The Texas Private Annuity Agreement is a legal contract that enables individuals to transfer assets while retaining a fixed stream of income for a specified period. This agreement is commonly used in estate planning strategies and can provide significant tax benefits for both parties involved. In a Texas Private Annuity Agreement, the person transferring the assets (known as the "annuitant" or "transferor") agrees to give up ownership rights to the assets in exchange for regular payments made by the person receiving the assets (known as the "obliged" or "annuity issuer"). These payments are typically made over the life of the annuitant or a predetermined period, as agreed upon in the contract. The key advantage of a Texas Private Annuity Agreement is its potential to effectively transfer assets outside the realm of estate and gift taxes. By using this strategy, individuals can remove appreciating assets from their estates while still receiving a source of income. This can be particularly beneficial for those who have significant taxable estates and want to minimize their tax liabilities. Different types of Texas Private Annuity Agreements may include: 1. Lifetime Private Annuity: In this type of agreement, the annuitant receives periodic payments for their entire lifetime. Once the annuitant passes away, the payments cease, and there are no further obligations. 2. Term Private Annuity: This agreement specifies a fixed term during which the annuitant will receive regular payments. Unlike the lifetime option, the term private annuity does not end upon the annuitant's death. Instead, it continues until the agreed-upon term is completed. 3. Joint and Survivor Private Annuity: This type of agreement benefits two individuals, usually spouses or partners. Payments are made to both annuitants either until the death of the last surviving annuitant or for a fixed term, whichever occurs first. When considering a Texas Private Annuity Agreement, it is essential to consult with a qualified attorney or financial advisor well-versed in estate planning and tax laws. They can help determine the most suitable annuity structure and ensure compliance with all legal requirements. Understanding the intricacies of the agreement and seeking professional advice will help individuals make informed decisions regarding their financial futures and estate planning goals.

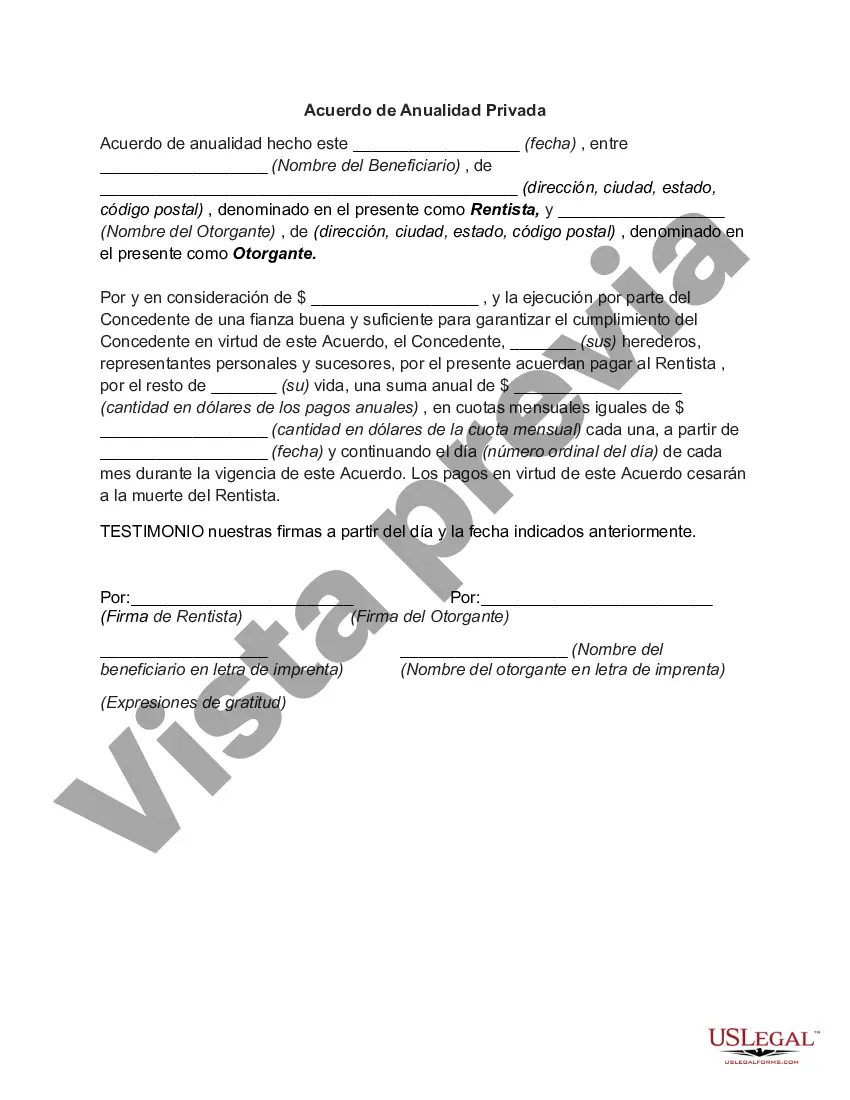

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Acuerdo de Anualidad Privada - Private Annuity Agreement

Description

How to fill out Texas Acuerdo De Anualidad Privada?

If you wish to comprehensive, down load, or produce legal papers web templates, use US Legal Forms, the most important assortment of legal forms, which can be found on the web. Make use of the site`s basic and handy lookup to get the documents you will need. A variety of web templates for company and personal uses are categorized by types and suggests, or keywords and phrases. Use US Legal Forms to get the Texas Private Annuity Agreement with a handful of mouse clicks.

If you are already a US Legal Forms customer, log in for your accounts and then click the Download key to have the Texas Private Annuity Agreement. Also you can access forms you earlier downloaded inside the My Forms tab of your own accounts.

Should you use US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have chosen the form for the proper city/nation.

- Step 2. Utilize the Preview method to examine the form`s information. Never forget about to learn the explanation.

- Step 3. If you are not satisfied with the develop, use the Lookup area towards the top of the display screen to discover other versions from the legal develop format.

- Step 4. When you have found the form you will need, click on the Buy now key. Choose the costs strategy you like and add your accreditations to sign up on an accounts.

- Step 5. Approach the financial transaction. You can use your credit card or PayPal accounts to accomplish the financial transaction.

- Step 6. Find the formatting from the legal develop and down load it on your own device.

- Step 7. Comprehensive, modify and produce or indication the Texas Private Annuity Agreement.

Each and every legal papers format you get is the one you have permanently. You might have acces to each develop you downloaded inside your acccount. Select the My Forms section and decide on a develop to produce or down load again.

Compete and down load, and produce the Texas Private Annuity Agreement with US Legal Forms. There are millions of specialist and state-certain forms you can use for your company or personal requirements.