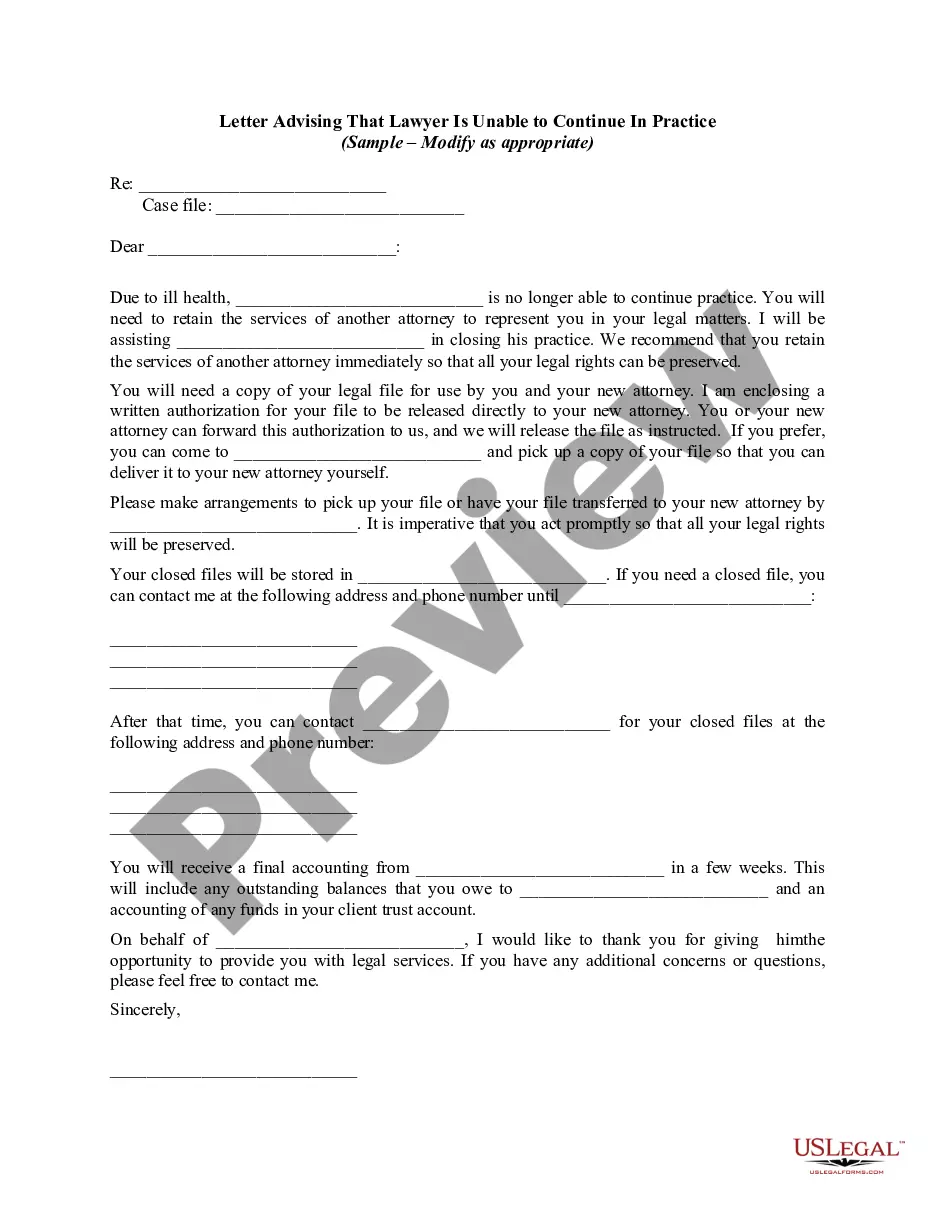

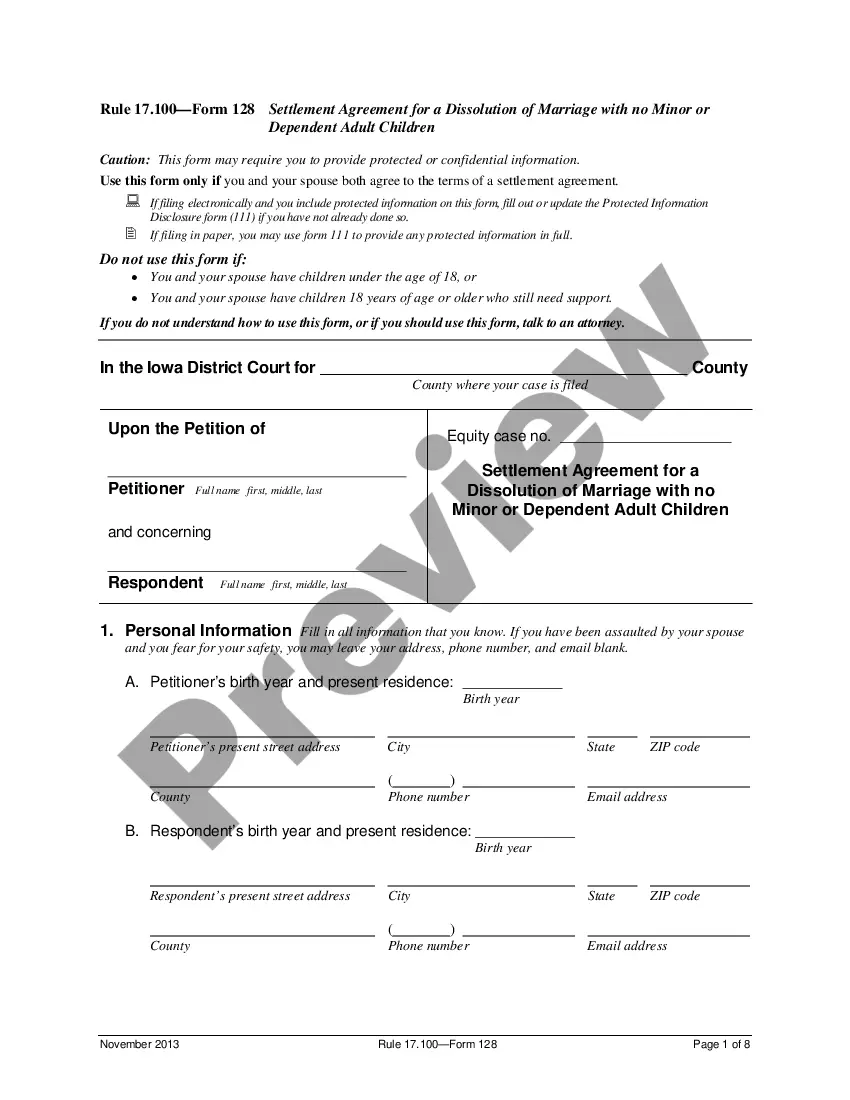

