A Letter of Credit (Irrevocable) is a written commitment from a financial institution, such as a bank, stating that the issuer will honor a specific payment obligation when it is due. The payment is made by the financial institution on behalf of the buyer (applicant) to the seller (beneficiary) of the goods or services. The letter of credit is an irrevocable guarantee, meaning it cannot be modified or cancelled without the mutual consent of all parties involved in the transaction. The main purpose of the letter of credit is to guarantee payment to the seller in the event that the buyer does not fulfill their obligation. This eliminates the risk of non-payment for the seller, and provides assurance to the buyer that the goods or services will be provided as agreed. There are many types of irrevocable letters of credit. Standby letters of credit are commonly used for commercial transactions, performance bonds, and payment guarantees. Financial institutions can also issue letters of credit to increase the creditworthiness of a buyer. Revolving letters of credit can be used to cover the cost of multiple shipments over a period of time. Sight drafts are commonly used to pay for goods that have already been delivered. Lastly, back-to-back letters of credit are used to make payments to a third party on behalf of the buyer.

Letter of Credit ( Irrevocable )

Description

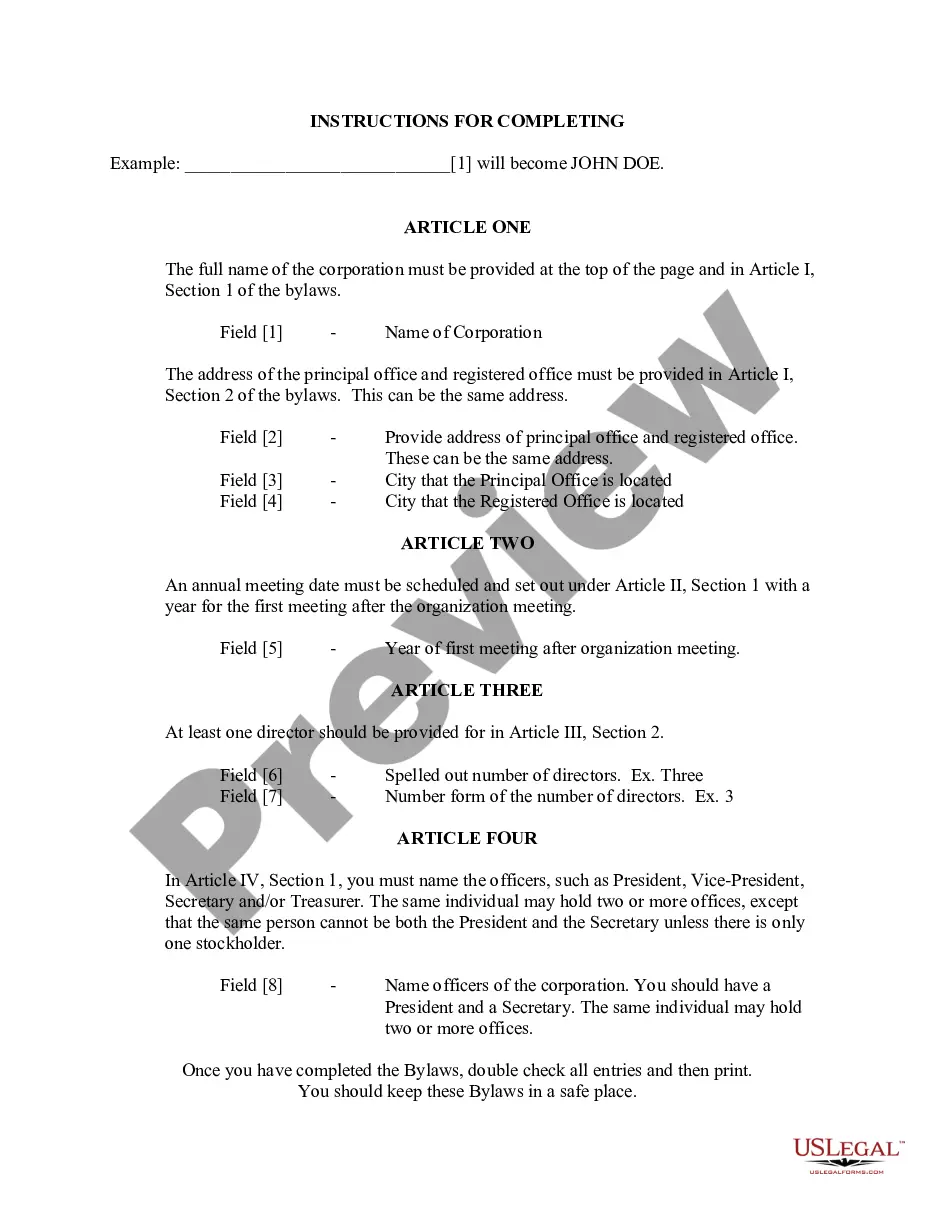

How to fill out Letter Of Credit ( Irrevocable )?

How much time and resources do you usually spend on drafting official documentation? There’s a better opportunity to get such forms than hiring legal specialists or spending hours browsing the web for a proper template. US Legal Forms is the top online library that offers professionally designed and verified state-specific legal documents for any purpose, including the Letter of Credit ( Irrevocable ).

To acquire and prepare a suitable Letter of Credit ( Irrevocable ) template, follow these simple steps:

- Look through the form content to make sure it meets your state laws. To do so, check the form description or use the Preview option.

- If your legal template doesn’t satisfy your needs, locate a different one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Letter of Credit ( Irrevocable ). If not, proceed to the next steps.

- Click Buy now once you find the right blank. Select the subscription plan that suits you best to access our library’s full service.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is totally reliable for that.

- Download your Letter of Credit ( Irrevocable ) on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously downloaded documents that you safely keep in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as frequently as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most trusted web services. Join us today!

Form popularity

FAQ

An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees. Irrevocable letters of credit provide more security than revocable ones. A confirmed letter of credit is one to which a second bank, usually in the exporter's country adds its own undertaking that payment will be made.

An Irrevocable Letter of Credit is one which cannot be cancelled or amended without the consent of all parties concerned. A Revolving Letter of Credit is one where, under terms and conditions thereof, the amount is renewed or reinstated without specific amendments to the credit being needed.

One party will request a letter of credit to be provided to the receiving party. Because a letter of credit is a document obtained from a bank or other financial institution, the applicant needs to partner with a lender to secure a letter of credit.

Expensive, tedious and time consuming in terms of absolute cost, working capital, and credit line usage. Additional need for security and collateral to satisfy bank's coverage terms for the buyer. Lengthy and laborious claims process involving more paperwork for the seller.

An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees. Irrevocable letters of credit provide more security than revocable ones. A confirmed letter of credit is one to which a second bank, usually in the exporter's country adds its own undertaking that payment will be made.

The standard cost of a letter of credit is around 0.75% of the total purchase cost. For letters that are in the 6 figures (typically around $250,000), these fees can add up and benefit the bank.

How to get an Irrevocable Letter of Credit? To obtain an ILOC, you need to reach out to your bank who will provide you with a representative.Don't try to draft an LC on your own or attempt to copy someone else's.Writing your ILOC may seem right in the short run to save money.

The initial expiration date shall be two (2) years from the date of issuance.