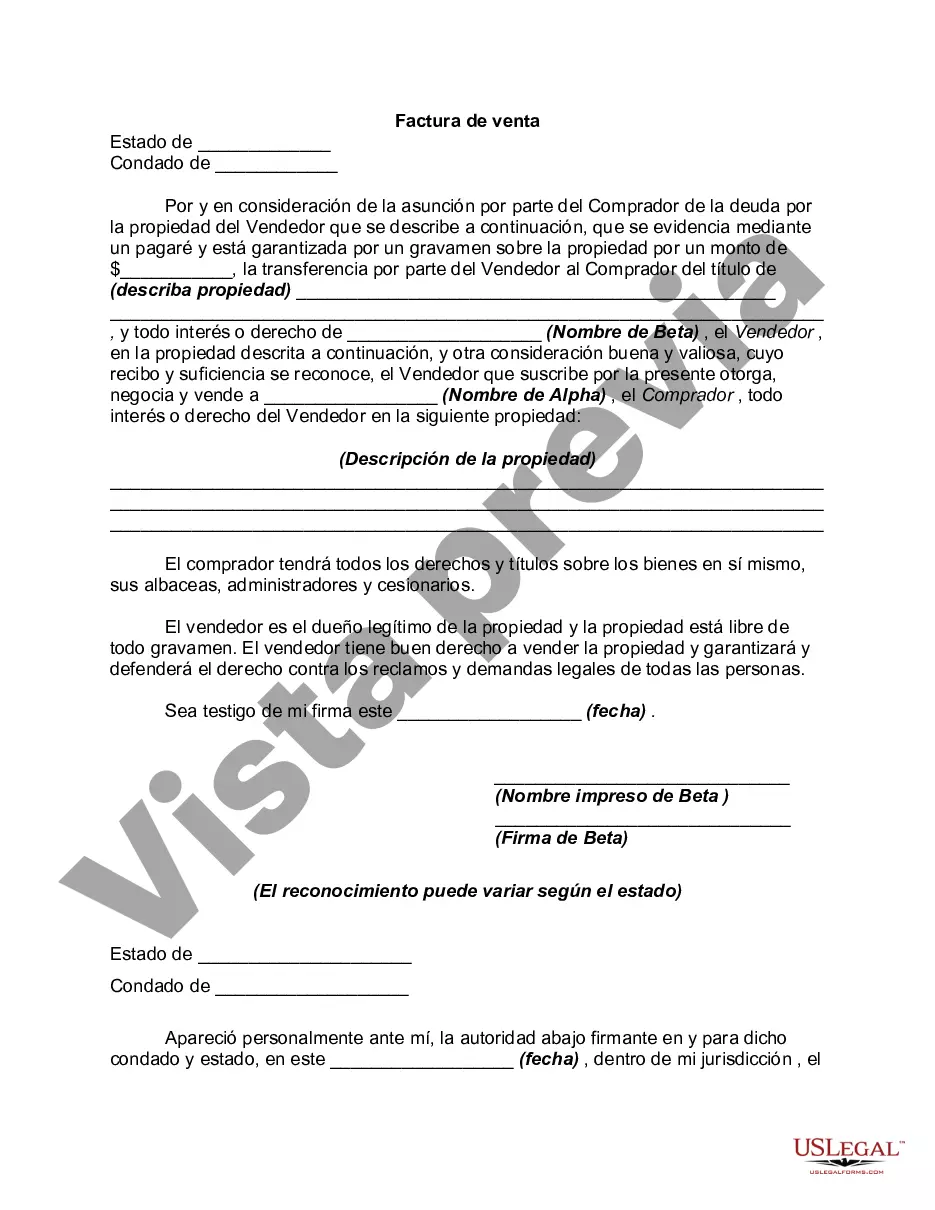

Texas Agreement to Exchange Property, also known as Barter Agreement with Assumption of, is a legal document that outlines the terms and conditions under which individuals or entities engage in a property exchange through a barter arrangement, with the additional provision of one party assuming certain liabilities or obligations related to the property being exchanged. This type of agreement ensures a fair and transparent exchange of assets between parties, providing a legal framework for the transaction. In Texas, there are various types of Agreement to Exchange Property — Barter Agreement with Assumption of, each customized to cater to specific situations and requirements. These include: 1. Real Estate Barter Agreement: This type of agreement is used when parties wish to exchange real estate properties. It covers the transfer of ownership, responsibilities, and any liabilities associated with the properties involved. The assumption clause in this agreement specifies which party assumes existing mortgages, loans, or other obligations tied to the properties. 2. Business Barter Agreement: This type of agreement is utilized when parties want to exchange ownership interests in businesses or business assets. It details the scope of the exchange, including the valuation of the businesses or assets being bartered, the transfer of permits or licenses, and any assumed debts or liabilities that accompany the transaction. 3. Personal Property Barter Agreement: This agreement applies when parties intend to swap personal property items, such as vehicles, furniture, electronics, or artwork. It clearly identifies the items being exchanged and the condition of each item. The assumption clause stipulates any outstanding loans or liabilities associated with the property being transferred. 4. Intellectual Property Barter Agreement: When parties aim to exchange intellectual property rights, such as patents, trademarks, or copyrights, this type of agreement is employed. It specifies the rights being transferred, any obligations or restrictions attached to the rights, and whether either party will assume any existing legal disputes or liabilities related to the intellectual property. Regardless of the type, a Texas Agreement to Exchange Property — Barter Agreement with Assumption of is a crucial contract that establishes the terms and conditions for a fair and lawful exchange. It protects the interests of all parties involved and ensures that all assets, liabilities, responsibilities, and obligations are clearly addressed and transferred according to the agreed-upon terms.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Acuerdo de Permuta de Propiedad - Acuerdo de Permuta con Asunción de - Agreement to Exchange Property - Barter Agreement with Assumption of

