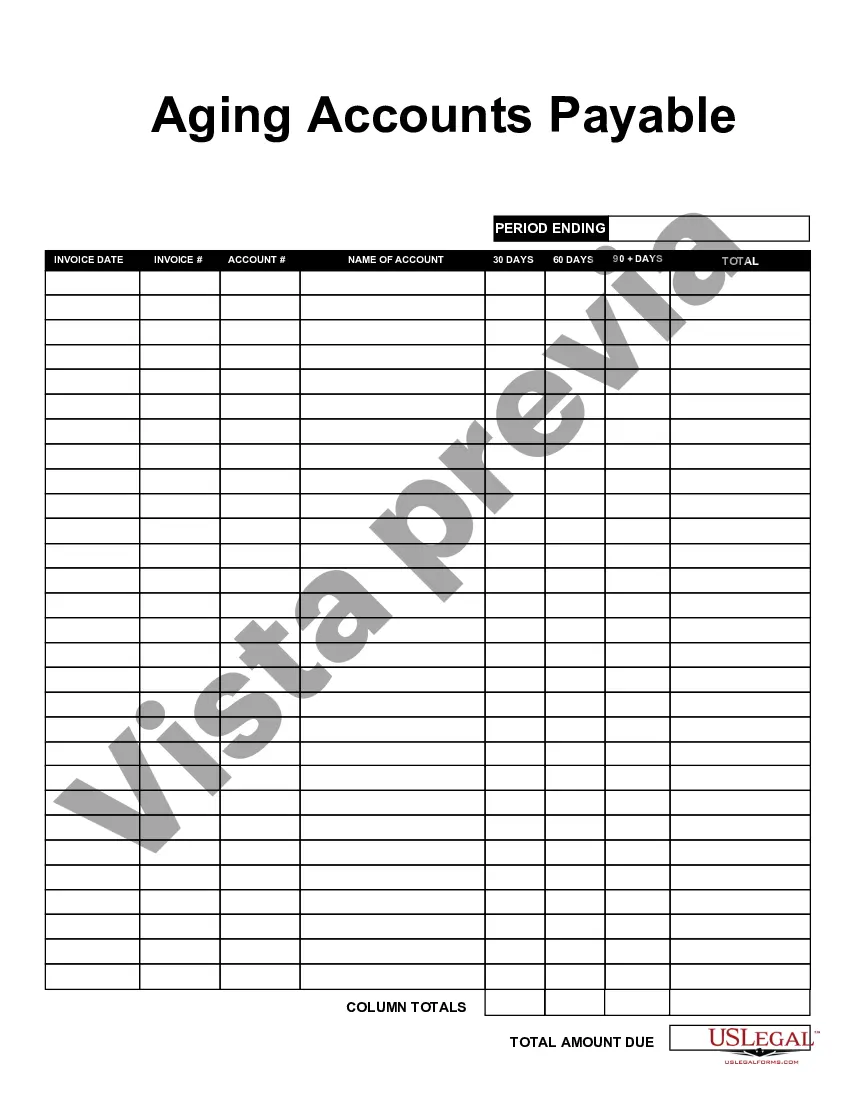

Texas Aging Accounts Payable refers to the process of tracking and analyzing the outstanding invoices and bills that a company or organization owes to its vendors or suppliers in the state of Texas. This specific term "Texas Aging Accounts Payable" indicates that the accounts payable are categorized according to their age or the length of time they have been outstanding. Accounts Payable represents the company's short-term liabilities and is an essential part of its financial management system. Tracking the aging accounts payable assists in the effective management of cash flow, budgeting, and maintaining relationships with suppliers. There are typically four types of Texas Aging Accounts Payable: 1. Current: These are the outstanding invoices that are due for payment within a short period, usually within the next 30 days. 2. 30-60 Days Aging: This category includes invoices or bills that have been overdue for payment for 30 to 60 days since the due date. 3. 60-90 Days Aging: This category comprises invoices or bills that have been overdue for payment for 60 to 90 days since the due date. 4. Over 90 Days Aging: This category consists of invoices or bills that have not been paid for more than 90 days since the due date. By categorizing the accounts payable based on their age, it becomes easier for businesses to prioritize payments and manage their financial obligations effectively. The Texas Aging Accounts Payable report provides crucial information for financial analysis, helping companies identify any potential cash flow issues or areas where they need to negotiate payment terms. Furthermore, Texas Aging Accounts Payable allows businesses to assess their relationship with suppliers, as delayed payments can strain these relationships. By monitoring the aging accounts payable closely, businesses can maintain healthy vendor relationships by addressing any outstanding payments promptly. In summary, Texas Aging Accounts Payable is an essential financial management tool that enables businesses to track and manage their outstanding invoices and bills according to their age. This categorization helps in effective cash flow management and maintaining healthy relationships with suppliers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Antigüedad de cuentas por pagar - Aging Accounts Payable

Description

How to fill out Texas Antigüedad De Cuentas Por Pagar?

