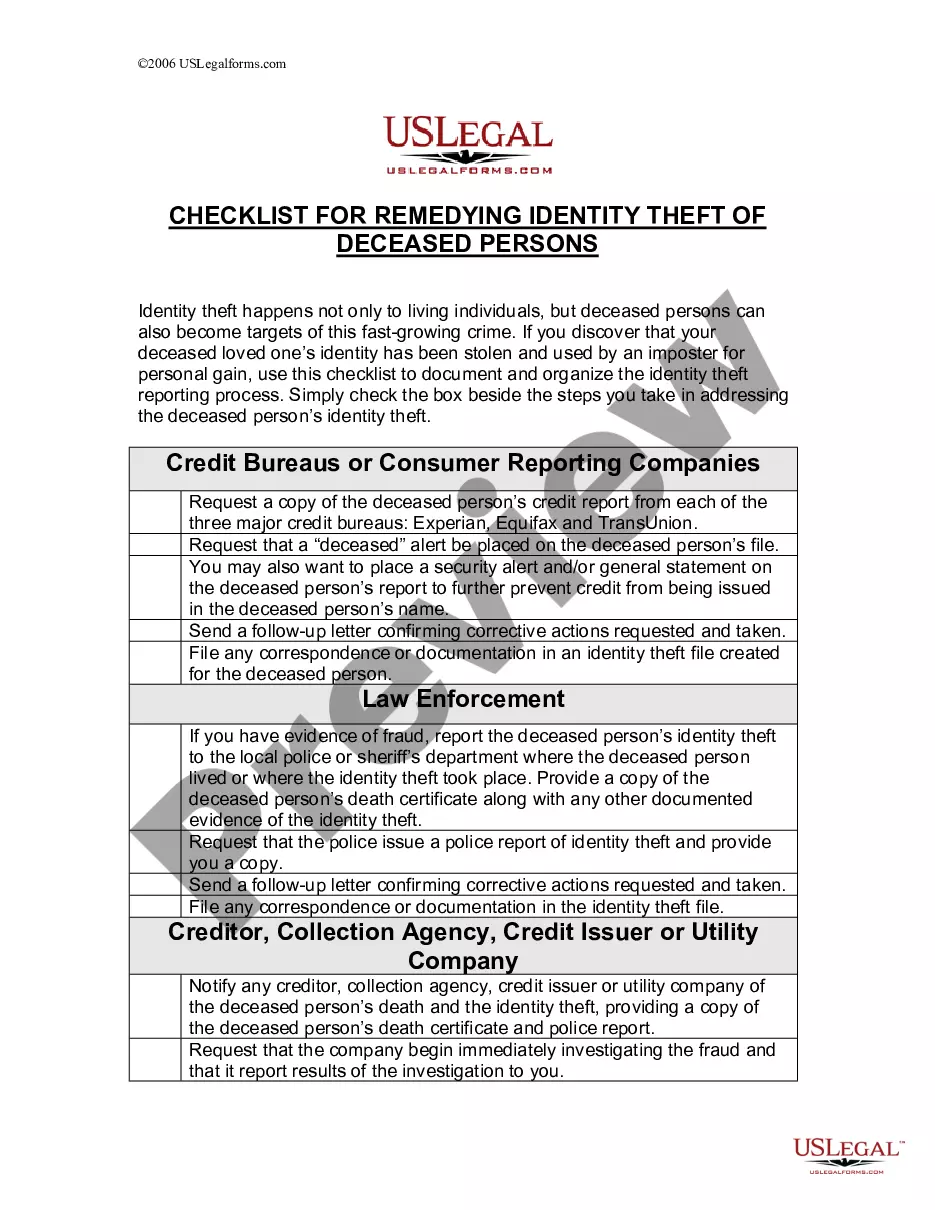

Checklist for Remedying Identity Theft of Deceased Persons

Description

How to fill out Checklist For Remedying Identity Theft Of Deceased Persons?

