The Texas Stop Annuity Request is a legal procedure that allows individuals to terminate or halt annuity payments in the state of Texas. An annuity is a financial product often used for retirement planning, in which a person invests a lump sum of money with an insurance company in exchange for regular payments over a specified period of time. When individuals find themselves in need of immediate funds or have a change in financial circumstances, they may consider stopping annuity payments. The process of doing so in Texas involves filing a Texas Stop Annuity Request with the appropriate authorities. The Texas Stop Annuity Request can be initiated for various types of annuities, including fixed annuities, variable annuities, and indexed annuities. Each type of annuity has its own unique characteristics and potential benefits. Fixed annuities provide a guaranteed fixed interest rate, while variable annuities offer the potential for higher returns but come with market risk. Indexed annuities combine elements of both fixed and variable annuities, with returns linked to a stock market index. There are several reasons why individuals may consider submitting a Texas Stop Annuity Request. Some common scenarios include urgent financial needs, medical emergencies, debt repayment, education expenses, or simply wanting more control over their finances. Whatever the reason may be, individuals must carefully evaluate their situation and understand the implications of stopping annuity payments before proceeding. To initiate the Texas Stop Annuity Request, individuals typically need to complete a specific form provided by the annuity issuer or the Texas state authorities. The form will require information such as the annuity contract details, personal information of the annuitant, reasons for stopping the payments, and any supporting documentation. It is important to ensure that all required information is accurately provided to avoid delays or complications in the process. Once the Texas Stop Annuity Request is submitted, the annuity issuer will review the application and evaluate the validity of the reasons provided. The issuer may request additional information or clarification if necessary. After careful assessment, the issuer will determine whether to approve or deny the request to stop annuity payments. If the request is approved, the individual will receive a lump sum payment or alternative arrangement according to the terms and conditions outlined in the annuity contract. In summary, the Texas Stop Annuity Request is a process that allows individuals in Texas to cease annuity payments based on specific circumstances. It provides individuals with a means to access funds when needed or when financial priorities change. It is important to consider seeking professional advice before submitting a Texas Stop Annuity Request to understand the potential ramifications and explore alternative options.

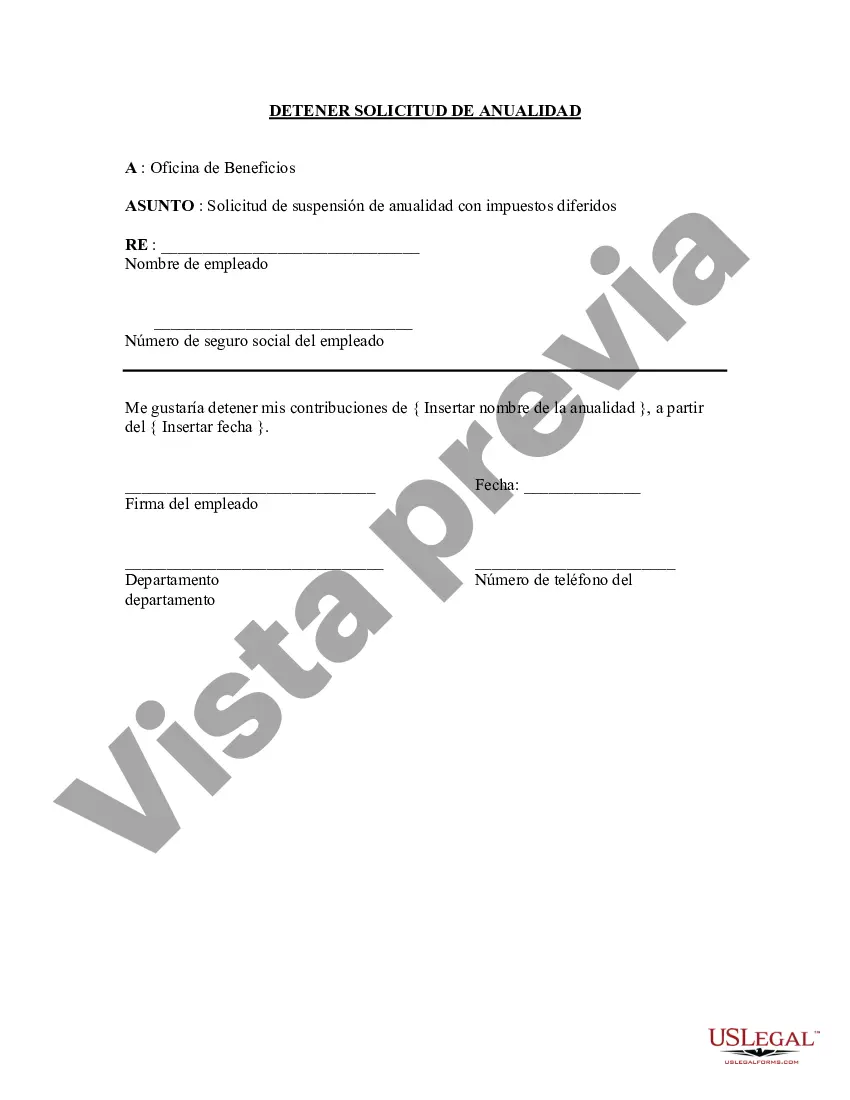

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Detener solicitud de anualidad - Stop Annuity Request

Description

How to fill out Texas Detener Solicitud De Anualidad?

US Legal Forms - one of the largest libraries of authorized types in the USA - delivers an array of authorized file layouts you may acquire or produce. Utilizing the internet site, you will get a huge number of types for company and specific reasons, sorted by classes, claims, or keywords.You will find the most recent models of types like the Texas Stop Annuity Request within minutes.

If you have a registration, log in and acquire Texas Stop Annuity Request from the US Legal Forms library. The Down load key can look on each type you perspective. You get access to all in the past delivered electronically types within the My Forms tab of the account.

If you wish to use US Legal Forms the very first time, listed below are easy recommendations to obtain started out:

- Make sure you have selected the proper type for your metropolis/state. Click on the Review key to check the form`s information. Browse the type information to actually have chosen the correct type.

- If the type doesn`t satisfy your requirements, utilize the Lookup industry at the top of the monitor to get the one which does.

- In case you are happy with the shape, confirm your choice by visiting the Purchase now key. Then, pick the rates strategy you prefer and give your qualifications to register for an account.

- Approach the transaction. Utilize your bank card or PayPal account to finish the transaction.

- Pick the structure and acquire the shape on the product.

- Make changes. Load, edit and produce and signal the delivered electronically Texas Stop Annuity Request.

Every format you included with your money lacks an expiration time which is your own eternally. So, if you wish to acquire or produce yet another backup, just visit the My Forms area and click in the type you want.

Gain access to the Texas Stop Annuity Request with US Legal Forms, by far the most substantial library of authorized file layouts. Use a huge number of specialist and express-certain layouts that fulfill your company or specific demands and requirements.