Consumer Credit Application Form

Description

How to fill out Consumer Credit Application Form?

US Legal Forms is the most easy and affordable way to find suitable formal templates. It’s the most extensive web-based library of business and personal legal paperwork drafted and checked by lawyers. Here, you can find printable and fillable blanks that comply with federal and local regulations - just like your Consumer Credit Application Form.

Getting your template takes just a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted Consumer Credit Application Form if you are using US Legal Forms for the first time:

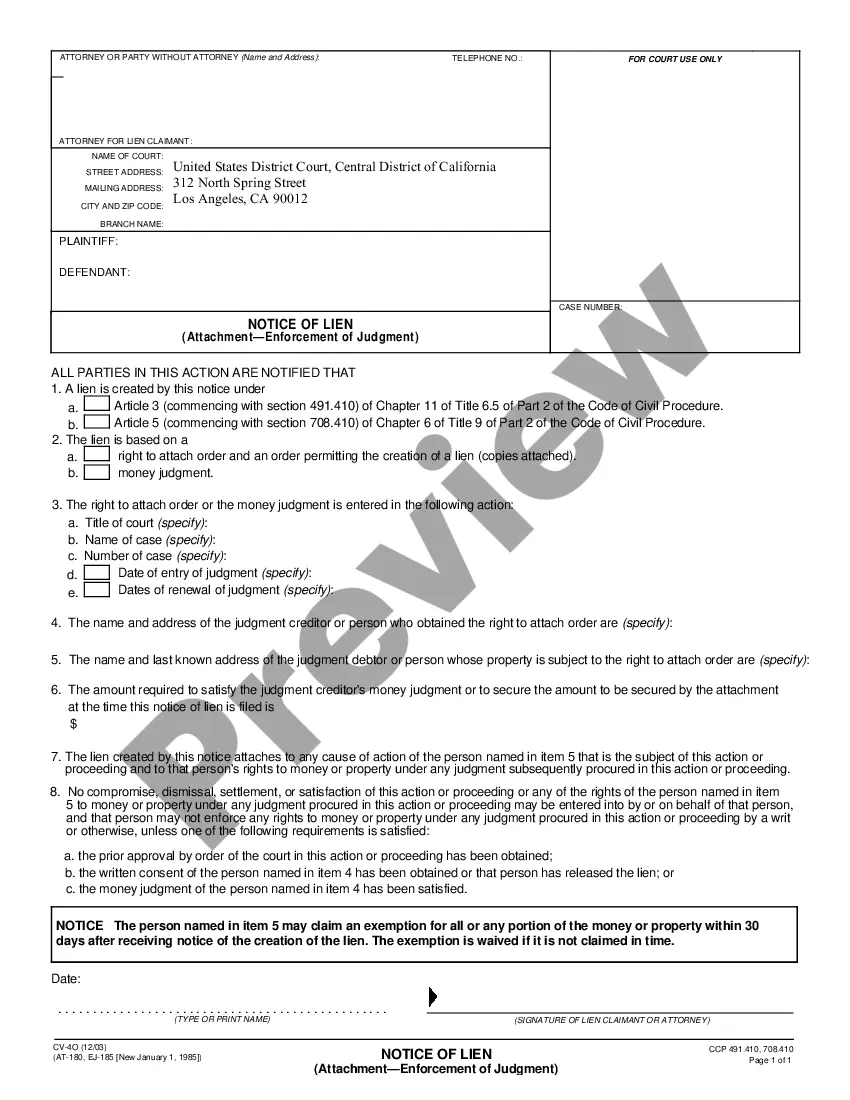

- Read the form description or preview the document to guarantee you’ve found the one corresponding to your demands, or locate another one using the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and judge the subscription plan you like most.

- Register for an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Select the preferred file format for your Consumer Credit Application Form and download it on your device with the appropriate button.

After you save a template, you can reaccess it anytime - simply find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more effectively.

Take full advantage of US Legal Forms, your reputable assistant in obtaining the required formal paperwork. Give it a try!

Form popularity

FAQ

Learn How to Fill the Credit Application form - YouTube YouTube Start of suggested clip End of suggested clip Information in the next section. Provide your shipping and billing contact. Information.MoreInformation in the next section. Provide your shipping and billing contact. Information.

Some common types of consumer credit are installment credit, non-installment credit, revolving credit, and open credit.

Three things a credit card application will need are your full name, your Social Security number or Individual Taxpayer Identification Number, and information about your income. This information will help card issuers verify whether you are a real person and if you can afford making payments on a new credit card.

Consumer credit refers to the credit facility financial institutions provide to their customers for purchasing goods and services. Common examples are credit card payments, consumer durables loans, and student loans.

A Consumer Loan Application is a form used by the applicant to request a loan to a bank or lending company. This form template has all the necessary questions in order to collect all required data when loaning money.

Three things a credit card application will need are your full name, your Social Security number or Individual Taxpayer Identification Number, and information about your income. This information will help card issuers verify whether you are a real person and if you can afford making payments on a new credit card.

Writing & Reviewing a Credit Application: What You Need to Know Customer's Name.Customer's Address and Telephone Number.Customer's Employer Identification Number (EIN)Customer's Bank Information and Credit References.Guarantor's Name, Address, Telephone, Social Security Number, Etc.Signature Line.

Learn How to Fill the Credit Application form - YouTube YouTube Start of suggested clip End of suggested clip Or through many businesses that accept credit arrangements. The first step in completing the form isMoreOr through many businesses that accept credit arrangements. The first step in completing the form is to enter the destination. Contact. Information which in this case is EXFO.