Line of Credit Promissory Note

Description

How to fill out Line Of Credit Promissory Note?

Aren't you tired of choosing from numerous templates each time you want to create a Line of Credit Promissory Note? US Legal Forms eliminates the wasted time numerous American citizens spend surfing around the internet for suitable tax and legal forms. Our skilled crew of lawyers is constantly upgrading the state-specific Forms catalogue, to ensure that it always offers the right files for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have a subscription should complete easy steps before being able to download their Line of Credit Promissory Note:

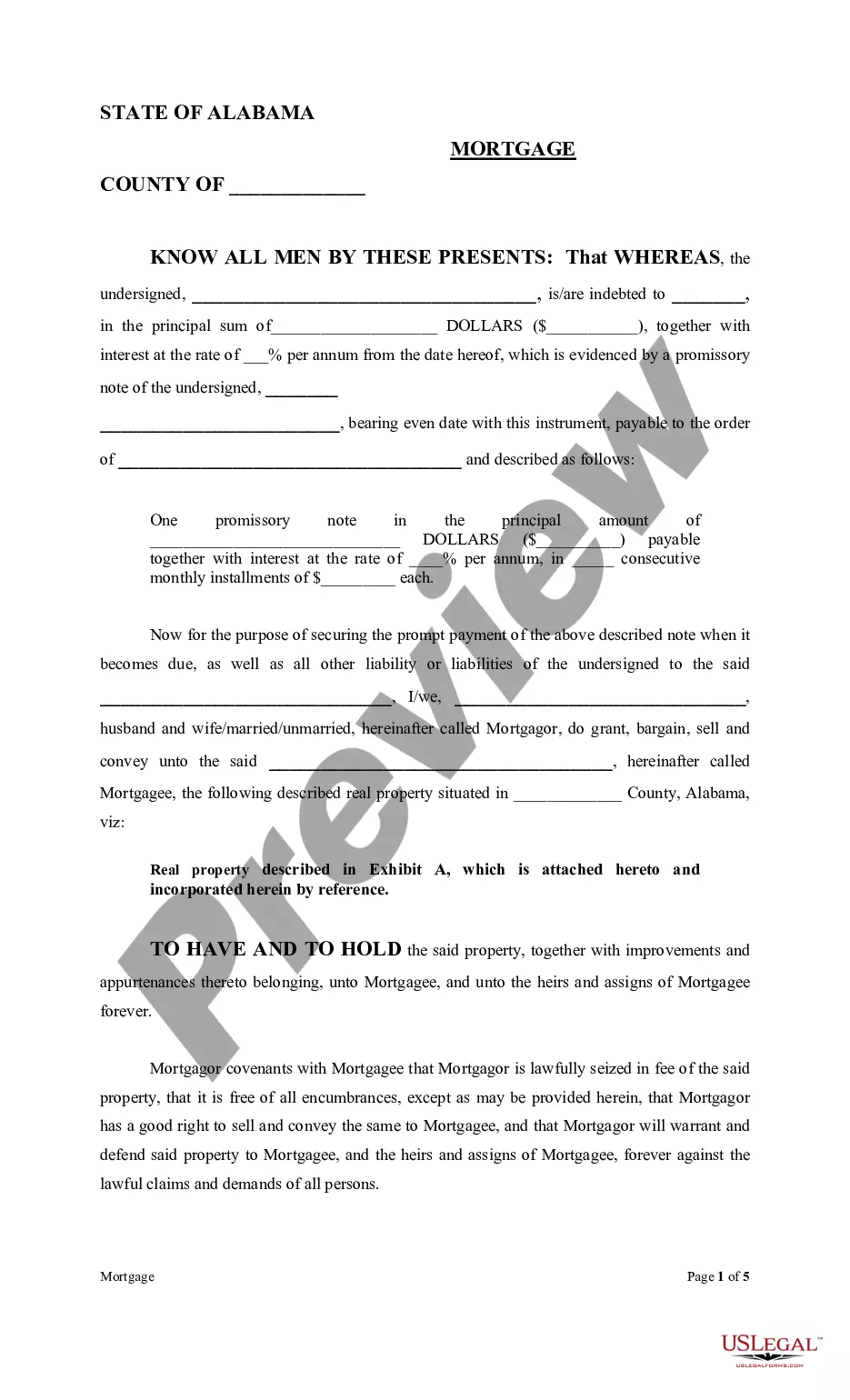

- Utilize the Preview function and look at the form description (if available) to make certain that it is the proper document for what you’re trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the right example for your state and situation.

- Make use of the Search field at the top of the webpage if you want to look for another file.

- Click Buy Now and choose a preferred pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Get your document in a required format to finish, print, and sign the document.

When you have followed the step-by-step guidelines above, you'll always have the capacity to log in and download whatever file you need for whatever state you need it in. With US Legal Forms, completing Line of Credit Promissory Note samples or any other official paperwork is not hard. Begin now, and don't forget to look at the examples with accredited attorneys!

