Request for Information on Deferred Collections is a type of request that is used to gather information from a third party in relation to a debt that has been deferred. This request typically includes details of the debt, such as the amount owed, the date of the original agreement, and any other pertinent information. Depending on the circumstances, the request may also include information about the debtor's financial situation that could impact their ability to pay the debt. There are two main types of Request for Information on Deferred Collections: active requests and dormant requests. Active requests are sent when a debt is still in the process of being paid off, while dormant requests are sent when a debt has been deferred for an extended period of time and the creditor wants to determine the debtor’s current financial situation. Both types of request typically include the same basic information, but active requests may include additional information to ensure that the creditor is able to collect the debt.

Request for Information on Deferred Collections

Description

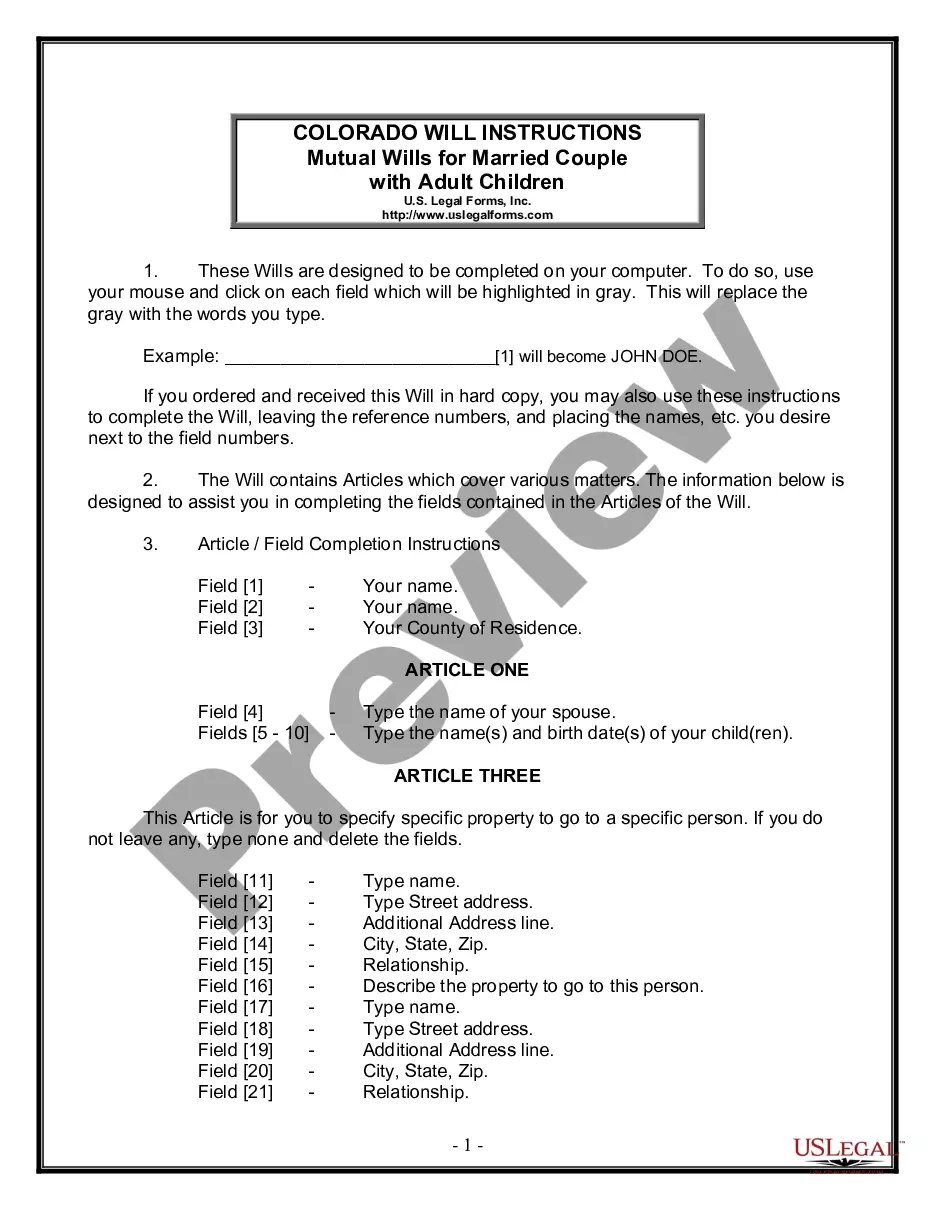

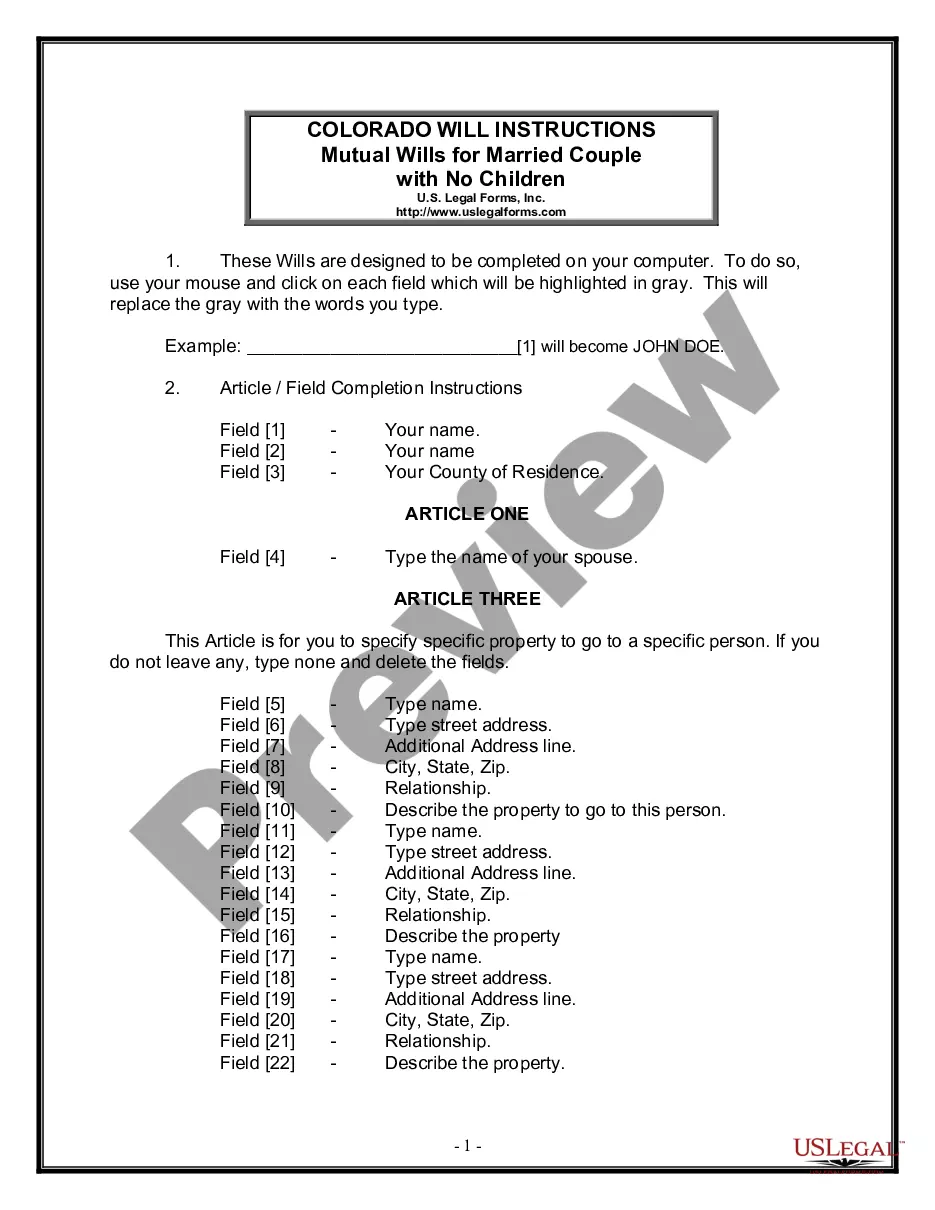

