Offering memorandums are legally binding documents that are used to provide important information relevant to the process of a financial transaction. An offering memorandum may be required when offering stocks to investors, or selling real estate. In any situation, the document will include data that is required by law to be supplied to investors, ensuring they have sufficient information to make an informed decision about making the purchase.

The Texas Offering Memorandum — Limited Partnership is a legal document outlining the terms and conditions for investment in a limited partnership in the state of Texas. It serves as an informational tool for potential investors, providing them with all the essential details necessary to make informed investment decisions. The Texas Offering Memorandum — Limited Partnership discloses various key aspects, such as the partnership's objectives, investment strategies, potential risks, and expected returns. It also provides information about the general partner, limited partners, management team, and their experience and track record. Additionally, the Texas Offering Memorandum — Limited Partnership outlines the terms of the investment, including the minimum investment amount, structure of the partnership, distribution of profits and losses, as well as important legal and tax considerations. It is an essential document for both the partnership and the investors, ensuring transparency and compliance with regulatory requirements. Different types of Texas Offering Memorandum — Limited Partnership may include: 1. Real Estate Limited Partnerships: These partnerships focus on real estate investments, such as commercial properties, residential developments, or land acquisition and development projects. 2. Energy Limited Partnerships: These partnerships specialize in energy-related investments, including oil and gas exploration, renewable energy projects, or infrastructure development in the energy sector. 3. Private Equity Limited Partnerships: These partnerships invest in privately held companies across various industries, seeking to provide capital for expansion, acquisitions, or turnaround opportunities. 4. Asset Management Limited Partnerships: These partnerships focus on managing and investing in a diverse range of assets, which may include stocks, bonds, commodities, or other investment instruments. 5. Technology Limited Partnerships: These partnerships target investments in technological innovations, start-ups, or emerging companies within the tech sector, aiming to capitalize on their growth potential. In summary, the Texas Offering Memorandum — Limited Partnership is a comprehensive document that outlines the terms, risks, and potential benefits of investing in a limited partnership in Texas. It serves as an essential tool for investors to evaluate the partnership opportunity and make informed investment decisions.The Texas Offering Memorandum — Limited Partnership is a legal document outlining the terms and conditions for investment in a limited partnership in the state of Texas. It serves as an informational tool for potential investors, providing them with all the essential details necessary to make informed investment decisions. The Texas Offering Memorandum — Limited Partnership discloses various key aspects, such as the partnership's objectives, investment strategies, potential risks, and expected returns. It also provides information about the general partner, limited partners, management team, and their experience and track record. Additionally, the Texas Offering Memorandum — Limited Partnership outlines the terms of the investment, including the minimum investment amount, structure of the partnership, distribution of profits and losses, as well as important legal and tax considerations. It is an essential document for both the partnership and the investors, ensuring transparency and compliance with regulatory requirements. Different types of Texas Offering Memorandum — Limited Partnership may include: 1. Real Estate Limited Partnerships: These partnerships focus on real estate investments, such as commercial properties, residential developments, or land acquisition and development projects. 2. Energy Limited Partnerships: These partnerships specialize in energy-related investments, including oil and gas exploration, renewable energy projects, or infrastructure development in the energy sector. 3. Private Equity Limited Partnerships: These partnerships invest in privately held companies across various industries, seeking to provide capital for expansion, acquisitions, or turnaround opportunities. 4. Asset Management Limited Partnerships: These partnerships focus on managing and investing in a diverse range of assets, which may include stocks, bonds, commodities, or other investment instruments. 5. Technology Limited Partnerships: These partnerships target investments in technological innovations, start-ups, or emerging companies within the tech sector, aiming to capitalize on their growth potential. In summary, the Texas Offering Memorandum — Limited Partnership is a comprehensive document that outlines the terms, risks, and potential benefits of investing in a limited partnership in Texas. It serves as an essential tool for investors to evaluate the partnership opportunity and make informed investment decisions.

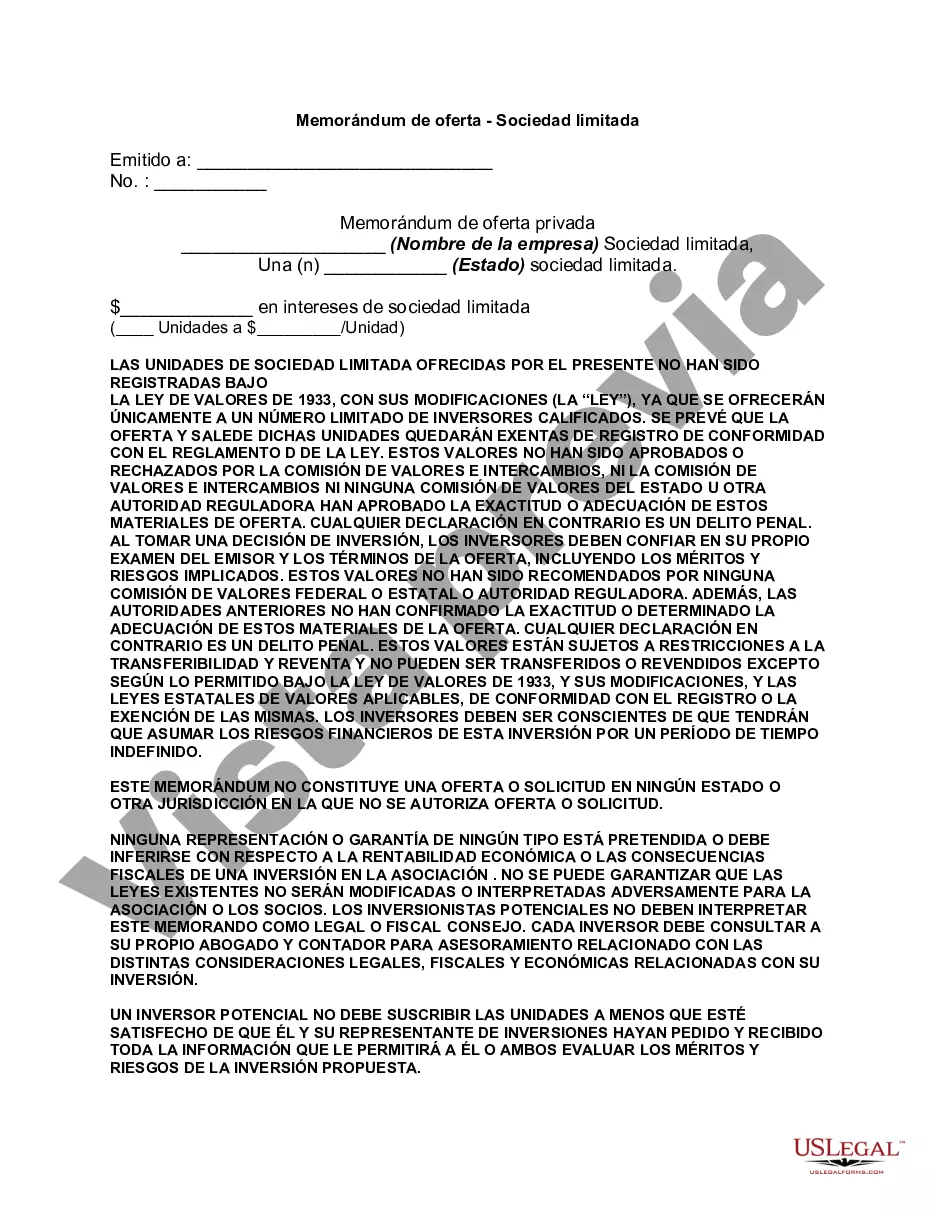

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.