Audited FY Financial Statement

Description

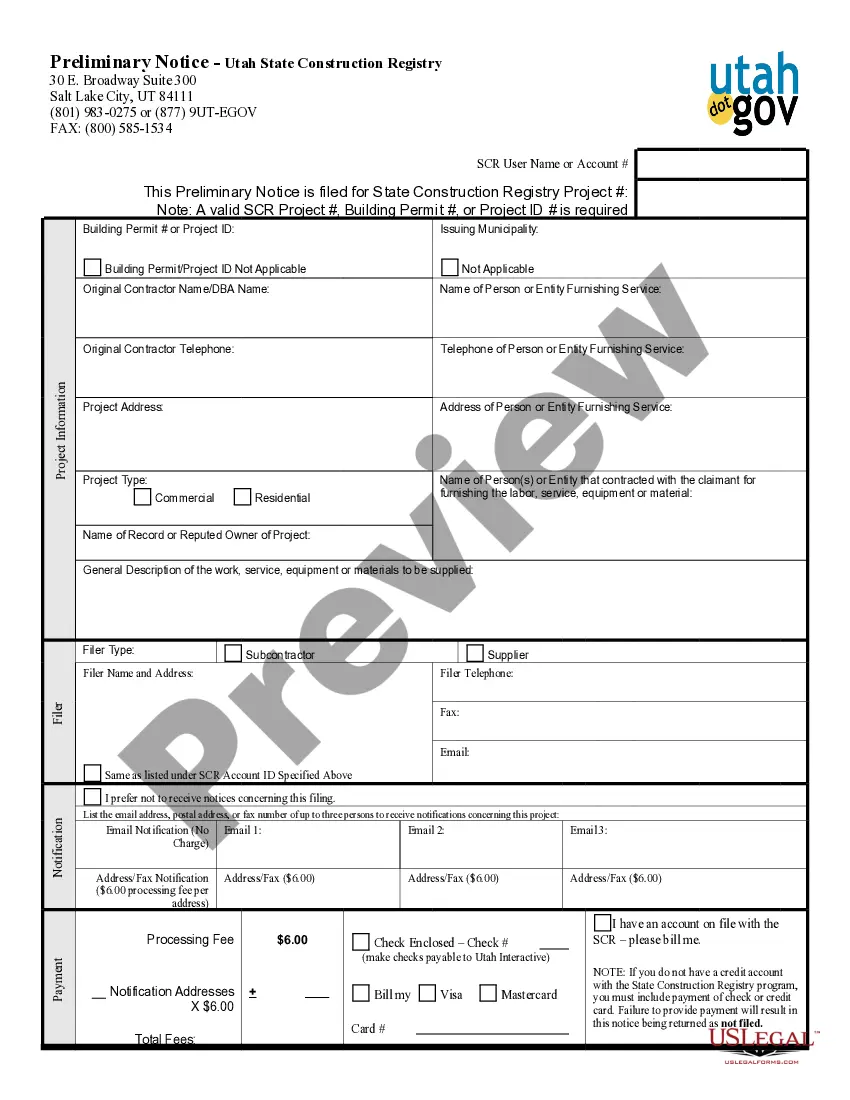

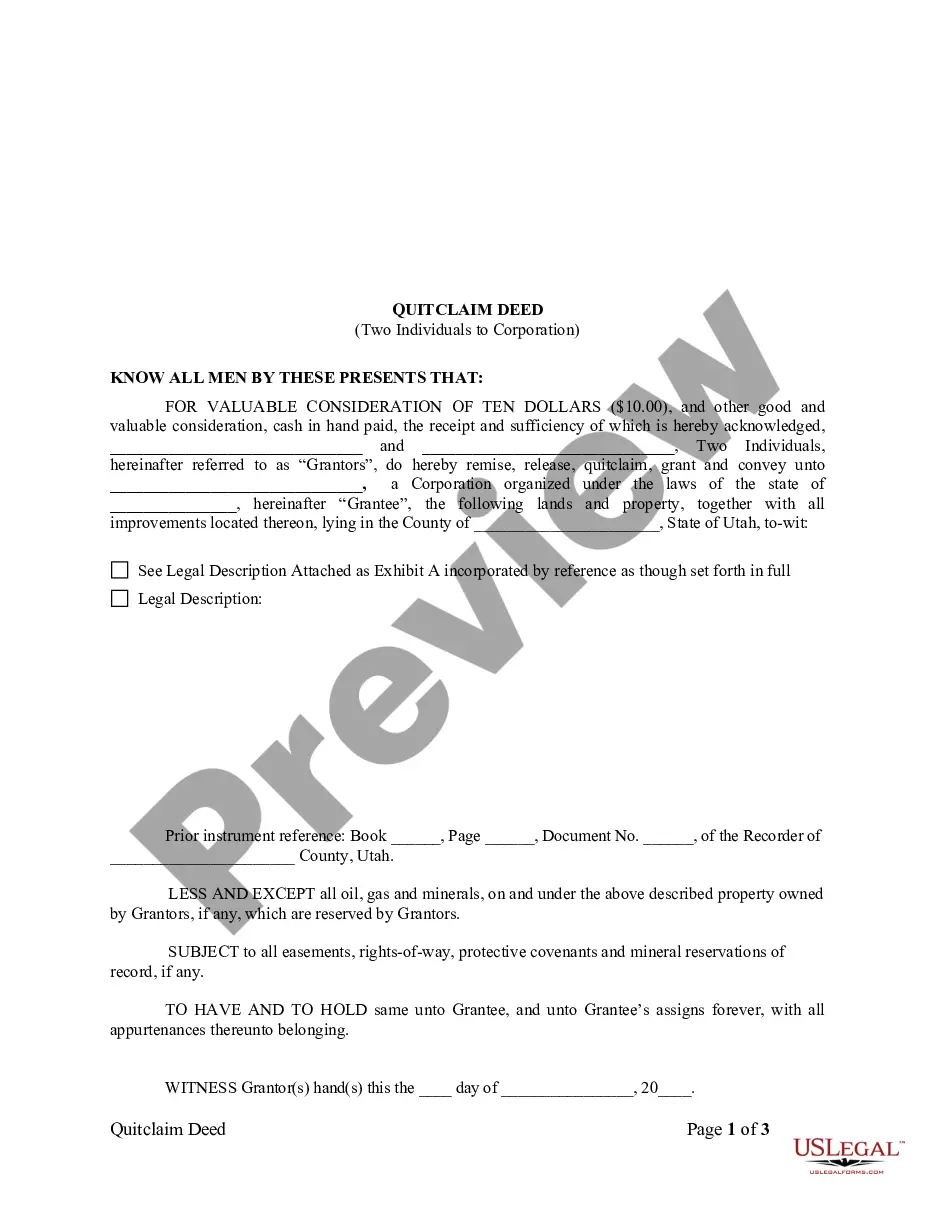

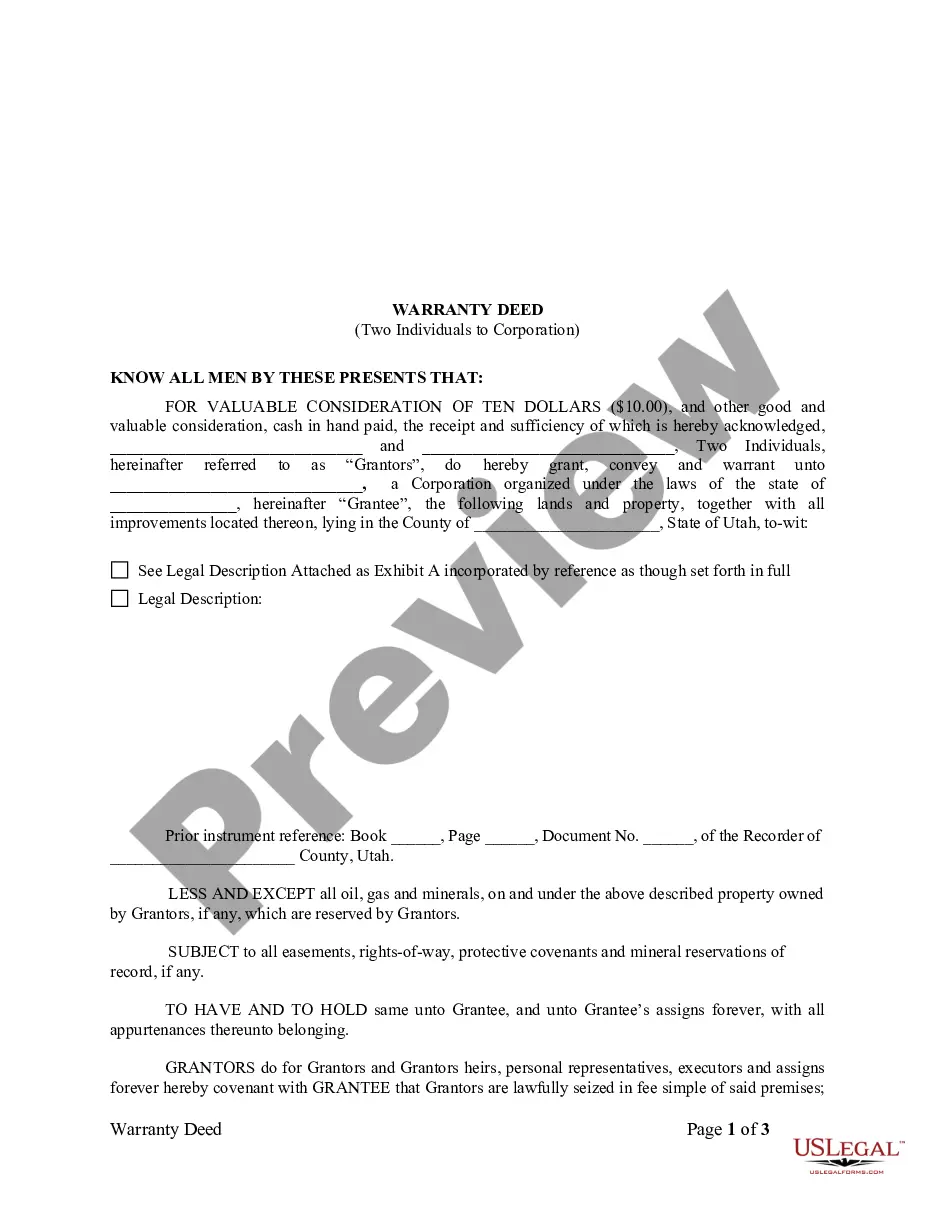

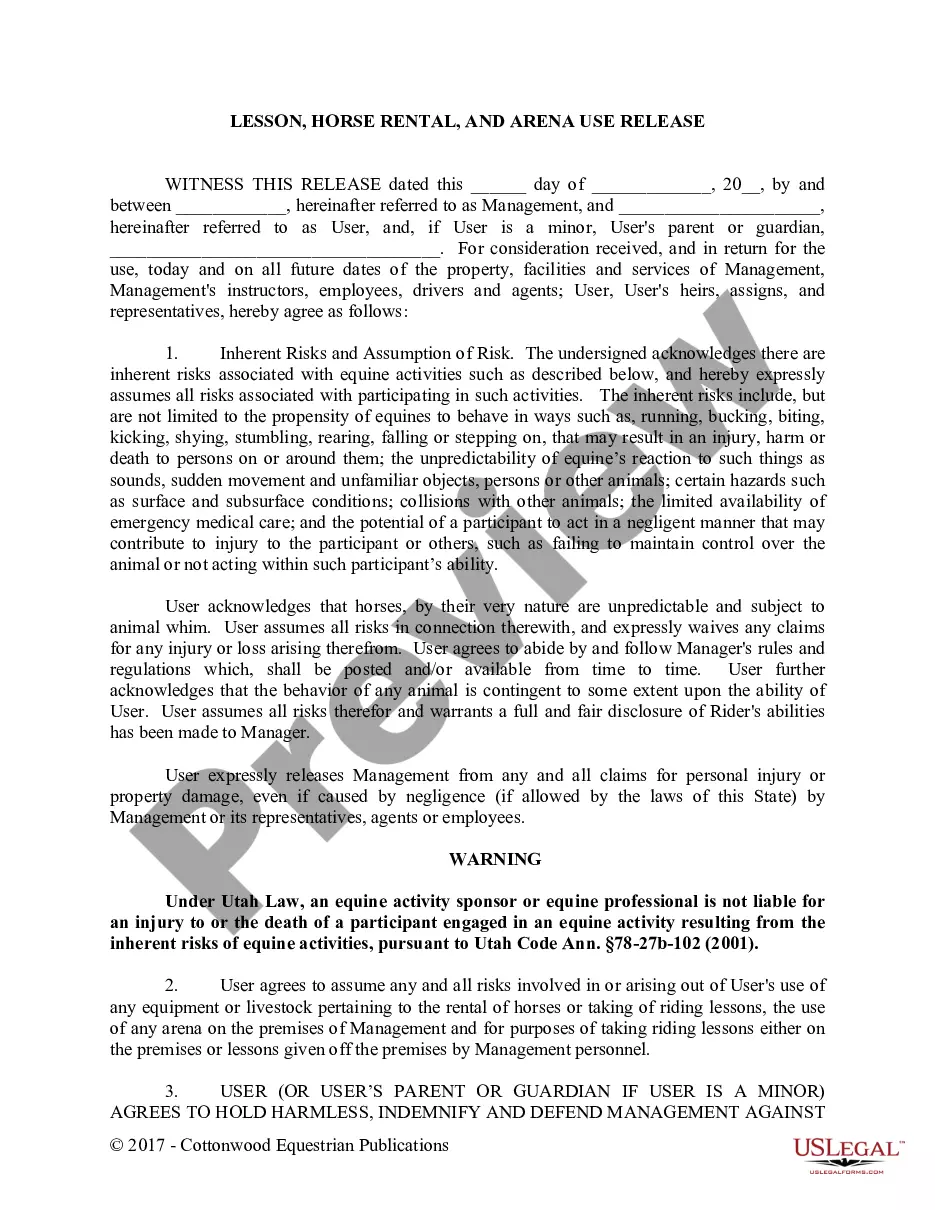

How to fill out Audited FY Financial Statement?

Coping with official documentation requires attention, precision, and using properly-drafted blanks. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Audited FY Financial Statement template from our library, you can be sure it meets federal and state regulations.

Working with our service is straightforward and quick. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to find your Audited FY Financial Statement within minutes:

