A number of states have enacted measures to facilitate greater communication between borrowers and lenders by requiring mortgage servicers to provide certain notices to defaulted borrowers prior to commencing a foreclosure action. The measures serve a dual purpose, providing more meaningful notice to borrowers of the status of their loans and slowing down the rate of foreclosures within these states. For instance, one state now requires a mortgagee to mail a homeowner a notice of intent to foreclose at least 45 days before initiating a foreclosure action on a loan. The notice must be in writing, and must detail all amounts that are past due and any itemized charges that must be paid to bring the loan current, inform the homeowner that he or she may have options as an alternative to foreclosure, and provide contact information of the servicer, HUD-approved foreclosure counseling agencies, and the state Office of Commissioner of Banks.

Notice of Intent to Foreclose - Mortgage Loan Default

Description

Key Concepts & Definitions

Notice of Intent to Foreclose Mortgage Loan: A legal document a lender sends to a borrower indicating the lender's plan to initiate foreclosure proceedings. This notice typically precedes the actual foreclosure and gives details such as the amount due and ways to avoid foreclosure.

Step-by-Step Guide

- Review the Notice: When you receive a notice of intent to foreclose, carefully check the details, including the amount alleged to be due and the date by which you can address the situation.

- Consult Legal Advice: Consider hiring an attorney who specializes in real estate or foreclosure to understand your rights and options.

- Communicate with the Lender: Engage with your lender to discuss possible arrangements, such as loan modification, forbearance, or a repayment plan.

- Explore Alternatives: Look into government programs and non-profit organizations that offer assistance to homeowners facing foreclosure.

- Act by Deadlines: Be sure to meet any deadlines specified in the notice to avoid escalation of the foreclosure process.

Risk Analysis

- Loss of Property: The most direct risk of ignoring a notice of intent to foreclose is losing your home.

- Credit Damage: Foreclosure can negatively impact your credit score significantly, making it difficult to obtain loans in the future.

- Legal Consequences: You might face lawsuits or additional legal actions from the lender if the sale of the property doesn't cover the mortgage owed.

Best Practices

- Keep Good Records: Maintain all correspondence related to your mortgage and foreclosure notices.

- Meet Deadlines: Adhere to all deadlines to take advantage of any possible solutions to prevent foreclosure.

- Stay Informed: Keep yourself updated about your rights and any new government regulations pertaining to foreclosure.

Common Mistakes & How to Avoid Them

- Ignoring the Notice: Many borrowers ignore the initial notices, which limits their options later. Always respond promptly.

- Failing to Seek Advice: Failing to consult with a legal or financial expert can result in missing opportunities to negotiate or find alternatives to foreclosure.

- Omitting Financial Assessment: Not assessing your financial situation can hinder your ability to present a case to your lender or a court if it comes to that.

