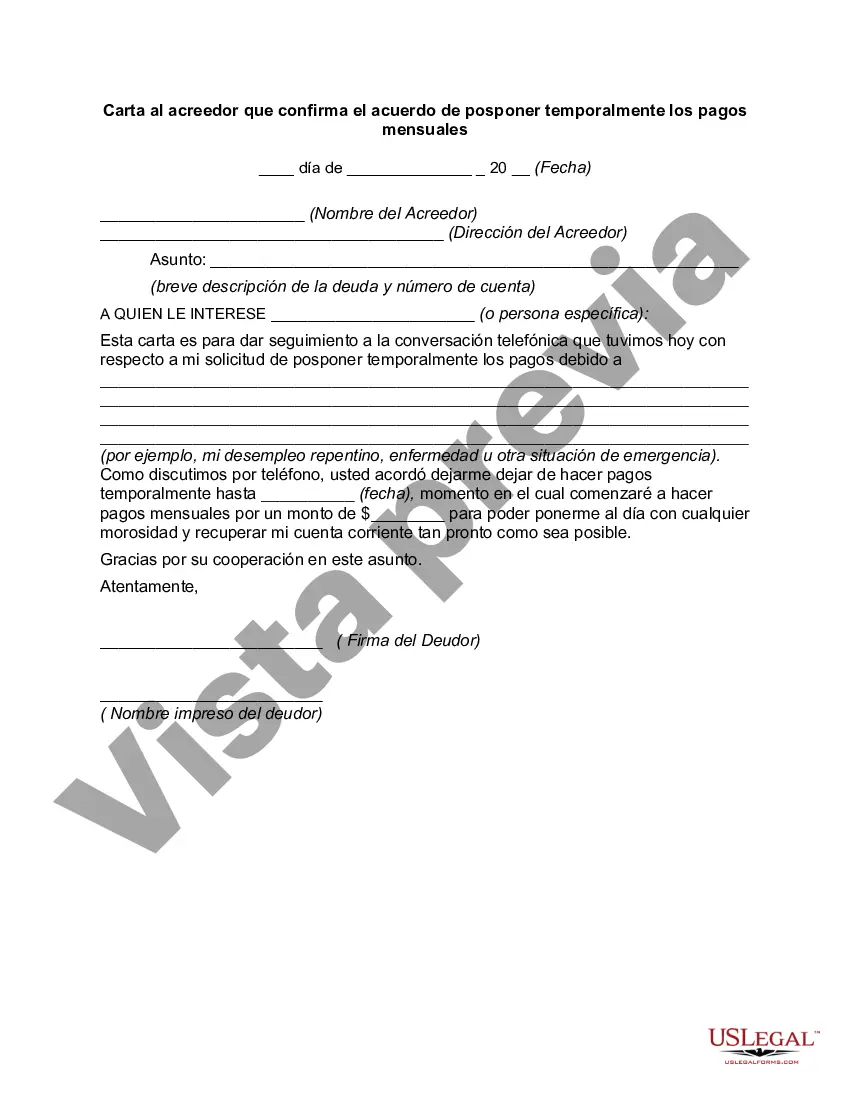

A Texas Letter to Creditor Confirming Agreement is a formal document that outlines an agreement between a debtor and a creditor in the state of Texas. This letter serves as written confirmation that the debtor and creditor have reached a mutual understanding to temporarily postpone the monthly payments agreed upon. Such a letter is typically used in financial situations where a debtor is facing temporary financial hardship but still wishes to honor their obligation. Key elements to include in a Texas Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed are: 1. Sender's Information: Begin the letter by providing the sender's full name, contact details, and address. It is crucial to mention the receiver's name and contact information as well. 2. Date: Include the current date of writing the letter to establish an official timeline. 3. Reference: Clearly state the subject of the letter as "Texas Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed." This reference will help identify the purpose of the document at a glance. 4. Creditor's Information: Mention the creditor's name, official mailing address, phone number, and any other relevant details to ensure accurate communication. 5. Debtor's Information: Provide the debtor's full name, address, phone number, and other necessary information to ensure proper identification. 6. Loan/Credit Details: Include specific information about the loan or credit agreement, such as the loan amount, interest rate, payment due dates, and the original terms agreed upon. 7. Financial Hardship Explanation: Clearly explain the reasons for the temporary postponement of monthly payments, emphasizing the temporary financial hardship being faced. It is important to describe the situation accurately and honestly to maintain transparency. 8. Request for Temporary Postponement: Clearly state the request for temporary postponement of monthly payments and specify the duration for which the debtor seeks relief. It is crucial to include a start and end date for the proposed period. 9. Agreement Confirmation: Request the creditor's confirmation of the agreement to temporarily postpone the payments, ensuring both parties are in agreement. Encourage the creditor to respond in writing to validate the arrangement. 10. Acknowledgment of Responsibility: Reiterate the debtor's commitment to fulfilling the obligation once the agreed-upon postponement period ends. Assure the creditor that any deferred payments will be made promptly upon resuming regular installments. 11. Contact Information: Provide contact details, such as phone number and email address, should the creditor need to reach out for further clarification or to provide their response in writing. Some alternate types of applicable Texas Letters to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed could include variations based on the type of debt involved, such as credit card debt, student loan debt, mortgage payments, or auto loan payments.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Carta al acreedor que confirma el acuerdo de posponer temporalmente los pagos mensuales - Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed

Description

How to fill out Texas Carta Al Acreedor Que Confirma El Acuerdo De Posponer Temporalmente Los Pagos Mensuales?

If you need to full, obtain, or print out lawful papers themes, use US Legal Forms, the biggest variety of lawful varieties, which can be found on the web. Take advantage of the site`s simple and convenient look for to find the papers you want. A variety of themes for enterprise and specific purposes are sorted by categories and suggests, or key phrases. Use US Legal Forms to find the Texas Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed in a couple of clicks.

In case you are already a US Legal Forms client, log in to the accounts and click on the Obtain switch to have the Texas Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed. You can also entry varieties you in the past acquired within the My Forms tab of your respective accounts.

If you work with US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the shape for the proper town/land.

- Step 2. Utilize the Preview choice to examine the form`s content material. Never forget to see the explanation.

- Step 3. In case you are not happy using the form, take advantage of the Lookup discipline on top of the screen to discover other types of your lawful form design.

- Step 4. Once you have identified the shape you want, select the Purchase now switch. Pick the rates prepare you prefer and include your accreditations to register to have an accounts.

- Step 5. Method the deal. You may use your bank card or PayPal accounts to accomplish the deal.

- Step 6. Pick the formatting of your lawful form and obtain it in your product.

- Step 7. Comprehensive, modify and print out or indicator the Texas Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed.

Every lawful papers design you buy is the one you have eternally. You might have acces to every single form you acquired in your acccount. Click on the My Forms segment and select a form to print out or obtain once more.

Contend and obtain, and print out the Texas Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed with US Legal Forms. There are thousands of skilled and condition-specific varieties you can use for your enterprise or specific requires.