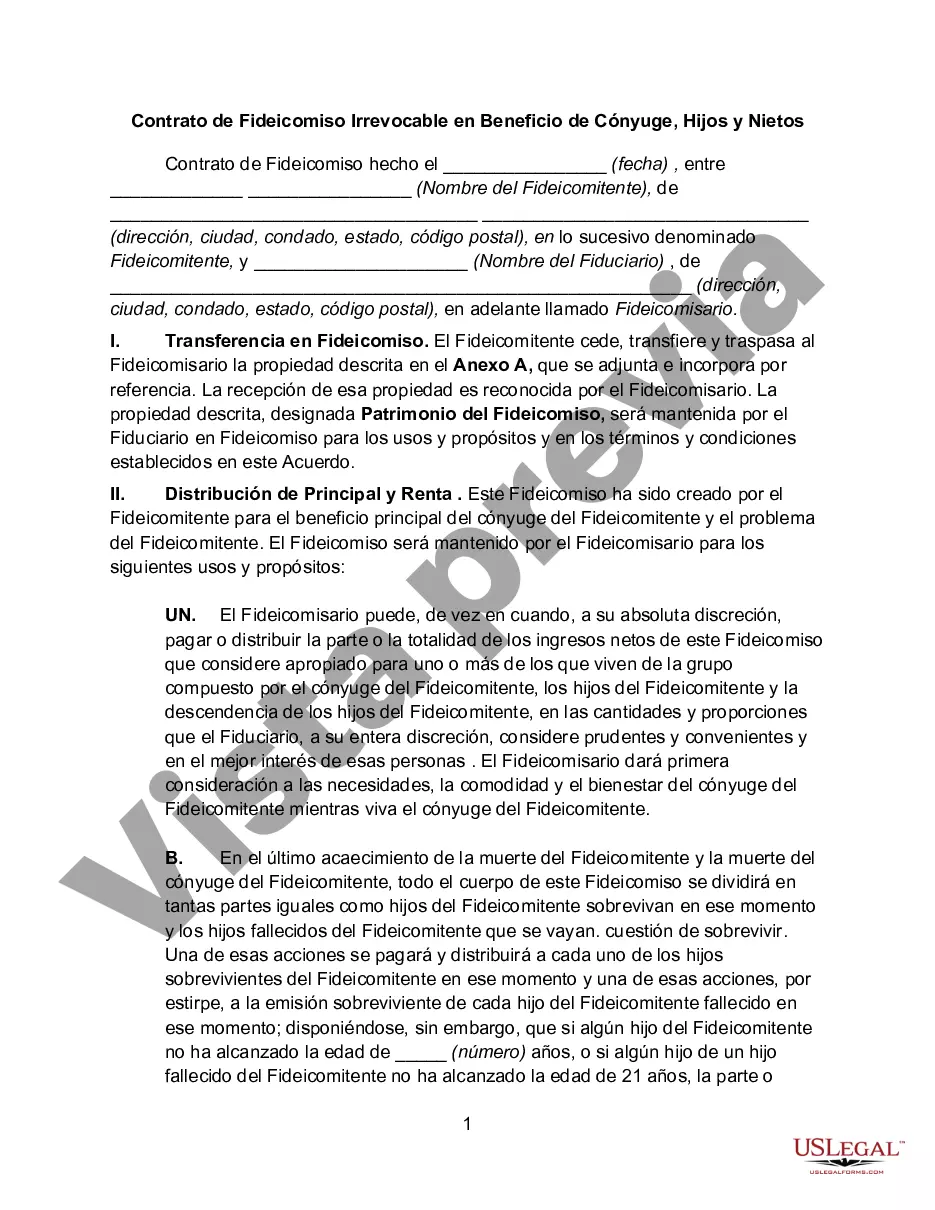

The Texas Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is a legally binding document that allows individuals in Texas to protect and distribute their assets to their loved ones. This type of trust provides a secure way to ensure financial stability for future generations. The primary purpose of the Texas Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is to allow the trust creator (also known as the settler) to transfer their assets into a trust for the benefit of their immediate family members. By doing so, the settler can ensure that their assets are managed and distributed according to their wishes, even after their passing. This type of trust comes with several key benefits. Firstly, it allows the settler to minimize estate taxes and avoid probate, ensuring a smooth transition of assets to the designated beneficiaries. Additionally, it provides asset protection, shielding the trust assets from creditors and potential lawsuits. There are different types of Texas Irrevocable Trust Agreements for the Benefit of Spouse, Children, and Grandchildren that individuals can consider based on their unique circumstances: 1. Spousal Support Trust: This trust type is designed to ensure the well-being of the surviving spouse by providing income and financial support throughout their lifetime. It secures the spouse's future financial stability while protecting the trust assets for the benefit of the children and grandchildren. 2. Education Trust: This trust aims to provide financial support for the education expenses of children and grandchildren. It can cover tuition fees, books, living expenses, and other educational needs. The settler can specify the terms and conditions for disbursements to ensure the funds are used solely for educational purposes. 3. Medical Trust: The primary focus of this trust is to cover medical expenses for the spouse and descendants. It can provide resources for healthcare treatments, long-term care, medications, and other medical-related costs. The trust ensures that the family's healthcare needs are met, even in the absence of the settler. 4. Inheritance Protection Trust: This trust type is designed to protect the inheritance of children and grandchildren from various risks such as divorce, lawsuits, or irresponsible spending. It allows the settler to designate a trustee who has the authority to manage and distribute the assets on behalf of the beneficiaries. The trust can have specific provisions to shield the assets and prevent them from being depleted irresponsibly. When creating a Texas Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren, it is crucial to consult with an experienced attorney specializing in trust and estate planning. They can help tailor the trust to meet the individual's goals and ensure compliance with Texas state laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Contrato de Fideicomiso Irrevocable en Beneficio de Cónyuge, Hijos y Nietos - Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren

Description

How to fill out Texas Contrato De Fideicomiso Irrevocable En Beneficio De Cónyuge, Hijos Y Nietos?

If you have to complete, acquire, or print out legitimate file themes, use US Legal Forms, the largest variety of legitimate varieties, that can be found on-line. Take advantage of the site`s basic and hassle-free search to get the paperwork you will need. A variety of themes for business and personal purposes are sorted by groups and says, or keywords. Use US Legal Forms to get the Texas Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren in a handful of clicks.

If you are presently a US Legal Forms customer, log in to the account and then click the Down load button to have the Texas Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren. You can also entry varieties you formerly downloaded inside the My Forms tab of the account.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Make sure you have selected the form for your proper metropolis/nation.

- Step 2. Make use of the Preview solution to check out the form`s content. Do not forget about to see the information.

- Step 3. If you are not satisfied with the develop, take advantage of the Look for discipline near the top of the monitor to get other variations of your legitimate develop format.

- Step 4. Once you have located the form you will need, select the Buy now button. Choose the prices plan you choose and include your references to register for the account.

- Step 5. Method the transaction. You should use your charge card or PayPal account to perform the transaction.

- Step 6. Pick the format of your legitimate develop and acquire it on your own device.

- Step 7. Total, change and print out or indicator the Texas Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren.

Each and every legitimate file format you buy is yours eternally. You may have acces to each and every develop you downloaded in your acccount. Go through the My Forms area and select a develop to print out or acquire yet again.

Be competitive and acquire, and print out the Texas Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren with US Legal Forms. There are many specialist and status-certain varieties you can use to your business or personal needs.