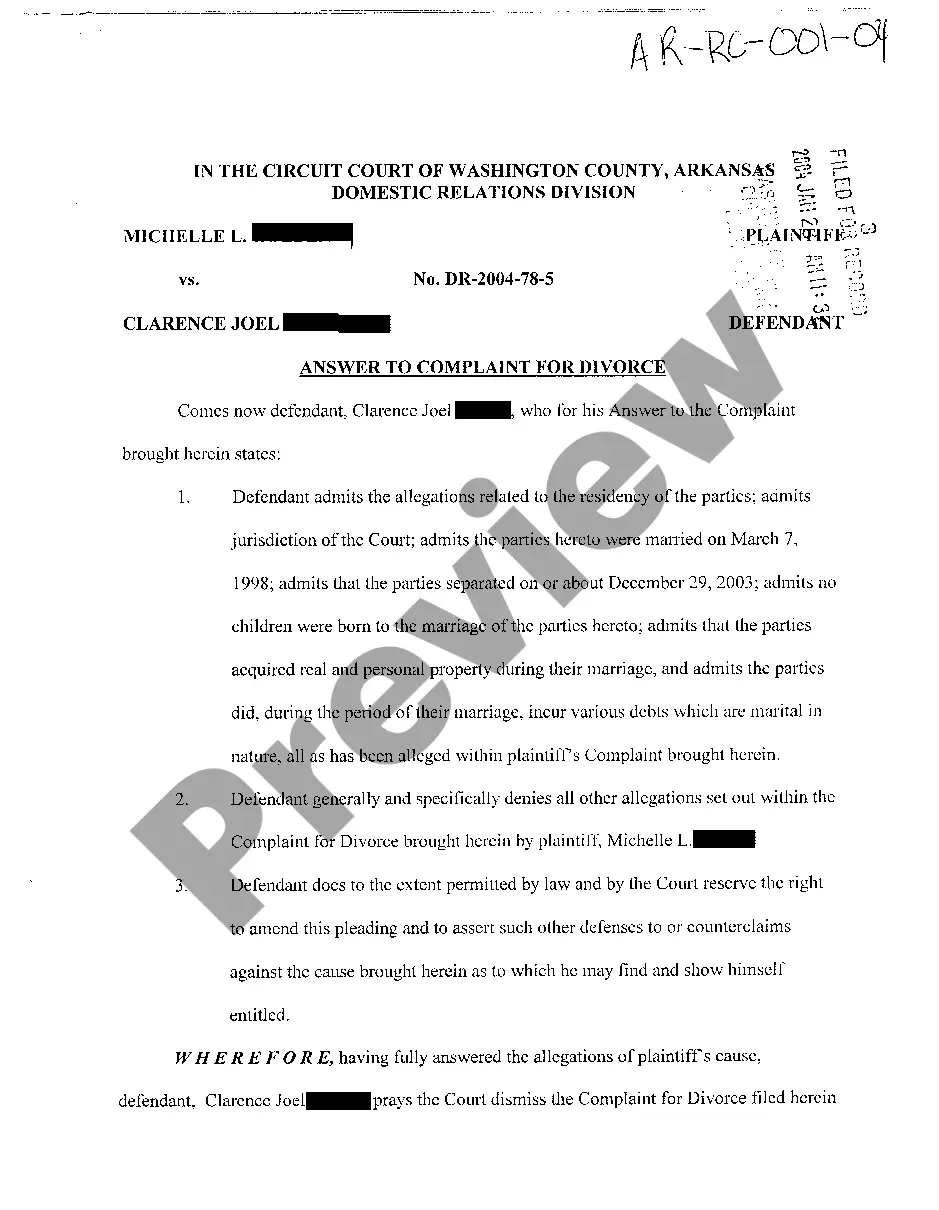

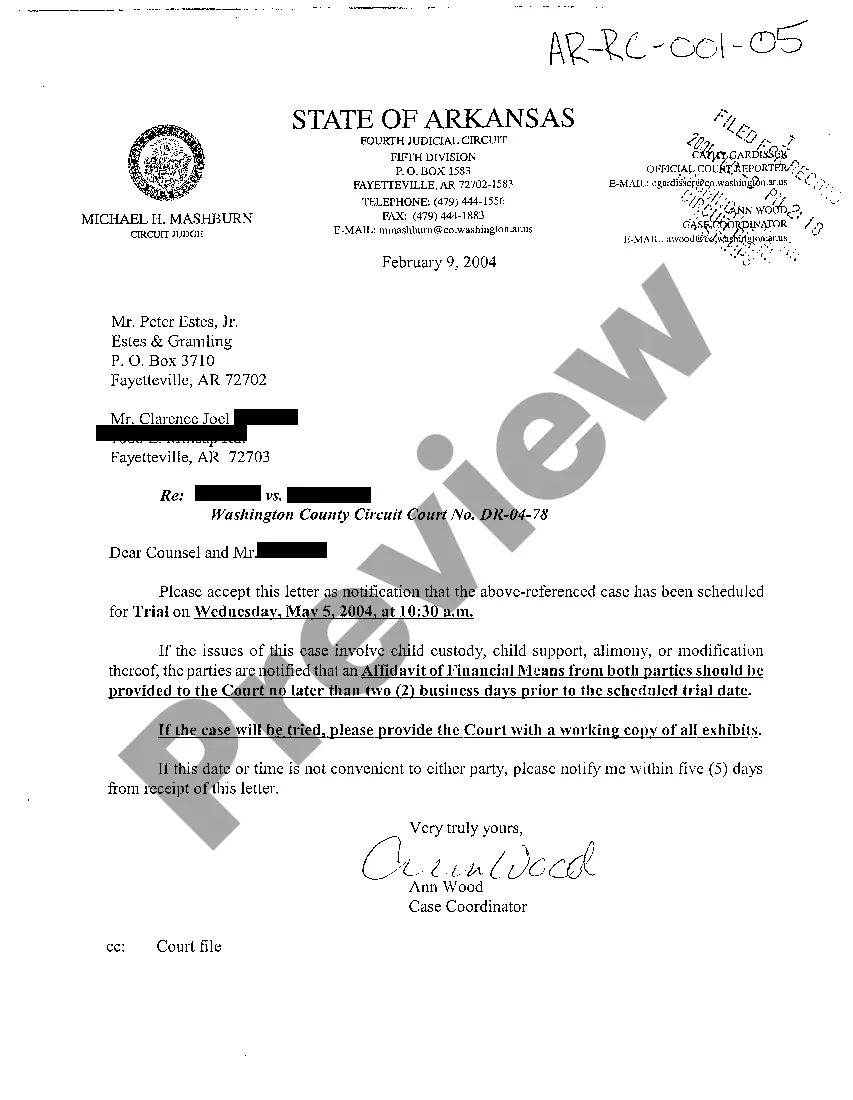

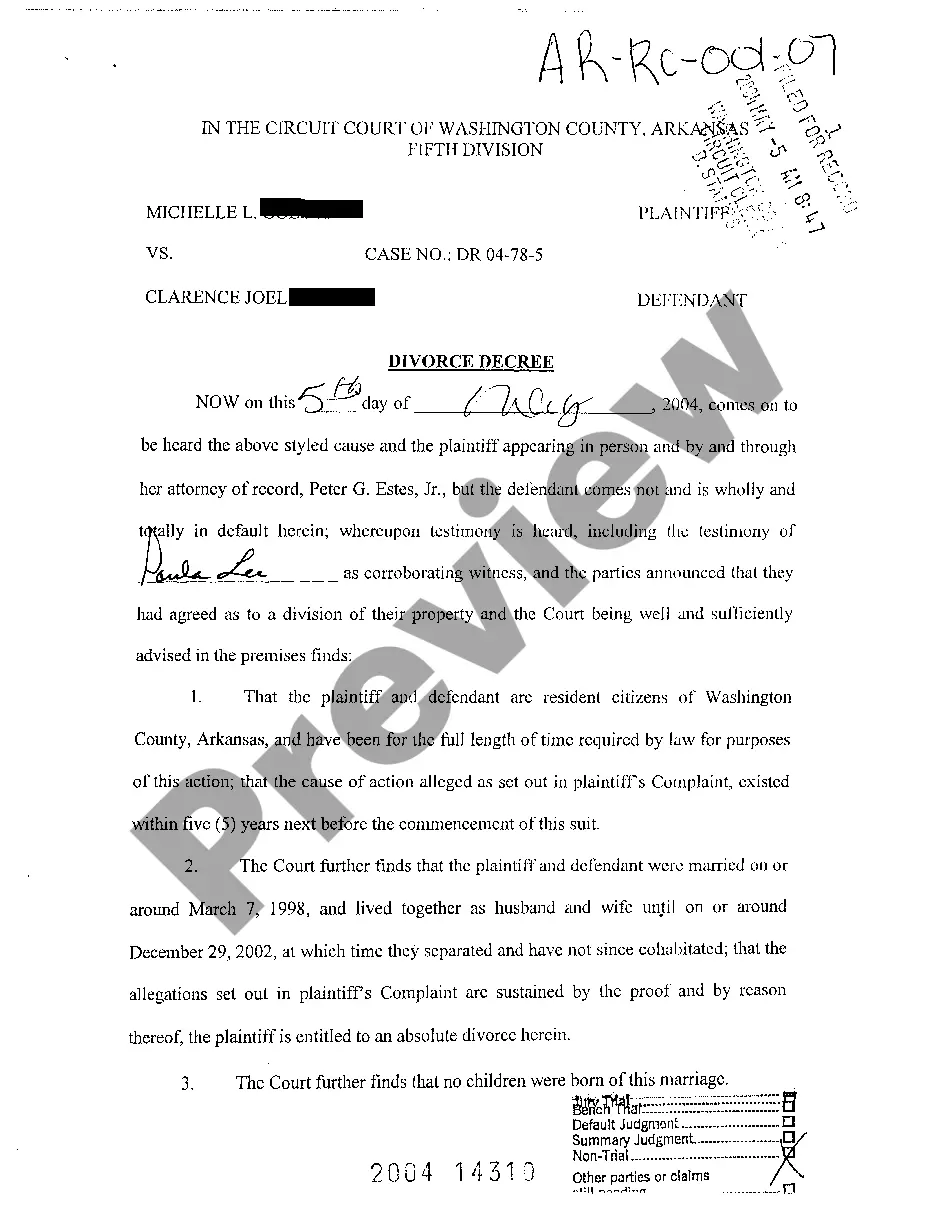

How to fill out Notice Of Intent To Foreclose - Mortgage Loan Default?

Aren't you sick and tired of choosing from numerous samples every time you want to create a Notice of Intent to Foreclose - Mortgage Loan Default? US Legal Forms eliminates the lost time numerous Americans spend searching the internet for suitable tax and legal forms. Our skilled group of attorneys is constantly upgrading the state-specific Forms collection, so it always provides the proper documents for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form can be found in the My Forms tab.

Visitors who don't have an active subscription need to complete easy steps before having the ability to get access to their Notice of Intent to Foreclose - Mortgage Loan Default:

- Use the Preview function and look at the form description (if available) to be sure that it’s the appropriate document for what you’re trying to find.

- Pay attention to the applicability of the sample, meaning make sure it's the appropriate sample to your state and situation.

- Use the Search field on top of the web page if you need to look for another file.