Form popularity

FAQ

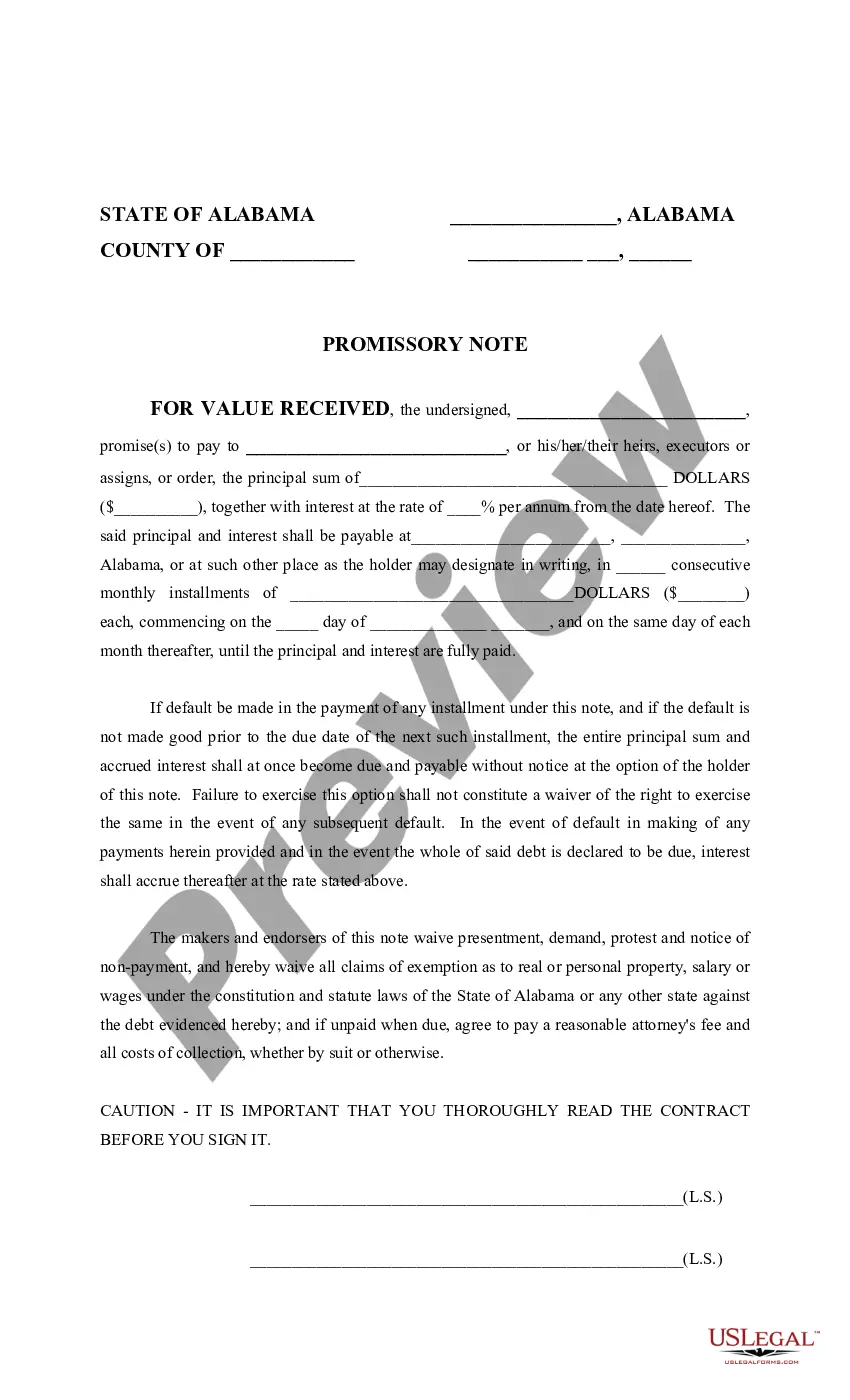

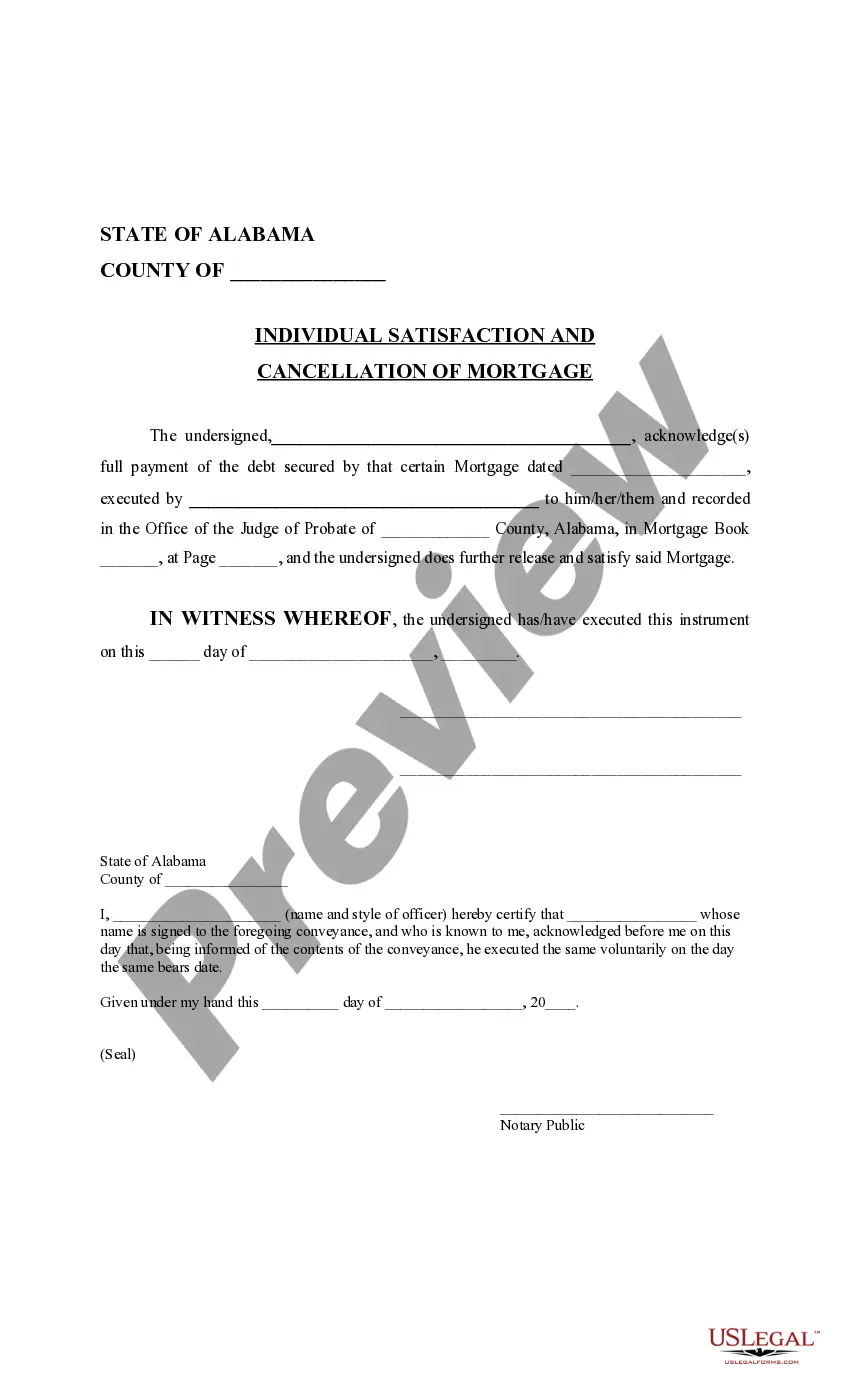

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

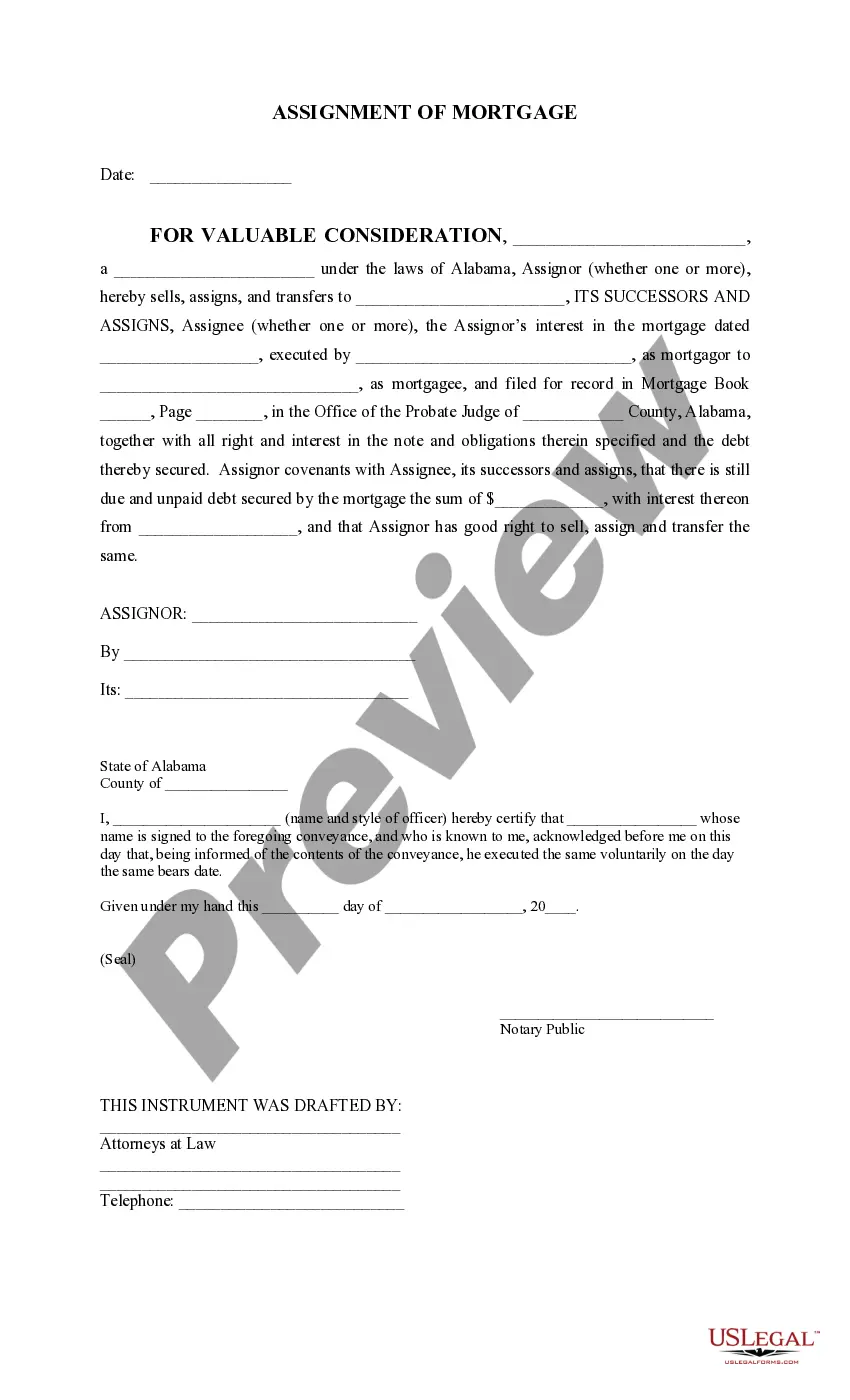

Borrower and Lender Details. A promissory note outlines information about both parties including the names, streets addresses, city, state and zip code of each party. Loan Information. Legal Language. Signatures. Warnings.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note. Accept full payment of the loan. Mark paid in full on the promissory note. Place a signature beside the paid in full notation. Mail the original promissory note to the borrower.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