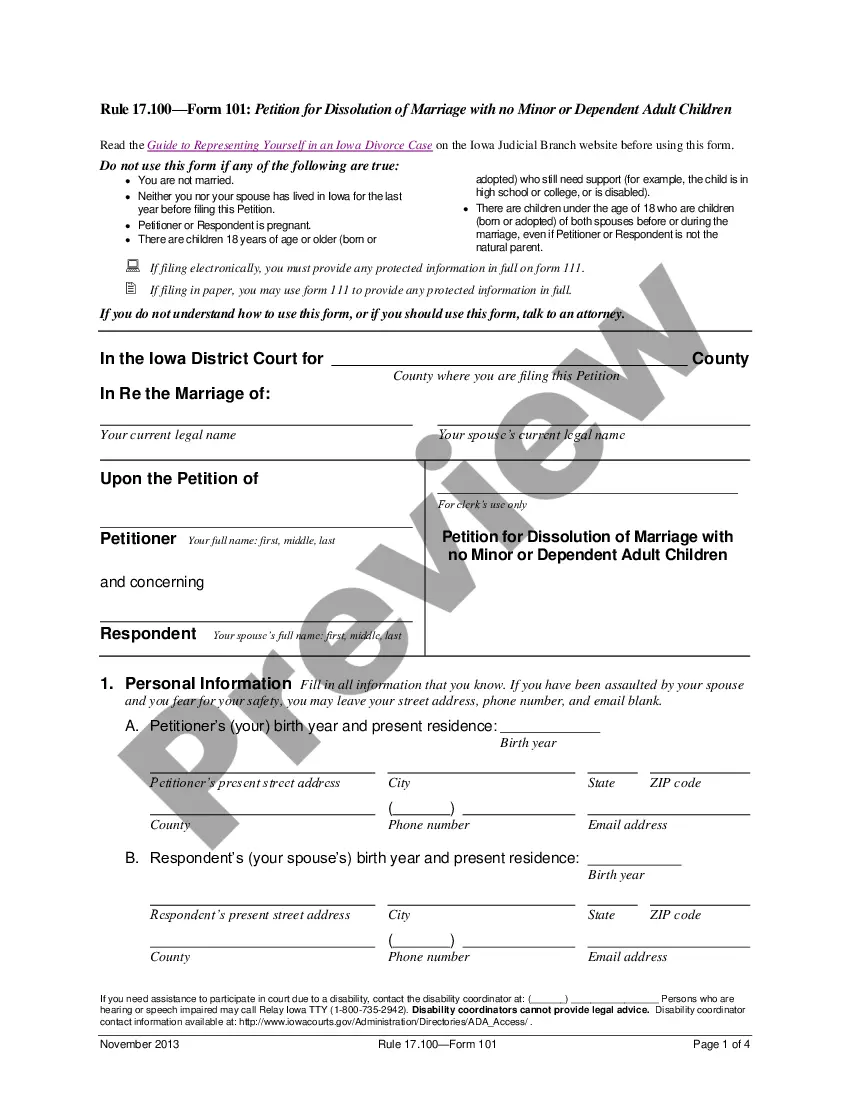

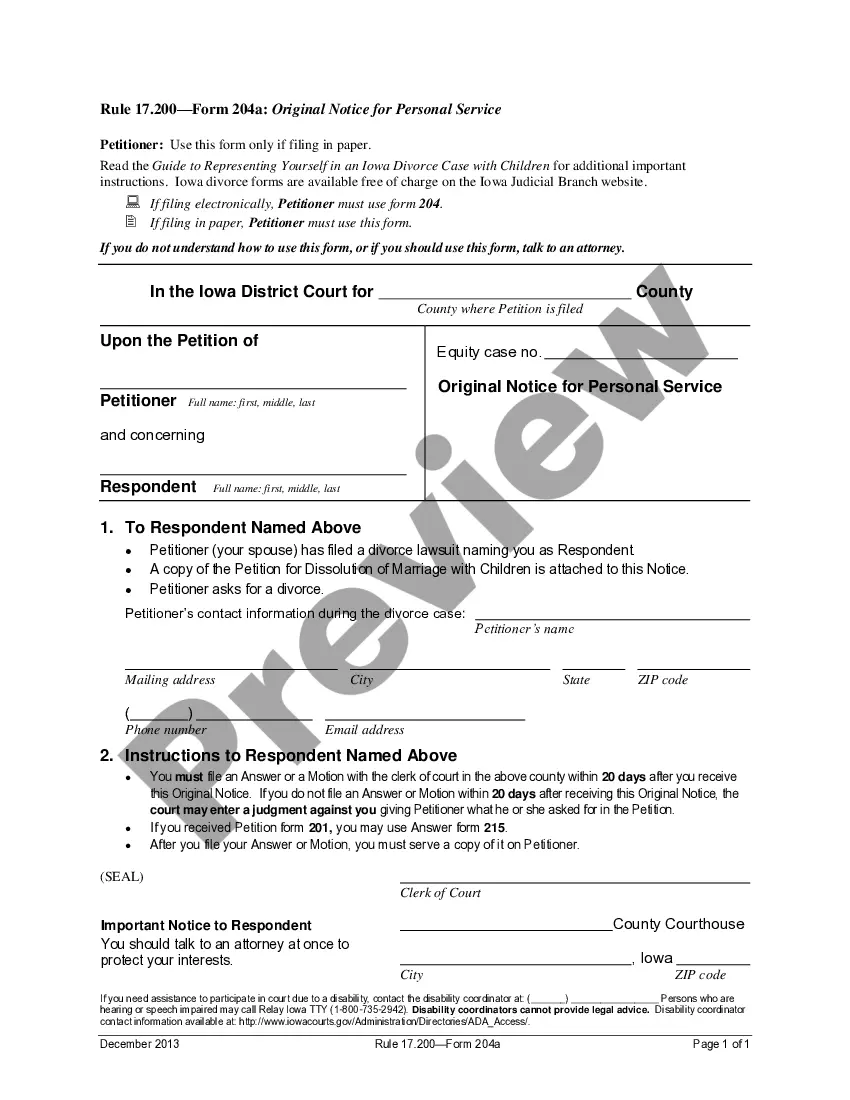

Sample Letter for Bringing Account Current

Description Bring Account Current

How to fill out Letter Bringing Account Form Statement?

