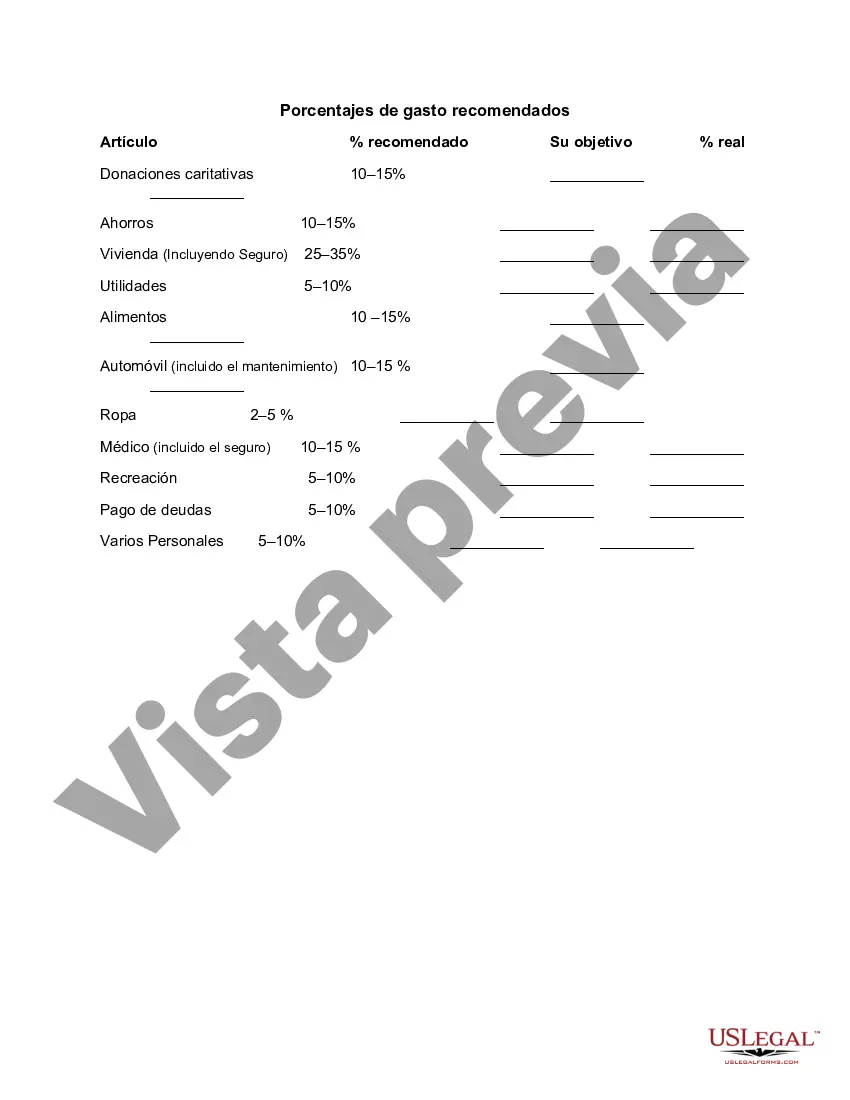

Texas Recommended Spending Percentages are guidelines provided by the Texas State Government to assist individuals, families, and businesses in managing their financial resources effectively. These percentages help establish a balanced budget and allocate funds appropriately across key expenditure categories. It is important to note that the specific recommended percentages may differ depending on personal circumstances, financial goals, and income level. 1. Housing: The Texas Recommended Spending Percentage for housing typically suggests allocating around 30% of monthly income towards housing expenses, including mortgage or rent payments, property taxes, insurance, and maintenance costs. 2. Transportation: Another significant expenditure category is transportation, which incorporates vehicle-related costs such as car loan payments, fuel, insurance, repairs, and public transportation fares. The Texas Recommended Spending Percentage for transportation generally encourages allocating around 15-20% of monthly income to this category. 3. Food: Food expenses encompass groceries and dining out. The Texas Recommended Spending Percentage for food may vary between 10-15% of monthly income, depending on dietary preferences, family size, and eating habits. 4. Healthcare: The Texas Recommended Spending Percentage for healthcare should consider expenses like health insurance premiums, copay, deductibles, prescription medications, and medical treatments. It is advisable to allocate around 5-10% of monthly income to healthcare costs. 5. Debt Repayment: If one has outstanding debts, allocating a portion of income towards debt repayment is important. The Texas Recommended Spending Percentage for this category typically suggests limiting debt payments to 5-10% of monthly income. 6. Savings: Allocating a percentage of income towards savings helps build an emergency fund and work towards financial goals. The Texas Recommended Spending Percentage for savings is generally advised to be around 10-15% of monthly income. It is important to remember that these percentages are recommended as a general guideline and may need adjustments based on individual circumstances. Additionally, it is crucial to prioritize spending based on personal financial goals, such as education, retirement, or other long-term aspirations. Regularly reviewing and adjusting spending patterns according to personal needs and financial situation is essential to maintain financial stability and achieve future financial success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Porcentajes de gasto recomendados - Recommended Spending Percentages

Description

How to fill out Texas Porcentajes De Gasto Recomendados?

Are you presently in a placement that you need to have paperwork for either business or person reasons just about every time? There are a lot of legal file templates accessible on the Internet, but locating kinds you can depend on isn`t effortless. US Legal Forms delivers thousands of develop templates, much like the Texas Recommended Spending Percentages, that happen to be composed to meet state and federal needs.

If you are previously familiar with US Legal Forms internet site and have your account, merely log in. After that, it is possible to download the Texas Recommended Spending Percentages format.

If you do not provide an profile and need to start using US Legal Forms, adopt these measures:

- Discover the develop you want and ensure it is to the appropriate city/area.

- Make use of the Preview switch to review the shape.

- Read the description to actually have selected the correct develop.

- In case the develop isn`t what you are looking for, take advantage of the Look for discipline to find the develop that meets your needs and needs.

- Whenever you obtain the appropriate develop, just click Acquire now.

- Opt for the rates plan you desire, fill out the required details to generate your bank account, and buy an order making use of your PayPal or credit card.

- Decide on a practical paper file format and download your duplicate.

Find all the file templates you possess bought in the My Forms food list. You may get a further duplicate of Texas Recommended Spending Percentages anytime, if needed. Just click the essential develop to download or produce the file format.

Use US Legal Forms, by far the most substantial assortment of legal varieties, to save some time and steer clear of mistakes. The assistance delivers appropriately manufactured legal file templates which can be used for a range of reasons. Produce your account on US Legal Forms and start generating your lifestyle easier.