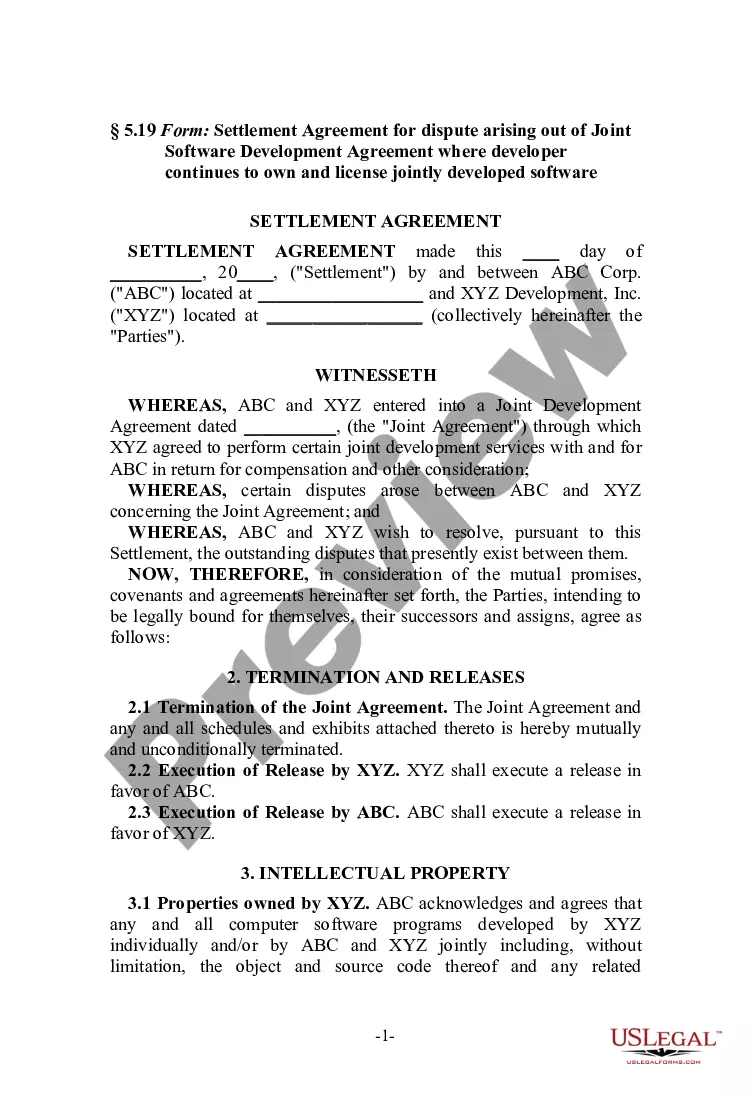

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

