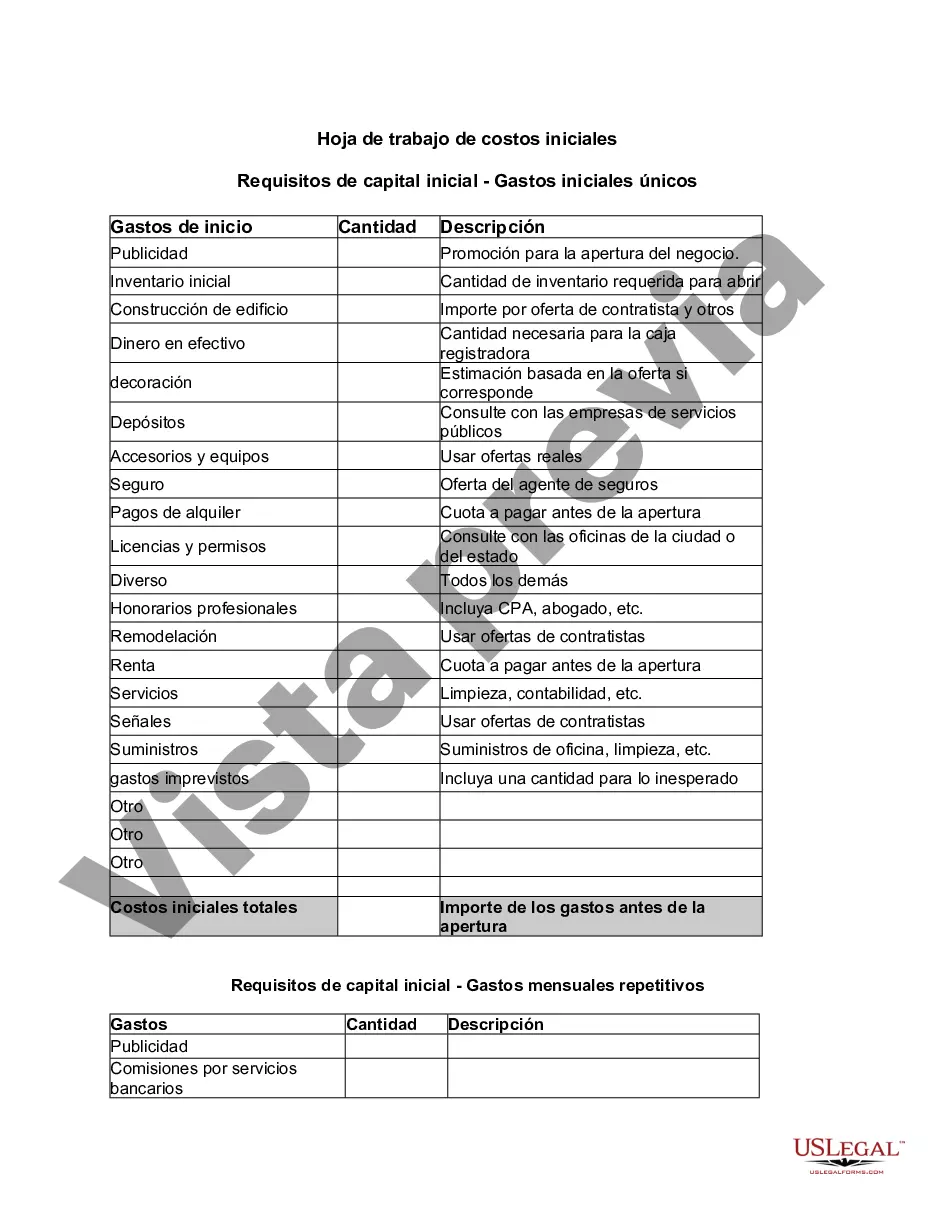

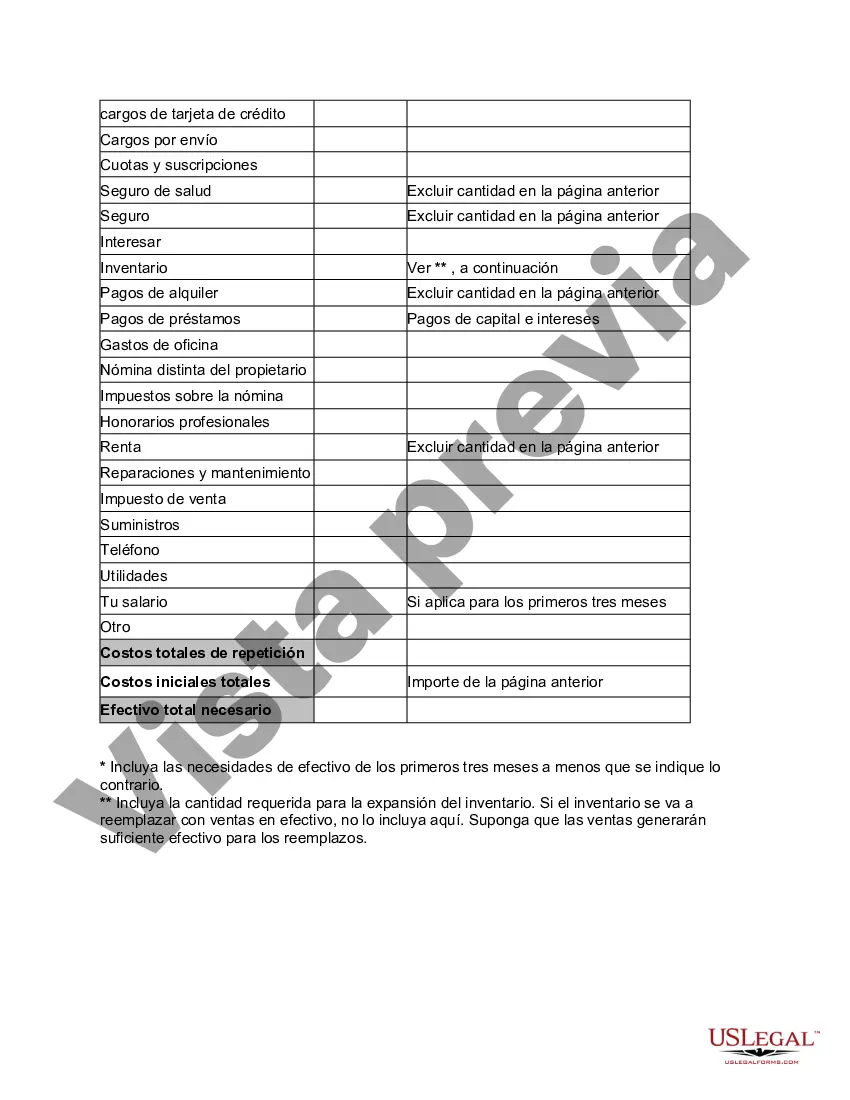

Texas Startup Costs Worksheet is a comprehensive tool designed to assist entrepreneurs in estimating and organizing the expenses associated with starting a business in the state of Texas. This worksheet serves as a valuable resource for business owners and startups looking to develop a clear understanding of the financial requirements and planning involved in launching a successful venture. By utilizing the Texas Startup Costs Worksheet, entrepreneurs can outline their anticipated expenses, allocate their available funds effectively, and make informed decisions regarding their business's financial aspects. This worksheet acts as a roadmap, helping entrepreneurs avoid financial surprises and ensuring a well-structured financial plan. The Texas Startup Costs Worksheet typically includes various sections that cover different aspects of startup expenses. Some key sections may include: 1. One-time Costs: This section outlines the initial expenses required to establish the business, such as legal fees, permits and licenses, logo design, branding, market research, and equipment purchases or leases. 2. Recurring Costs: It encompasses ongoing expenses necessary to keep the business operational. These costs usually include rent, utilities, payroll, insurance, inventory, marketing, advertising, website hosting, and software subscriptions. 3. Marketing and Advertising Expenses: This section focuses on expenses associated with promoting the business, including online advertising campaigns, social media marketing, print materials, events, and public relations. 4. Technology and Software Costs: This section outlines the cost of necessary technology and software solutions tailored to the business's operations, such as accounting software, customer relationship management (CRM) systems, project management tools, and website development. 5. Professional Services: This section includes the costs associated with professional assistance, such as legal and accounting services, consulting fees, and business coaching. 6. Miscellaneous Expenses: This section covers any additional costs that do not fit into the other categories, including office supplies, travel expenses, training and education, memberships, and subscriptions. It is important to note that while the above sections are common, the Texas Startup Costs Worksheet can be tailored to the specific needs and requirements of the business. Different industries and business models may have