and any other regular income. 3. Assets: A comprehensive list of all assets owned by the debtor, including real estate properties, vehicles, investments, bank accounts, retirement funds, valuable possessions, and any other valuable assets. This section often requires the debtor to provide detailed information about each asset, such as estimated value, outstanding loans or liens, and ownership details. 4. Liabilities: A thorough overview of all outstanding debts and financial obligations. This section includes information about mortgages, loans, credit card debts, medical bills, taxes owed, and any other liabilities. Debtors must disclose the current balance, monthly payments, interest rates, and payment terms for each liability. 5. Monthly Expenses: An itemized breakdown of the debtor's monthly expenses, including but not limited to rent or mortgage payments, utilities, transportation costs, healthcare expenses, insurance premiums, groceries, childcare, and any other regular expenses. The Texas Debtor's Affidavit of Financial Status aims to provide creditors with a clear understanding of the debtor's financial capabilities and limitations. By disclosing this information, debtors aim to persuade creditors to consider settling the past due debt for a compromised amount or potentially write off the debt entirely. It serves as a tool for negotiation and helps both parties reach a mutually beneficial agreement. It is important to note that there may be variations or different types of Texas Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities, as different creditors or legal situations may require additional information or specific formats. Debtors should consult with legal professionals or reference local guidelines to ensure the accuracy and compliance of their affidavit.

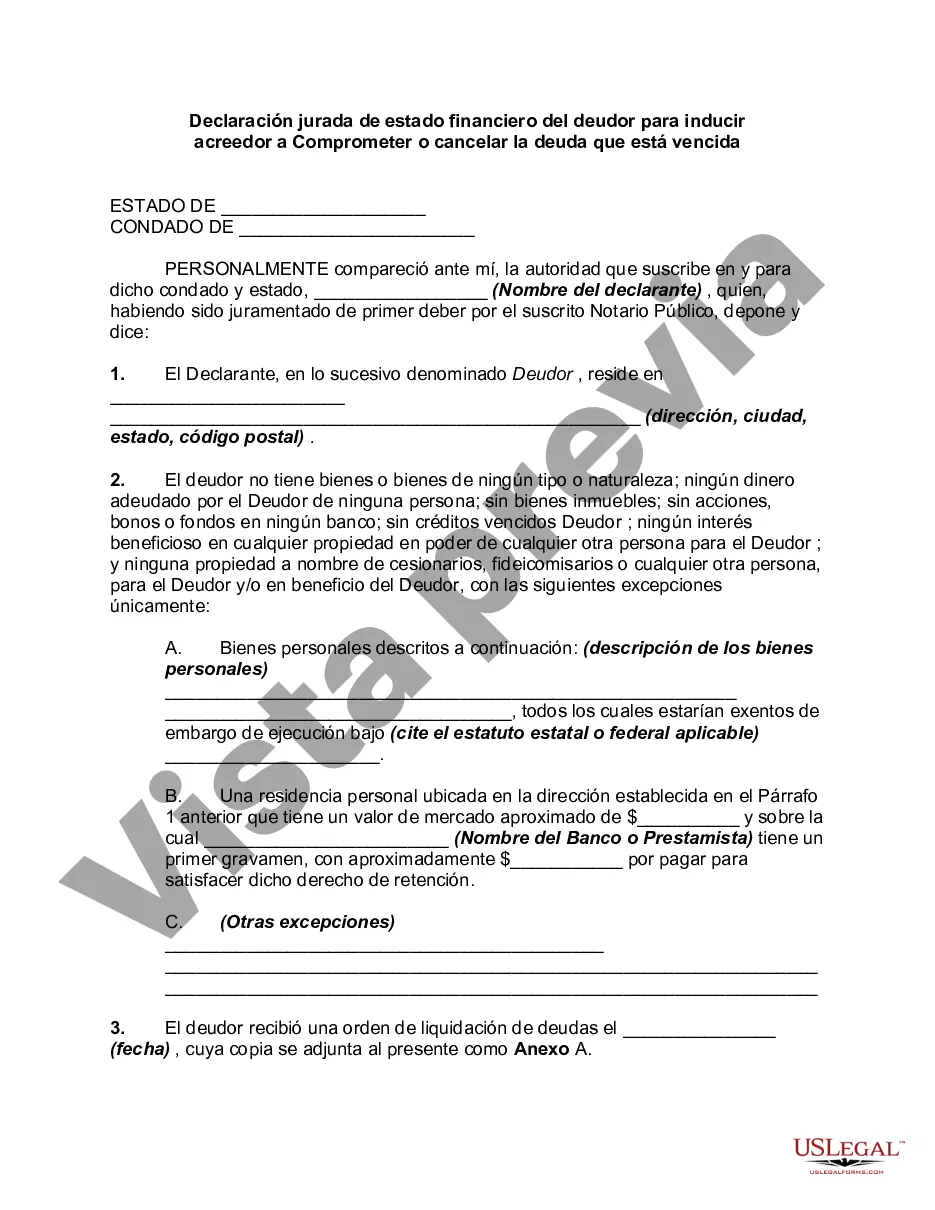

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.