Description

How to fill out Texas Acuerdo De Permuta De Propiedad - Acuerdo De Permuta Con Asunción De?

If you want to full, acquire, or print out lawful document web templates, use US Legal Forms, the largest collection of lawful types, that can be found online. Use the site`s easy and practical research to obtain the files you want. A variety of web templates for company and personal uses are sorted by classes and claims, or keywords and phrases. Use US Legal Forms to obtain the Texas Agreement to Exchange Property - Barter Agreement with Assumption of in just a number of click throughs.

If you are presently a US Legal Forms consumer, log in for your bank account and click the Down load option to find the Texas Agreement to Exchange Property - Barter Agreement with Assumption of. You may also accessibility types you formerly downloaded in the My Forms tab of your respective bank account.

Should you use US Legal Forms the first time, follow the instructions listed below:

- Step 1. Make sure you have selected the form for that right city/land.

- Step 2. Utilize the Preview choice to check out the form`s articles. Do not neglect to see the description.

- Step 3. If you are not satisfied together with the type, utilize the Lookup discipline at the top of the monitor to discover other types of the lawful type web template.

- Step 4. After you have discovered the form you want, click the Get now option. Pick the pricing strategy you choose and add your credentials to register on an bank account.

- Step 5. Method the transaction. You can use your Мisa or Ьastercard or PayPal bank account to perform the transaction.

- Step 6. Select the file format of the lawful type and acquire it in your system.

- Step 7. Complete, edit and print out or indication the Texas Agreement to Exchange Property - Barter Agreement with Assumption of.

Each lawful document web template you purchase is the one you have permanently. You have acces to each and every type you downloaded within your acccount. Click the My Forms segment and pick a type to print out or acquire yet again.

Remain competitive and acquire, and print out the Texas Agreement to Exchange Property - Barter Agreement with Assumption of with US Legal Forms. There are thousands of specialist and status-specific types you can utilize for your personal company or personal requirements.