A Texas Commercial Lease Agreement for Tenant is a legally binding contract that outlines the terms and conditions between a commercial property owner (landlord) and a business or individual (tenant) who wishes to lease the property for commercial purposes. This agreement ensures that both parties are aware of their rights and obligations, and it helps in setting clear expectations for the tenancy. The terms of a Texas Commercial Lease Agreement may vary depending on the specific needs and arrangements agreed upon by the landlord and tenant. However, there are several common elements found in most agreements. 1. Basic Information: This section includes the names and contact information of both parties involved, and the address and description of the property being leased. 2. Term of Lease: The agreement will specify the duration of the lease, including the start and end dates. It may also include options for lease renewal or termination. 3. Rent and Payment Terms: This section outlines the amount of rent to be paid, the frequency of payment (monthly, quarterly, or yearly), and the acceptable payment methods. It may also mention any late payment penalties or fees. 4. Security Deposit: This clause addresses the amount of security deposit required from the tenant, as well as the conditions for its refund or deductions. 5. Permitted Use: The agreement will specify the authorized commercial activities allowed on the premises. This may include limitations or exclusions on certain types of businesses. 6. Maintenance and Repairs: Both parties' responsibilities for maintaining and repairing the property will be outlined, including who is responsible for costs associated with necessary repairs and maintenance. 7. Alterations and Improvements: This section details whether the tenant is permitted to make alterations or improvements to the property and the conditions under which it is allowed. 8. Insurance: The agreement may require the tenant to obtain and maintain specific insurance coverage, such as general liability insurance or property insurance. 9. Default and Termination: This clause explains the circumstances under which the agreement can be terminated, such as non-payment of rent, violation of terms, or breach of contract. 10. Dispute Resolution: The agreement may specify the preferred method of resolving disputes, such as mediation or arbitration, rather than litigation. Some specific types of Texas Commercial Lease Agreements for Tenants include: 1. Gross Lease: In this type of lease, the tenant pays a fixed amount of rent, and the landlord is responsible for covering all operating expenses, including property taxes, insurance, and maintenance costs. 2. Net Lease: Here, the tenant pays a base rent, as well as additional charges for certain operating costs, such as property taxes, insurance, and maintenance expenses. The three common types of net leases are Single Net Lease, Double Net Lease, and Triple Net Lease. 3. Percentage Lease: This type of lease is commonly used in retail spaces, where the tenant pays a base rent plus a percentage of their monthly sales. In conclusion, a Texas Commercial Lease Agreement for Tenant is a contractual document that establishes the rights and obligations of both the landlord and the tenant when leasing a commercial property. This agreement covers various key elements like rent, lease term, permitted use, maintenance responsibilities, and dispute resolution. Different types of commercial leases, including gross, net, and percentage leases, cater to specific needs and circumstances.