- Remember to attentively examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for an alternative formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Audited FY Financial Statement in the format you prefer. If it’s your first experience with our service, click Buy now to continue.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to prepare it paper-free.

All documents are drafted for multi-usage, like the Audited FY Financial Statement you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

Small businesses are usually exempt from financial audits, small business criteria are based on either financial criteria (total assets and sales) or organizational structure such as being a sole proprietorship, limited liability company, partnership, or not-for-profit organization.

The deadline for filing AFS will depend on when your company's registered financial year is. Typically, corporations whose fiscal dates other than December 31 should file their AFS within 120 calendar days from the end of its fiscal year.

Lenders require an audit of financial statements if a business wants a loan. This is to protect them and verify the figures within the financial statements are accurate.

Key Takeaways. A certified financial statement has been audited for accuracy by an independent accountant. A compiled statement may provide investors with useful information but it has not been audited. The quarterly and annual reports issued by public companies are certified financial statements.

Audited financial statements are those that have been reviewed and verified as accurate by a Certified Public Accountant (CPA). Any company may require audited statements for internal use or to present to external stakeholders. The company prepares the financial statements and presents them to a CPA for assessment.

Independent review All companies that are not required to have audited financial statements must have their financial statements independently reviewed (with the exception of companies where all the shareholders are also directors and therefore are not required to obtain an audit or a review).

All public companies must undergo an independent audit every year. This ensures that the financial statements released by the company accurately reflect its operations.