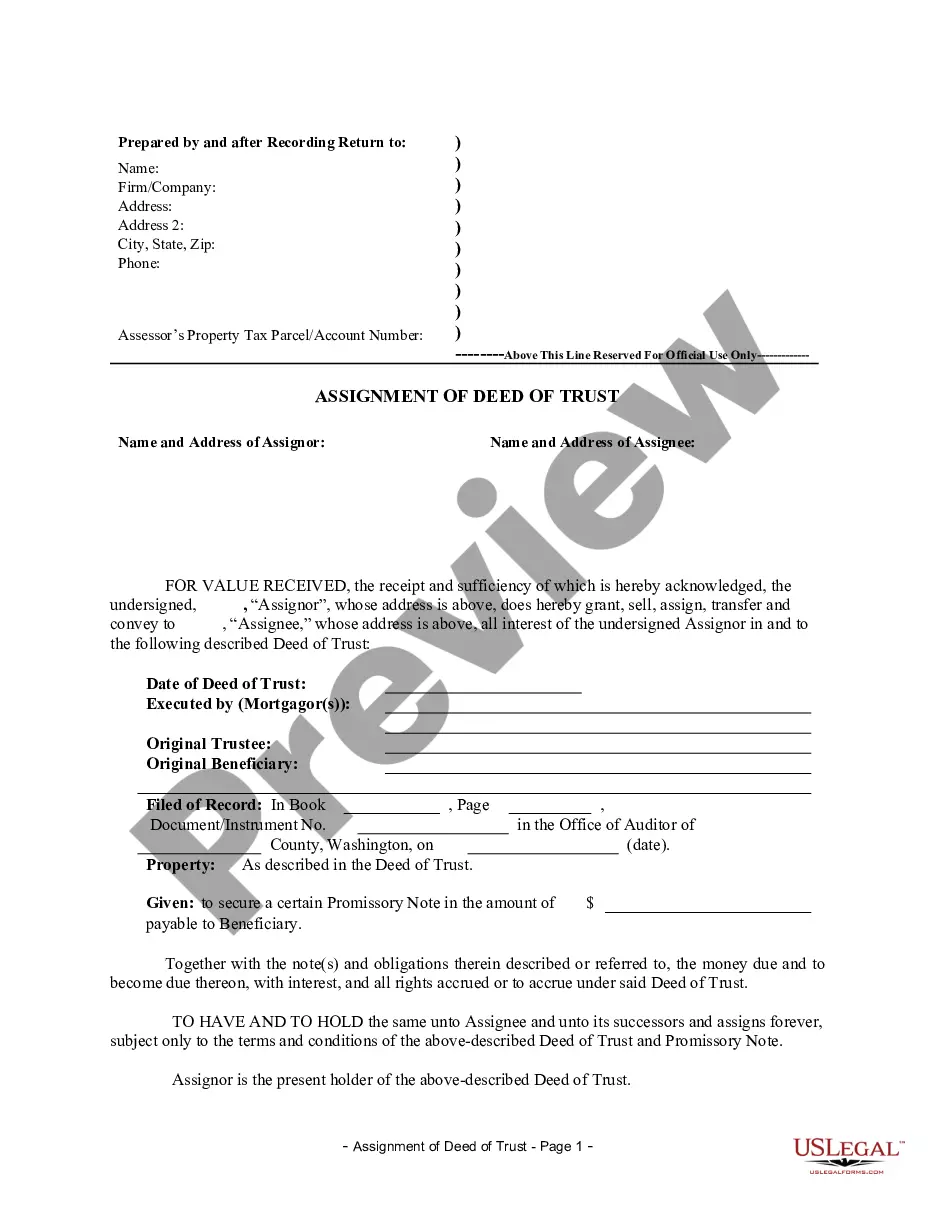

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage

Description Promissory Note With Interest

How to fill out Cancels Mortgagor Mortgage?

Aren't you tired of choosing from countless templates every time you require to create a Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage? US Legal Forms eliminates the wasted time countless Americans spend browsing the internet for perfect tax and legal forms. Our skilled crew of lawyers is constantly upgrading the state-specific Samples library, to ensure that it always provides the right documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form can be found in the My Forms tab.

Users who don't have a subscription need to complete quick and easy actions before having the capability to download their Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage:

- Use the Preview function and read the form description (if available) to make sure that it’s the right document for what you are trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the correct example to your state and situation.

- Make use of the Search field at the top of the webpage if you want to look for another file.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your document in a required format to complete, create a hard copy, and sign the document.

When you’ve followed the step-by-step guidelines above, you'll always have the capacity to log in and download whatever file you need for whatever state you require it in. With US Legal Forms, completing Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage templates or any other official files is not difficult. Get started now, and don't forget to recheck your samples with accredited attorneys!

Payment Promissory Note Agreement Form popularity

Agreement Promissory Note Other Form Names

Agreement Modify Document FAQ

The Loan shall be evidenced and governed by a new promissory note (the New Note) which amends and restates in its entirety, but does not extinguish, the Note. Anything to the contrary notwithstanding, if any inconsistency exists between the Loan Agreement and the New Note, the New Note shall control.

Identity of the Parties. The names of the lender and borrower need to be stated. Date of the Agreement. Interest Rate. Repayment Terms. Default provisions. Signatures. Choice of Law. Severability.

The maturity date is the date on which a note becomes due and must be paid. Sometimes notes require monthly installments (or payments) but usually all of the principal and interest must be paid at the same time. The wording in the note expresses the maturity date and determines when the note is to be paid.

Look for a sample template online which you can use as a guide for when you are drafting your document. Open a word processing software and start formatting your document. Identify the parties who are involved in the loan. Write your consideration to make your loan valid.

The Promissory Note is hereby modified and amended by deleting the last sentence of the first paragraph of the Promissory Note in its entirety, and replacing it with the following: All outstanding principal and interest shall be due and payable on June 3, 2012 (the Due Date).

Starting the Document. Write the date at the top of the page. Write the Terms of the Loan. State the purpose of the personal payment agreement and the terms for returning the money. Date the Document. Statement of Agreement. Sign the Document. Record the Document.

Dear Sir, I, Ramesh Gupta, am writing this letter to request you to grant me some extension for repayment of my car loan with your bank. I would like to bring to your notice that my car loan started with your bank in the year 2014 in the month of June for three years.

State the purpose for the loan. #Set forth the amount and terms of the loan. Your agreement should clearly state the amount of money you're lending your friend, the interest rate, and the total amount your friend will pay you back.

Demand promissory notes are notes that do not carry a specific maturity date, but are due on demand of the lender. Usually the lender will only give the borrower a few days' notice before the payment is due. Promissory notes may be used in combination with security agreements.