Title: Texas Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment Description: In the realm of business agreements and assignments, the Texas Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment is a legally binding contract that provides assurance and protection to corporations and distributors involved in assignments of distributorship funds in the state of Texas. This detailed description aims to explain the concept, purpose, and various types of Texas Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment. Keywords: — TexaGuaranint— - Distributorship Funds — Distribu—oCorporationatio— - Assignee - Assignment — Paym—nt - Assuranc— - Protection - Legally Binding — Business Agreement Types of Texas Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment: 1. Limited Liability Texas Guaranty: Under this type of guaranty, the distributor agrees to assume limited liability for the payment of distributorship funds owed to the corporation by the assignee. This arrangement guarantees partial protection to the corporation in case of default or non-payment. 2. Absolute Texas Guaranty: In an absolute guaranty scenario, the distributor takes full responsibility for the payment of distributorship funds by the assignee to the corporation. This type of guaranty provides stronger protection to the corporation, ensuring complete payment in case the assignee fails to fulfill their financial obligations. 3. Recourse Texas Guaranty: With a recourse guaranty, the distributor guarantees payment of distributorship funds by the assignee to the corporation. In the event the assignee defaults, the distributor becomes liable for the unpaid amounts and can be pursued for recovery by the corporation. 4. Non-Recourse Texas Guaranty: Under a non-recourse guaranty, the distributor assumes responsibility for the payment of distributorship funds only to the extent of funds received from the assignee. If the assignee defaults, the distributor is not personally liable for the outstanding balance beyond the received funds. 5. Continuing Texas Guaranty: This type of guaranty ensures that the obligations of the distributor to guarantee payment of distributorship funds remains in effect for the duration of the distributorship arrangement, even if there are changes in the ownership or structure of the distributor or assignee. Irrespective of the specific type, a Texas Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment acts as a vital contractual instrument, safeguarding the financial interests of corporations and distributors striving for a smooth assignment of distributorship funds within the state.

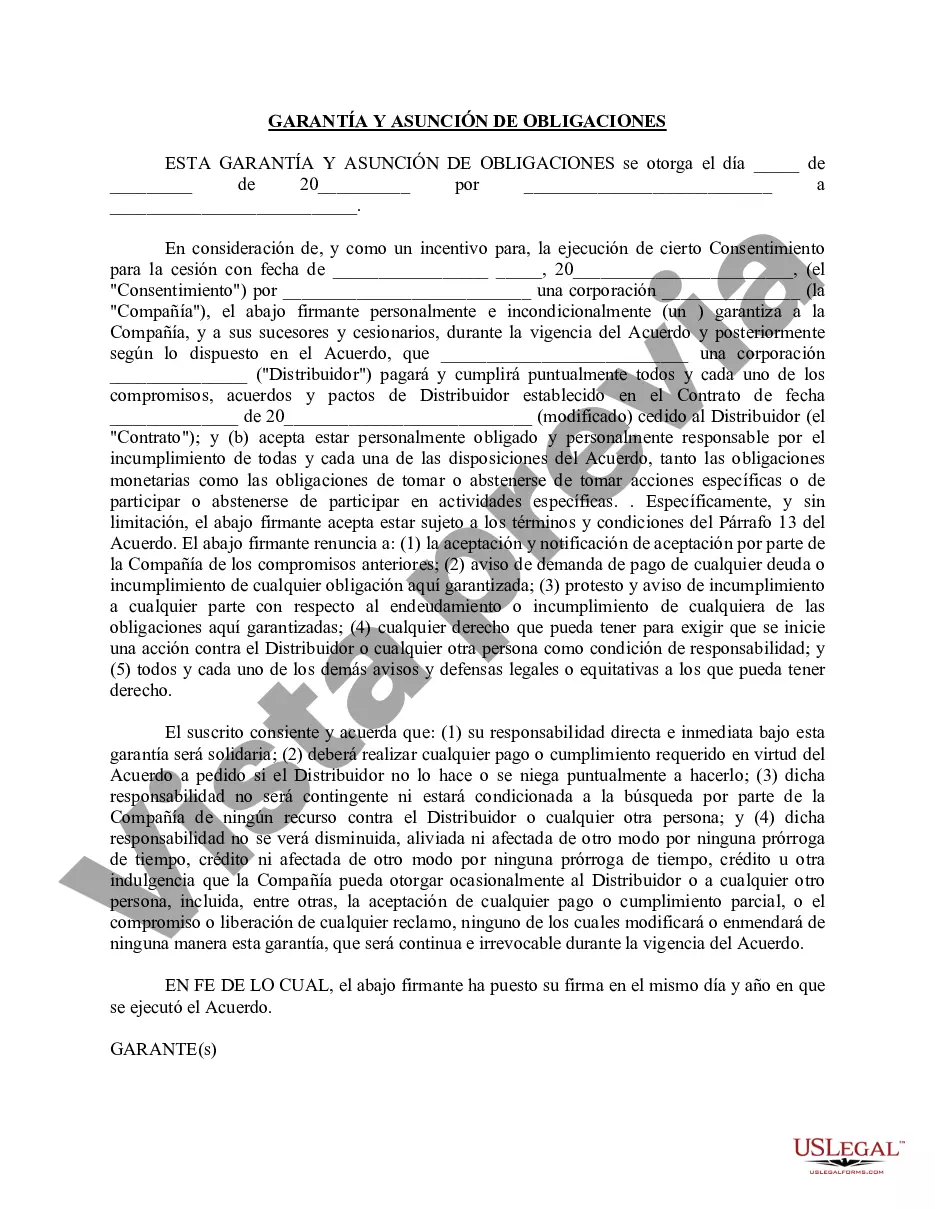

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Garantía del Distribuidor a la Corporación del Pago de los Fondos de Distribución por parte del Cesionario Debido a la Cesión - Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment

Description

How to fill out Texas Garantía Del Distribuidor A La Corporación Del Pago De Los Fondos De Distribución Por Parte Del Cesionario Debido A La Cesión?

Have you been in the place the place you need to have papers for possibly enterprise or specific reasons virtually every working day? There are a variety of lawful document templates available online, but getting ones you can rely on is not simple. US Legal Forms provides thousands of form templates, such as the Texas Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment, that are written to fulfill state and federal needs.

When you are presently familiar with US Legal Forms internet site and also have an account, simply log in. After that, it is possible to acquire the Texas Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment template.

If you do not come with an profile and would like to begin to use US Legal Forms, adopt these measures:

- Find the form you want and ensure it is to the proper area/region.

- Take advantage of the Review button to review the shape.

- See the outline to actually have chosen the proper form.

- If the form is not what you`re trying to find, make use of the Lookup industry to discover the form that fits your needs and needs.

- Once you find the proper form, click on Buy now.

- Choose the rates strategy you want, fill out the desired details to generate your bank account, and pay for an order with your PayPal or charge card.

- Select a practical paper format and acquire your duplicate.

Find every one of the document templates you have bought in the My Forms menus. You can obtain a more duplicate of Texas Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment whenever, if possible. Just click the necessary form to acquire or print the document template.

Use US Legal Forms, one of the most comprehensive variety of lawful kinds, in order to save some time and prevent mistakes. The services provides expertly created lawful document templates that can be used for a variety of reasons. Generate an account on US Legal Forms and initiate producing your lifestyle easier.