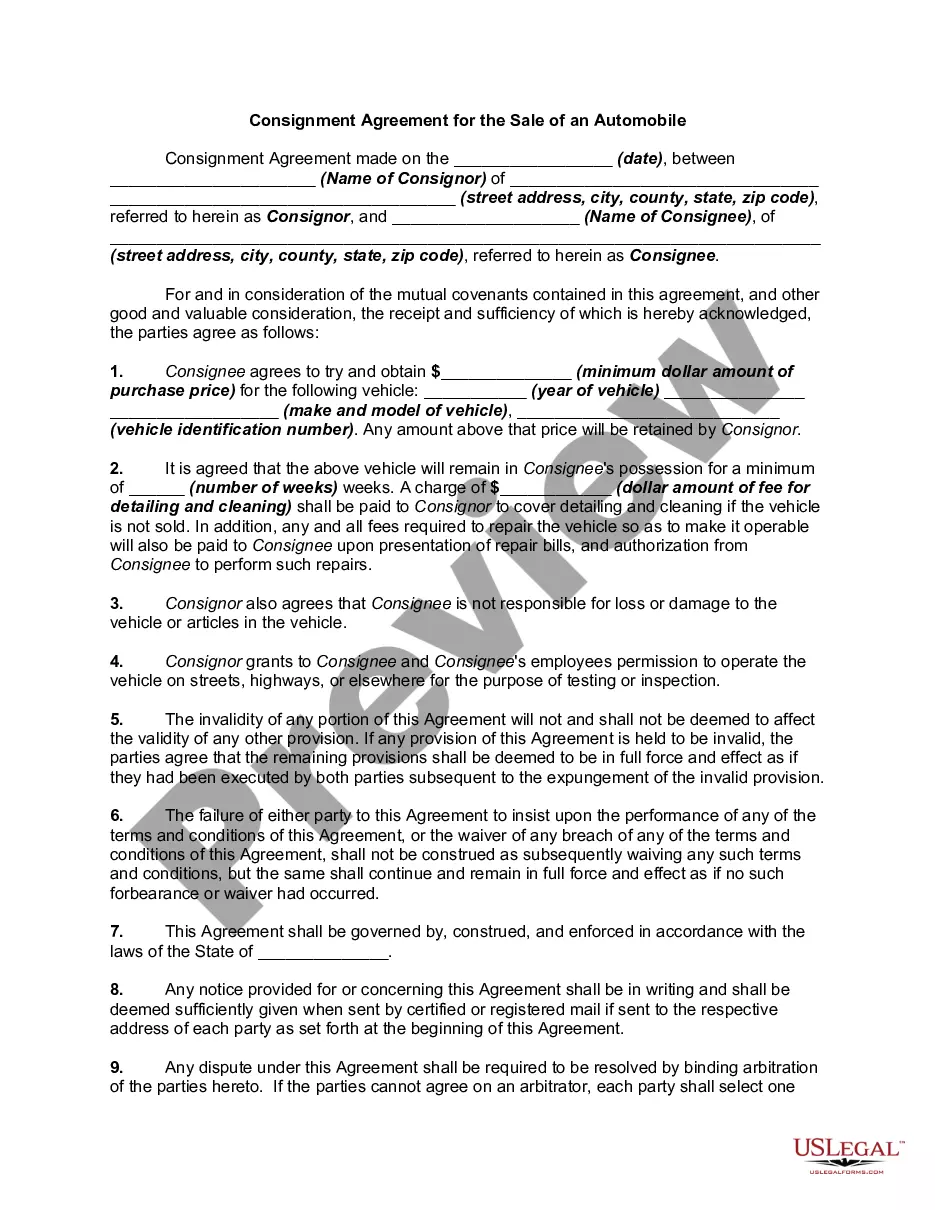

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.