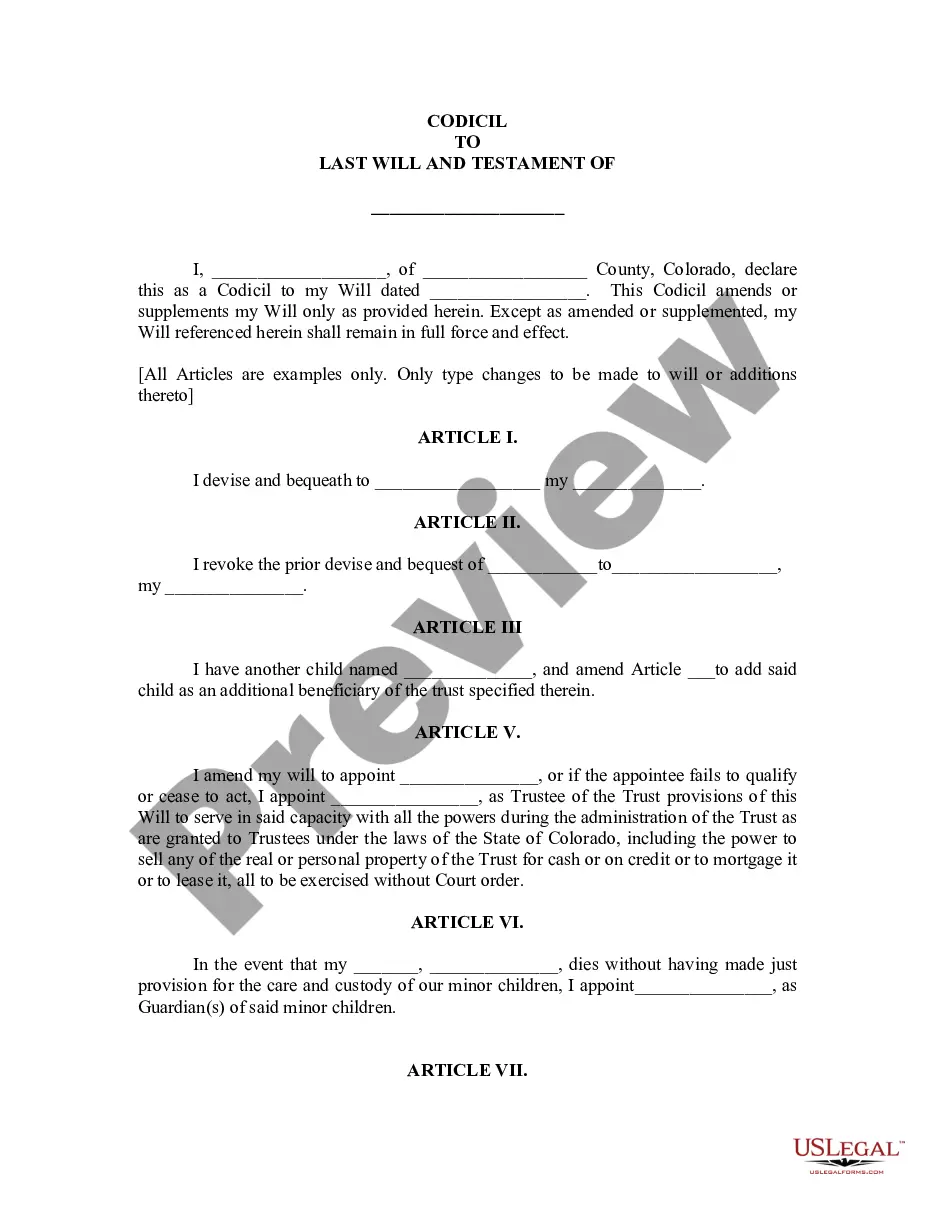

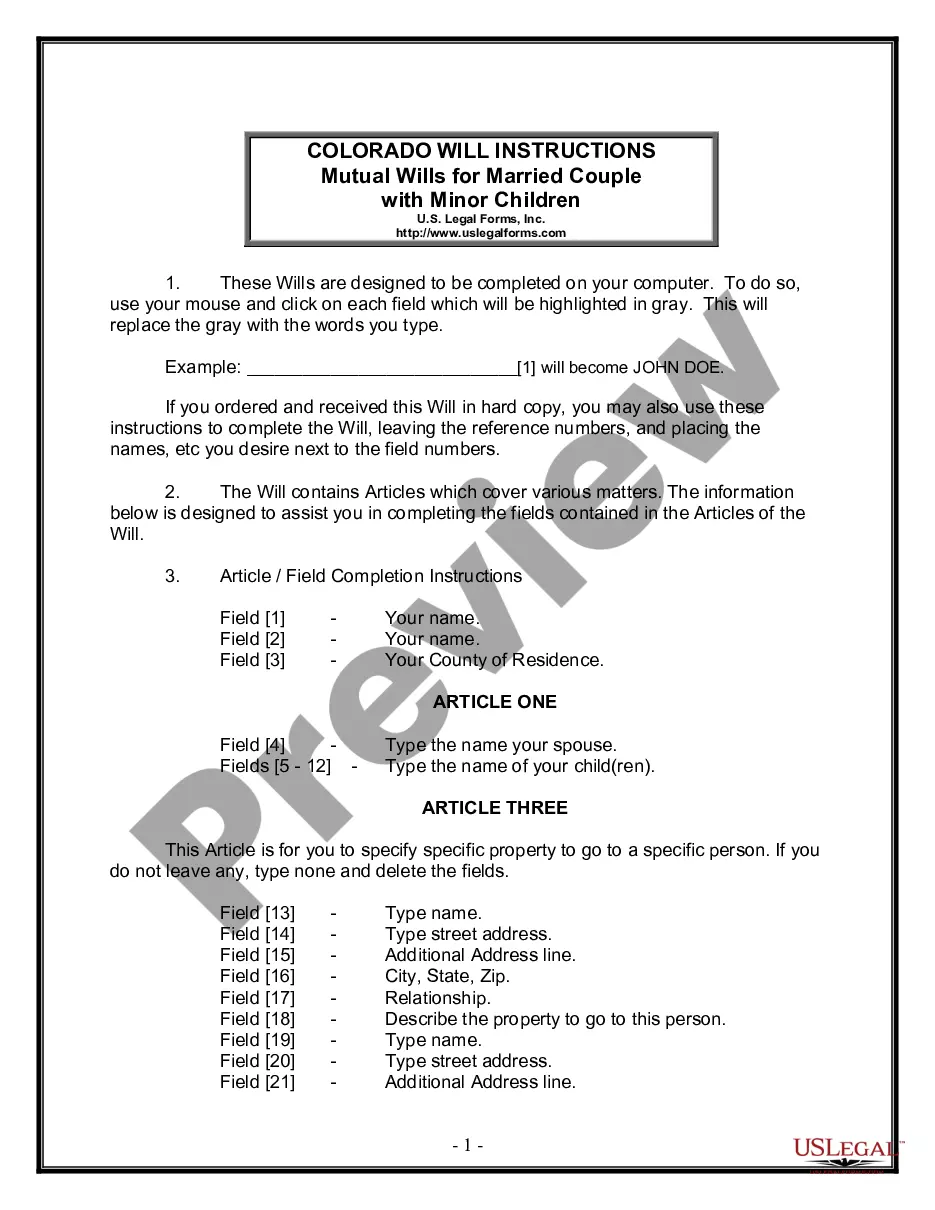

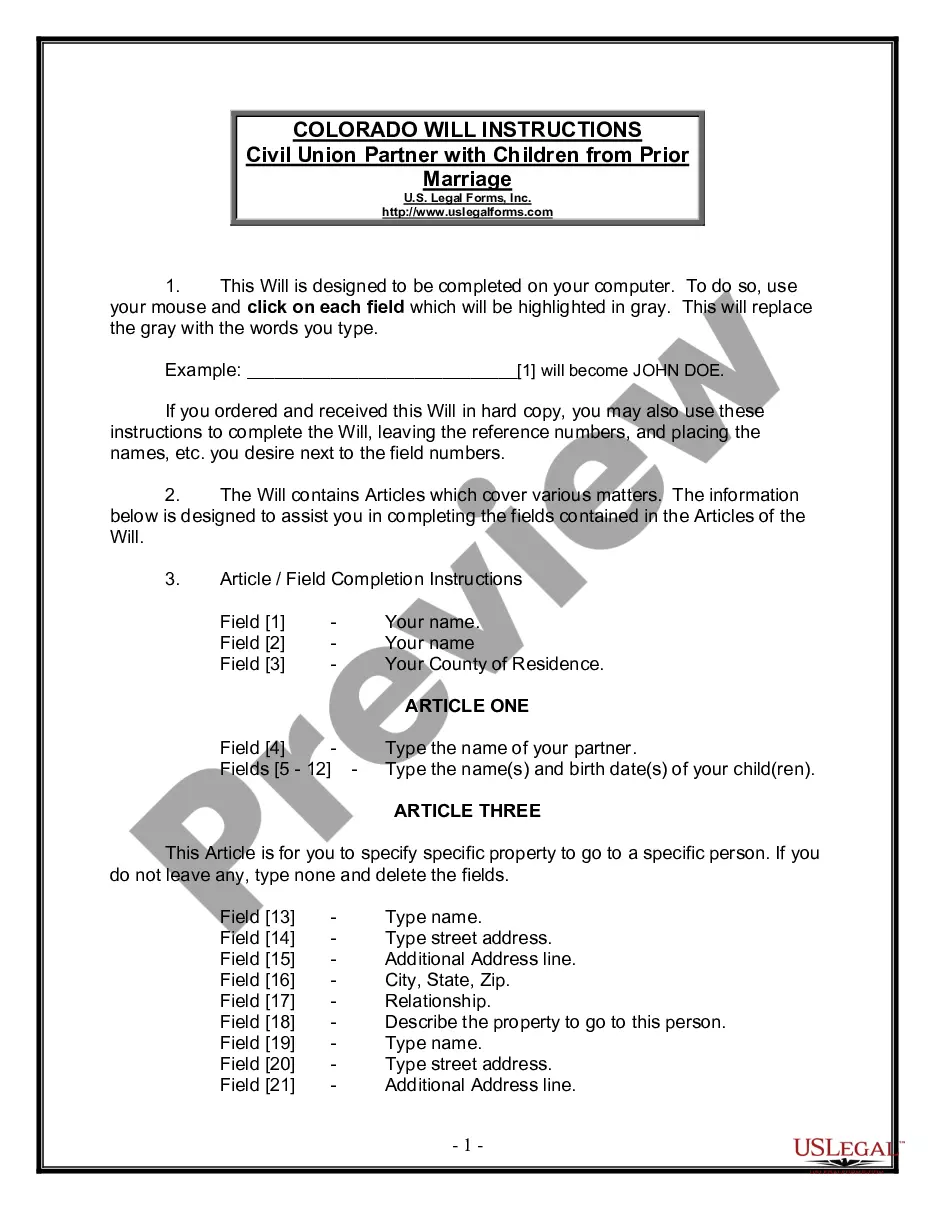

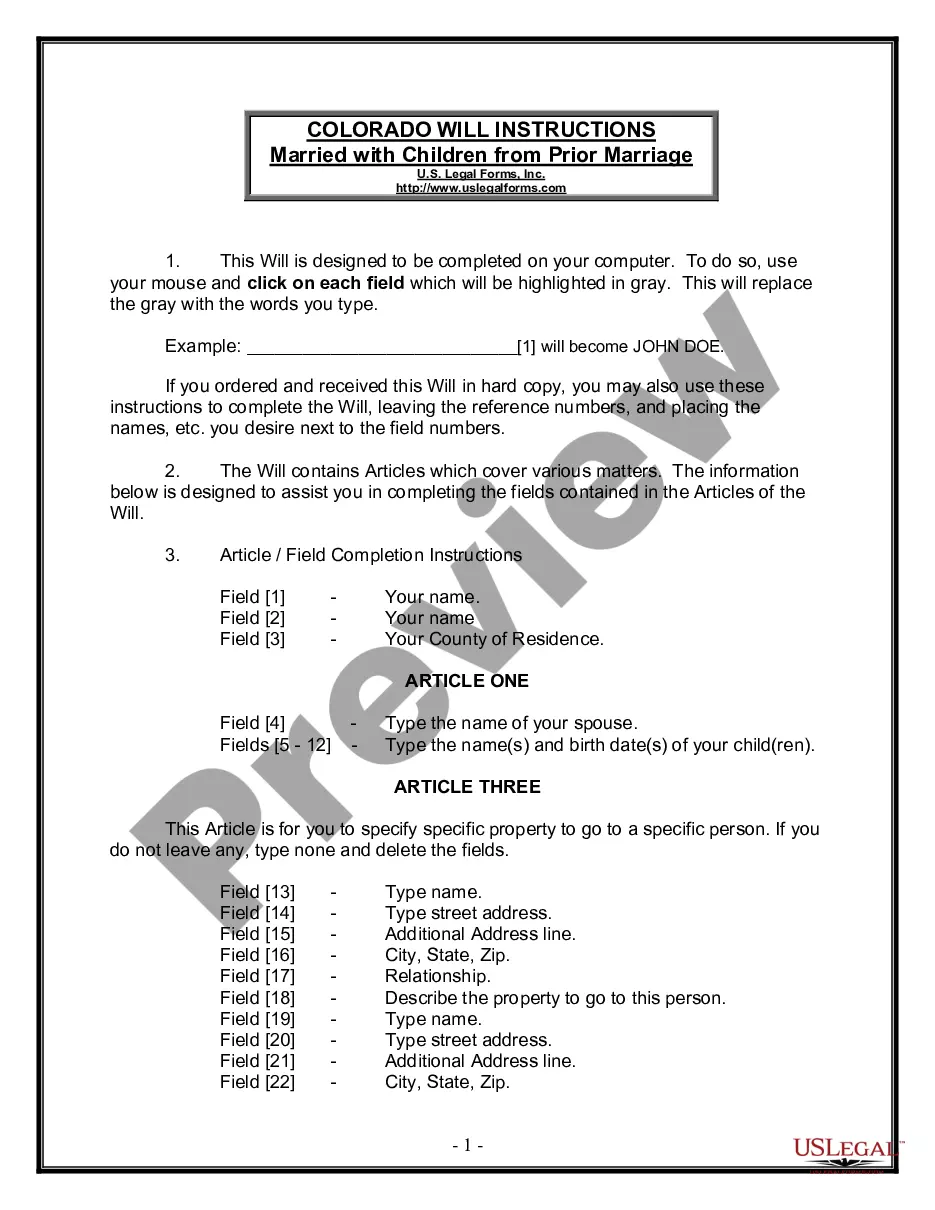

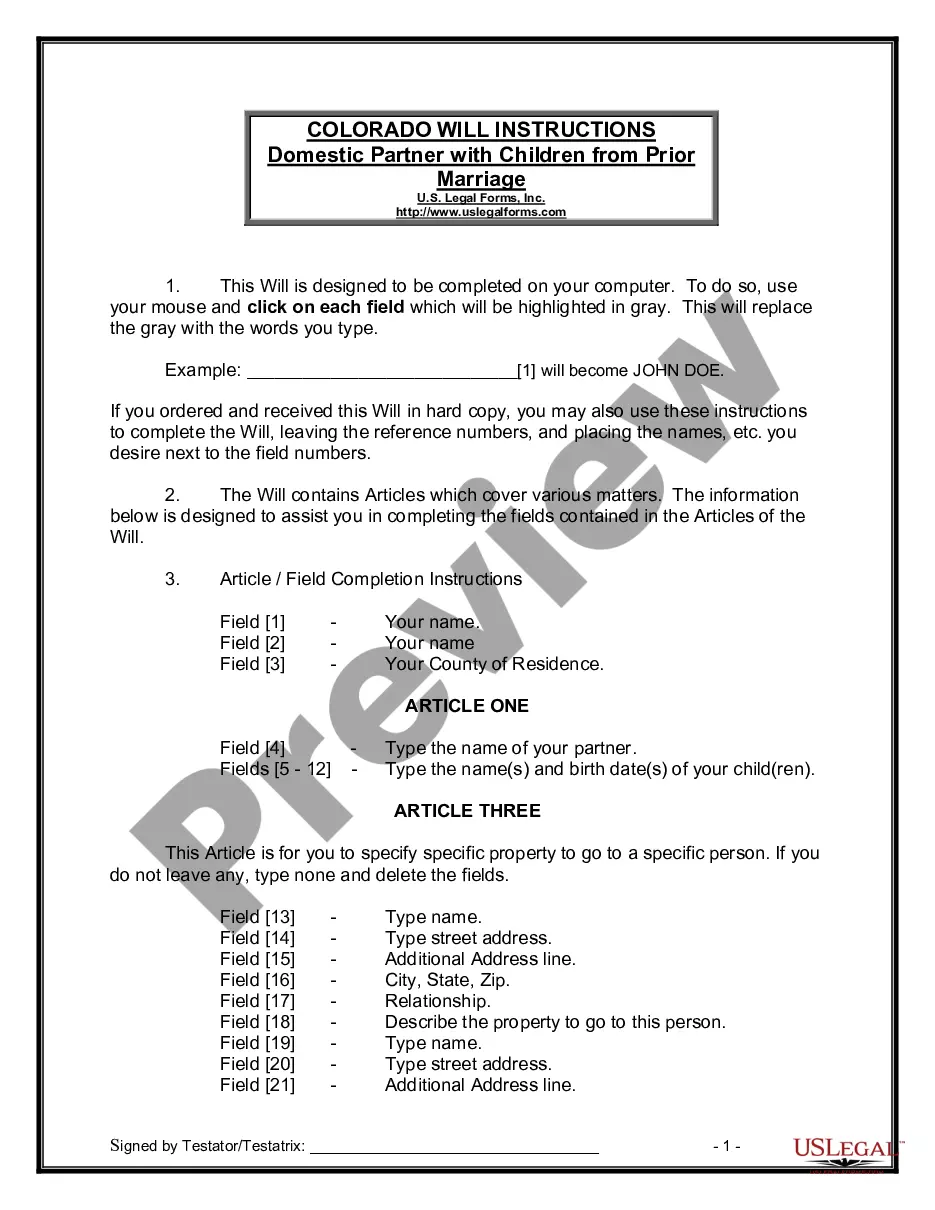

How to fill out Request For Information On Deferred Collections?

US Legal Forms is the most easy and affordable way to find suitable formal templates. It’s the most extensive online library of business and personal legal paperwork drafted and checked by legal professionals. Here, you can find printable and fillable blanks that comply with national and local laws - just like your Request for Information on Deferred Collections.

Obtaining your template takes just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted Request for Information on Deferred Collections if you are using US Legal Forms for the first time:

- Read the form description or preview the document to ensure you’ve found the one meeting your requirements, or find another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and judge the subscription plan you prefer most.

- Register for an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Choose the preferred file format for your Request for Information on Deferred Collections and download it on your device with the appropriate button.

After you save a template, you can reaccess it anytime - simply find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more efficiently.

Take advantage of US Legal Forms, your trustworthy assistant in obtaining the corresponding formal paperwork. Give it a try!