Sample Letters - A Package of Sample Letters and Forms for Foreclosure

What this document covers

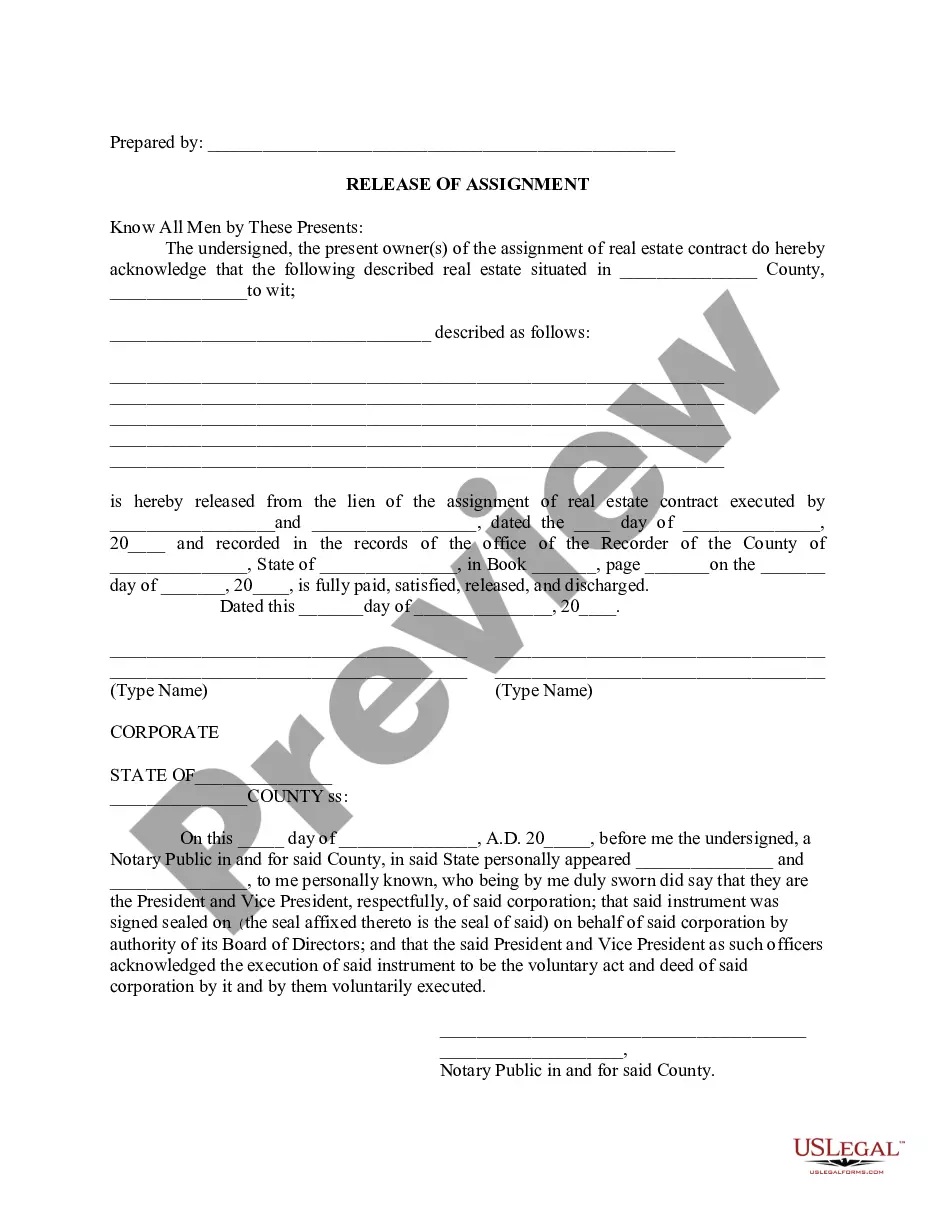

This package of foreclosure sample letters and forms is designed to assist individuals and organizations involved in the foreclosure process on real property. These documents provide templates that cater to various communication needs during foreclosure proceedings, such as notifying parties of impending foreclosure sales, requesting necessary documentation, and addressing legal notifications. Unlike generic letters, this package is tailored to ensure compliance with the necessary legal requirements specific to foreclosure cases.

Key components of this form

- Model letters for notifying relevant parties about foreclosure actions.

- Template for requesting bid amounts prior to foreclosure sales.

- Instructions for adapting the letters to specific situations and jurisdictions.

- Information on confirming publication of foreclosure notices.

When to use this document

This package should be used when you are in the process of foreclosing on a property. It comes in handy for communicating with lenders, bidders, or legal representatives. Use these letters for notifying involved parties about the foreclosure sale, requesting essential information, and ensuring compliance with local publication requirements.

Who this form is for

- Homeowners facing foreclosure who need to communicate with lenders.

- Real estate agents and brokers involved in foreclosure transactions.

- Legal professionals assisting clients through the foreclosure process.

- Investors looking to acquire properties in foreclosure.

How to complete this form

- Identify the parties involved, such as the lender, borrower, and any relevant real estate agent.

- Enter the property details that are subject to foreclosure, including the address and legal description.

- Fill in the dates and any applicable deadlines for actions related to foreclosure.

- Adapt the text of each letter as necessary to reflect your specific situation and jurisdiction.

- Ensure proper signatures where required to finalize each correspondence.

Does this document require notarization?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to update sample letters with accurate property and party details.

- Not adhering to local legal requirements for notifications.

- Missing deadlines for submitting letters or requests.

- Using outdated templates that do not comply with current laws.

Benefits of completing this form online

- Convenience of instant access to professionally drafted templates.

- Editable forms allow for quick customization to your specific needs.

- Ensured compliance with standard legal requirements for foreclosure communication.

- Time-efficient as you can download, fill, and send documents without delay.

Looking for another form?

Form popularity

FAQ

First, the costs and expenses of conducting the foreclosure sale are paid. Second, the lien that was foreclosed on is paid off. Third, if there is any money remaining after the foreclosed lien is paid, then any liens junior to the foreclosed lien are paid in their order of priority.

Respected sir, I, ___________(Name) hold a ____________ (type of loan account) account in your bank. I am writing this letter to request you to close my ____________ (type of loan account) account bearing account number ____________ (Loan Account no.).

You need to prepare an official offer, submit it to the home owner and then have them take it to their bank. This can be a slow process, so be patient. If the bank accepts your offer then either they can help arrange the closing (if you get financing through them) or just contact a local title company to handle it.

Phase 1: Payment Default. Phase 2: Notice of Default. Phase 3: Notice of Trustee's Sale. Phase 4: Trustee's Sale. Phase 5: Real Estate Owned (REO) Phase 6: Eviction. The Bottom Line.

Respected sir, I, ___________(Name) hold a ____________ (type of loan account) account in your bank. I am writing this letter to request you to close my ____________ (type of loan account) account bearing account number ____________ (Loan Account no.).

Make your opener as personal as possible. Tell them about yourself. Point out the home's attributes. Find a connection. Explain your bid, even if it's low. Close with lots of thanks.

Most likely they will respond in 3 to 5 business days. On some occasions, they will respond in 24 hours. We have no control over the bank's decision making process. Some banks do not look at offers until the property has been on the market for 5 to 10 days or even 20 days before they review an offer.

Your name, address, phone number and account number. The type of debt resolution you're seeking. Your financial situation that has caused you to fall behind in your payments. A detailed budget and your plan for making payments (if you want to keep your home)

The borrower defaults on the loan. The lender issues a notice of default (NOD). A notice of trustee's sale is recorded in the county office. The lender tries to sell the property at a public auction.