A bulk sale is a sale of goods by a business which engages in selling items out of inventory (as opposed to manufacturing or service industries), often in liquidating or selling a business, and is governed by the bulk sales law. Article 6 of the Uniform Commercial Code (UCC), which has been adopted at least in part all states, governs bulk sales. The heart of the bulk sales law is the requirement that the transferee provide the transferor's creditors with notice of the pending bulk transfer. This notice is the essential protection provided to creditors; once notified, the creditor must take the necessary steps to adequately protect his or her interest.

The Texas Bulk Sale Notice is an essential legal document used to provide notice to creditors and interested parties regarding the bulk sale of a business located in the state of Texas. This notice aims to protect creditors' rights and ensure that they have the opportunity to recover any outstanding debts owed to them by the seller before the sale takes place. The purpose of the Texas Bulk Sale Notice is to prevent sellers from fraudulently liquidating business assets without satisfying their financial obligations. It acts as a safeguard for creditors, giving them the chance to assert their claims against the seller before the sale is completed. By notifying potential purchasers of any existing liabilities, the notice serves as a method to protect buyers from unknowingly inheriting the seller's debt. Key features of the Texas Bulk Sale Notice include detailed information about the seller, the purchaser, and the assets involved in the sale. It typically includes the name, address, and contact details of both parties, and a comprehensive list of the assets to be transferred. The notice also includes a relevant description of the type of business being sold, allowing creditors to identify if they have any outstanding claims against it. There are different types of Texas Bulk Sale Notice that may vary depending on the nature and scale of the business being sold. Some examples include: 1. General Business Sale: This type of notice is used when a business, such as a retail store or restaurant, is being sold in its entirety, including all assets, liabilities, and ongoing operations. 2. Asset Sale: In the case of an asset sale, only specific assets are being transferred rather than the entire business entity. This type of notice provides details about the assets being sold and allows creditors to assert their rights against those specific assets. 3. Stock Sale: A stock sale notice is used when the sale involves the transfer of shares or stock in a corporation. It notifies creditors of any potential changes in ownership and allows them to exercise their rights against the corporation. Overall, the Texas Bulk Sale Notice is a crucial instrument for protecting the interests of both creditors and buyers involved in a business sale. It ensures transparency, facilitates the resolution of outstanding debts, and minimizes the risk of fraud that may occur during the transfer of business assets.The Texas Bulk Sale Notice is an essential legal document used to provide notice to creditors and interested parties regarding the bulk sale of a business located in the state of Texas. This notice aims to protect creditors' rights and ensure that they have the opportunity to recover any outstanding debts owed to them by the seller before the sale takes place. The purpose of the Texas Bulk Sale Notice is to prevent sellers from fraudulently liquidating business assets without satisfying their financial obligations. It acts as a safeguard for creditors, giving them the chance to assert their claims against the seller before the sale is completed. By notifying potential purchasers of any existing liabilities, the notice serves as a method to protect buyers from unknowingly inheriting the seller's debt. Key features of the Texas Bulk Sale Notice include detailed information about the seller, the purchaser, and the assets involved in the sale. It typically includes the name, address, and contact details of both parties, and a comprehensive list of the assets to be transferred. The notice also includes a relevant description of the type of business being sold, allowing creditors to identify if they have any outstanding claims against it. There are different types of Texas Bulk Sale Notice that may vary depending on the nature and scale of the business being sold. Some examples include: 1. General Business Sale: This type of notice is used when a business, such as a retail store or restaurant, is being sold in its entirety, including all assets, liabilities, and ongoing operations. 2. Asset Sale: In the case of an asset sale, only specific assets are being transferred rather than the entire business entity. This type of notice provides details about the assets being sold and allows creditors to assert their rights against those specific assets. 3. Stock Sale: A stock sale notice is used when the sale involves the transfer of shares or stock in a corporation. It notifies creditors of any potential changes in ownership and allows them to exercise their rights against the corporation. Overall, the Texas Bulk Sale Notice is a crucial instrument for protecting the interests of both creditors and buyers involved in a business sale. It ensures transparency, facilitates the resolution of outstanding debts, and minimizes the risk of fraud that may occur during the transfer of business assets.

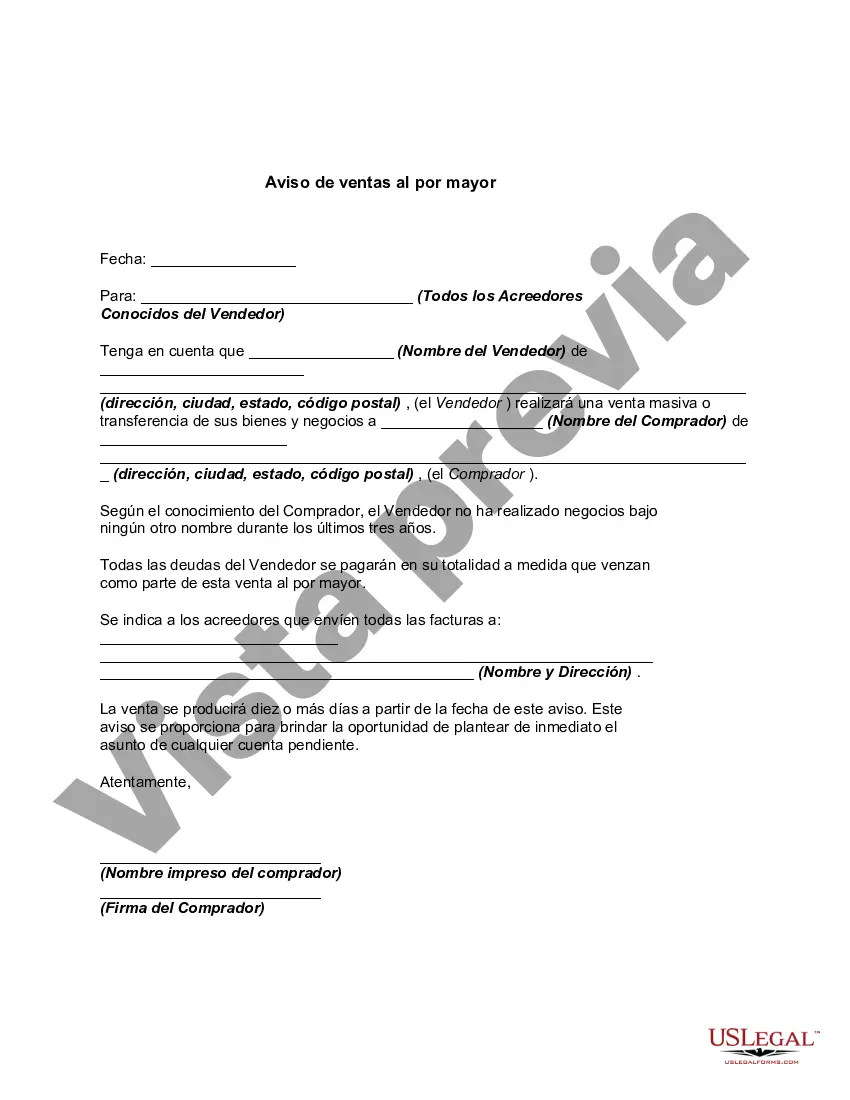

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.