Assumption Agreement of Loan Payments

Description

How to fill out Assumption Agreement Of Loan Payments?

Aren't you tired of choosing from numerous templates every time you need to create a Assumption Agreement of Loan Payments? US Legal Forms eliminates the wasted time countless American citizens spend searching the internet for suitable tax and legal forms. Our skilled group of lawyers is constantly changing the state-specific Templates catalogue, to ensure that it always has the right files for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have an active subscription should complete a few simple steps before having the capability to get access to their Assumption Agreement of Loan Payments:

- Use the Preview function and look at the form description (if available) to ensure that it’s the proper document for what you are looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the right template to your state and situation.

- Make use of the Search field at the top of the page if you need to look for another file.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Download your sample in a convenient format to complete, print, and sign the document.

After you have followed the step-by-step instructions above, you'll always be capable of log in and download whatever file you will need for whatever state you need it in. With US Legal Forms, finishing Assumption Agreement of Loan Payments templates or other legal paperwork is not hard. Get started now, and don't forget to look at the samples with certified attorneys!

Form popularity

FAQ

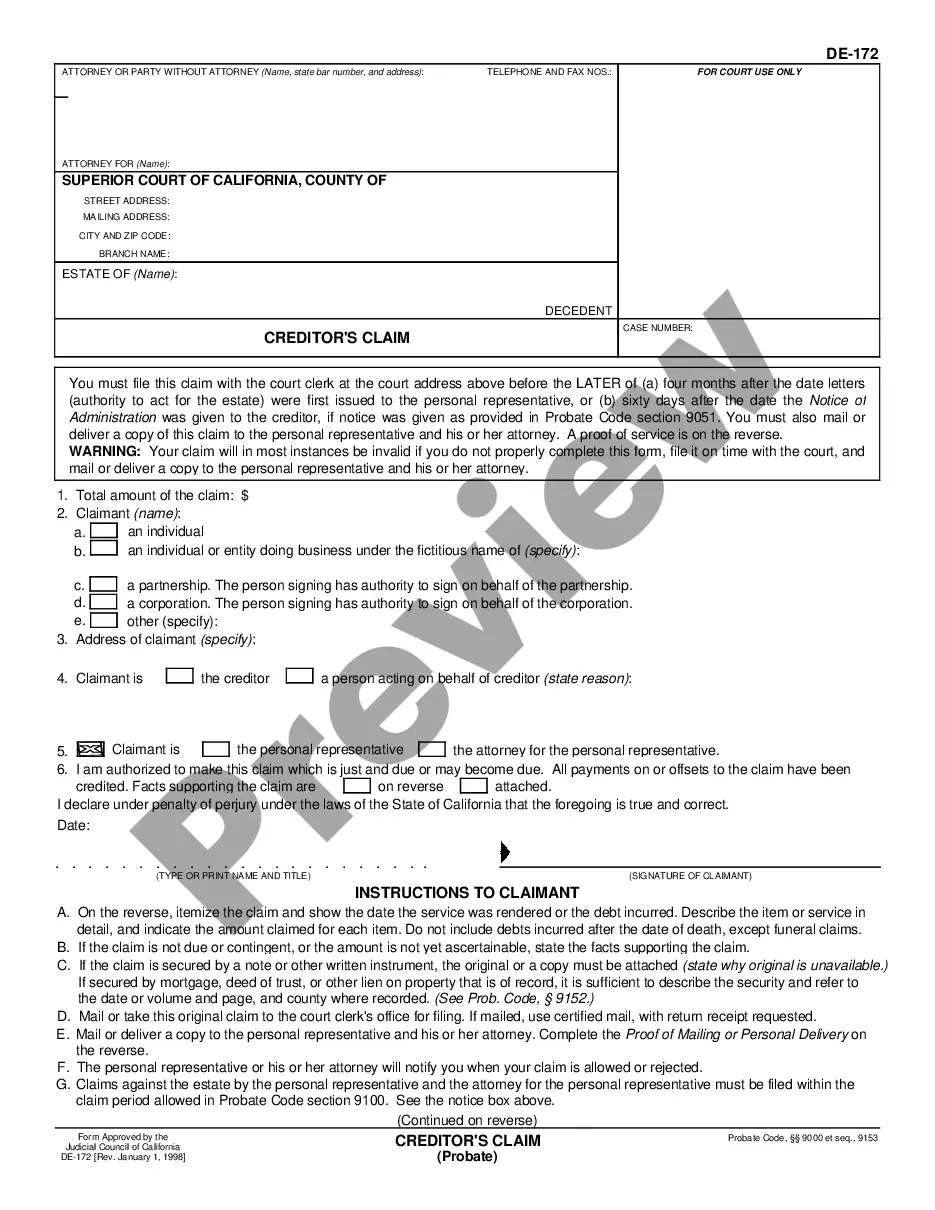

1) Find Out If the Loan is Assumable You can check the loan documents to see whether assumptions are permitted. The loan document will typically state whether or not the loan is assumable under the "assumption clause." The terms may also appear under the "due on sale clause" if loan assumption isn't permitted.

A fee that the buyer of a property with an assumable mortgage pays to the lender for the ability to take over the mortgage.

Cost. This is determined by the loan program and (in some cases) where the property's located. The average assumption fees range from $562 to $1,062. Additional 3rd party fees may apply.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

The seller may also be required to sign the assumption agreement and the terms may release the seller from responsibility. The lender usually requires a credit history from the buyer before approving the assumption and the payment of assumption fee(s).

The primary borrower and all co-borrowers sign the mortgage or trust deed. State law dictates whether a mortgage or a trust deed is recorded, but some states permit either document to be used, says Private Money Lending.

Keep in mind that the average loan assumption takes anywhere from 45-90 days to complete. The more issues there are with underwriting, the longer you'll have to wait to finalize your agreement.