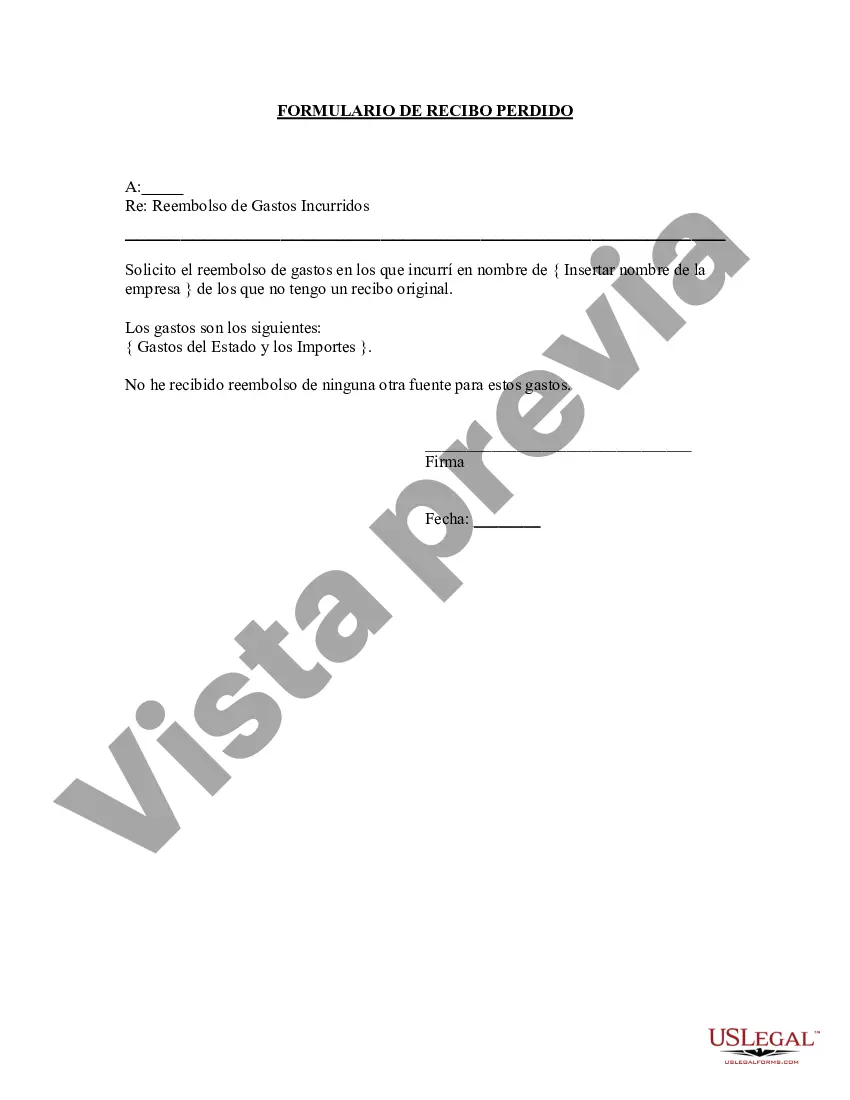

Texas Lost Receipt Forms are documents used to report lost or missing receipts for expenses incurred by individuals or businesses in the state of Texas. These forms serve as a means to provide evidence or documentation for these expenses in cases where the original receipt is no longer available. The Texas Lost Receipt Form is typically filled out by the individual or business who lost their original receipt and needs to claim the expense for reimbursement or tax purposes. It is essential to provide accurate and detailed information in this form to ensure the validity of the claim. The form will usually require information such as the name, address, and contact details of the claimant, along with the date and description of the lost receipt and the amount of the expense. Different types of Texas Lost Receipt Forms may vary depending on the specific organization or institution requiring the form. For example, there may be specific forms for employees who lost a receipt for a business expense, forms for students who lost a receipt for a university-related expense, or forms for individuals filing personal expense claims. It is crucial to use the correct form that aligns with the specific circumstances and requirements of the entity reviewing the claim. Keywords: Texas, Lost Receipt Form, evidence, documentation, expenses, reimbursement, tax purposes, claim, accuracy, claimant, organization, institution, employees, students, personal expense claims.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Formulario de recibo perdido - Lost Receipt Form

Description

How to fill out Texas Formulario De Recibo Perdido?

It is possible to commit hours on the web searching for the legal document format which fits the state and federal needs you require. US Legal Forms supplies thousands of legal forms that are reviewed by professionals. You can actually down load or produce the Texas Lost Receipt Form from the services.

If you already have a US Legal Forms profile, you are able to log in and then click the Down load switch. Afterward, you are able to comprehensive, revise, produce, or signal the Texas Lost Receipt Form. Each and every legal document format you get is the one you have forever. To have another version of the obtained type, go to the My Forms tab and then click the related switch.

If you are using the US Legal Forms web site initially, adhere to the straightforward guidelines below:

- First, make certain you have chosen the right document format for the county/metropolis of your liking. Read the type information to make sure you have chosen the appropriate type. If available, utilize the Review switch to search through the document format as well.

- In order to find another variation in the type, utilize the Research discipline to get the format that meets your requirements and needs.

- Upon having discovered the format you want, simply click Get now to move forward.

- Choose the rates prepare you want, enter your references, and sign up for an account on US Legal Forms.

- Comprehensive the financial transaction. You should use your Visa or Mastercard or PayPal profile to pay for the legal type.

- Choose the structure in the document and down load it to your system.

- Make alterations to your document if possible. It is possible to comprehensive, revise and signal and produce Texas Lost Receipt Form.

Down load and produce thousands of document layouts using the US Legal Forms web site, which provides the largest collection of legal forms. Use professional and status-distinct layouts to handle your small business or personal requirements.