Request for Disclosure of Credit History and Inquiries is a document that requests an individual's credit history from a credit bureau. It is typically used by financial institutions and other organizations to assess the credit worthiness of an individual. It includes information about an individual's credit accounts, payment history, credit inquiries, and public records. There are two types of Request for Disclosure of Credit History and Inquiries: 1. Automatic Request: This type of request is initiated by the credit bureau and includes the consumer’s credit history and inquiries for the past two years. 2. Manual Request: This type of request is initiated by the individual and includes the consumer’s credit history and inquiries going back as far as 7 years.

Request for Disclosure of Credit History and Inquiries

Description

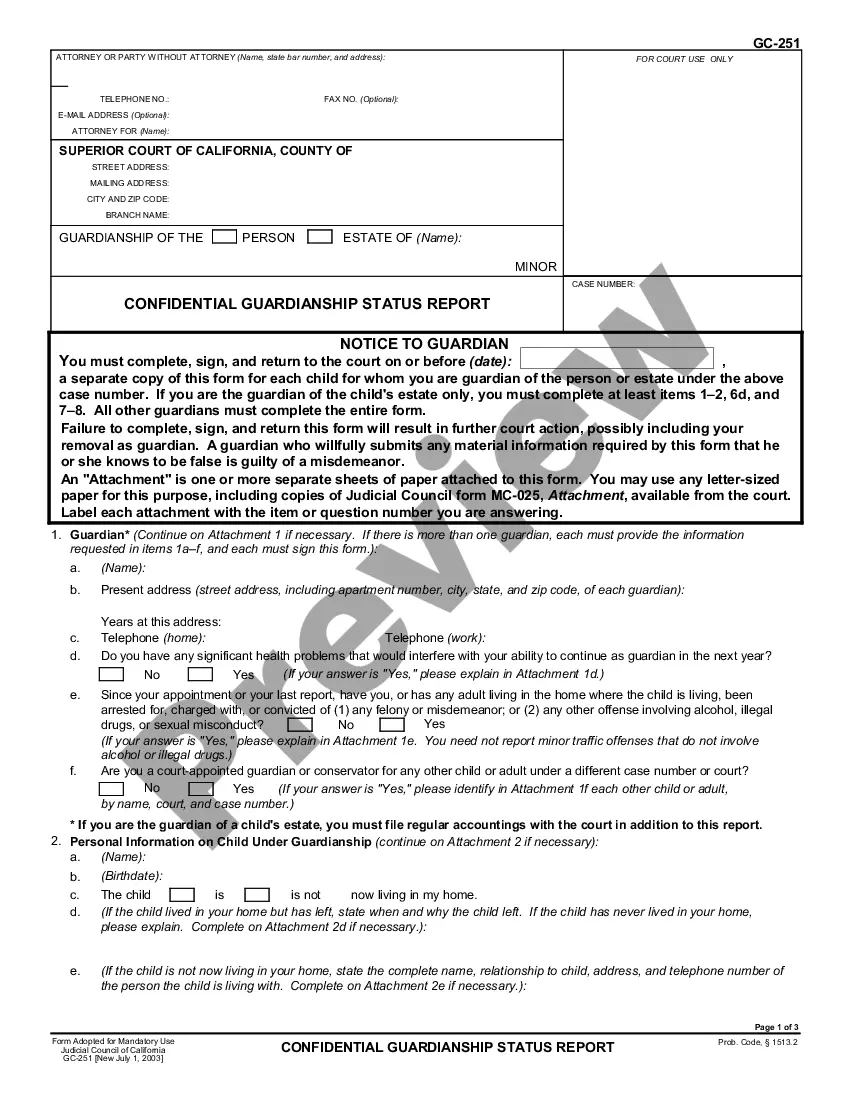

How to fill out Request For Disclosure Of Credit History And Inquiries?

Preparing legal paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them correspond with federal and state regulations and are examined by our specialists. So if you need to complete Request for Disclosure of Credit History and Inquiries, our service is the best place to download it.

Getting your Request for Disclosure of Credit History and Inquiries from our service is as easy as ABC. Previously registered users with a valid subscription need only log in and click the Download button once they locate the proper template. Later, if they need to, users can take the same document from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few minutes. Here’s a brief guide for you:

- Document compliance verification. You should carefully examine the content of the form you want and make sure whether it satisfies your needs and fulfills your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab on the top of the page until you find a suitable blank, and click Buy Now once you see the one you need.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Request for Disclosure of Credit History and Inquiries and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

A hard inquiry, or a "hard pull," occurs when you apply for a new line of credit, such as a credit card or loan. It means that a creditor has requested to look at your credit file to determine how much risk you pose as a borrower. Hard inquiries show up on your credit report and can affect your credit score.

Most commonly, inquiries are the result of an application for credit, goods or services; an account review made by a company that you already do business with; or a preapproved offer of credit that has been sent to you. There are two types of credit inquiries: hard inquiries and soft inquiries.

Requesting your own credit report has no effect on your credit score.

A consumer disclosure is the long version of your credit report that contains all credit inquiries and suppressed information not found in your standard credit report, as well as the normal credit report records of balances, payment history, personal information, etc.

Monitor your credit. Checking your credit reports regularly can help you stay on top of hard inquiries and other factors that impact your credit. You can get free copies of your credit reports from each of the three major credit bureaus?Equifax®, Experian® and TransUnion®?by visiting AnnualCreditReport.com.

Credit Information Disclosure is a system you can use to verify your credit information including the content of your contract. with CIC member companies (such as credit companies) and your payment status. You can see whether and how your information is currently registered at credit bureaus.

Simply put, a credit inquiry is a credit check. Inquiries happen when there is a legally permitted request to see your credit report from a company or person.

You may request your reports: Online by visiting AnnualCreditReport.com. By calling 1-877-322-8228 (TTY: 1-800-821-7232) By filling out the Annual Credit Report request form and mailing it to: Annual Credit Report Request Service. PO Box 105281. Atlanta, GA 30348-5281.