Texas Proposal to adopt and approve management stock purchase plan

Description

How to fill out Proposal To Adopt And Approve Management Stock Purchase Plan?

If you have to full, down load, or produce lawful file layouts, use US Legal Forms, the biggest assortment of lawful types, that can be found online. Utilize the site`s simple and easy handy research to find the files you require. Various layouts for organization and person uses are categorized by groups and says, or key phrases. Use US Legal Forms to find the Texas Proposal to adopt and approve management stock purchase plan in just a handful of click throughs.

When you are presently a US Legal Forms client, log in to the account and then click the Download key to get the Texas Proposal to adopt and approve management stock purchase plan. You may also accessibility types you formerly acquired from the My Forms tab of your respective account.

If you work with US Legal Forms initially, refer to the instructions below:

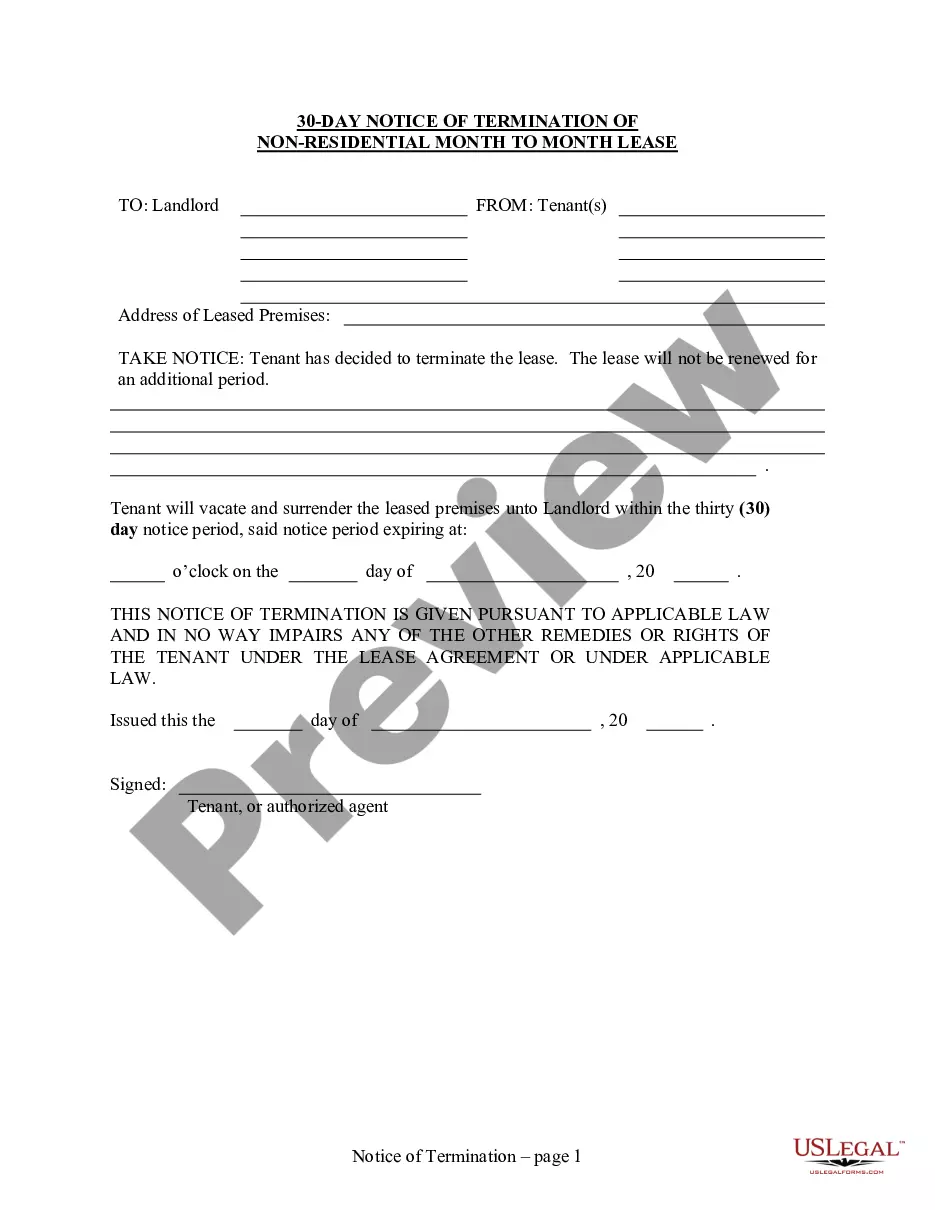

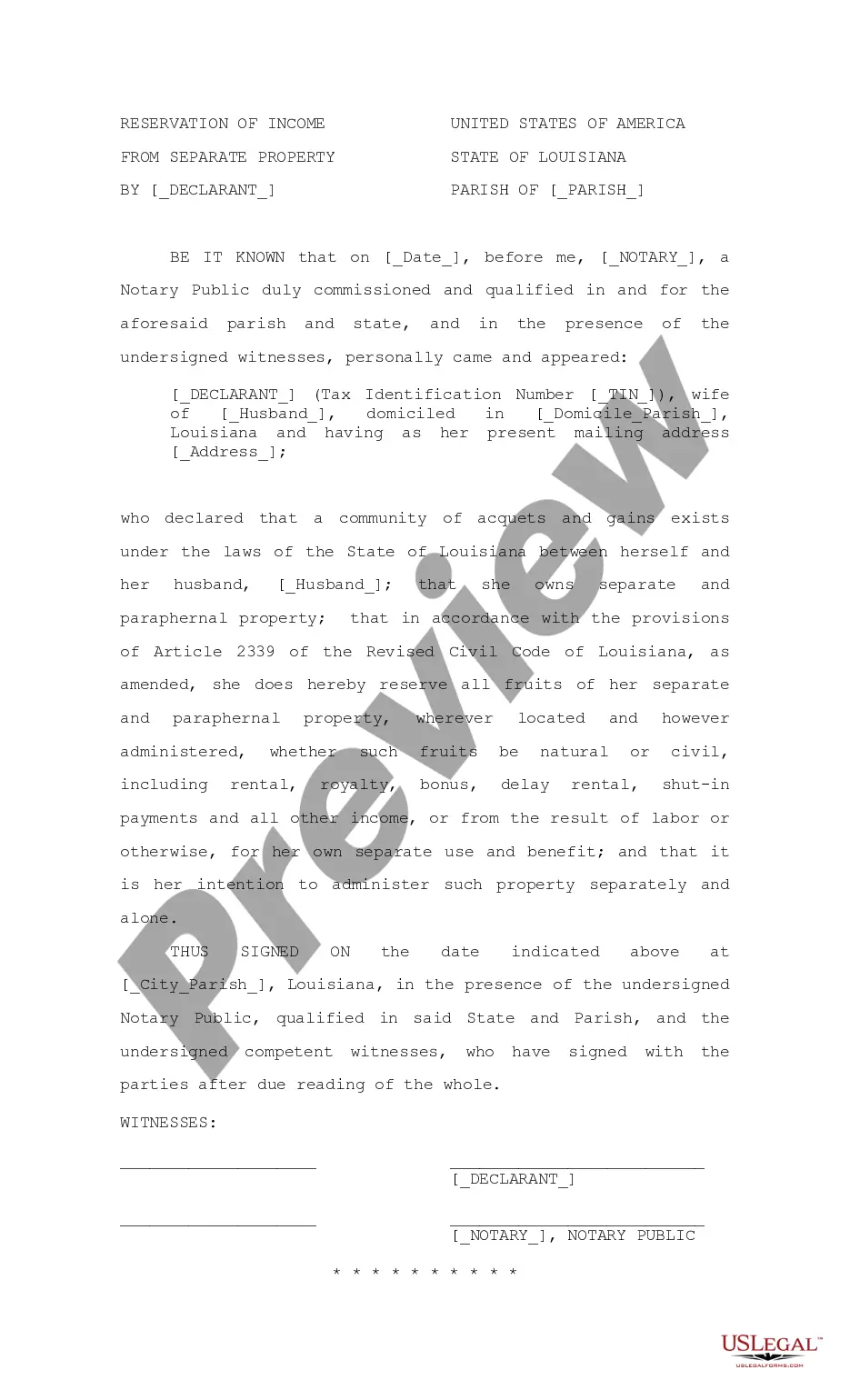

- Step 1. Be sure you have selected the shape to the right town/region.

- Step 2. Take advantage of the Review method to look over the form`s content material. Do not forget to see the description.

- Step 3. When you are not satisfied with all the develop, make use of the Lookup field near the top of the display screen to locate other versions in the lawful develop format.

- Step 4. Upon having located the shape you require, click the Acquire now key. Opt for the costs strategy you favor and put your qualifications to sign up to have an account.

- Step 5. Method the financial transaction. You may use your credit card or PayPal account to complete the financial transaction.

- Step 6. Pick the structure in the lawful develop and down load it on your own system.

- Step 7. Full, modify and produce or indication the Texas Proposal to adopt and approve management stock purchase plan.

Each and every lawful file format you buy is yours eternally. You have acces to every single develop you acquired in your acccount. Select the My Forms portion and choose a develop to produce or down load again.

Be competitive and down load, and produce the Texas Proposal to adopt and approve management stock purchase plan with US Legal Forms. There are thousands of expert and express-certain types you can use for the organization or person requires.

