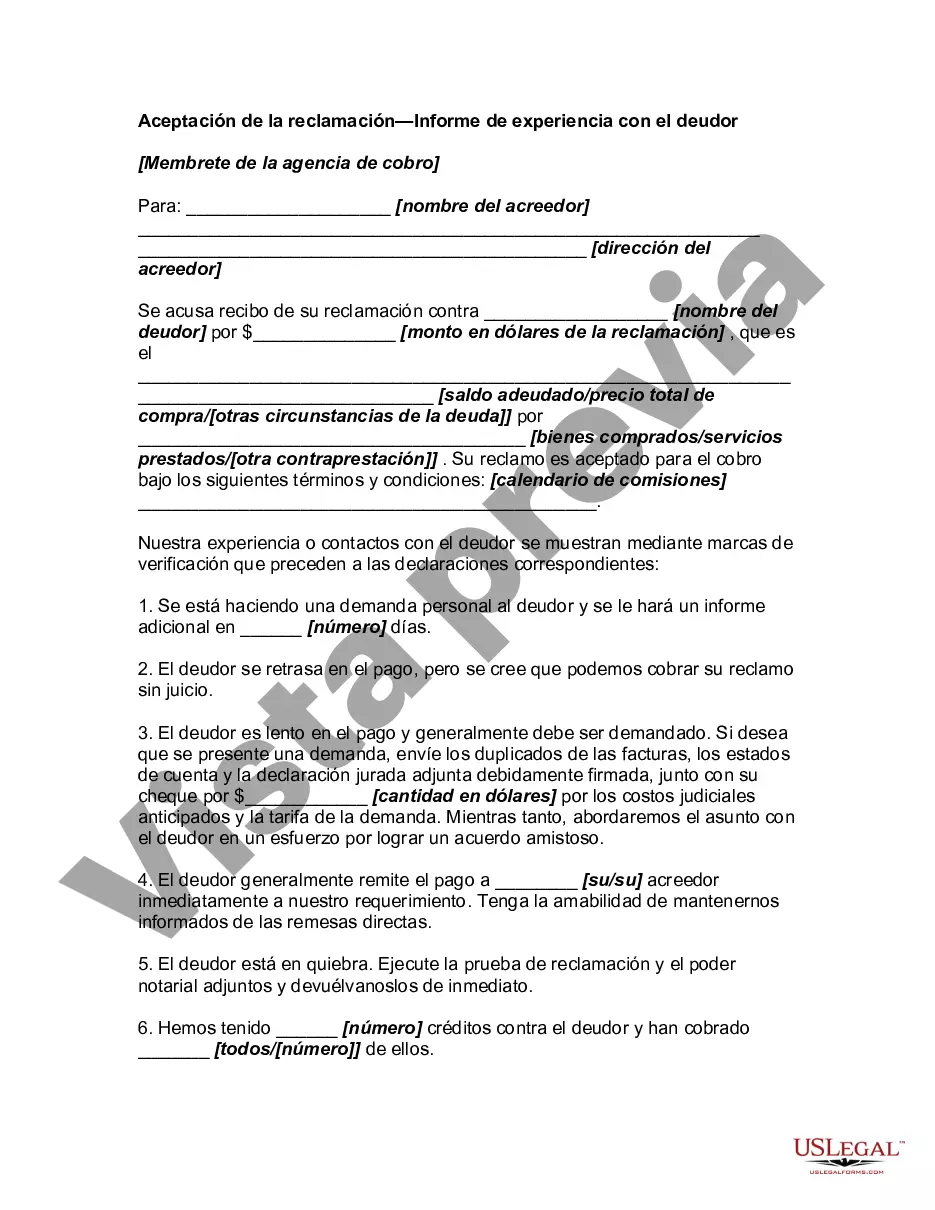

Texas Acceptance of Claim by Collection Agency and Report of Experience with Debtor is an important legal document used in Texas to acknowledge the submission of a claim by a collection agency against a debtor. This document serves as a record and verification of the claim made by the collection agency and outlines the history and experience between the agency and the debtor. It plays a crucial role in the debt collection process and helps in providing a transparent and accountable system. There are different types of Texas Acceptance of Claim by Collection Agency and Report of Experience with Debtor, such as: 1. Standard Acceptance of Claim by Collection Agency and Report of Experience with Debtor: This is the most common type of form used by collection agencies to formally acknowledge the receipt and acceptance of a claim against a debtor. It includes information about the debt, the debtor's contact details, and any relevant documentation supporting the claim. 2. Verified Acceptance of Claim by Collection Agency and Report of Experience with Debtor: This type of form requires additional steps to verify the claim made by the collection agency. It may involve validating the claimed amount, examining supporting documents, and conducting background checks on the debtor. Once the claim is verified, the collection agency accepts it and provides a comprehensive report of their experience with the debtor. 3. Disputed Acceptance of Claim by Collection Agency and Report of Experience with Debtor: In some cases, the debtor may dispute the claim made by the collection agency. This type of form is used when there is a disagreement regarding the debt, and the collection agency acknowledges the dispute while still accepting the claim. It allows for a transparent resolution process, ensuring both parties have a fair chance to present their case. 4. Mutual Agreement Acceptance of Claim by Collection Agency and Report of Experience with Debtor: This form is used when the collection agency and the debtor reach a mutual agreement regarding the claim. It outlines the terms and conditions of repayment or settlement agreed upon between both parties. This type of acceptance is crucial for documenting the agreement and serves as a reference for any future disputes. When completing a Texas Acceptance of Claim by Collection Agency and Report of Experience with Debtor form, it is essential to include accurate and detailed information. The form typically requires the following information: 1. Collection agency details: Name, address, contact information, and license number. 2. Debtor details: Name, address, contact information, and any relevant identifying details. 3. Claim details: Including the amount claimed, supporting documentation, and any additional comments or remarks. 