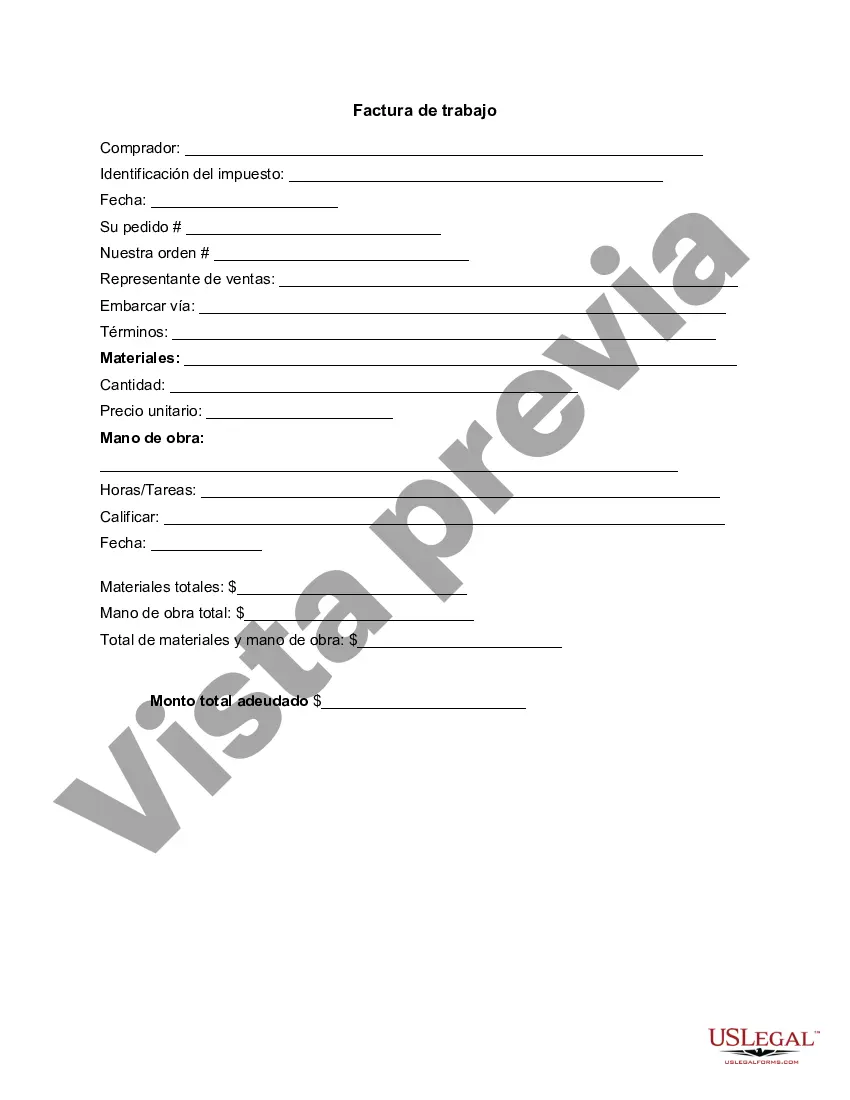

A Texas Invoice Template for Software Developers is a pre-designed document that enables software developers in Texas to bill their clients or employers for their services or products. This template simplifies the invoicing process and ensures accurate billing information is included. It is specifically tailored to meet the needs of software developers based in Texas, taking into account the specific tax regulations and requirements of the state. The Texas Invoice Template for Software Developers typically includes various sections to capture crucial details. These sections may include: 1. Header: This section includes the software developer's logo, their business name, address, contact details, and the invoice number for reference. 2. Client Information: This section gathers the client's name, address, contact details, and any specific billing requirements or purchase order numbers they may have provided. 3. Invoice Details: This section includes the date the invoice was issued, the payment due date, and the date of the services or products provided. Additionally, it may provide space to mention any terms or conditions related to payment terms or late fees. 4. Itemized Software Development Services: In this section, the software developer lists the services or products provided, along with a description, quantity, unit price, and total price for each item. It may also display any applicable taxes or discounts. 5. Subtotal and Total: This section provides a breakdown of the subtotal, summing up all the item prices. It may also include separate sections for applicable taxes, discounts, and the grand total amount payable by the client. 6. Payment Details: This section provides options for the client to understand the payment methods available, including payment instructions, bank account details, PayPal, or any other relevant payment information. 7. Terms and Conditions: This section outlines any additional terms and conditions related to the software developer's services or products, such as intellectual property rights, confidentiality, or dispute resolution clauses. Types of Texas Invoice Templates for Software Developers: 1. Basic Texas Invoice Template: This type of template includes the essential sections mentioned above and is suitable for software developers who require a simple and straightforward invoice format. 2. Detailed Texas Invoice Template: This template might provide more advanced features and sections tailored specifically for complex software development projects. It may include additional fields to capture detailed project descriptions, milestones, or hours allocated to specific tasks, making it suitable for clients who require more detailed billing information. 3. Texas Invoice Template with Sales Tax Calculation: This type of template automatically calculates and adds the applicable sales tax based on Texas tax rates. This makes it convenient for software developers to accurately charge and collect tax from their clients while ensuring they comply with state tax regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Plantilla de factura para desarrollador de software - Invoice Template for Software Developer

Description

How to fill out Texas Plantilla De Factura Para Desarrollador De Software?

Discovering the right legal record design could be a battle. Obviously, there are plenty of web templates available on the Internet, but how would you obtain the legal form you need? Use the US Legal Forms web site. The assistance gives a huge number of web templates, such as the Texas Invoice Template for Software Developer, that you can use for business and personal needs. Each of the types are checked by pros and meet state and federal requirements.

Should you be previously authorized, log in in your bank account and then click the Down load button to find the Texas Invoice Template for Software Developer. Utilize your bank account to search from the legal types you have purchased in the past. Go to the My Forms tab of your respective bank account and get another copy from the record you need.

Should you be a new end user of US Legal Forms, here are simple guidelines that you should comply with:

- Very first, make sure you have selected the correct form for your area/area. You may look over the shape while using Review button and read the shape outline to make sure it is the right one for you.

- If the form does not meet your expectations, take advantage of the Seach discipline to get the correct form.

- When you are certain that the shape is suitable, click on the Get now button to find the form.

- Select the prices program you would like and enter in the required information and facts. Design your bank account and pay for an order utilizing your PayPal bank account or Visa or Mastercard.

- Select the submit structure and acquire the legal record design in your device.

- Complete, revise and print out and indication the obtained Texas Invoice Template for Software Developer.

US Legal Forms is definitely the largest library of legal types where you can see various record web templates. Use the company to acquire skillfully-made documents that comply with status requirements.