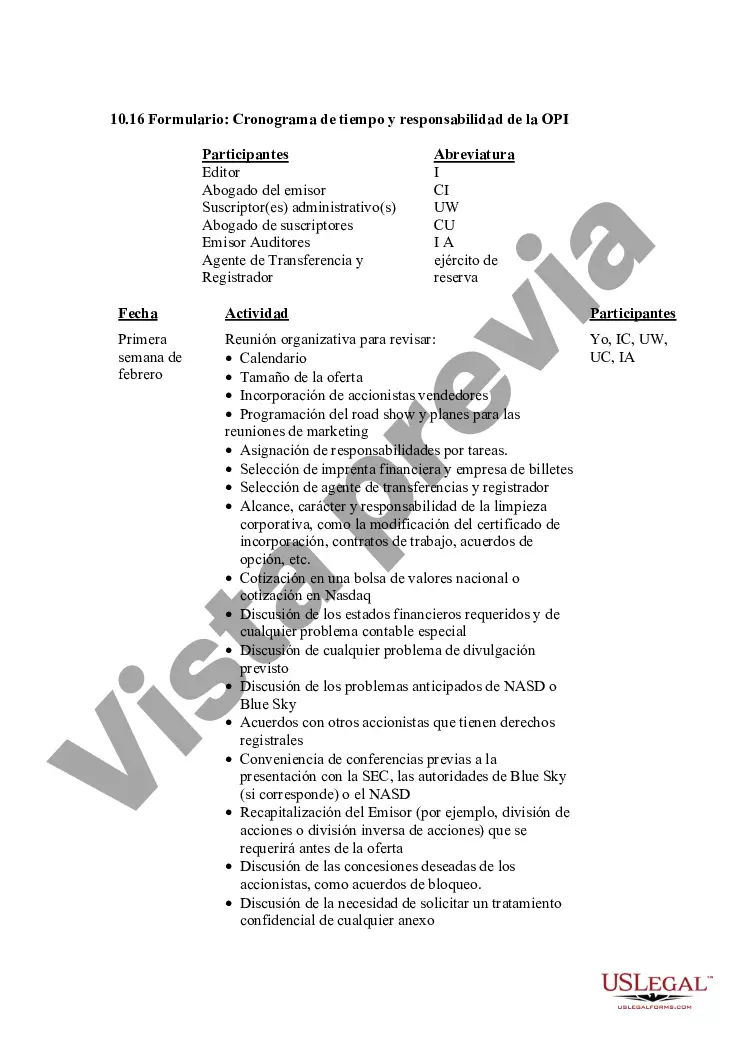

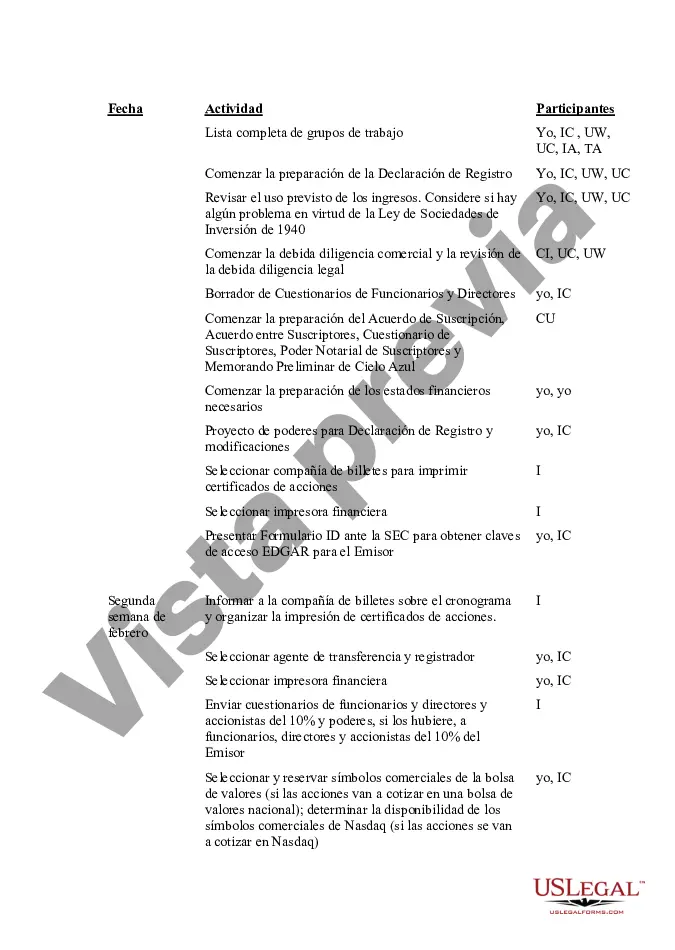

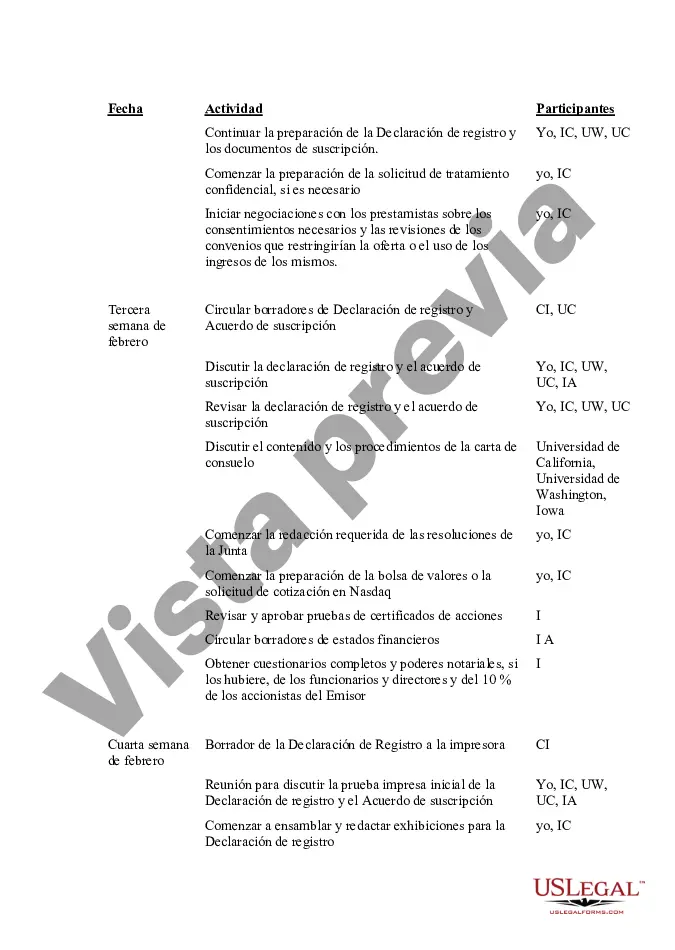

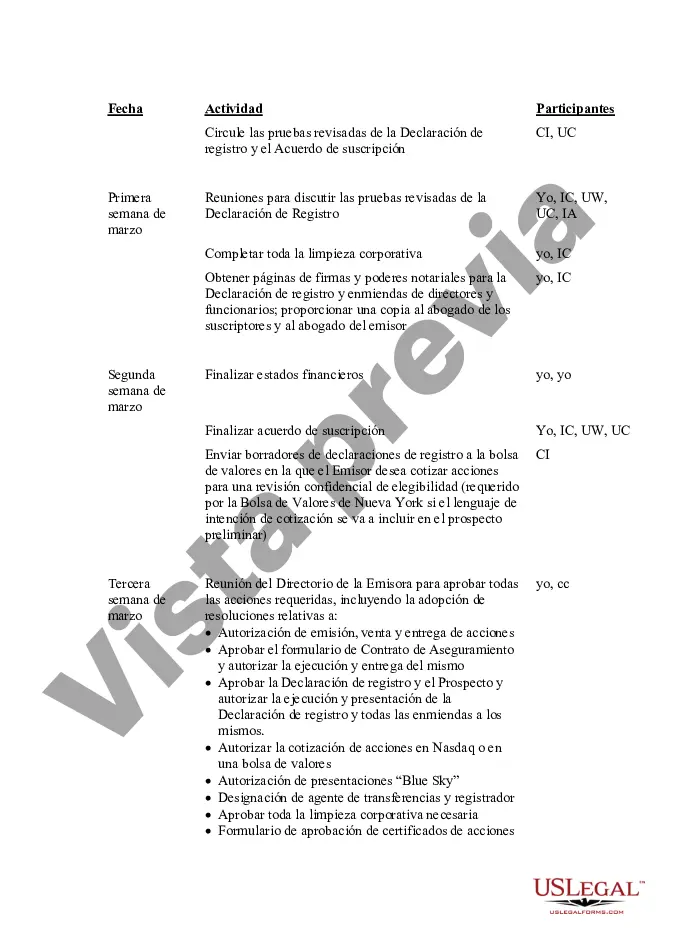

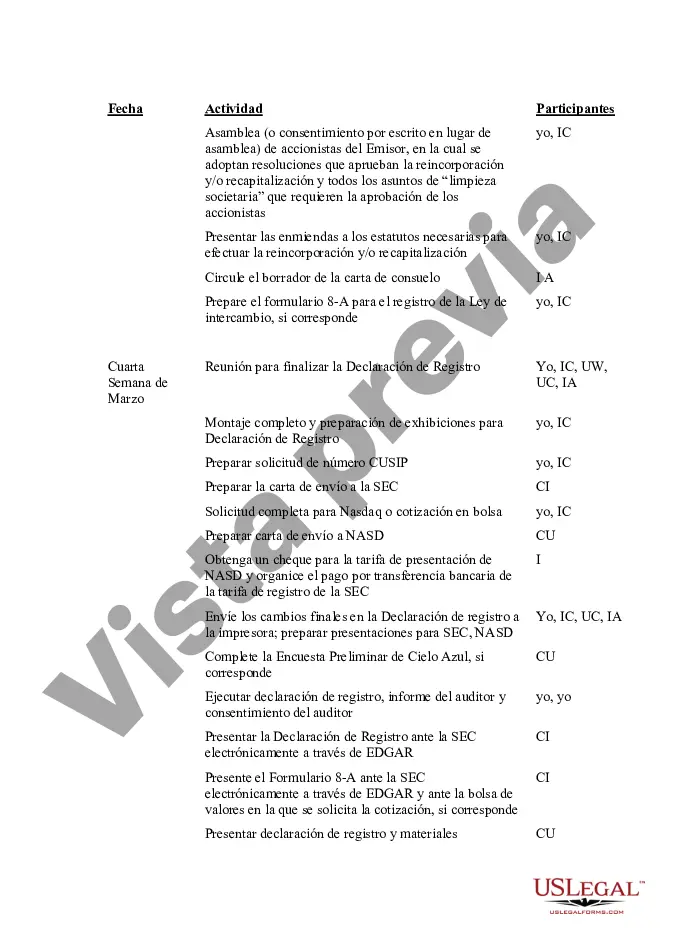

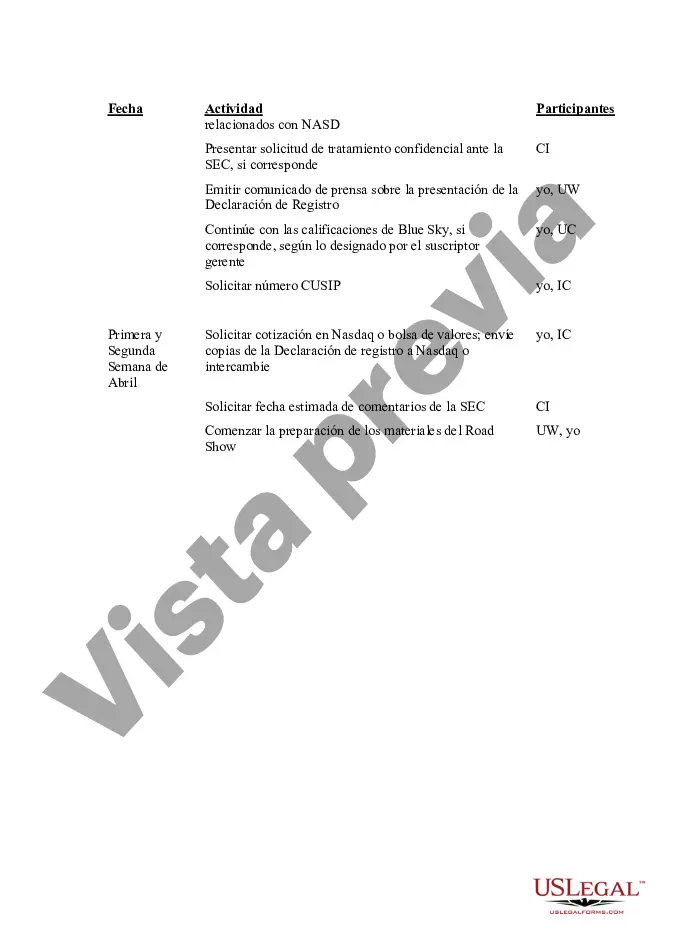

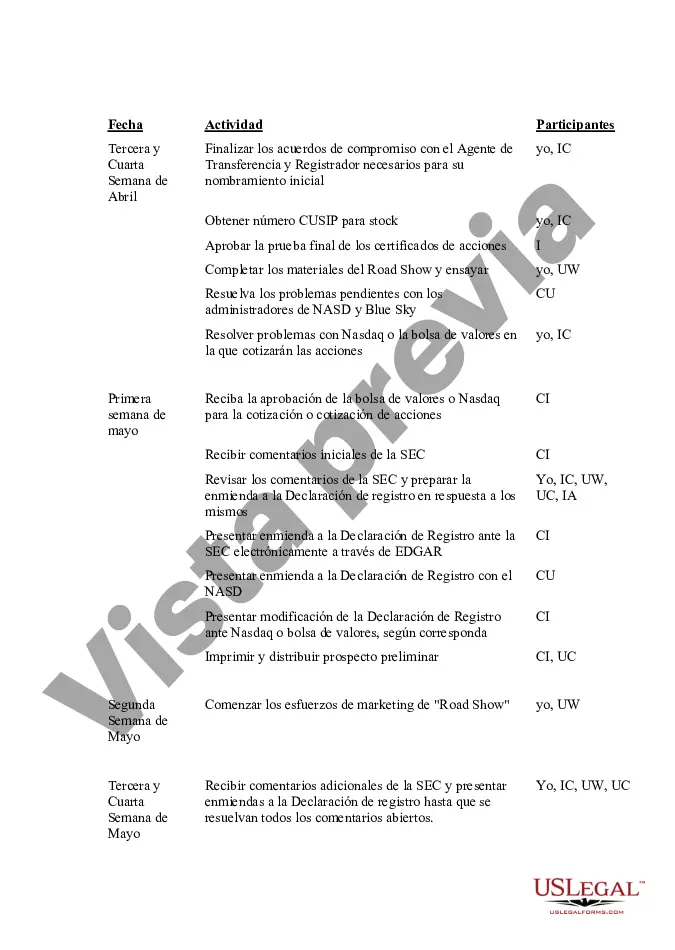

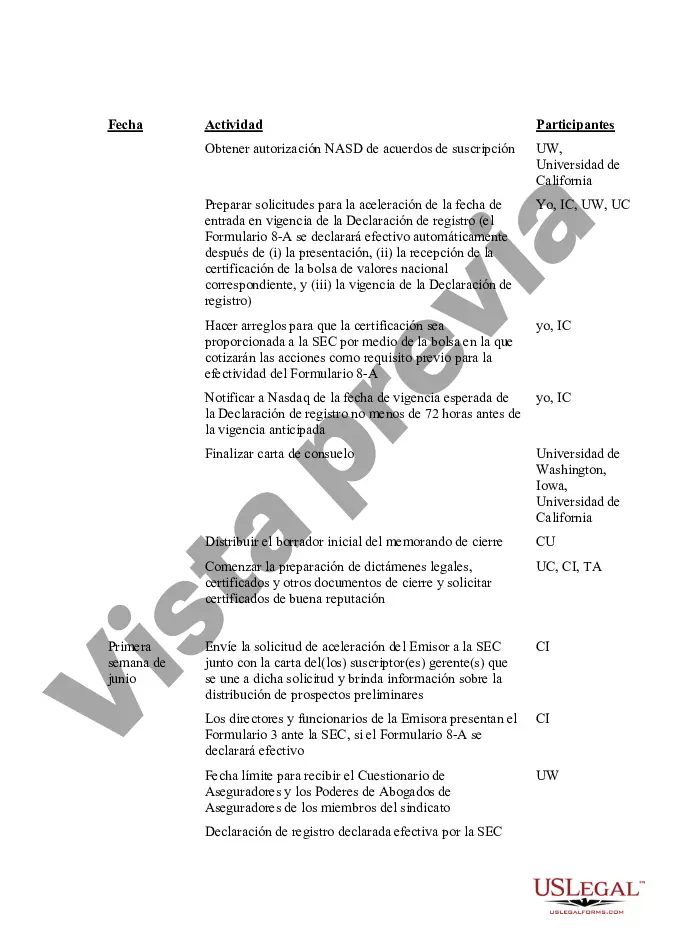

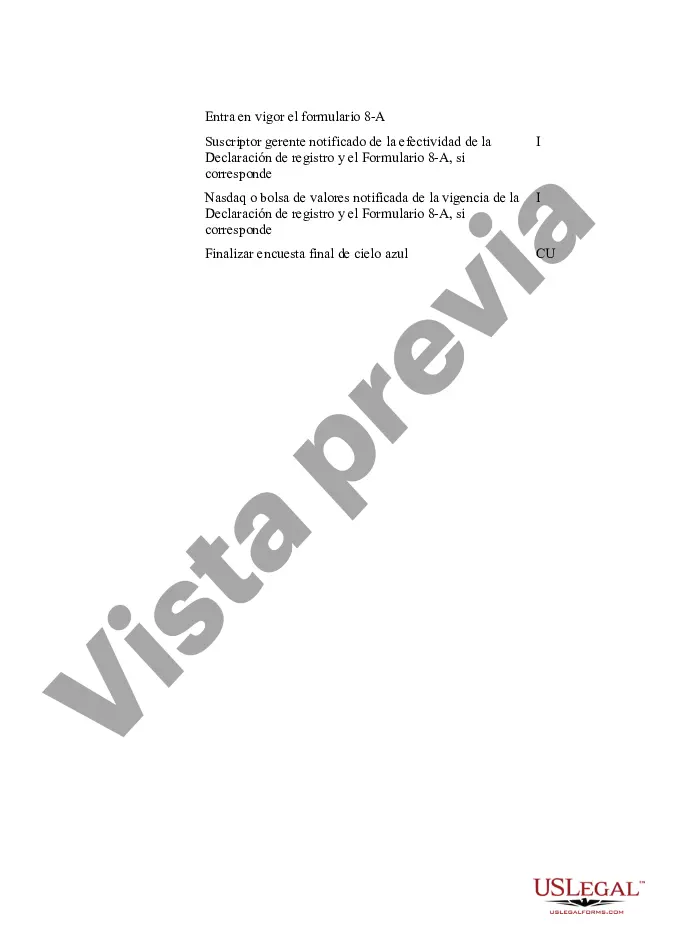

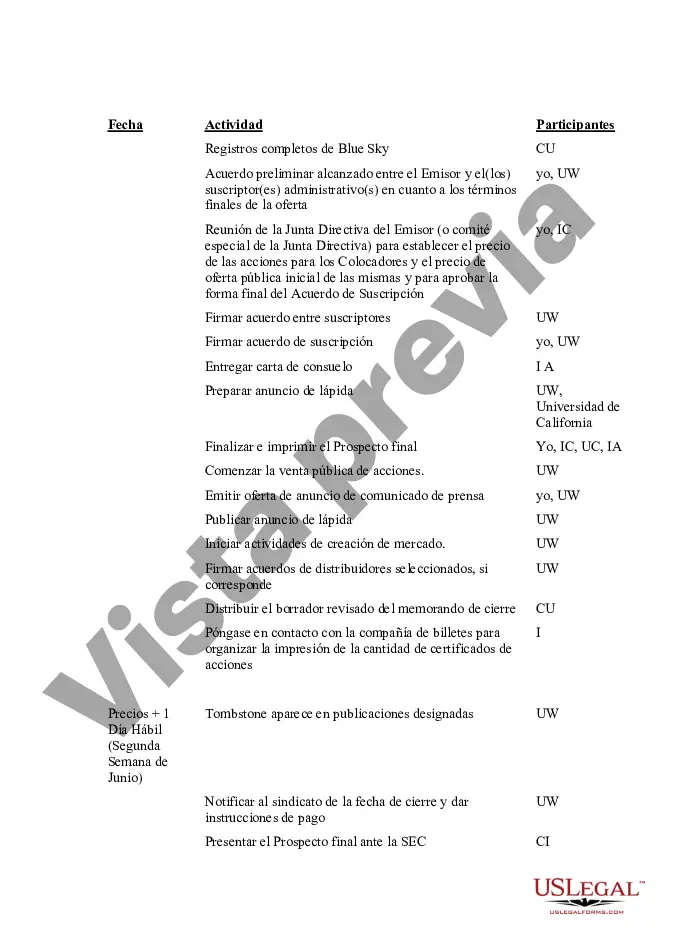

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

Texas IPO Time and Responsibility Schedule is a comprehensive framework that outlines the timeline and accountability measures involved in conducting an Initial Public Offering (IPO) in the state of Texas. This schedule is significant for businesses looking to go public, as it ensures a structured and organized approach to the IPO process. The Texas IPO Time and Responsibility Schedule typically includes important milestones and associated responsibilities