Texas Monthly Retirement Planning is a comprehensive financial service designed specifically for retirees or individuals nearing retirement in the state of Texas. This retirement planning service focuses on helping Texans make informed decisions regarding their financial goals, investments, and estate planning as they transition into their retirement years. Texas Monthly Retirement Planning takes into account various factors such as income sources, potential expenses, health care costs, and lifestyle preferences to create a personalized retirement roadmap. Through this service, individuals can gain a clear understanding of their financial situation and the steps they need to take to achieve a secure and comfortable retirement in Texas. The main types of Texas Monthly Retirement Planning include: 1. Investment Strategies: Texas Monthly Retirement Planning offers various investment strategies tailored to individual needs and risk tolerances. These strategies aim to maximize returns while minimizing the risks associated with market fluctuations, ensuring a steady income during retirement. 2. Social Security Optimization: This type of retirement planning focuses on maximizing Social Security benefits for retirees. Texas Monthly Retirement Planning helps individuals understand the best time to begin claiming Social Security, strategies for spousal benefits, and how to navigate complex regulations to make the most of this important income source. 3. Tax Planning: Texas Monthly Retirement Planning also includes tax planning services, which aim to minimize tax liabilities during retirement. This involves identifying potential tax-saving opportunities, making strategic decisions regarding withdrawals from retirement accounts, and maximizing deductions and credits specifically applicable to retirees in Texas. 4. Estate Planning: Under Texas Monthly Retirement Planning, individuals can receive guidance on estate planning to ensure their assets are protected and distributed according to their wishes. This includes setting up wills, trusts, and powers of attorney, as well as considering options to minimize estate taxes and probate costs. By utilizing Texas Monthly Retirement Planning services, individuals can have peace of mind knowing that their retirement future is well-planned and aligned with their unique needs and preferences. Whether it's optimizing investments, maximizing Social Security benefits, minimizing taxes, or ensuring a seamless estate plan, Texas Monthly Retirement Planning provides the essential tools and expertise to help Texans confidently navigate their retirement journey.

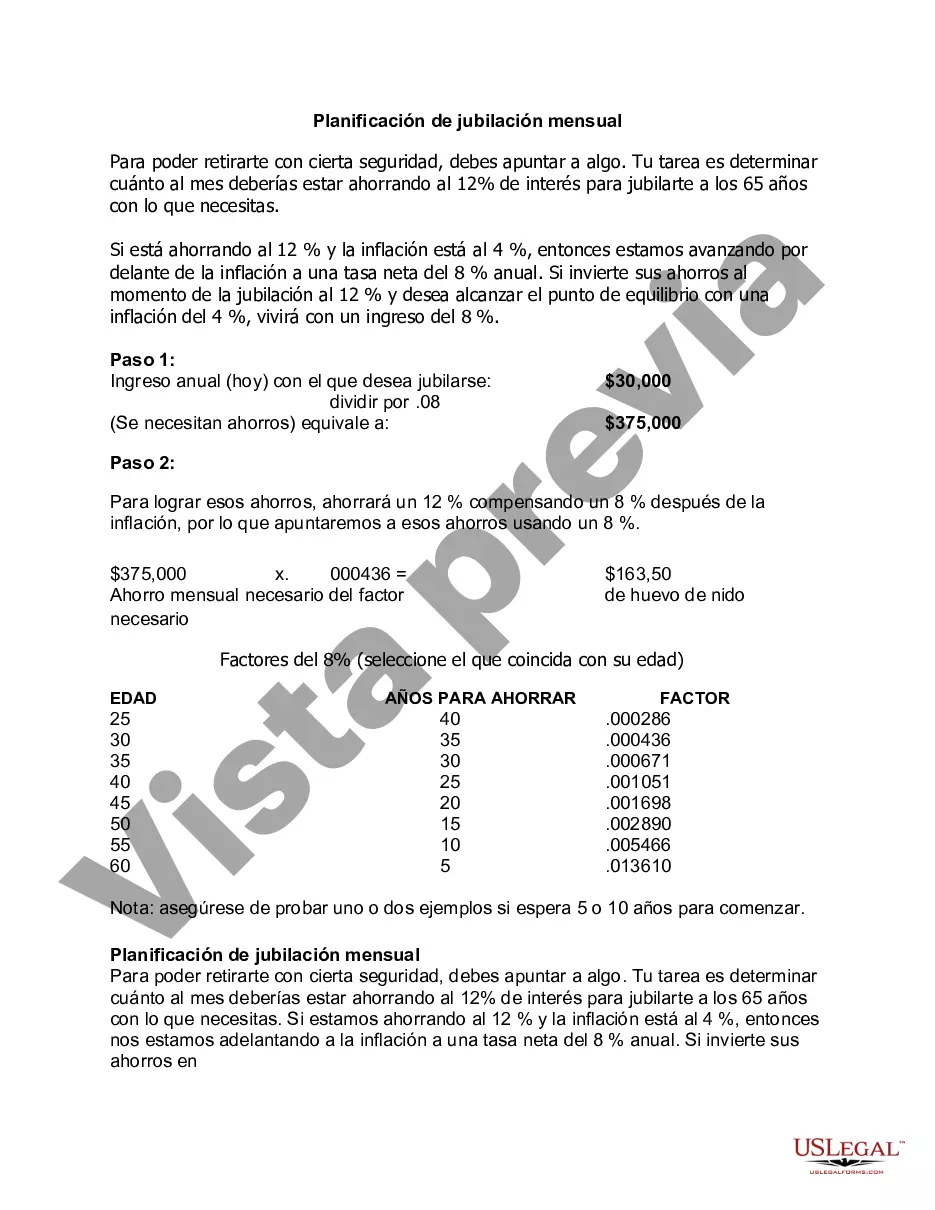

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Planificación de jubilación mensual - Monthly Retirement Planning

Description

How to fill out Texas Planificación De Jubilación Mensual?

You are able to devote time on-line looking for the legitimate document format which fits the federal and state demands you require. US Legal Forms offers thousands of legitimate kinds that are examined by professionals. It is possible to download or produce the Texas Monthly Retirement Planning from my service.

If you currently have a US Legal Forms profile, you may log in and click on the Download button. Following that, you may total, change, produce, or indicator the Texas Monthly Retirement Planning. Every legitimate document format you buy is the one you have permanently. To have another duplicate of the obtained kind, check out the My Forms tab and click on the corresponding button.

Should you use the US Legal Forms web site initially, adhere to the basic guidelines under:

- First, ensure that you have selected the right document format for the state/metropolis of your choosing. Read the kind outline to ensure you have picked out the right kind. If available, use the Review button to look throughout the document format also.

- In order to get another model from the kind, use the Research field to discover the format that meets your needs and demands.

- After you have found the format you want, click on Acquire now to proceed.

- Select the prices plan you want, type in your accreditations, and sign up for a free account on US Legal Forms.

- Complete the transaction. You can use your bank card or PayPal profile to pay for the legitimate kind.

- Select the file format from the document and download it to the product.

- Make changes to the document if necessary. You are able to total, change and indicator and produce Texas Monthly Retirement Planning.

Download and produce thousands of document templates using the US Legal Forms site, that offers the largest selection of legitimate kinds. Use specialist and state-certain templates to take on your organization or individual requirements.