This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty

Description Payment Release Request Letter

How to fill out Mortgage Securing Template?

Aren't you sick and tired of choosing from hundreds of templates each time you need to create a Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty? US Legal Forms eliminates the lost time an incredible number of American citizens spend surfing around the internet for suitable tax and legal forms. Our expert group of lawyers is constantly updating the state-specific Forms collection, so it always offers the proper documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click on the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have an active subscription need to complete simple steps before having the ability to download their Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty:

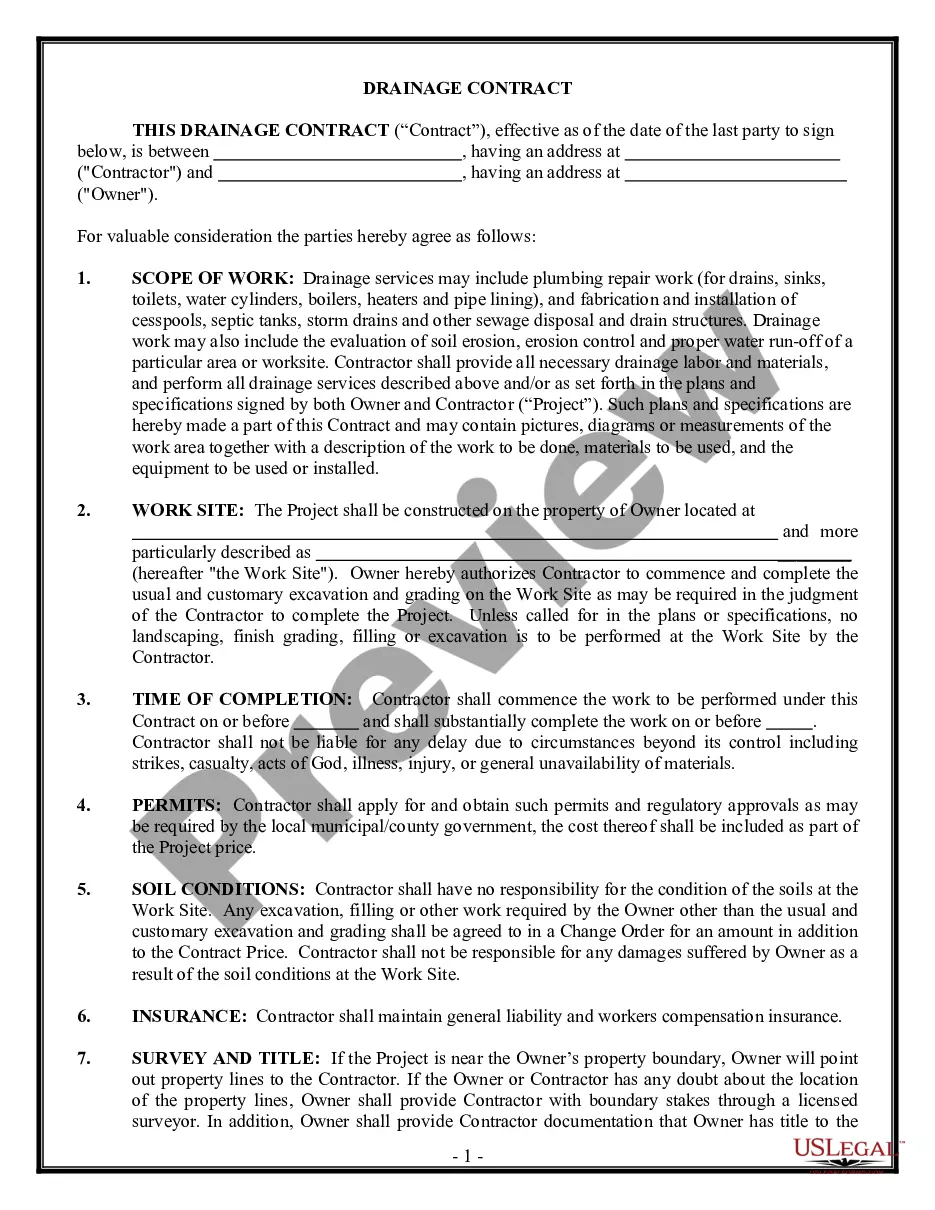

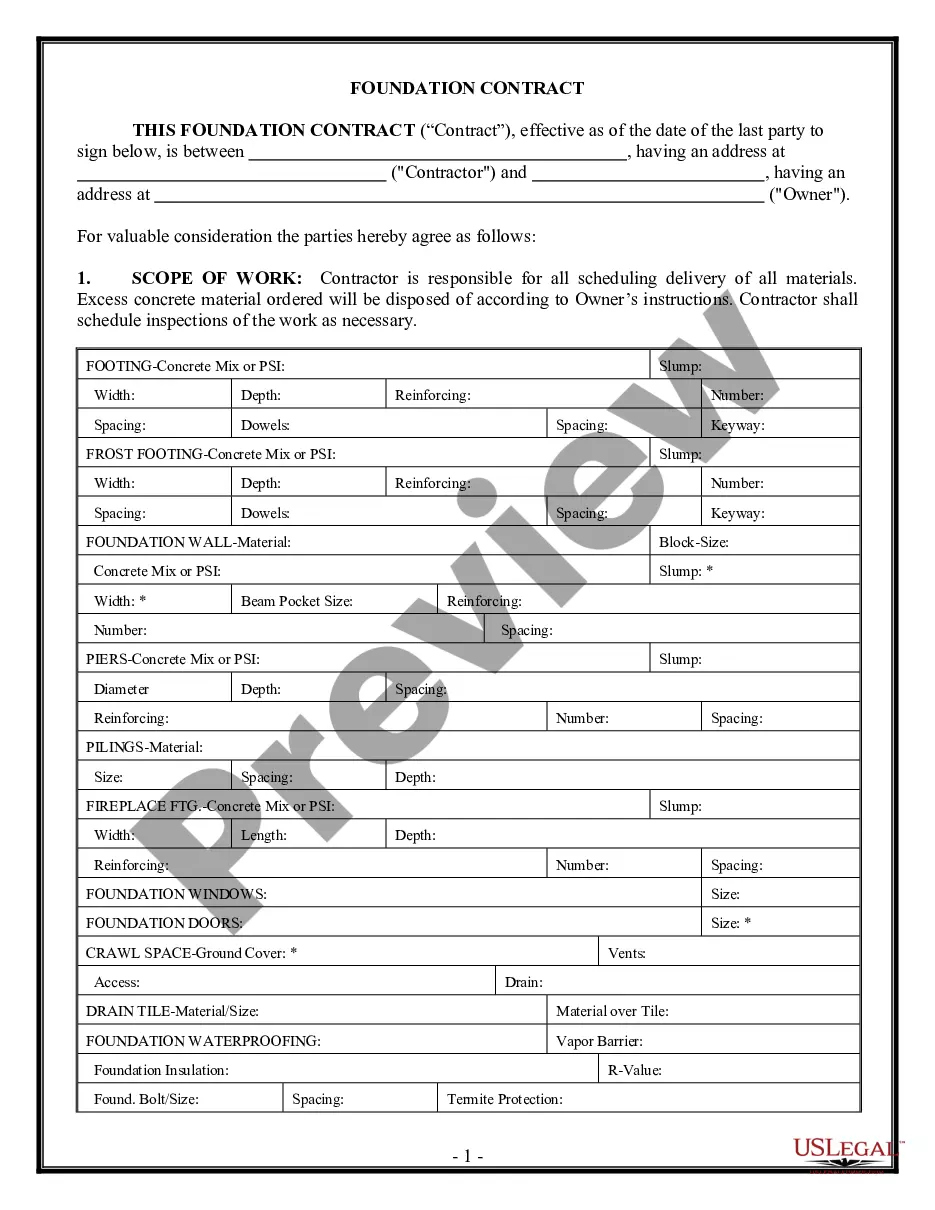

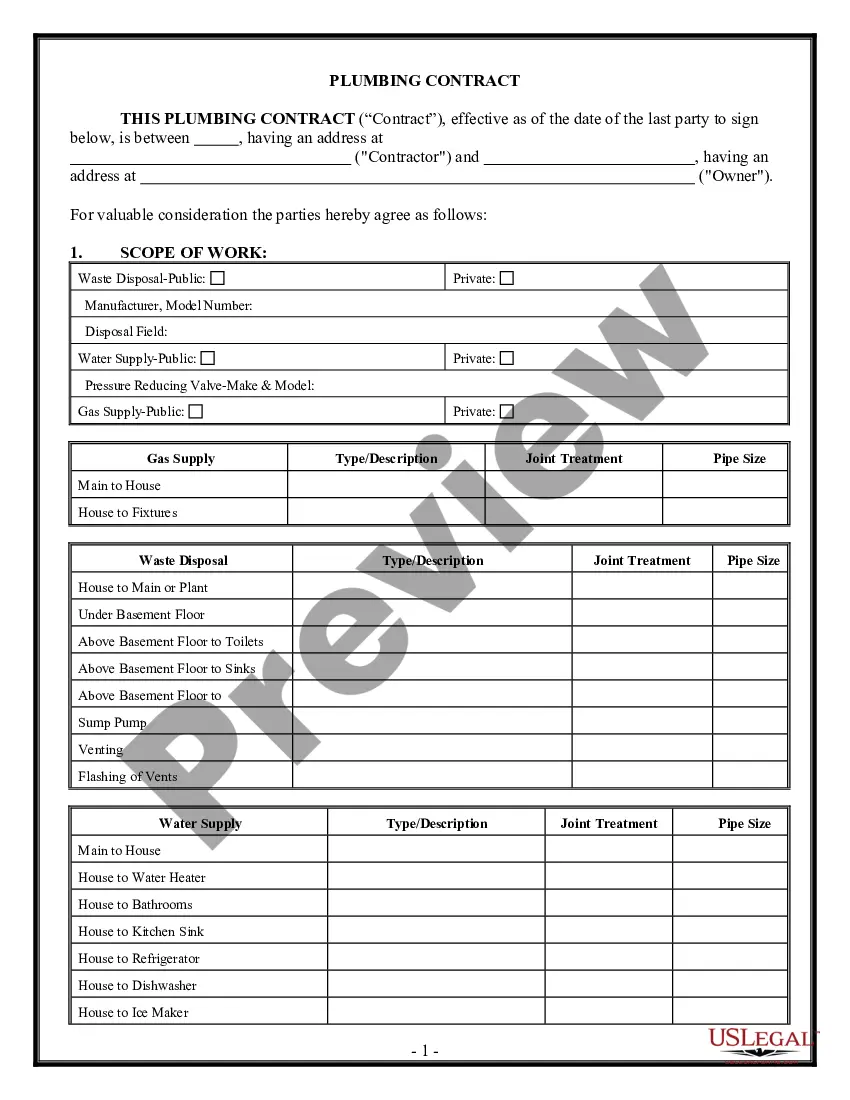

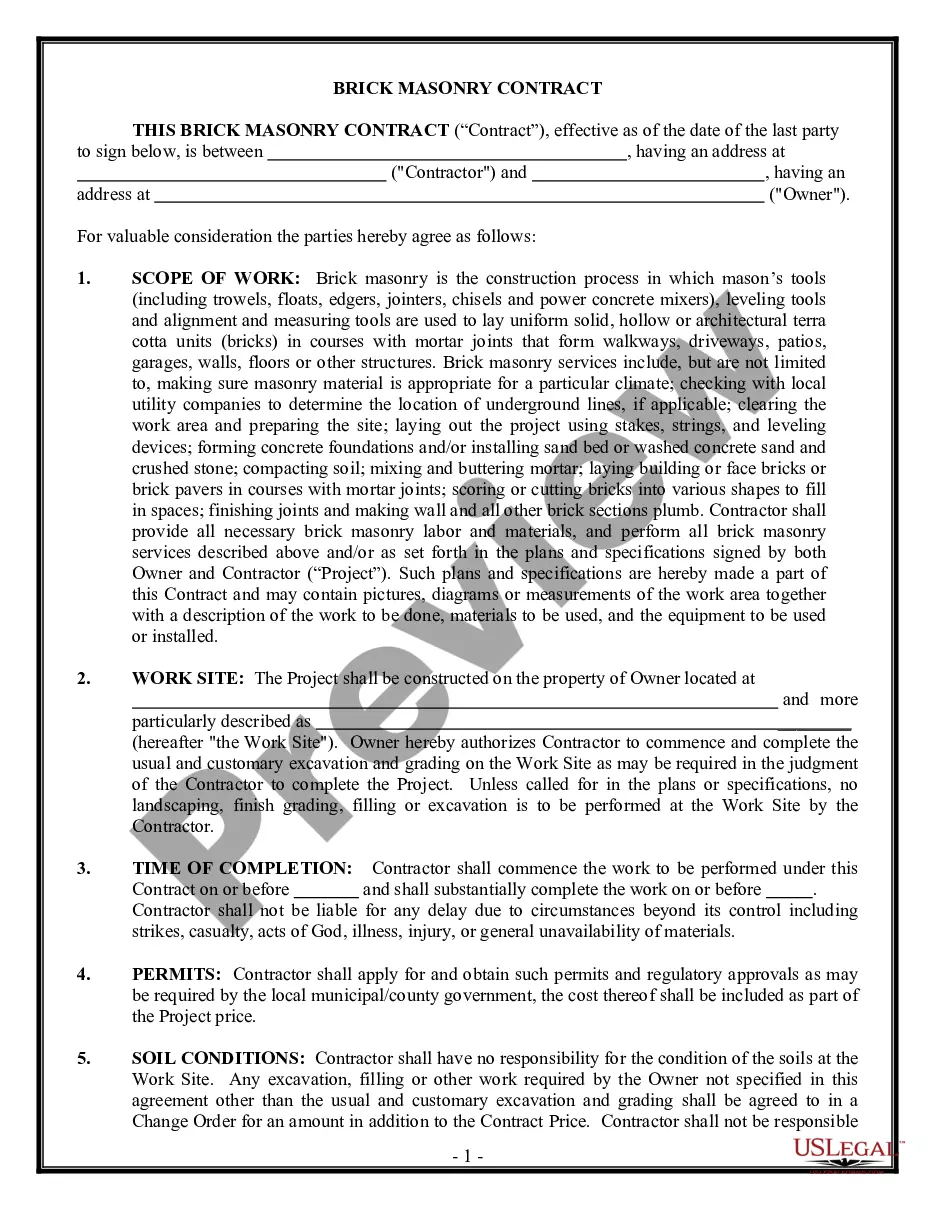

