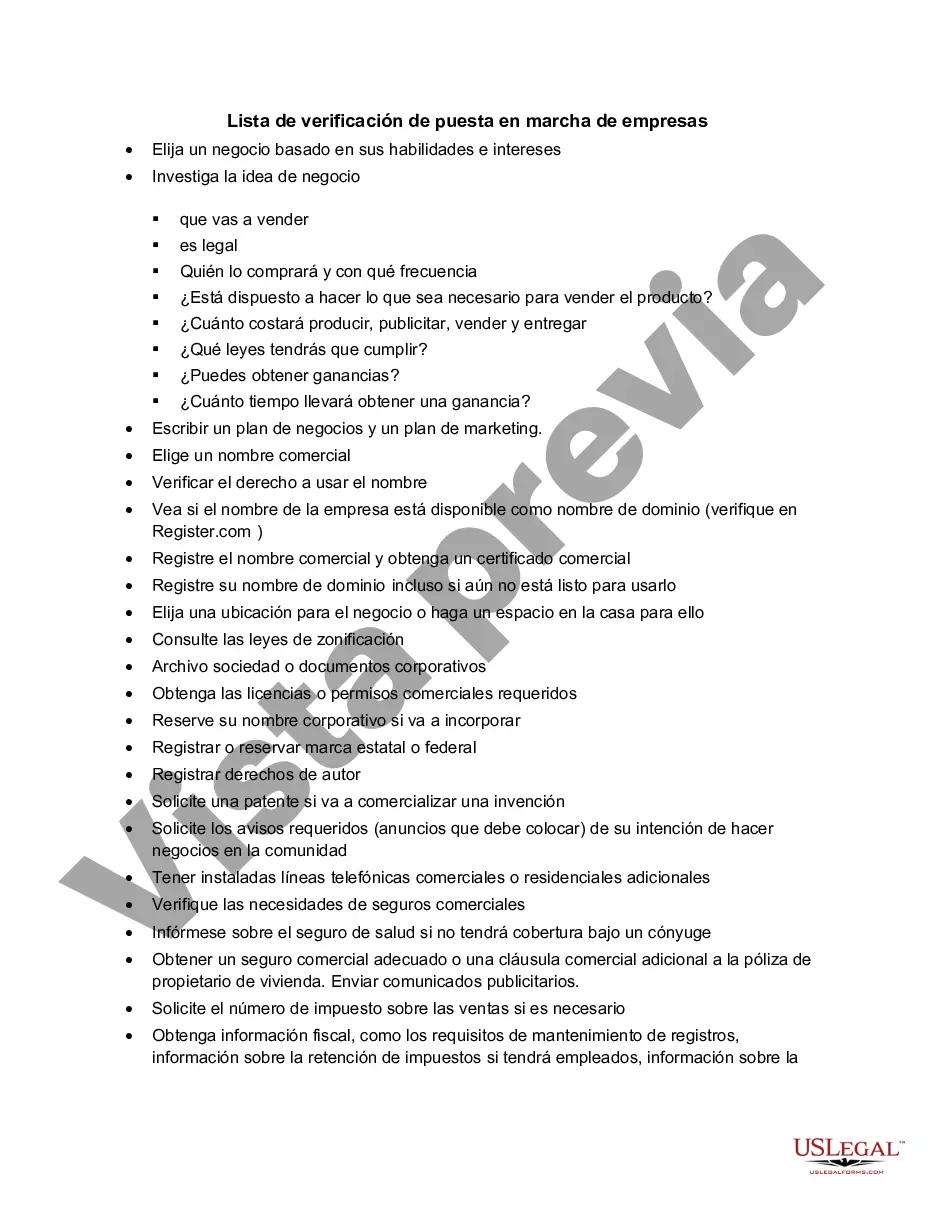

The Texas Business Start-up Checklist is a comprehensive guide that outlines the essential steps and requirements for starting a business in the state of Texas. This checklist is a valuable resource for aspiring entrepreneurs or those planning to expand their businesses in Texas. It covers various aspects of starting a business, including legal, financial, and operational considerations. Some key topics covered in the Texas Business Start-up Checklist include: 1. Business Structure: Guidance on choosing the appropriate legal structure for your business, such as sole proprietorship, partnership, limited liability company (LLC), or corporation. 2. Name Registration: Steps to register a unique and distinguishable business name with the Texas Secretary of State's office to ensure legal compliance. 3. Permits and Licenses: Information on obtaining necessary permits, licenses, and certifications specific to your industry or profession, ensuring compliance with state regulations. 4. Tax Obligations: Guidelines on registering with the Texas Comptroller of Public Accounts for state tax purposes, understanding sales tax requirements, payroll taxes, and other related obligations. 5. Employer Responsibilities: Overview of the requirements for hiring employees, including obtaining an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) and adhering to labor laws. 6. Insurance: Considerations for obtaining appropriate insurance coverage to protect your business, employees, and assets from potential risks and liabilities. 7. Financing Options: Information on funding sources, including loans, grants, and incentives, that are available to support starting or expanding a business in Texas. 8. Intellectual Property: Overview of the processes involved in protecting intellectual property, including trademarks, copyrights, and patents, to safeguard your business's unique assets. 9. Local Zoning and Regulations: Understanding local zoning laws, permits, and regulations that may vary based on the city or county in which you plan to establish your business. 10. Business Planning and Resources: Suggestions for creating a comprehensive business plan, including market research, competitor analysis, and financial projections. Additionally, it provides information on entrepreneurship resources and support organizations available in Texas. While there may not be specific types of Texas Business Start-up Checklists, variations or specialized checklists may exist for specific industries or sectors such as food services, healthcare, construction, or technology. These industry-specific checklists may outline additional requirements, permits, or regulations that are pertinent to those particular industries within the state of Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Lista de verificación de puesta en marcha de empresas - Business Start-up Checklist

Description

How to fill out Texas Lista De Verificación De Puesta En Marcha De Empresas?

US Legal Forms - one of several most significant libraries of legitimate types in the USA - provides a variety of legitimate document web templates it is possible to acquire or print. Using the website, you may get a large number of types for company and specific purposes, categorized by categories, states, or key phrases.You will discover the most recent types of types such as the Texas Business Start-up Checklist in seconds.

If you already have a subscription, log in and acquire Texas Business Start-up Checklist from your US Legal Forms library. The Obtain key can look on every single develop you view. You have access to all earlier delivered electronically types in the My Forms tab of your own accounts.

If you wish to use US Legal Forms initially, listed here are basic instructions to get you started out:

- Make sure you have chosen the proper develop for your personal city/county. Click on the Review key to check the form`s content. Browse the develop outline to ensure that you have selected the proper develop.

- When the develop doesn`t fit your demands, use the Lookup area towards the top of the display screen to obtain the one which does.

- If you are pleased with the form, verify your selection by simply clicking the Buy now key. Then, pick the prices prepare you want and supply your references to register for an accounts.

- Procedure the financial transaction. Utilize your credit card or PayPal accounts to complete the financial transaction.

- Select the formatting and acquire the form on the gadget.

- Make alterations. Load, change and print and indicator the delivered electronically Texas Business Start-up Checklist.

Each format you added to your money does not have an expiry date and it is your own property for a long time. So, in order to acquire or print one more duplicate, just check out the My Forms portion and then click in the develop you require.

Get access to the Texas Business Start-up Checklist with US Legal Forms, the most comprehensive library of legitimate document web templates. Use a large number of professional and status-particular web templates that meet up with your business or specific needs and demands.