- Click Buy Now and select a convenient pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Get your template in a required format to finish, print, and sign the document.

As soon as you have followed the step-by-step recommendations above, you'll always have the capacity to log in and download whatever file you will need for whatever state you want it in. With US Legal Forms, finishing Notice of Intent to Foreclose - Mortgage Loan Default templates or other legal documents is easy. Get started now, and don't forget to look at your examples with accredited lawyers!

Form popularity

FAQ

The notice of default doesn't affect your credit file, but when the account defaults this will be recorded.If the debt is regulated by the Consumer Credit Act, you must be sent a default notice warning letter and have time to act on it before the default is recorded on your credit file.

If you cannot work out a doable solution with the mortgage lender, or you ignore their notices completely, you will then go into foreclosure. Typically, this happens once your payment becomes 120 days past due.The IRS views any financial loss on the part of the lender for your mortgage as taxable income for you.

A notice of default is typically the final action lenders take before activating the lien and seizing the collateral for foreclosure. A notice of default is usually filed with the state court in which the lien is recorded followed by a hearing to activate the perfected lien recorded with the mortgage closing.

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.

You can stop the foreclosure process by informing your lender that you will pay off the default amount and extra fees. Your lender would prefer to have the money much more than they would have your home, so unless there are extenuating circumstances, this should work.

A default occurs when a borrower does not make his or her mortgage loan payment and falls behind. When this happens, he or she risks the home heading into the foreclosure process. Usually, the foreclosure process is started within thirty days after the due date is not met.

After the lender files the Notice of Default, you get 90 days to bring your past-due bill current. After the 90 days pass, the lender files a Notice of Sale with the clerk. The Notice of Sale displays the location, date and time of the sale. It lists the trustee's name and contact information.