- Use the Preview function and read the form description (if available) to be sure that it’s the correct document for what you’re trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the correct example for the state and situation.

- Utilize the Search field on top of the site if you want to look for another document.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Get your sample in a required format to finish, create a hard copy, and sign the document.

As soon as you have followed the step-by-step recommendations above, you'll always have the ability to sign in and download whatever document you need for whatever state you require it in. With US Legal Forms, completing Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty templates or other official files is not difficult. Get started now, and don't forget to look at the samples with certified attorneys!

Liabilities With Mortgage Form popularity

Guaranty Securing Other Form Names

Guaranty Performance With FAQ

A guarantor is a third party who 'guarantees' a loan, mortgage or rental agreement. This means they agree to repay the total amount owed if the borrower or renter can't pay what they owe. By guaranteeing the agreement, you become responsible for any arrears that occur.

No, if you have signed an agreement and are acting as the guarantor for a guarantor loan, you cannot stop being this until the loan term has ended.

Most landlords and letting agents require tenants to have a Guarantor in order to qualify as a suitable tenant. Some tenants for one reason or another can't arrange a Guarantor.The reality is, a guarantor is a prerequisite for every sensible landlord, and rightly so.

It's very common for a guarantee to last as long as the tenancy lasts. So, if the tenant remains in the property for four years, you will continue to be responsible for any arrears or damages during that entire period. Most tenancies will run for a fixed term and will then continue on a month-by-month basis.

Close the loan/pay off the loan early. Get the borrower/guarantor to pay off the loan early. The lender goes out of business.

A Guarantor's obligations A guarantor may be bound to maintain repayments on a borrower's loan in circumstances where the borrower defaults on repayments. Alternatively they may be called upon to repay the loan in full.

A guaranty of payment is an independent agreement by a person or an entity to pay the loan when it goes into default. Even if the borrower is unable or unwilling to pay back the loan, the Bank can require the guarantor to pay it back.

Guarantors are asked to sign a guarantee agreement this is a legally binding document and once you sign it you become responsible for the loan repayments if the person you are acting as guarantor for cannot pay.

The landlord allows the guarantor to surrender their legal obligations as a guarantor. If the Deed of guarantee contains a termination provision (allowing the guarantor to withdraw on say two months' notice)- the provision can allow the termination during the fixed term.