Guide for Protecting Minors from Identity Theft

Description

How to fill out Guide For Protecting Minors From Identity Theft?

Aren't you tired of choosing from numerous samples each time you need to create a Guide for Protecting Minors from Identity Theft? US Legal Forms eliminates the lost time numerous Americans spend searching the internet for ideal tax and legal forms. Our skilled team of lawyers is constantly upgrading the state-specific Samples library, to ensure that it always offers the right files for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form can be found in the My Forms tab.

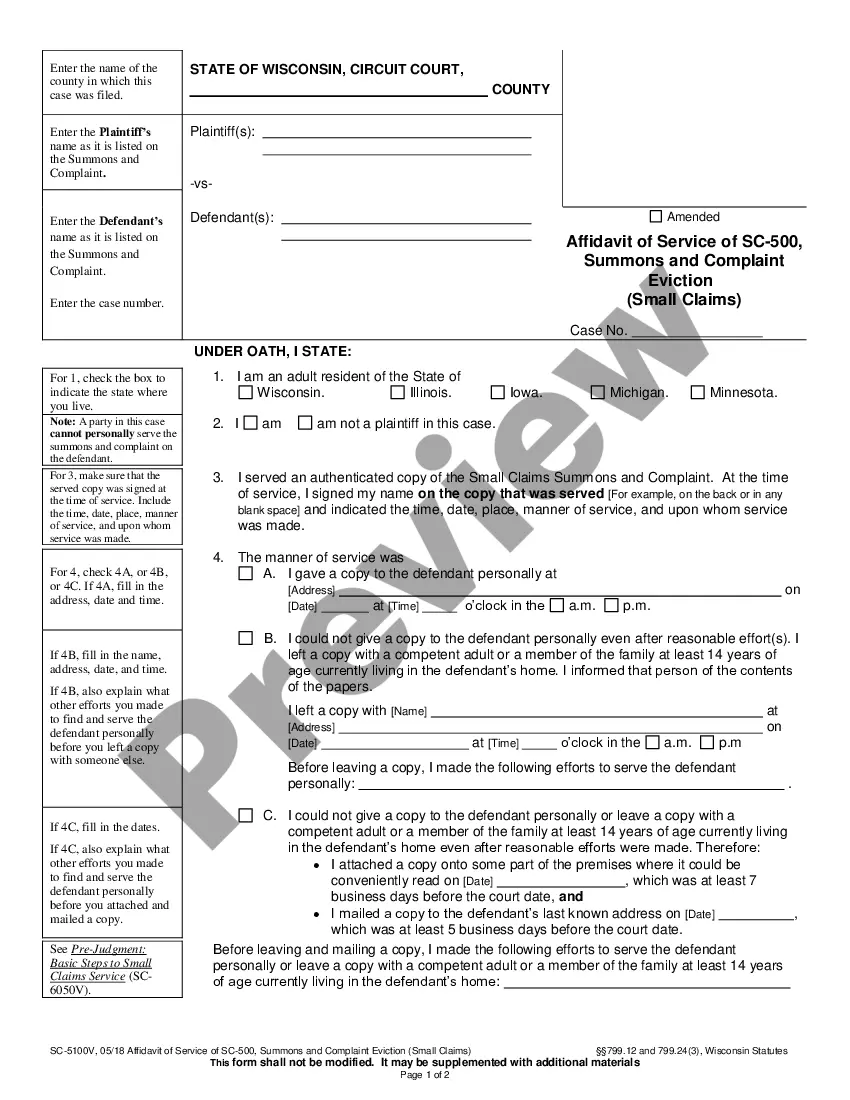

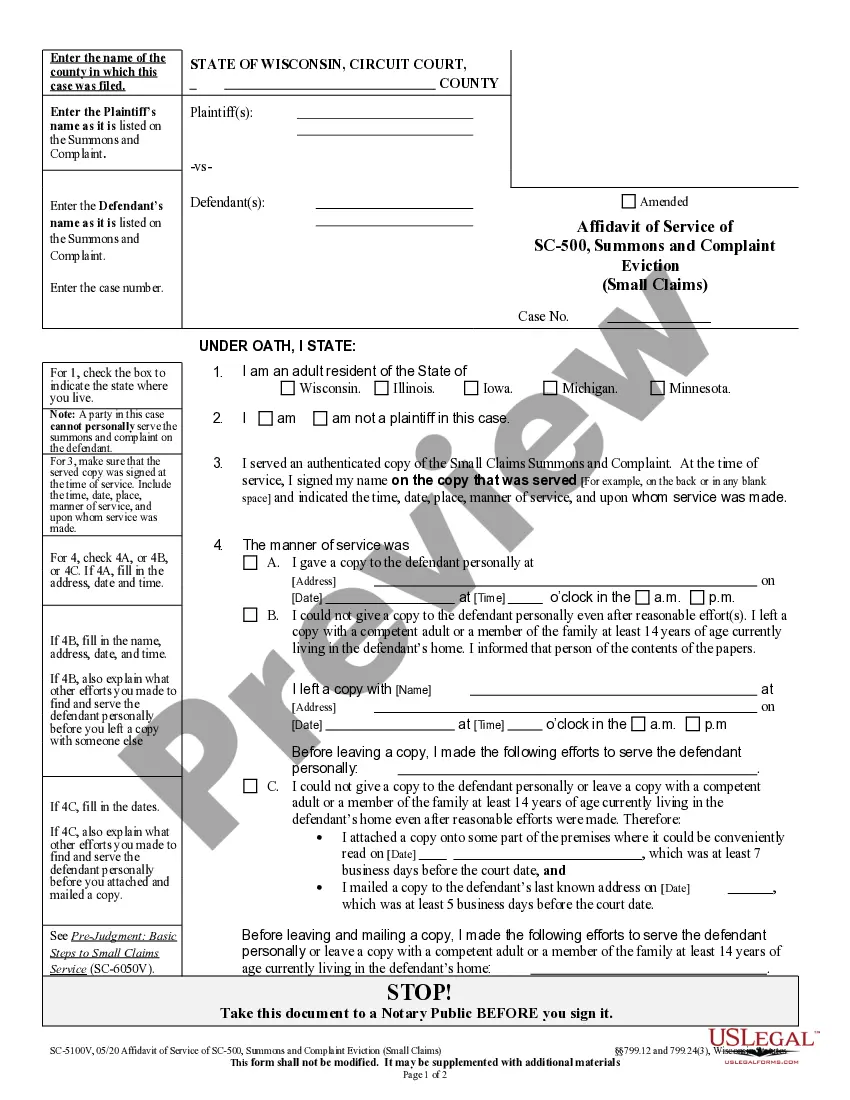

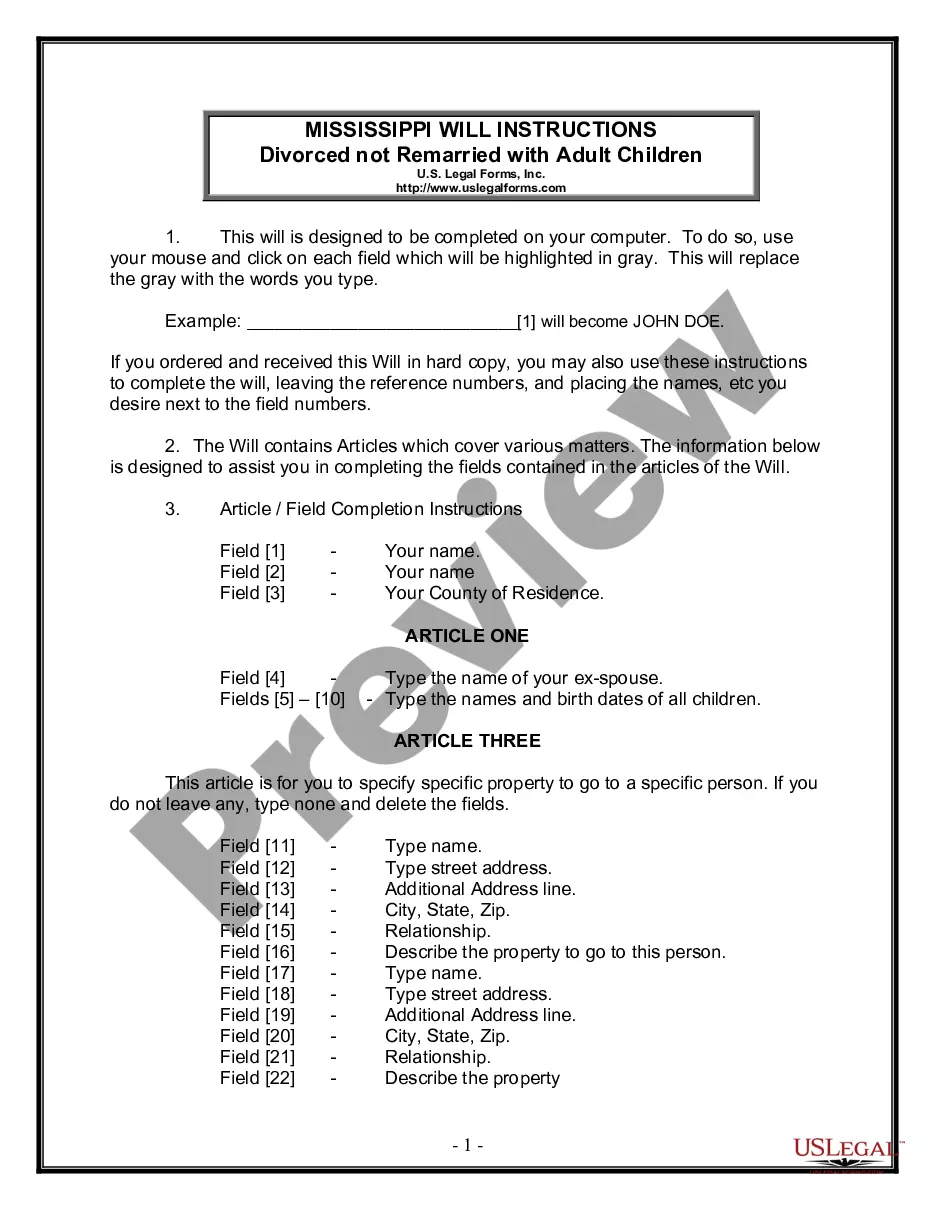

Visitors who don't have an active subscription should complete quick and easy steps before being able to download their Guide for Protecting Minors from Identity Theft:

- Utilize the Preview function and look at the form description (if available) to make certain that it is the best document for what you’re trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the appropriate sample for your state and situation.

- Utilize the Search field on top of the page if you want to look for another document.

- Click Buy Now and select an ideal pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Download your template in a required format to complete, print, and sign the document.