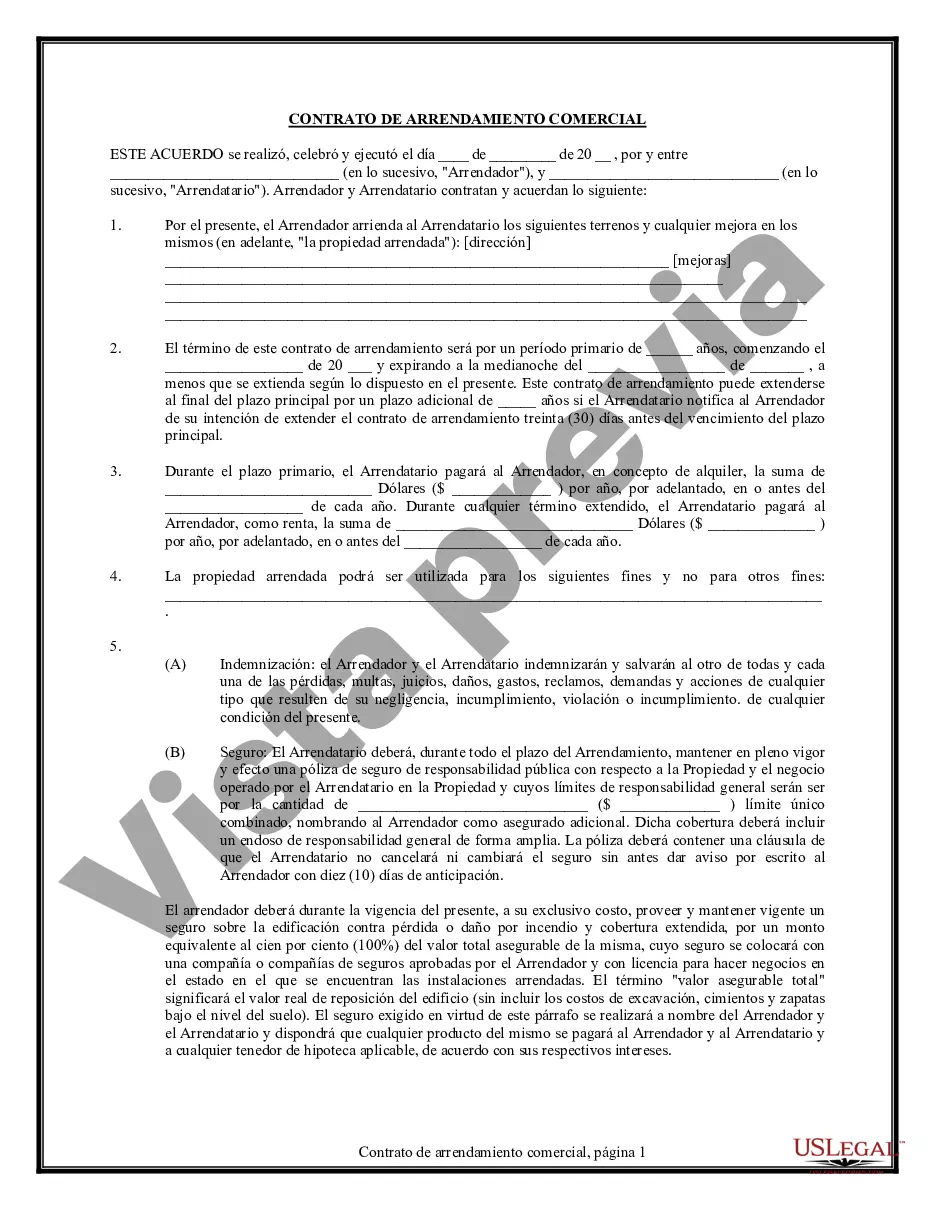

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Contrato de Arrendamiento Comercial para Inquilino - Commercial Lease Agreement for Tenant

Description

How to fill out Texas Contrato De Arrendamiento Comercial Para Inquilino?

It is possible to invest time online attempting to find the legal papers template that meets the state and federal requirements you want. US Legal Forms offers thousands of legal kinds that are reviewed by experts. You can actually obtain or print out the Texas Commercial Lease Agreement for Tenant from the support.

If you already possess a US Legal Forms accounts, you are able to log in and then click the Acquire switch. Afterward, you are able to comprehensive, edit, print out, or indicator the Texas Commercial Lease Agreement for Tenant. Every legal papers template you acquire is your own eternally. To get an additional version of the purchased type, check out the My Forms tab and then click the corresponding switch.

If you are using the US Legal Forms website the very first time, follow the simple instructions under:

- Initial, make certain you have chosen the best papers template to the county/metropolis of your choice. Look at the type information to make sure you have selected the appropriate type. If readily available, use the Review switch to appear through the papers template as well.

- If you wish to discover an additional edition in the type, use the Search industry to discover the template that fits your needs and requirements.

- Once you have identified the template you would like, just click Buy now to proceed.

- Choose the rates plan you would like, key in your accreditations, and register for a free account on US Legal Forms.

- Full the deal. You may use your Visa or Mastercard or PayPal accounts to pay for the legal type.

- Choose the file format in the papers and obtain it for your product.

- Make changes for your papers if necessary. It is possible to comprehensive, edit and indicator and print out Texas Commercial Lease Agreement for Tenant.

Acquire and print out thousands of papers layouts making use of the US Legal Forms Internet site, that provides the largest selection of legal kinds. Use expert and condition-certain layouts to take on your business or personal needs.