Sample Letter for Notice of Estate Disbursement Plan - Waiver to Entry of Judgment

Description

How to fill out Sample Letter For Notice Of Estate Disbursement Plan - Waiver To Entry Of Judgment?

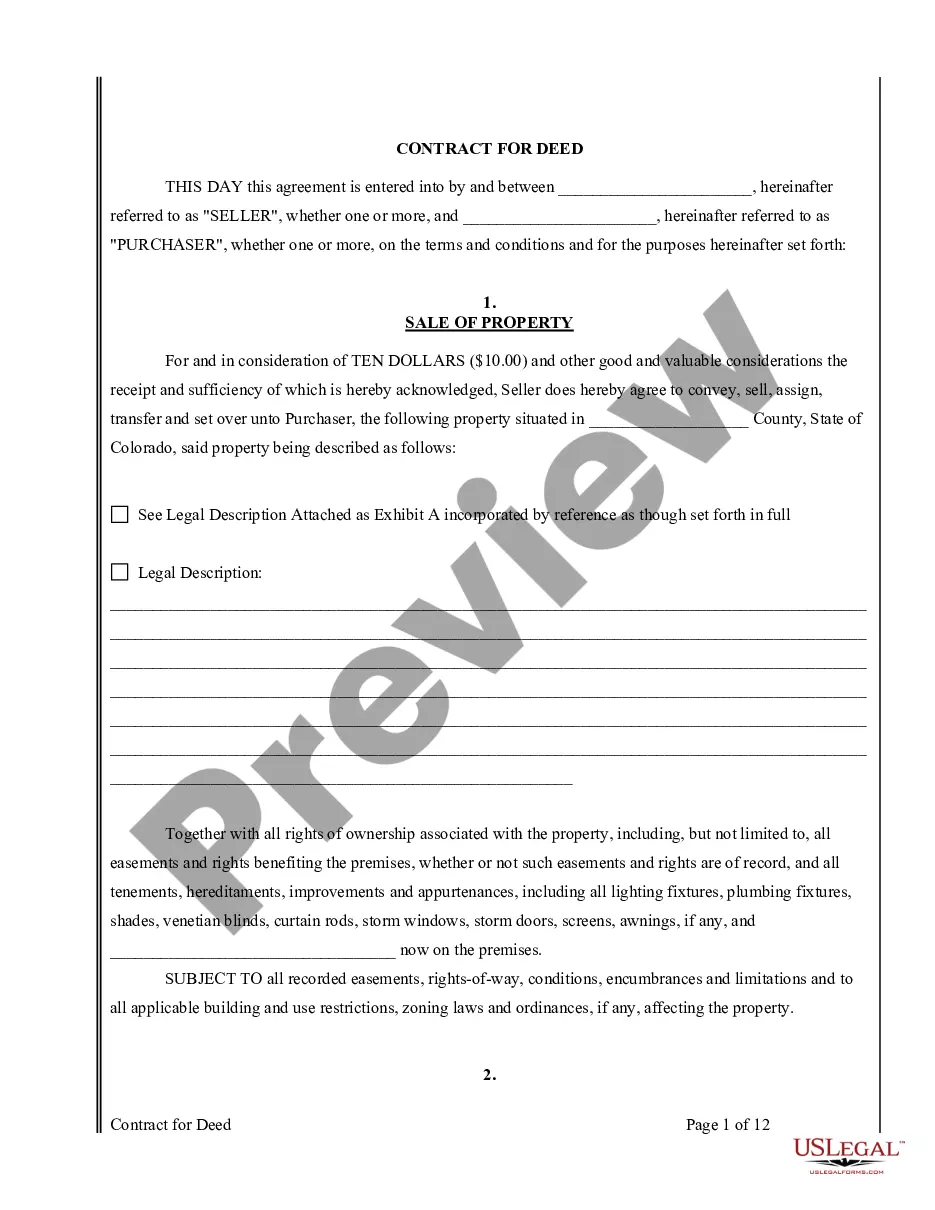

Use US Legal Forms to obtain a printable Sample Letter for Notice of Estate Disbursement Plan - Waiver to Entry of Judgment. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most complete Forms library online and offers reasonably priced and accurate samples for consumers and lawyers, and SMBs. The templates are categorized into state-based categories and a number of them might be previewed before being downloaded.

To download samples, users need to have a subscription and to log in to their account. Click Download next to any template you want and find it in My Forms.

For people who do not have a subscription, follow the following guidelines to easily find and download Sample Letter for Notice of Estate Disbursement Plan - Waiver to Entry of Judgment:

- Check out to make sure you have the proper template with regards to the state it’s needed in.

- Review the form by reading the description and by using the Preview feature.

- Hit Buy Now if it is the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to the device and feel free to reuse it many times.

- Use the Search field if you need to find another document template.

US Legal Forms provides thousands of legal and tax templates and packages for business and personal needs, including Sample Letter for Notice of Estate Disbursement Plan - Waiver to Entry of Judgment. More than three million users already have used our service successfully. Choose your subscription plan and get high-quality forms in a few clicks.

Form popularity

FAQ

When calculating the value of an estate, the gross value is the sum of all asset values, and the net value is the gross value minus any debts: in other words, the actual worth of the estate.

An inventory and appraisal is a required filing in California probate. The inventory and appraisal is a single document that (1) inventories the property in the decedent's estate and (2) contains an appraisal of the property in the inventory. California Probate Code § 8800(a).

A letter of instructions is an informal document that gives your survivors information concerning important financial and personal matters that must be attended to after your demise.

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.

The first step in probating an estate is to locate all of the decedent's estate planning documents and other important papers, even before being appointed to serve as the personal representative or executor.

Give the letter a personal touch and address each of your heirs and beneficiaries personally. Tell them any last wishes you may have or any hopes you have for their future. Write as clearly as possible. Use specific details and avoid using shorthand.

An estate bank account is opened up by the executor, who also obtains a tax ID number. The various accounts of the deceased person are then transferred to the account. The executor must pay creditors, file tax returns and pay any taxes due. Then, he must collect any money or benefits owed to the decedent.

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.