Texas Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is a legal arrangement in which a trust or transfers assets or property to a trustee to hold and manage for the benefit of a named beneficiary after a specified period of time. The significant aspect of this trust is that it allows the trust or to receive income from the trust assets during their lifetime. One type of Texas Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is a "Qualified Personnel Residence Trust" (PRT). A PRT is utilized primarily for protecting a residence or vacation home's value from estate taxes while allowing the trust or to continue residing in the property for a specified period. After this timeframe, the trust or may receive income generated by the property while still retaining some control over it. Another type is the "Granter Retained Income Trust" (GRIT). A GRIT allows the trust or to transfer assets, typically income-producing ones, into the trust while retaining the right to receive income for a specified period. By doing so, the trust or can reduce their estate tax liability and ultimately transfer assets to the named beneficiary. Furthermore, a "Crummy Trust" can also be considered under this category. A Crummy Trust is designed with provisions that enable the trust or to make annual exclusion gifts in the form of contributions to the trust. The trust or has the right to receive income from the trust after a specified time while the remaining assets are preserved for the beneficiary. In summary, a Texas Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is a legal entity that allows a trust or to transfer assets to a trustee, who holds and manages these assets for the benefit of a named beneficiary. Types of irrevocable trusts that fall under this category include Qualified Personnel Residence Trusts (Parts), Granter Retained Income Trusts (Grits), and Crummy Trusts. Each trust type serves specific purposes such as estate tax reduction, asset protection, and gifting opportunities.

