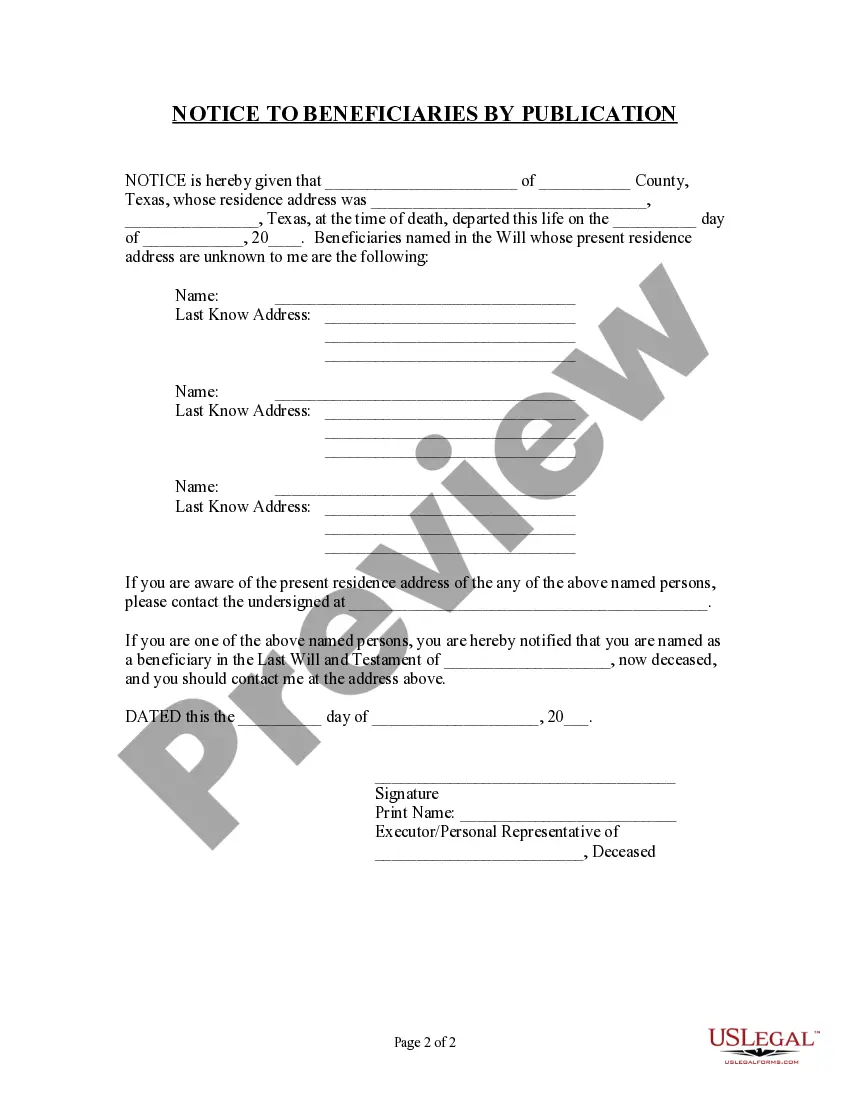

This Notice to Beneficiaries form is for the executor/executrix or personal representative to provide notice to the beneficiaries named in the will of the deceased. A second notice is also provided for publication where the location of the beneficiaries is unknown.

Texas Notice to Beneficiaries of being Named in Will

Description

Key Concepts & Definitions

Notice to Beneficiaries: A formal communication indicating that someone has been named in a will as beneficiary of the estate deceased. Estate Planning: The process of organising the distribution of one's assets after death, including wills, trusts, and inheritance claims. Probate Process: The legal procedure through which an estate is distributed under court supervision. Executor of Estate: An individual appointed to administer the deceaseds estate.

Step-by-Step Guide on Handling Notice of Being Named in a Will

- Confirm Receipt: Upon receiving a notice, confirm its receipt to the executor estate or the attorney handling the estate.

- Contact Attorney: Its advisable to consult with an attorney specialized in trusts and estates to clarify your legal position and rights.

