Sample Letter for Notice of Default in Franchise Agreement

Description Notice Default Document

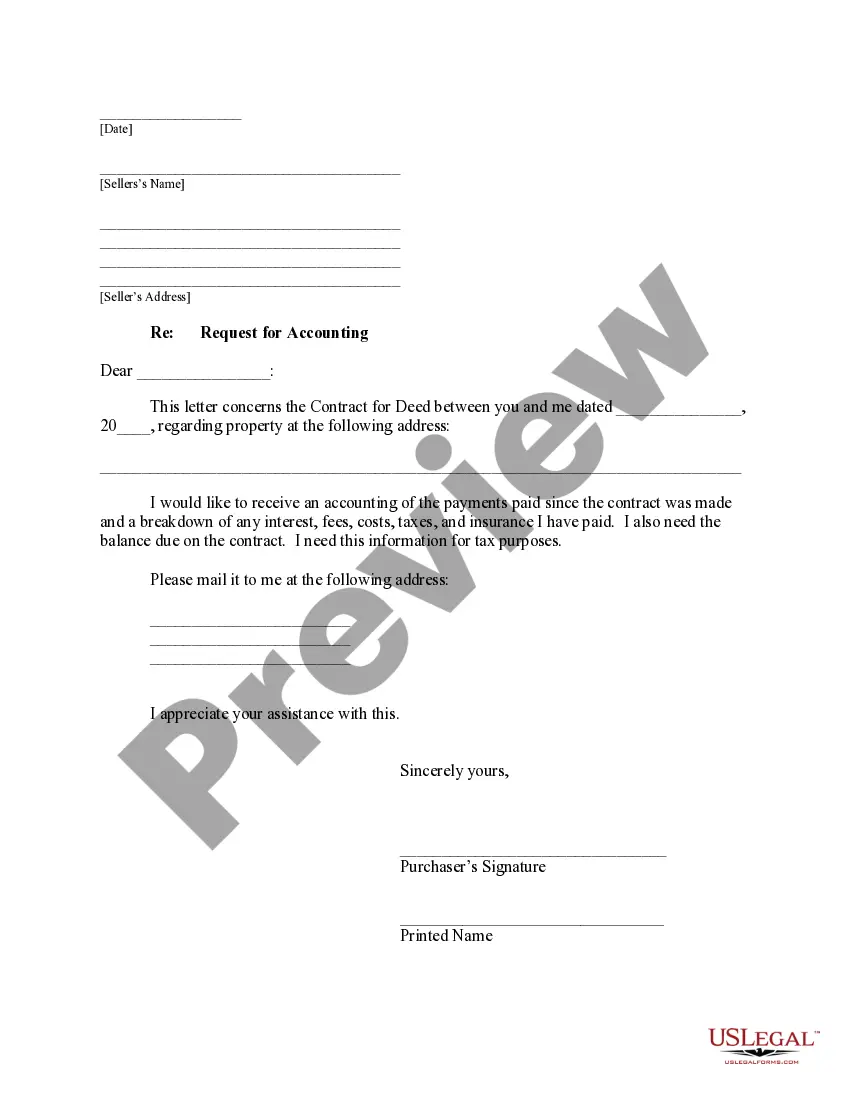

How to fill out Sample Letter Notice Default Complete?

Use US Legal Forms to get a printable Sample Letter for Notice of Default in Franchise Agreement. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most extensive Forms library on the internet and offers reasonably priced and accurate samples for customers and legal professionals, and SMBs. The templates are grouped into state-based categories and a few of them might be previewed before being downloaded.

To download samples, users need to have a subscription and to log in to their account. Hit Download next to any template you want and find it in My Forms.

For those who don’t have a subscription, follow the tips below to quickly find and download Sample Letter for Notice of Default in Franchise Agreement:

- Check to ensure that you get the right form in relation to the state it is needed in.

- Review the form by reading the description and by using the Preview feature.

- Press Buy Now if it’s the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Use the Search field if you need to get another document template.

US Legal Forms offers a large number of legal and tax samples and packages for business and personal needs, including Sample Letter for Notice of Default in Franchise Agreement. Over three million users have utilized our service successfully. Select your subscription plan and have high-quality forms in a few clicks.

Franchise Agreement Form popularity

Sample Franchise Agreement Other Form Names

Letter Default Agreement Sample FAQ

Once a default notice has been issued, the debt can be passed or sold to a debt collector. You may then start receiving letters and phone calls from the debt collector to chase up on the debt, and payments would need to be made to the debt collector rather than the original creditor.

Once a default is recorded on your credit profile, you can't have it removed before the six years are up (unless it's an error). However, there are several things that can reduce its negative impact: Repayment. Try and pay off what you owe as soon as possible.

Default judgments happen when you don't respond to a lawsuit often from a debt collector and a judge resolves the case without hearing your side.Next up could be wage garnishment or a bank account levy, which allows a creditor to remove money from your bank accounts to repay the debt.

What happens when you get a default notice? Your creditor will ask you to pay the full amount of the debt instead of paying the instalments you first agreed.Your creditor can also take further action after the account has defaulted, including: Passing the debt to a collection agency.

Default notices are recorded on credit files and usually remain there for six years. This could affect your ability to obtain credit in the future. If the default was issued by mistake or you made the full payment within the time period, you can ask for it to be removed from your file.

Write to the agency making the claim. Present evidence of why the NOD was improperly issued or why you legitimately cannot make payments. Ask the agency in the letter if they will take a lower monthly payment, total settlement or a payment plan. Send a copy of your letter by certified mail.

Generally, if a defendant fails to respond to a complaint you can get a default judgment after 45 days. However, the court system is very slow these days and it can take several months to get the court to issue the default judgment.

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.