4. Report of experience with the debtor: A description of past interactions with the debtor, including attempts to contact, negotiation efforts, and any payment history or default incidents. In conclusion, the Texas Acceptance of Claim by Collection Agency and Report of Experience with Debtor is a vital document that ensures a transparent and formal process for collection agencies and debtors in Texas. There are various types of these forms adapted to different situations, allowing for clear communication and resolution of disputes in the debt collection process. Properly completing this document is crucial to maintain the integrity of the debt collection process and protect the rights of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Aceptación de Reclamo por Agencia de Cobranza e Informe de Experiencia con Deudor - Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

How to fill out Texas Aceptación De Reclamo Por Agencia De Cobranza E Informe De Experiencia Con Deudor?

Choosing the best lawful record template could be a have a problem. Obviously, there are plenty of templates available on the Internet, but how do you obtain the lawful kind you want? Use the US Legal Forms site. The service provides 1000s of templates, such as the Texas Acceptance of Claim by Collection Agency and Report of Experience with Debtor, that can be used for business and private needs. Each of the varieties are checked by professionals and meet up with federal and state specifications.

Should you be already listed, log in for your account and then click the Down load switch to find the Texas Acceptance of Claim by Collection Agency and Report of Experience with Debtor. Make use of your account to check from the lawful varieties you might have purchased earlier. Proceed to the My Forms tab of your own account and obtain an additional version in the record you want.

Should you be a new customer of US Legal Forms, here are basic guidelines that you should stick to:

- Initial, be sure you have selected the appropriate kind for your personal town/region. You may check out the form using the Preview switch and look at the form description to guarantee it will be the best for you.

- In the event the kind fails to meet up with your requirements, utilize the Seach area to discover the right kind.

- When you are certain that the form is suitable, go through the Buy now switch to find the kind.

- Opt for the costs strategy you would like and enter in the essential info. Make your account and buy your order utilizing your PayPal account or charge card.

- Select the submit structure and down load the lawful record template for your device.

- Full, modify and printing and sign the obtained Texas Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

US Legal Forms will be the most significant local library of lawful varieties in which you can see numerous record templates. Use the company to down load expertly-made paperwork that stick to state specifications.