at each stage of an IPO. This schedule serves as a guide for companies to adhere to legal and regulatory requirements while availing themselves of the benefits of going public. Keywords: Texas, IPO, Time and Responsibility Schedule, Initial Public Offering, timeline, accountability measures, businesses, structured, organized approach, legal, regulatory requirements, benefits. There are various types of Texas IPO Time and Responsibility Schedules based on the specific requirements and industry of the company going public. Some notable variations of IPO schedules include: 1. Technology IPO Time and Responsibility Schedule: This schedule is tailored to the unique needs and challenges faced by technology companies during their IPO journey. It focuses on factors such as intellectual property protection, market competition, and emerging trends in the technology sector. 2. Healthcare IPO Time and Responsibility Schedule: This schedule is specifically designed for healthcare organizations and life sciences companies aiming to go public. It emphasizes compliance with complex healthcare regulations, clinical trial requirements, and the involvement of regulatory bodies. 3. Energy Sector IPO Time and Responsibility Schedule: This schedule caters to companies operating in the energy sector, including oil, gas, and renewable energy industries. It takes into account regulatory permits, environmental considerations, and market volatility specific to the energy sector. 4. Financial Services IPO Time and Responsibility Schedule: This schedule is intended for financial institutions and companies involved in banking, asset management, insurance, or other financial services. It highlights the importance of regulatory compliance, risk management, and disclosure of financial information. These variations of the Texas IPO Time and Responsibility Schedule