Model Adjustable Rate Note — Home Equity ConversionMARCHEDEC) is a financial instrument used by homeowners who are 62 years or older to convert their home equity into cash or a line of credit. This type of loan is also known as a reverse mortgage loan. It allows seniors to access the equity they have built up in their homes without having to sell the property or make monthly mortgage payments. Marches are available in two forms: fixed-rate and adjustable-rate. With the fixed-rate option, homeowners receive a one-time lump sum payment or a line of credit that remains constant throughout the loan term. The adjustable-rate option allows homeowners to receive a lump sum payment or a line of credit with an adjustable interest rate. The interest rate may change every year, depending on the market rate. MARCHED loans are non-recourse, meaning that the lender may not pursue any other assets if the borrower defaults on the loan. They are also typically not taxable and do not require monthly payments. As such, they can be a great option for seniors who want to access their home equity without the burden of a mortgage payment.

Model Adjustable Rate Note - Home Equity Conversion

Description

How to fill out Model Adjustable Rate Note - Home Equity Conversion?

How much time and resources do you typically spend on composing formal paperwork? There’s a better way to get such forms than hiring legal experts or wasting hours searching the web for an appropriate blank. US Legal Forms is the top online library that offers professionally designed and verified state-specific legal documents for any purpose, including the Model Adjustable Rate Note - Home Equity Conversion.

To obtain and complete an appropriate Model Adjustable Rate Note - Home Equity Conversion blank, adhere to these simple steps:

- Look through the form content to make sure it complies with your state requirements. To do so, check the form description or utilize the Preview option.

- In case your legal template doesn’t meet your needs, locate a different one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Model Adjustable Rate Note - Home Equity Conversion. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Opt for the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is absolutely safe for that.

- Download your Model Adjustable Rate Note - Home Equity Conversion on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously purchased documents that you safely keep in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most reliable web services. Sign up for us now!

Form popularity

FAQ

Overall, Suze's opinion on reverse mortgages is that they should be a last resort for older Americans who need extra income. She recommends exploring other options first, such as downsizing to a smaller home or taking out a home equity line of credit.

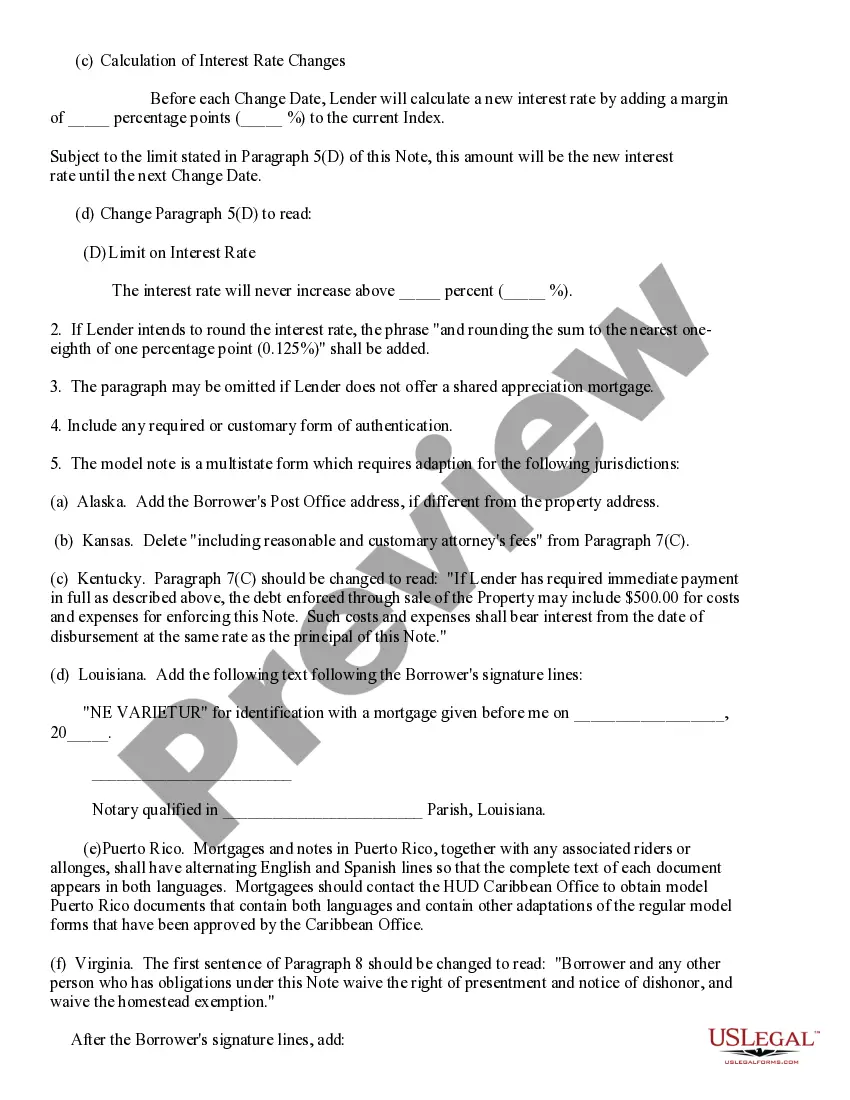

THIS NOTE CONTAINS PROVISIONS ALLOWING FOR CHANGES IN MY INTEREST RATE AND MY MONTHLY PAYMENT. THIS NOTE LIMITS THE AMOUNT MY INTEREST RATE CAN CHANGE AT ANY ONE TIME AND THE MAXIMUM RATE I MUST PAY.

Key Differences Between Reverse Mortgages and HECMs Reverse mortgages are available to consumers who are 55 and older in most states while HECMs are only available if you are 62 or older. HECMs also have more flexibility in their payout options while reverse mortgages only offer a single-lump sum in most cases.

Some of the potential disadvantages of getting a HECM include: You have to live in your home: When you get a HECM, your property must be your principal residence for much of the year. You'll have to pay back the HECM if you sell the home or want to move.

Does AARP recommend reverse mortgages? AARP does not recommend for or against reverse mortgages. They do however recommend that borrowers take the time to become educated so that borrowers are doing what is right for their circumstances.

While a reverse mortgage lets you access your equity without selling your house right away, it can be financially risky: A reverse mortgage increases your debt and can use up your equity. While the amount is based on your equity, you're still borrowing the money and paying the lender a fee and interest.

After a set period of time, often 1 ? 5 years, you'll have the option to convert your ARM loan into a conventional fixed-rate loan. In other words, you'll be able to settle into a single rate for the remaining life of your loan. While you won't pay closing costs on your conversion, there is generally an associated fee.

Reverse mortgages are ideal for retirees who don't have a lot of cash savings or investments but do have a lot of wealth built up in their homes. A reverse mortgage allows you to turn an otherwise illiquid asset into cash that you can use to cover expenses in retirement.