Aren't you sick and tired of choosing from countless samples every time you need to create a Checklist for Remedying Identity Theft of Deceased Persons? US Legal Forms eliminates the wasted time an incredible number of American citizens spend browsing the internet for appropriate tax and legal forms. Our skilled team of lawyers is constantly updating the state-specific Templates catalogue, to ensure that it always offers the proper files for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form are available in the My Forms tab.

Visitors who don't have an active subscription should complete simple steps before having the ability to get access to their Checklist for Remedying Identity Theft of Deceased Persons:

- Use the Preview function and look at the form description (if available) to make certain that it’s the appropriate document for what you’re trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the correct template to your state and situation.

- Utilize the Search field on top of the web page if you want to look for another file.

- Click Buy Now and choose a preferred pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your sample in a needed format to finish, create a hard copy, and sign the document.

After you’ve followed the step-by-step recommendations above, you'll always have the ability to log in and download whatever file you want for whatever state you require it in. With US Legal Forms, completing Checklist for Remedying Identity Theft of Deceased Persons samples or any other legal documents is not difficult. Begin now, and don't forget to recheck your examples with certified attorneys!

Form popularity

FAQ

When a Social Security beneficiary dies, the death is usually reported to SSA by a family member, a funeral home, or a government agency. Whoever does the reporting, according to SSA, the death should be reported as soon as possible.

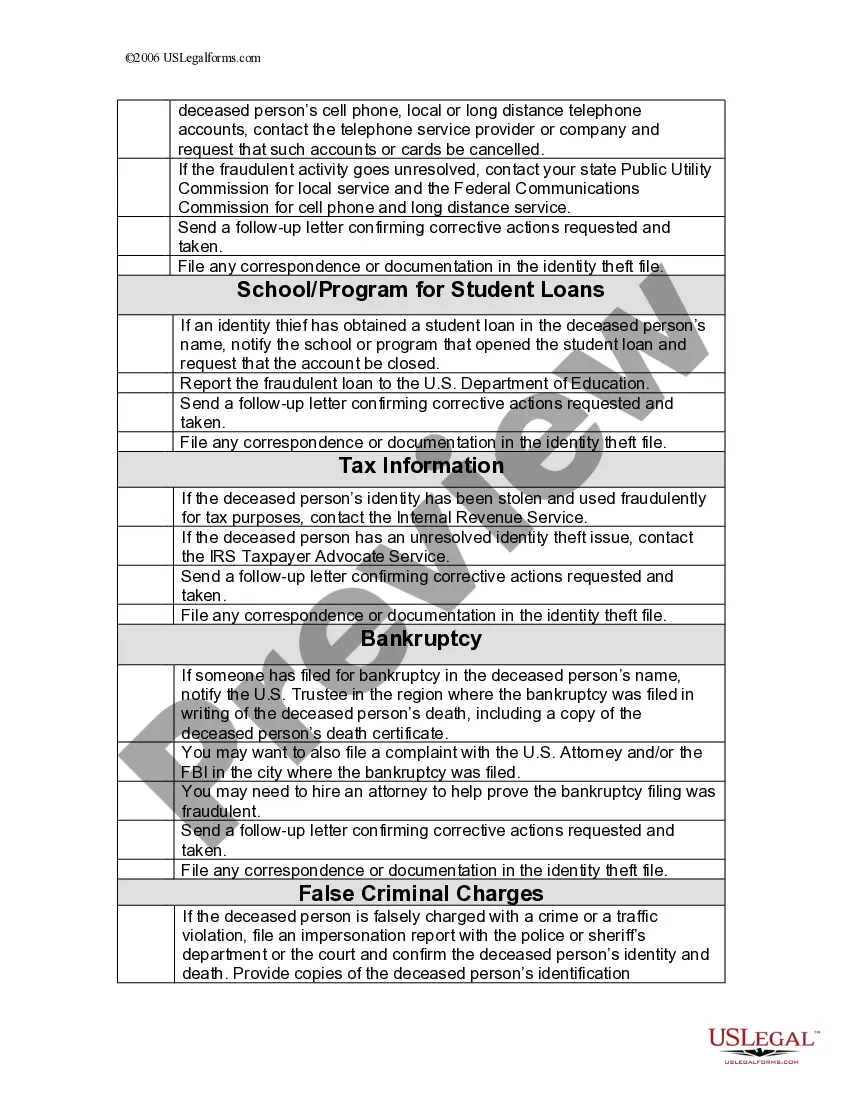

An identity thief's use of a deceased person's Social Security number may create problems for family members.Sometimes delays in reporting can provide time for identity thieves to collect enough personal information to open credit accounts or take other fraudulent actions using the deceased's information.