address the diverse requirements of different industries. By tailoring the schedule to a specific sector, companies can better navigate the complexities associated with their industry and ensure a successful IPO.Texas IPO Time and Responsibility Schedule is a comprehensive framework that outlines the timeline and accountability measures involved in conducting an Initial Public Offering (IPO) in the state of Texas. This schedule is significant for businesses looking to go public, as it ensures a structured and organized approach to the IPO process. The Texas IPO Time and Responsibility Schedule typically includes important milestones and associated responsibilities at each stage of an IPO. This schedule serves as a guide for companies to adhere to legal and regulatory requirements while availing themselves of the benefits of going public. Keywords: Texas, IPO, Time and Responsibility Schedule, Initial Public Offering, timeline, accountability measures, businesses, structured, organized approach, legal, regulatory requirements, benefits. There are various types of Texas IPO Time and Responsibility Schedules based on the specific requirements and industry of the company going public. Some notable variations of IPO schedules include: 1. Technology IPO Time and Responsibility Schedule: This schedule is tailored to the unique needs and challenges faced by technology companies during their IPO journey. It focuses on factors such as intellectual property protection, market competition, and emerging trends in the technology sector. 2. Healthcare IPO Time and Responsibility Schedule: This schedule is specifically designed for healthcare organizations and life sciences companies aiming to go public. It emphasizes compliance with complex healthcare regulations, clinical trial requirements, and the involvement of regulatory bodies. 3. Energy Sector IPO Time and Responsibility Schedule: This schedule caters to companies operating in the energy sector, including oil, gas, and renewable energy industries. It takes into account regulatory permits, environmental considerations, and market volatility specific to the energy sector. 4. Financial Services IPO Time and Responsibility Schedule: This schedule is intended for financial institutions and companies involved in banking, asset management, insurance, or other financial services. It highlights the importance of regulatory compliance, risk management, and disclosure of financial information. These variations of the Texas IPO Time and Responsibility Schedule address the diverse requirements of different industries. By tailoring the schedule to a specific sector, companies can better navigate the complexities associated with their industry and ensure a successful IPO.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.