- Attend Required Meetings: You may need to meet with the executor or participate in interviews to understand the estate details and your part in it.

- Review the Will: Ask to see a copy of the will to confirm details concerning your inheritance.

- Address Inheritance Claims: Discuss any potential inheritance disputes or issues with your attorney.

- Finalize Estate Claims: Follow the legal and formal processes to claim your inheritance once the probate process concludes.

Risk Analysis of Being Named as a Beneficiary

Being named as a beneficiary carries potential risks such as disputes over the will, misunderstandings among heirs, potential inheritance taxes, and delays in the probate process. Legally, your best approach is to name an executor for legal guidance and remain informed throughout the estate settlement process.

Best Practices

- Review and Understand the Will: Ensure you thoroughly understand the details and terms of the will you are named in.

- Keep Records: Maintain detailed records of all communications, notices received, and legal documents.

- Involve a Professional: Engage with a professional attorney specialized in trusts and estates to navigate the complexities of the probate process and legal matters related to the estate.

- Communicate Actively: Stay in regular contact with the executor and other relevant parties to be updated on the progress of the estates distribution.

Common Mistakes & How to Avoid Them

A common mistake is passively waiting without seeking legal advice, leading to missed deadlines or forfeited rights. Proactively managing your beneficiary rights by consulting with a legal professional and participating actively in the probate process can mitigate these issues.

FAQ

- What should I do if I receive a notice as a beneficiary? Verify the notice, consult with a 'contact attorney', and understand your rights and obligations.

- How long does the probate process typically take? The duration can vary widely but generally ranges from a few months to over a year, depending on the complexity of the estate.

- Can an executor change the will after the death of the estate holder? No, an executor is legally bound to follow the instructions of the will as it was written by the deceased.

How to fill out Texas Notice To Beneficiaries Of Being Named In Will?

Get access to high quality Texas Notice to Beneficiaries of being Named in Will forms online with US Legal Forms. Prevent hours of lost time searching the internet and dropped money on files that aren’t updated. US Legal Forms offers you a solution to exactly that. Get around 85,000 state-specific legal and tax forms that you could download and complete in clicks within the Forms library.

To get the sample, log in to your account and then click Download. The file will be saved in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- See if the Texas Notice to Beneficiaries of being Named in Will you’re considering is suitable for your state.

- Look at the form using the Preview option and read its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to keep on to register.

- Pay by card or PayPal to finish making an account.

- Choose a favored file format to save the file (.pdf or .docx).

Now you can open the Texas Notice to Beneficiaries of being Named in Will sample and fill it out online or print it out and do it yourself. Take into account mailing the document to your legal counsel to be certain everything is completed properly. If you make a error, print and complete sample once again (once you’ve created an account every document you save is reusable). Make your US Legal Forms account now and access a lot more samples.

Form popularity

FAQ

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

The executor can sell property without getting all of the beneficiaries to approve.If the executor can sell the property for more than 90 percent of its appraised value then they do not need to get the permission of the beneficiaries or of the court.

If you fail to probate a will within the 4 year time period, then the decedent's estate will be treated as though they died intestate without a will. There are specific laws in Texas that govern which heirs are entitled to the estate's assets when a person dies intestate.

According to estate planning attorney Adam Ansari, it is legal for an executor to purchase the home instead of selling it, as long as the executor purchases the property for fair market value and all of the beneficiaries agree with the terms of the sale.

Texas has a probate process similar to many other states, but before we go any further, let's ask an important question: Do you even need to probate the estate? Not all assets go through probate. Assets that automatically transfer to another person without a court order will avoid probate.

Generally the heirs don't decide if the house is sold unless somehow it is titled in all their names. If is a specific gift and the will requires it be transferred to all six, and one does not want to sell, that person can buy out the other 5. There of course is always a partition Acton.

An executor can sell a property without the approval of all beneficiaries. The will doesn't have specific provisions that require beneficiaries to approve how the assets will be administered. However, they should consult with beneficiaries about how to share the estate.

No. The person must be appointed by the probate court as the personal representative and letters issued for the appointment as personal representative to be effective. California Probate Code §8400(a).To learn about the duties of a personal representative in California probate, click here.