Scammers are using the recently deceased to open new credit cards. Death and taxes go together we know that.Evidence is mounting that identity thieves are using personal information from the recently deceased to open new credit cards under the dead person's name. It's ghoulish, all right, but it's also stoppable.

The Social Security Administration (www.ssa.gov) does not reappoint a Social Security number to someone else after the original owner's death. The SSA estimates that there are enough new number combinations to last well into the next SEVERAL generations.

An identity thief's use of a deceased person's Social Security number may create problems for family members.Sometimes delays in reporting can provide time for identity thieves to collect enough personal information to open credit accounts or take other fraudulent actions using the deceased's information.

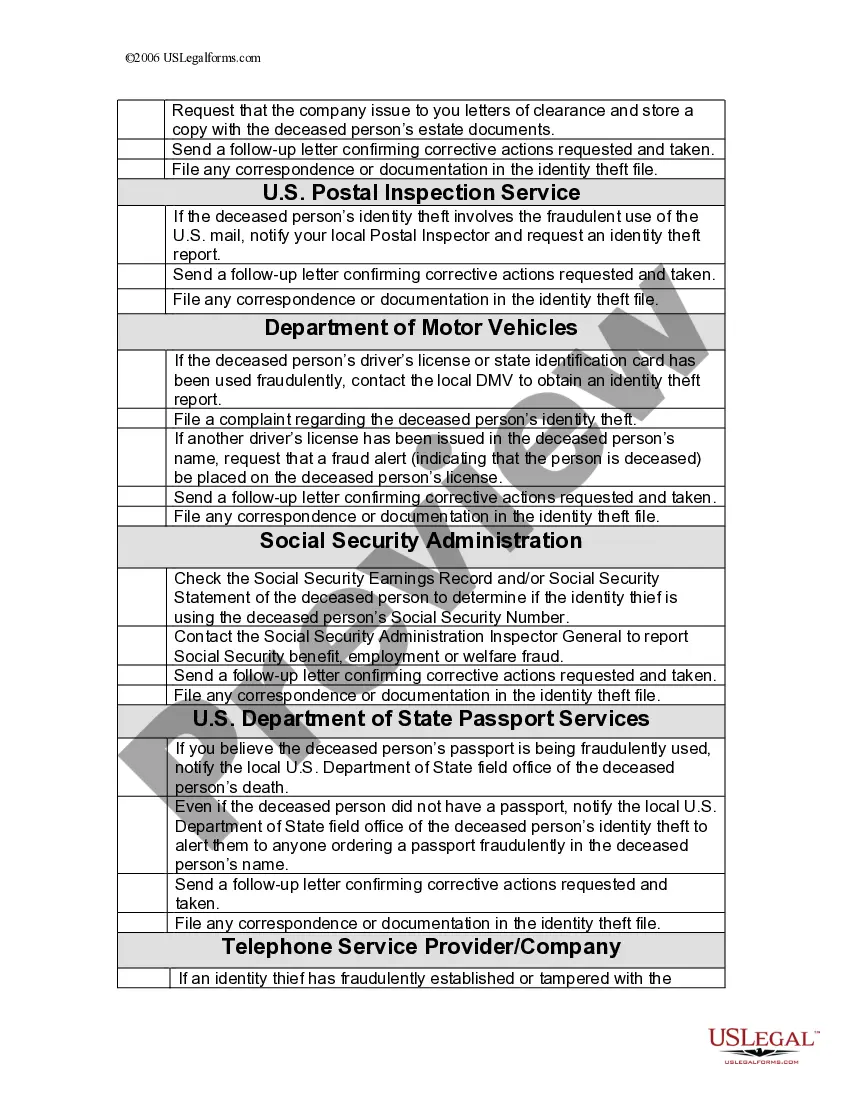

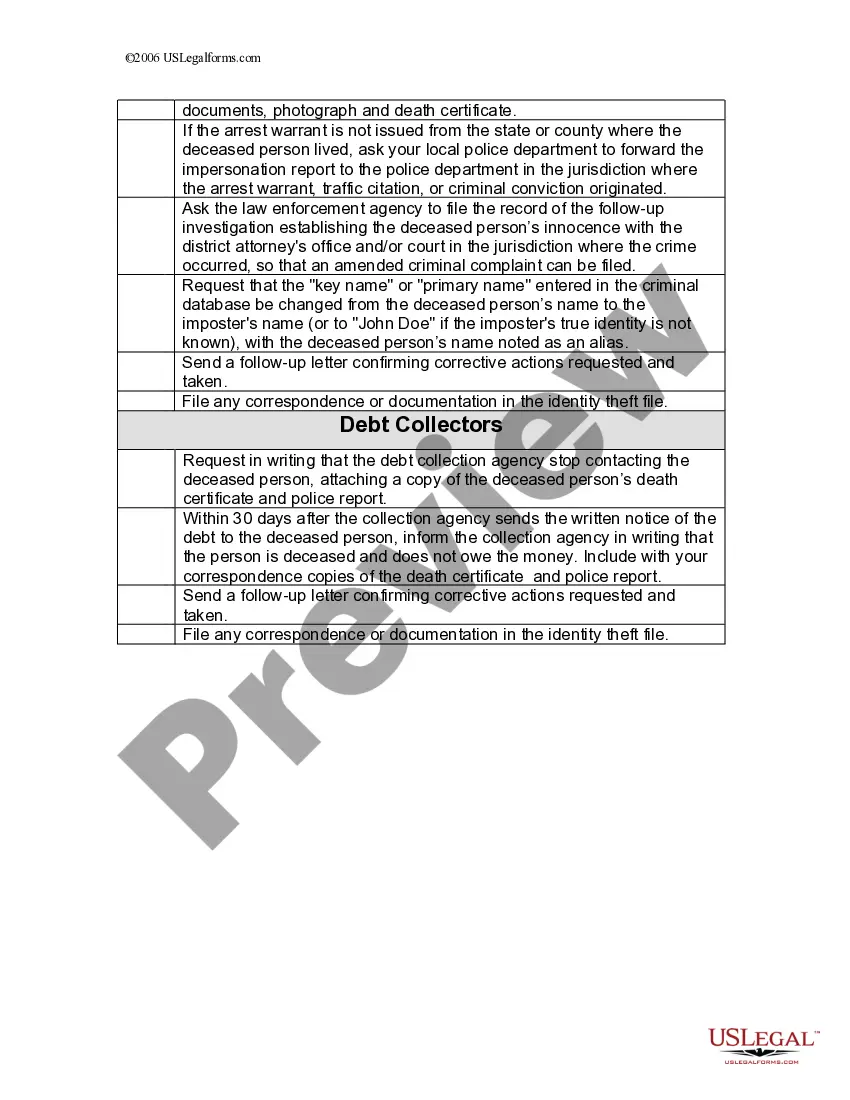

For joint accounts, remove the deceased's name. Report the death to Social Security by calling 800-772-1213. Contact the department of motor vehicles to cancel the deceased's driver's license, to prevent duplicates from being issued to fraudsters.

Identity theft can victimize the dead. Identity thieves can strike even after death.The file contains the following information: Social Security number, name, date of birth, date of death, state of last known residence, and zip code of last lump sum payment.

Identity Theft of a Deceased PersonIdentity thieves can get personal information about deceased individuals by reading obituaries, stealing death certificates, or searching genealogy websites that sometimes provide death records from the Social Security Death Index.

Limit the amount of personal information you share about the deceased in newspaper and online obituaries. Notify the Social Security Administration of the death. Send the IRS a copy of the death certificate so that the agency can note that the person is deceased.