A bailment is the act of placing property in the custody and control of another, usually by agreement in which the holder (the bailee) is responsible for the safekeeping and return of the property. Ownership or title to the property remains in the bailor.

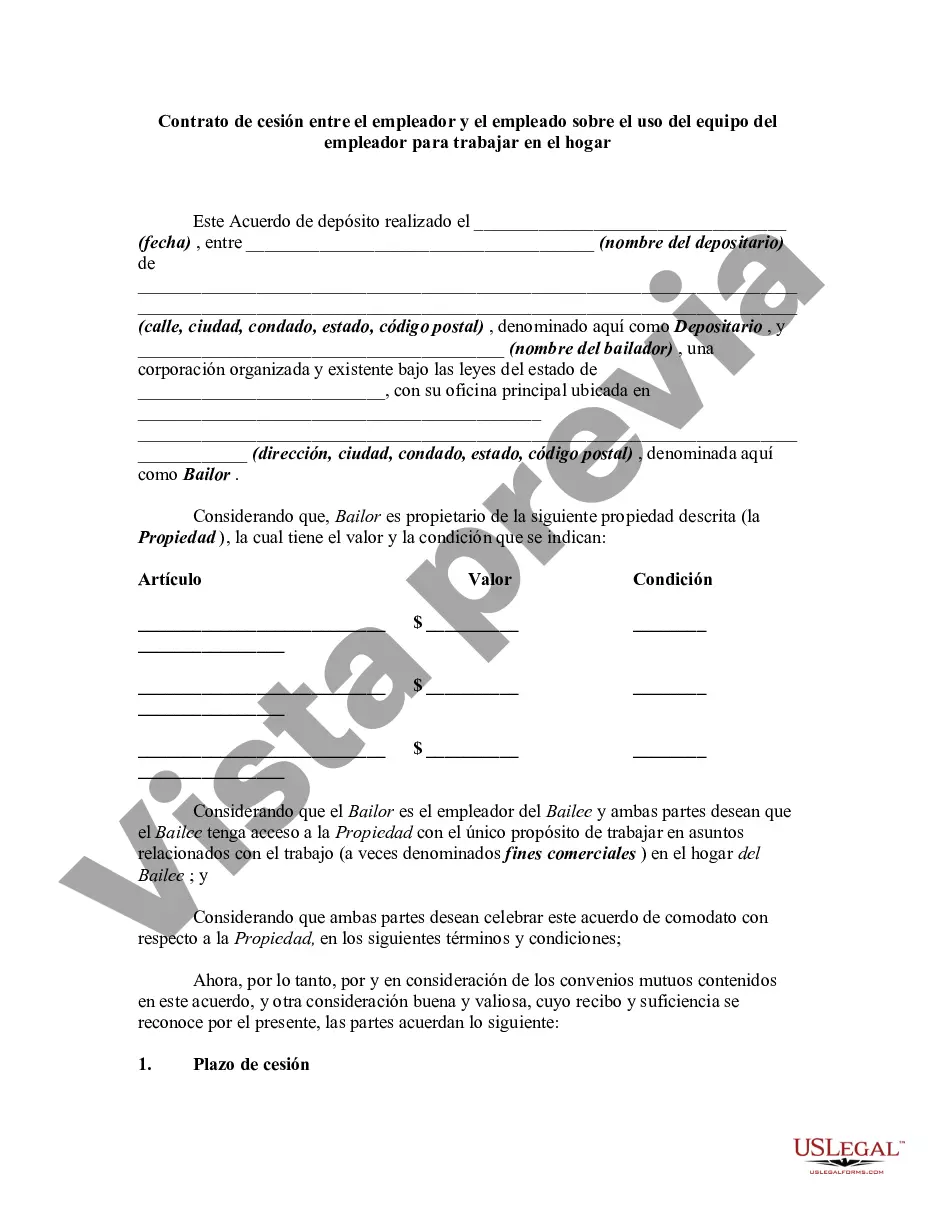

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contrato Empleado - Bailment Contract Between Employer and Employee Regarding Use of Employer's Equipment in Order to Work at Home

Description Contrato Entre Empleado

How to fill out Empleador Trabajar Hacer?

Aren't you tired of choosing from hundreds of samples each time you want to create a Bailment Contract Between Employer and Employee Regarding Use of Employer's Equipment in Order to Work at Home? US Legal Forms eliminates the wasted time an incredible number of American people spend browsing the internet for suitable tax and legal forms. Our expert team of attorneys is constantly changing the state-specific Samples collection, so it always provides the appropriate files for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form may be found in the My Forms tab.

Users who don't have an active subscription should complete easy steps before being able to get access to their Bailment Contract Between Employer and Employee Regarding Use of Employer's Equipment in Order to Work at Home:

- Make use of the Preview function and look at the form description (if available) to ensure that it is the right document for what you are trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the correct sample for your state and situation.

- Utilize the Search field on top of the page if you want to look for another document.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Download your template in a needed format to finish, print, and sign the document.

When you’ve followed the step-by-step recommendations above, you'll always be able to sign in and download whatever file you will need for whatever state you require it in. With US Legal Forms, finishing Bailment Contract Between Employer and Employee Regarding Use of Employer's Equipment in Order to Work at Home samples or any other legal documents is not hard. Get going now, and don't forget to recheck your samples with accredited lawyers!