When you have followed the step-by-step guidelines above, you'll always be capable of log in and download whatever file you want for whatever state you need it in. With US Legal Forms, completing Guide for Protecting Minors from Identity Theft samples or any other legal documents is simple. Get started now, and don't forget to look at the examples with certified lawyers!

Form popularity

FAQ

Gather the needed documents. The three major credit bureaus (Experian, Equifax and TransUnion) have slightly different requirements. Print out child freeze request forms. 3. Mail the request and document copies. Wait for confirmation, then store it securely.

Now a child's number can more easily be used to establish a credit history. Minors are especially vulnerable because they are likely to have an unblemished credit history.In some cases, thieves get access to a child's stolen Social Security number.

First, you need to check with the Social Security Administration once a year to make sure no one is using your child's SSN. Secondly, you need to check your child's credit report (free Equifax -1-800-525-6285; Experian-1-888-397-3742; TransUnion-1-800-680-7289.)

Identity thieves can also use your identity when they commit other crimes, such as entering (or exiting) a country illegally, trafficking drugs, smuggling other substances, committing cyber crimes, laundering money and much more. In fact, they can use your identity to commit almost any crime imaginable in your name.

Contact Companies Where Fraud Occurred. Contact the Credit Bureaus. Consider a Child Credit Freeze. Report Identity Theft to the FTC. Find Out Who Has Access to Your Child's Personal Information. Pay Attention to Forms from School. Read the Notices from Your Child's School.

Parents and legal guardians have unfettered access to their children's personal information. In many cases, a parent, a close relative, or a legal guardian might use the child's Social Security number to commandeer their identity (and clean credit history).

Password-Protect Your Devices. Use a Password Manager. Watch Out for Phishing Attempts. Never Give Out Personal Information Over the Phone. Regularly Check Your Credit Reports. Protect Your Personal Documents. Limit Your Exposure.

A child's identity is very attractive to thieves. It's also a relatively easy crime to commit; a thief could pair any name and birth date with a stolen Social Security number, essentially creating a false identity.

Contact the Federal Trade Commission (FTC) to report the ID theft and get a recovery plan. Contact your local law enforcement and get a police report. Contact the fraud departments of companies where accounts were opened in your child's name.