unique expenses that need to be accounted for. Therefore, entrepreneurs can customize the worksheet according to their individual circumstances. Overall, the Texas Startup Costs Worksheet serves as a fundamental tool for entrepreneurs in Texas, providing a clear and structured framework for evaluating and estimating the financial aspects of starting a business. By utilizing this resource, entrepreneurs can confidently plan and budget their startup costs, thereby increasing their chances of building a financially sustainable and successful venture.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Hoja de trabajo de costos iniciales - Startup Costs Worksheet

Description

How to fill out Texas Hoja De Trabajo De Costos Iniciales?

Have you been inside a placement where you need papers for either organization or person purposes nearly every day? There are tons of authorized record themes available on the net, but discovering ones you can trust isn`t simple. US Legal Forms delivers 1000s of form themes, just like the Texas Startup Costs Worksheet, that are created to fulfill state and federal requirements.

If you are previously familiar with US Legal Forms website and possess an account, just log in. Next, you are able to obtain the Texas Startup Costs Worksheet design.

If you do not offer an bank account and wish to start using US Legal Forms, follow these steps:

- Find the form you will need and make sure it is for the correct area/area.

- Take advantage of the Preview option to examine the form.

- Browse the description to actually have selected the right form.

- When the form isn`t what you`re seeking, make use of the Look for industry to obtain the form that meets your needs and requirements.

- If you find the correct form, click Buy now.

- Opt for the costs plan you desire, complete the desired info to generate your money, and purchase the order utilizing your PayPal or charge card.

- Choose a handy file structure and obtain your duplicate.

Get all of the record themes you possess bought in the My Forms menu. You can aquire a further duplicate of Texas Startup Costs Worksheet whenever, if needed. Just go through the essential form to obtain or print out the record design.

Use US Legal Forms, the most substantial collection of authorized forms, to save time as well as steer clear of faults. The service delivers skillfully produced authorized record themes which you can use for an array of purposes. Make an account on US Legal Forms and commence generating your lifestyle a little easier.