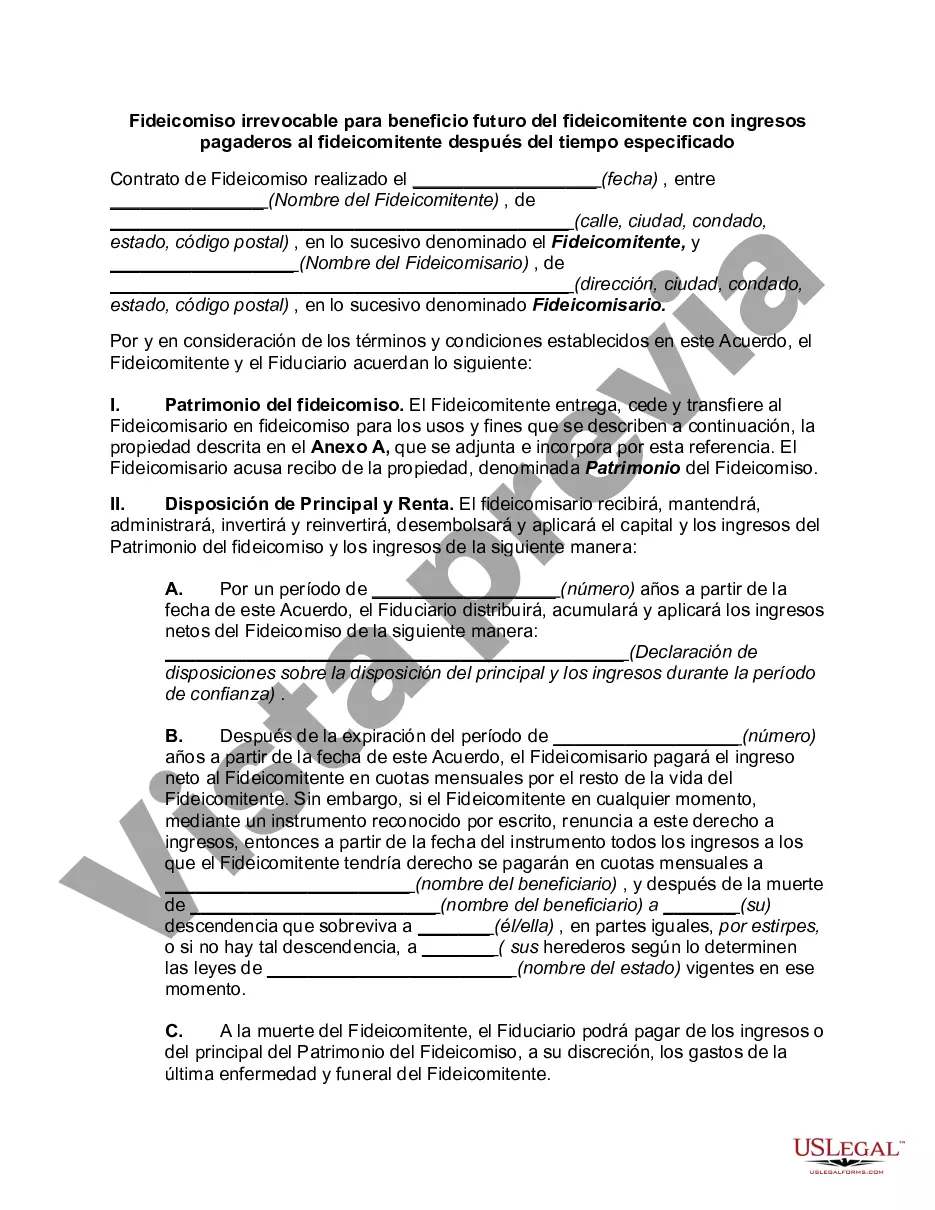

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Fideicomiso irrevocable para beneficio futuro del fideicomitente con ingresos pagaderos al fideicomitente después del tiempo especificado - Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Texas Fideicomiso Irrevocable Para Beneficio Futuro Del Fideicomitente Con Ingresos Pagaderos Al Fideicomitente Después Del Tiempo Especificado?

If you want to comprehensive, download, or produce legitimate file templates, use US Legal Forms, the greatest collection of legitimate forms, that can be found online. Utilize the site`s easy and hassle-free research to find the files you need. A variety of templates for enterprise and person purposes are sorted by types and says, or search phrases. Use US Legal Forms to find the Texas Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time in just a couple of click throughs.

In case you are previously a US Legal Forms customer, log in for your profile and then click the Acquire key to have the Texas Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time. You can even entry forms you in the past acquired within the My Forms tab of your profile.

If you are using US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for your proper metropolis/country.

- Step 2. Utilize the Review choice to look through the form`s articles. Don`t forget about to read the outline.

- Step 3. In case you are not happy with the type, use the Look for field near the top of the monitor to find other variations from the legitimate type web template.

- Step 4. Upon having found the form you need, click the Buy now key. Pick the costs plan you choose and add your references to sign up on an profile.

- Step 5. Approach the financial transaction. You can use your credit card or PayPal profile to accomplish the financial transaction.

- Step 6. Select the file format from the legitimate type and download it in your product.

- Step 7. Total, change and produce or indicator the Texas Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time.

Every legitimate file web template you buy is your own for a long time. You might have acces to every single type you acquired within your acccount. Go through the My Forms area and choose a type to produce or download once more.

Compete and download, and produce the Texas Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time with US Legal Forms. There are many expert and state-specific forms you can use for the enterprise or person requirements.

Form popularity

FAQ

Under current law assets in a grantor trust do not receive a step up in basis upon the grantor's death and are not included in the taxable estate of the grantor.

Too bad, says the IRS, unless you are an estate or trust. Under Section 663(b) of the Internal Revenue Code, any distribution by an estate or trust within the first 65 days of the tax year can be treated as having been made on the last day of the preceding tax year.

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust according to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.

Generally, a trustee is the only person allowed to withdraw money from an irrevocable trust.

When a trust is irrevocable but some or all of the trust can be disbursed to or for the benefit of the individual, the look-back period applying to disbursements which could be made to or for the individual but are made to another person or persons is 36 months.

The 65-day rule relates to distributions from complex trusts to beneficiaries made after the end of a calendar year. For the first 65 days of the following year, a distribution is considered to have been made in the previous year.

The IRS requires that any gifts be made out of a trust be under the beneficiary's full control immediately. This present interest rule means that if a gift is made with conditions and the beneficiary does not have control over it at the time its made then it doesn't qualify for the annual exclusion amount.

Some of the grantor trust rules outlined by the IRS are as follows: The power to add or change the beneficiary of a trust. The power to borrow from the trust without adequate security. The power to use the income from the trust to pay life insurance premiums.

Irrevocable trusts are primarily set up for estate and tax considerations. That's because it removes all incidents of ownership, removing the trust's assets from the grantor's taxable estate. It also relieves the grantor of the tax liability on the income generated by the assets.

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. Their children or spouse would be the residual beneficiaries.