Texas Commercial Partnership Agreement between an Investor and Worker

Description

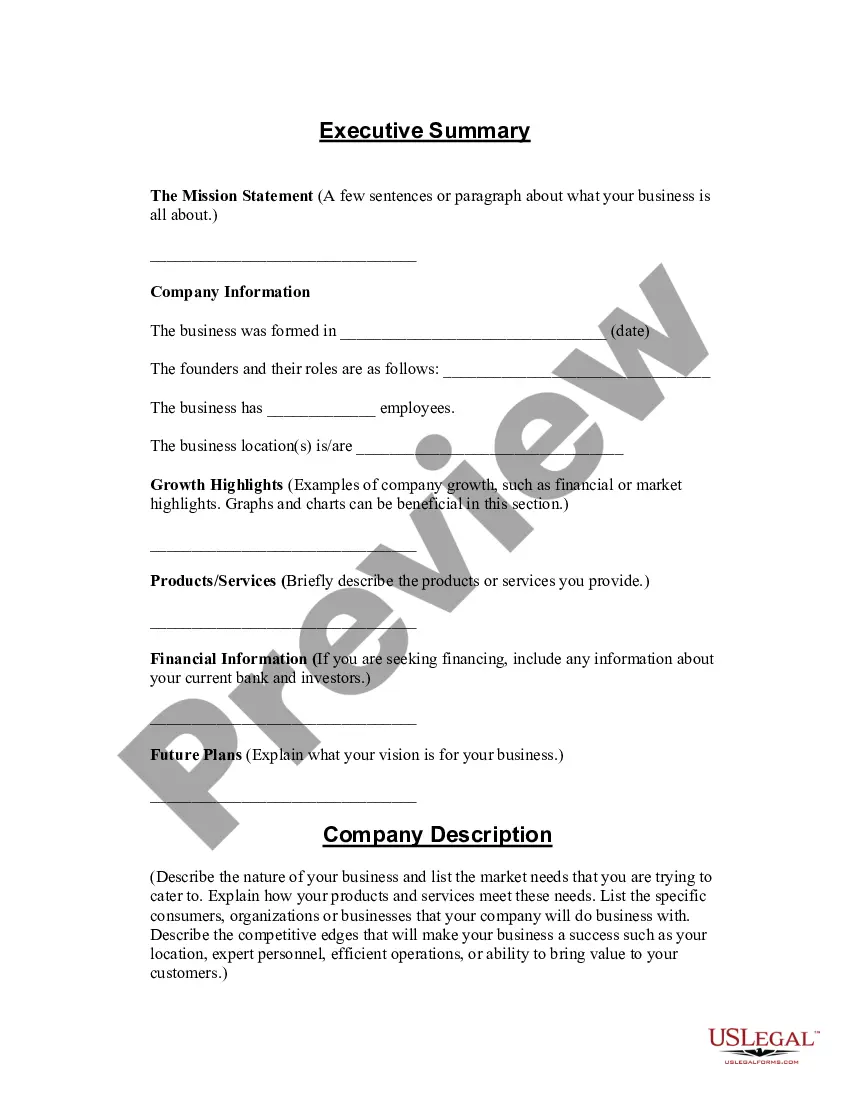

How to fill out Commercial Partnership Agreement Between An Investor And Worker?

Selecting the ideal legal document template can be challenging.

Of course, there are numerous designs accessible online, but how can you discover the legal form you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Texas Commercial Partnership Agreement between an Investor and Employee, that you can utilize for both business and personal purposes.

You can view the form using the Review option and examine the form details to ensure it is suitable for you.

- All templates are verified by experts and comply with federal and state regulations.

- If you're already registered, Log In to your account and click the Acquire button to obtain the Texas Commercial Partnership Agreement between an Investor and Employee.

- Use your account to browse through the legal templates you've previously purchased.

- Go to the My documents section of your account to download another copy of the documents you require.

- If you're a first-time user of US Legal Forms, here are some straightforward instructions to follow.

- First, ensure you've selected the correct form for your specific city/county.

Form popularity

FAQ

To form a partnership in Texas, you should take the following steps:Choose a business name.File an assumed business name.Draft and sign a partnership agreement.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.

Companies generally use their in-house counsel to draft the partnership agreement. Other partners can also make contributions and negotiations before agreeing to it and signing it. If you are a business owner, looking to draft your own partnership agreement, you can do so using free templates available online.

Verify your partnership agreement is notarized by taking it to the printers. Every partner will be required to sign a notarized form in notary public presence at the time of signing. While not every state requires notarization, it can still be beneficial to do so.

The partners must sign each copy in the presence of a witness. The witnesses must sign and add their name, address, occupation and the date directly underneath the signature of the party they are witnessing. The date of the agreement is the date on which the parties signed if that was the same day.

Here are five clauses every partnership agreement should include:Capital contributions.Duties as partners.Sharing and assignment of profits and losses.Acceptance of liabilities.Dispute resolution.

How to Write a Business Partnership Agreementname of the partnership.goals of the partnership.duration of the partnership.contribution amounts of each partner (cash, property, services, future contributions)ownership interests of each partner (assets)management roles and terms of authority of each partner.More items...

4 Types of Partnership in BusinessGeneral Partnership. This partnership is the most common form of business cooperation.Limited Partnership. Limited Partnership (LP) is a type of business partnership that is formal and has been authorized by the state.Limited Liability Partnership.Limited Liability Limited Partnership.

What to include in your partnership agreementName of the partnership.Contributions to the partnership.Allocation of profits, losses, and draws.Partners' authority.Partnership decision-making.Management duties.Admitting new partners.Withdrawal or death of a partner.More items...

Yes, notarisation of the partnership deed is essential along with registration, as it makes the agreement between partners a legal one which can be defended in the court of law, if any conflicts arise between the partners.

7 Things Every Partnership Agreement Needs To AddressContributions. Make sure you clearly lay out each partner's stake in the formation and ongoing finances of the business.Distributions.Ownership.Decision Making.Dispute Resolution.Critical Developments.Dissolution.