Texas Credit Information Request refers to a formal process through which individuals or organizations can obtain their credit-related information in the state of Texas. This request allows you to access various details about your credit history, including credit scores, credit reports, and other financial information. Understanding this process is crucial for anyone looking to monitor, manage, or improve their creditworthiness in the Lone Star State. There are primarily three types of Texas Credit Information Requests: 1. Texas Credit Information Request for Individuals: This type of request is specifically designed for individuals who want to obtain their personal credit information. Whether you're applying for a loan, mortgage, or credit card, it's essential to review your credit reports for all three major credit bureaus (Equifax, Experian, and TransUnion). This request enables you to identify any errors, inaccuracies, or potential fraud in your credit history. 2. Texas Credit Information Request for Landlords: Landlords in Texas often use credit checks to assess the financial stability and trustworthiness of potential tenants. By making this type of credit information request, landlords can gain valuable insights into an applicant's payment history, outstanding debts, and overall creditworthiness. This helps them make informed decisions when selecting tenants and reducing the risk of renting property to individuals with poor financial backgrounds. 3. Texas Credit Information Request for Employers: Some employers in Texas require credit checks as part of their hiring process, particularly for positions involving financial responsibilities or access to sensitive information. By submitting this type of credit information request, employers can evaluate an applicant's financial management skills, overall debt load, and any potential red flags that might indicate financial instability. This information assists employers in making informed employment decisions while safeguarding their business interests. Overall, Texas Credit Information Request provides individuals, landlords, and employers with essential credit-related data necessary for making informed decisions. By systematically requesting and reviewing credit information, individuals can ensure the accuracy of their credit history, while landlords and employers can assess the financial reliability of potential tenants or employees.

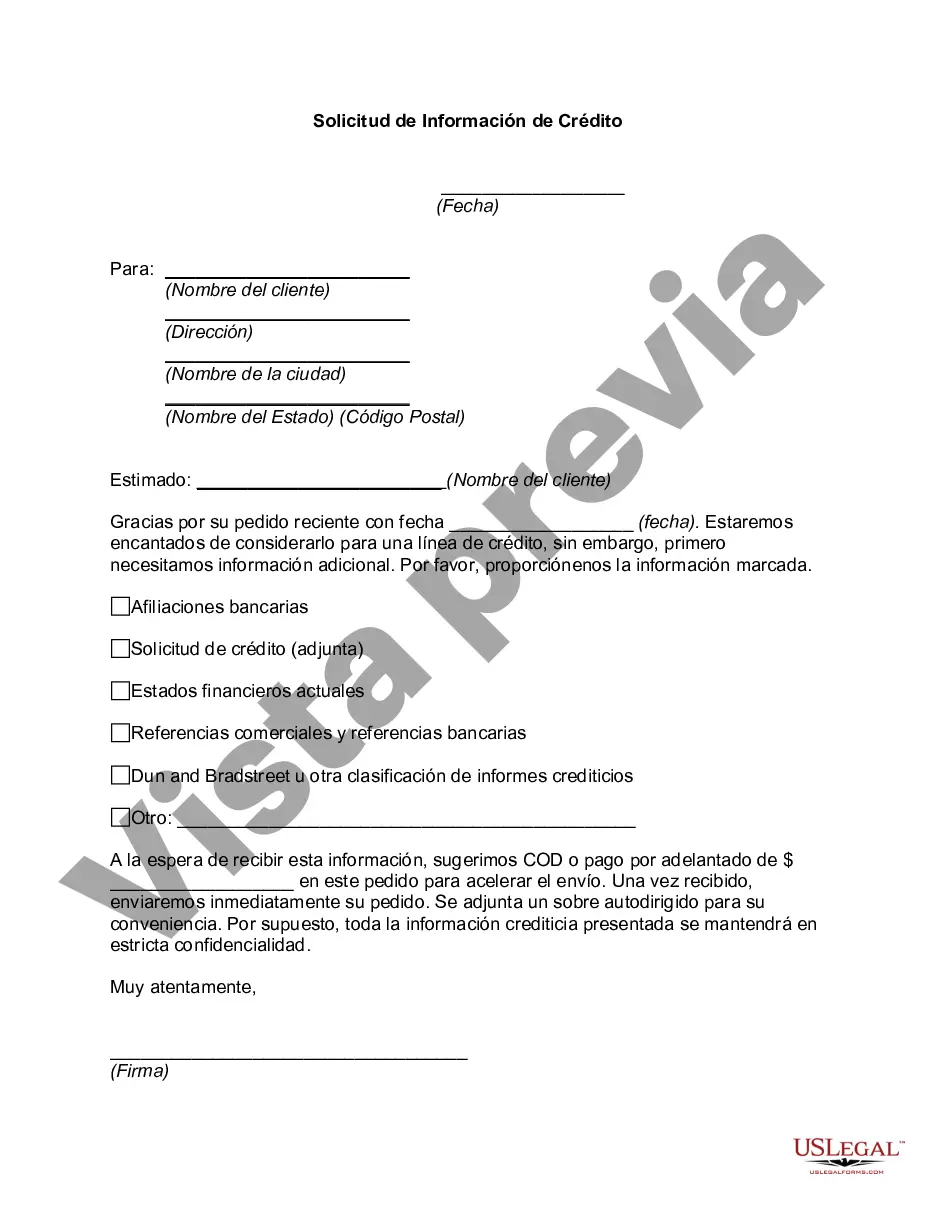

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Solicitud de Información de Crédito - Credit Information Request

Description

How to fill out Texas Solicitud De Información De Crédito?

If you need to total, acquire, or printing authorized papers themes, use US Legal Forms, the most important assortment of authorized forms, which can be found on the Internet. Take advantage of the site`s simple and easy convenient look for to discover the papers you need. Various themes for enterprise and personal functions are sorted by classes and states, or keywords and phrases. Use US Legal Forms to discover the Texas Credit Information Request in a couple of click throughs.

Should you be already a US Legal Forms consumer, log in in your profile and then click the Acquire key to find the Texas Credit Information Request. Also you can access forms you formerly acquired inside the My Forms tab of your own profile.

If you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for your right city/land.

- Step 2. Utilize the Review solution to check out the form`s articles. Never forget to see the information.

- Step 3. Should you be unhappy with the form, utilize the Research area towards the top of the display to find other versions from the authorized form web template.

- Step 4. After you have identified the form you need, go through the Get now key. Choose the rates plan you choose and add your qualifications to sign up on an profile.

- Step 5. Procedure the deal. You can utilize your charge card or PayPal profile to complete the deal.

- Step 6. Find the format from the authorized form and acquire it on your gadget.

- Step 7. Total, modify and printing or indicator the Texas Credit Information Request.

Each authorized papers web template you acquire is yours permanently. You have acces to each form you acquired inside your acccount. Go through the My Forms area and pick a form to printing or acquire once again.

Contend and acquire, and printing the Texas Credit Information Request with US Legal Forms. There are millions of professional and status-particular forms you can utilize to your enterprise or personal demands.