Discovering the right legitimate file template can be a have a problem. Naturally, there are tons of themes available on the net, but how would you discover the legitimate type you will need? Use the US Legal Forms website. The service offers 1000s of themes, including the Texas Aging Accounts Payable, that can be used for enterprise and private requirements. Every one of the types are examined by professionals and fulfill federal and state needs.

In case you are presently authorized, log in to the accounts and then click the Down load switch to find the Texas Aging Accounts Payable. Make use of accounts to search through the legitimate types you possess acquired earlier. Check out the My Forms tab of your own accounts and obtain yet another backup of the file you will need.

In case you are a new customer of US Legal Forms, allow me to share basic instructions that you can stick to:

- Very first, make sure you have chosen the proper type for your metropolis/state. You may look through the shape using the Preview switch and read the shape description to ensure this is basically the right one for you.

- In the event the type fails to fulfill your expectations, use the Seach field to obtain the proper type.

- Once you are sure that the shape is suitable, click the Buy now switch to find the type.

- Select the prices plan you want and enter the necessary info. Make your accounts and purchase the order making use of your PayPal accounts or charge card.

- Pick the document file format and obtain the legitimate file template to the gadget.

- Total, change and print and indicator the acquired Texas Aging Accounts Payable.

US Legal Forms is definitely the largest collection of legitimate types that you can find a variety of file themes. Use the service to obtain appropriately-manufactured paperwork that stick to status needs.

Form popularity

FAQ

Aging of Accounts Receivables = (Average Accounts Receivables 360 Days)/Credit SalesAging of Accounts Receivables = ($ 4, 50,000.00360 days)/$ 9, 00,000.00.Aging of Accounts Receivables = 90 Days.

An accounts payable aging report (or AP aging report) is a vital accounting document that outlines the due dates of the bills and invoices a business needs to pay. The opposite of an AP aging report is an accounts receivable aging report, which offers a timeline of when a business can expect to receive payments.

An accounts payable aging report (or AP aging report) is a vital accounting document that outlines the due dates of the bills and invoices a business needs to pay. The opposite of an AP aging report is an accounts receivable aging report, which offers a timeline of when a business can expect to receive payments.

The accounts payable turnover in days shows the average number of days that a payable remains unpaid. To calculate the accounts payable turnover in days, simply divide 365 days by the payable turnover ratio. Therefore, over the fiscal year, the company takes approximately 60.53 days to pay its suppliers.

The accounts payable turnover in days shows the average number of days that a payable remains unpaid. To calculate the accounts payable turnover in days, simply divide 365 days by the payable turnover ratio. Therefore, over the fiscal year, the company takes approximately 60.53 days to pay its suppliers.

AP Aging ReportsGo to Reports on the top menu.Choose Vendors and Payables.Select A/P Aging Detail.Tick the Customize Report tab.In the Dates field choose Custom.Enter the date for April in the From and To field.Tap OK.

When you pay off an invoice, remove the current or past due amount from your report. For example, say you paid off the $100 invoice that's 61 90 days past due for Vendor 3. After you pay Vendor 3 the $100, make sure you change the 61 90 days column to say $0.

To prepare accounts receivable aging report, sort the unpaid invoices of a business with the number of days outstanding. This report displays the amount of money owed to you by your customers for good and services purchased.

You can find accounts payable under the 'current liabilities' section on your balance sheet or chart of accounts. Accounts payable are different from other current liabilities like short-term loans, accruals, proposed dividends and bills of exchange payable.

The Accounts Payable Aging Report lists vendors to which you owe money in the rows. The columns separate your bills by how many days they are overdue, with the first column being bills that are not overdue, and the fifth column being bills that are more than 90 days overdue.