Return of Late Payment and Denial of Discount is a practice used by businesses to penalize customers who fail to make timely payments or take advantage of discounts. It can take several forms, including denying credit, charging late fees, and declining discounts. In some cases, businesses may also issue a return of late payment and denial of discount notice, which is a formal notification of the consequences of not paying on time or taking advantage of discounts. The notice can include details such as the amount owed, the date the payment was due, and the amount of any late fees or denied discounts. Depending on the situation, the notice may also provide information on how the customer can resolve the issue, such as making a payment or submitting proof of the discount offer.

Return of Late Payment and Denial of Discount

Description

How to fill out Return Of Late Payment And Denial Of Discount?

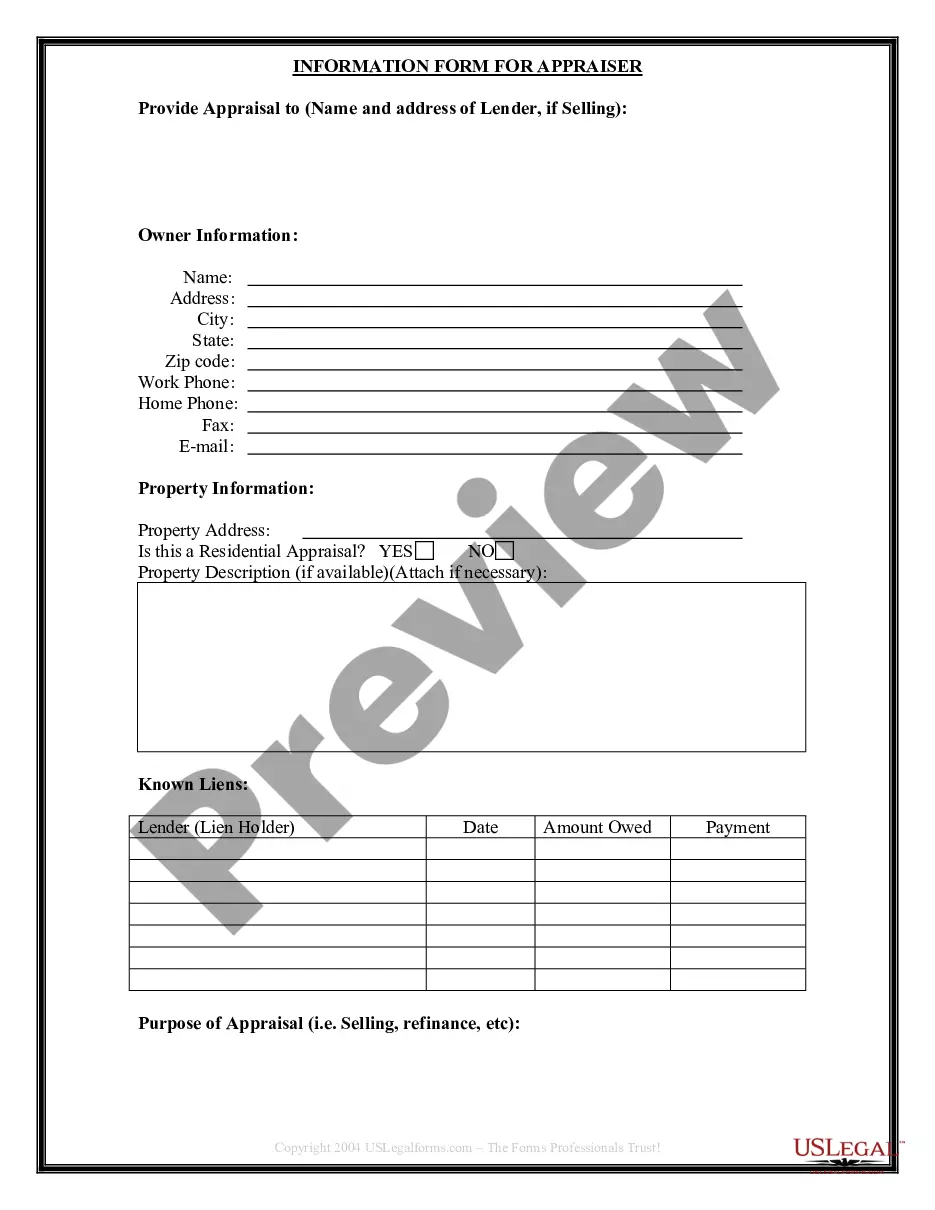

Preparing official paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them correspond with federal and state laws and are checked by our specialists. So if you need to prepare Return of Late Payment and Denial of Discount, our service is the best place to download it.

Getting your Return of Late Payment and Denial of Discount from our service is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button once they locate the proper template. Later, if they need to, users can use the same document from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few moments. Here’s a quick instruction for you:

- Document compliance verification. You should attentively examine the content of the form you want and make sure whether it satisfies your needs and meets your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab above until you find a suitable blank, and click Buy Now when you see the one you want.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Return of Late Payment and Denial of Discount and click Download to save it on your device. Print it to complete your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to obtain any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

Payment should only be delayed when there are disputes with the invoice and when there is a genuine reason for the delay. If you know that you are going to delay payment, you should write an apology letter to your supplier, which should be done in advance.

I hope you're well. We have yet to receive payment from yourselves of amount owed in respect of your invoice #reference number which was due for payment on date due. I would be grateful if you could let me know when we can expect to receive payment. If there are any problems, let me know!

Don't panic when the due date passes. Try to write a friendly, non-threatening payment request email subject line. Always attach a copy of the overdue invoice. Politely remind clients of the payment terms. Add your bank account or payment provider information to your payment request.

Thank you for choosing COMPANY NAME. We're happy that you've decided to buy our product and we can't wait to have you on board! Regarding your discount request, unfortunately, we won't be able to offer you a discount at the moment.

Include the following details in your overdue invoice letter: Invoice number and date. Amount owing. Payment terms such as late fees. Reminders of previous letters. Instructions for payment (include links in emails) Your contact information.

Dear Name, Further to my previous correspondence, I am contacting you regarding late payment for invoice invoice number. The invoice was due on due date, and payment is now overdue by number of days overdue. Be advised that late payment interest may be applied if we do not receive payment within 30 days.