Form popularity

FAQ

An ESPP Qualifying Disposition is defined as a sale of ESPP shares that meet the following requirements: 2+ years have passed since the beginning of the offering period in which you purchased shares. 1+ year has passed since the purchase date of the shares.

Taxes on your ESPP transaction will depend on whether the sale is a qualifying disposition or not. The sale will be considered a qualifying disposition if it meets both of these criteria: You held the stocks for at least one year from the PURCHASE date. You held the stocks for at least two years from the OFFERING date.

If you choose to withdraw, you must do so at least 15 days before the purchase date. For example, if the purchase date is June 30, you must make this change prior to June 15. After withdrawing from the plan, if you choose to participate again, you will need to re-enroll during an enrollment period.

ESPP has no vesting period because it gives stocks on the spot, whereas ESOP has a vesting period of a minimum of 1 year. ESPP shares will be in a lock-in period of one year from the date of allotment, and ESOP Company will decide the share's lock-in period.

The purchase date, sometimes known as the exercise date of your ESPP, is when contributions are used to purchase shares of company stock. The purchase date typically occurs at the end of the purchase period, and always occurs at the end of the offering period.

ESPPs can also be subject to a vesting schedule, or length of time before the stock is available to the employees, typically one or two years of service. Depending on when the employee sells the shares, the disposition will be classified as either qualified or not qualified.

An employee stock purchase plan allows you to buy company stock at a bargain price. Discounts usually range from 5% to 15%. For example, if you work and participate in Hilton's ESPP, you can buy Hilton stock at a 15% discount. If Hilton's stock is trading at $130/share, they'll buy it at $110.50/share for you.

Understanding Employee Stock Purchase Plans (ESPPs) This is offered as a benefit of employment when they are hired, in the same way that access to a 401(k) plan for retirement savings is a benefit. The goal is that employees can purchase valuable stock for lower than the market price, allowing them to make a profit.