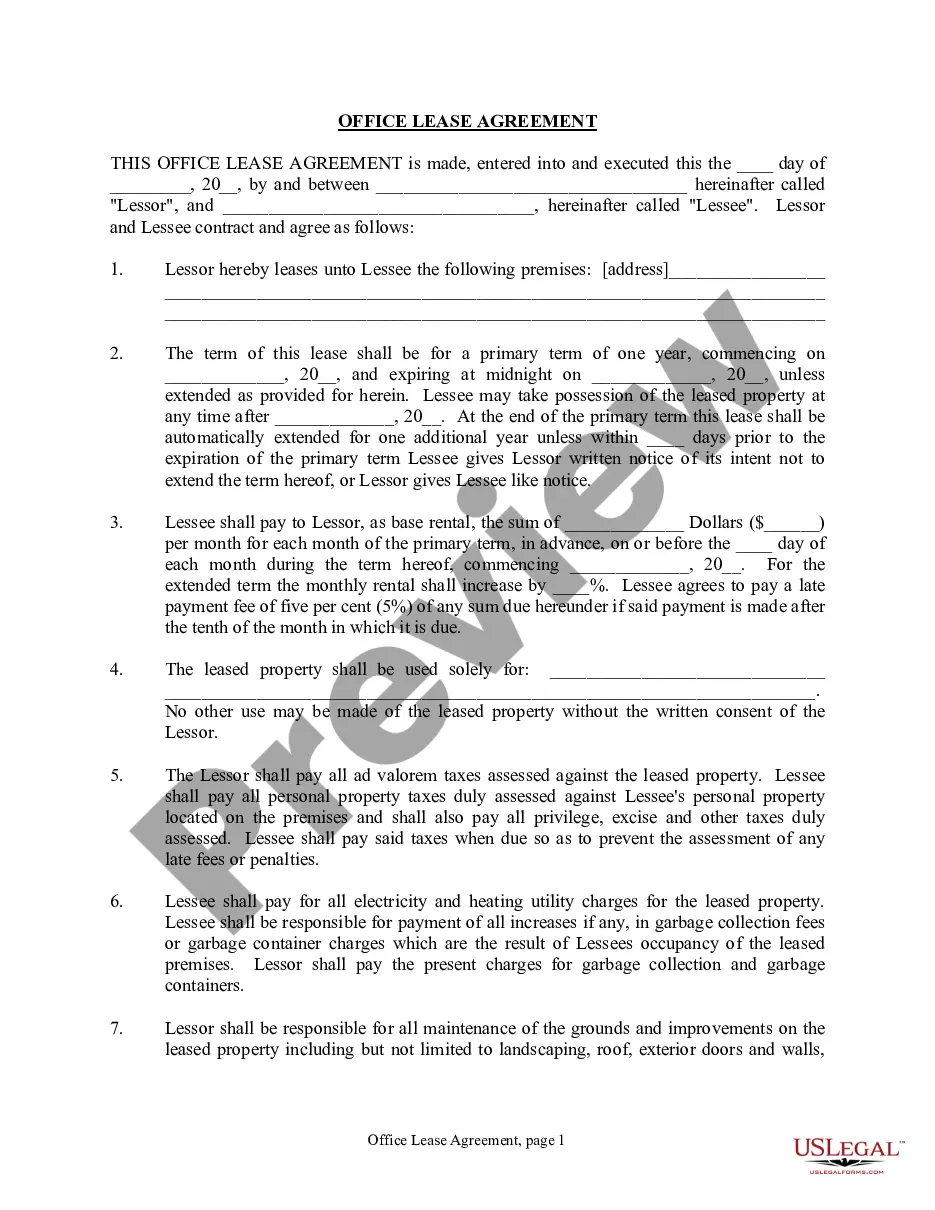

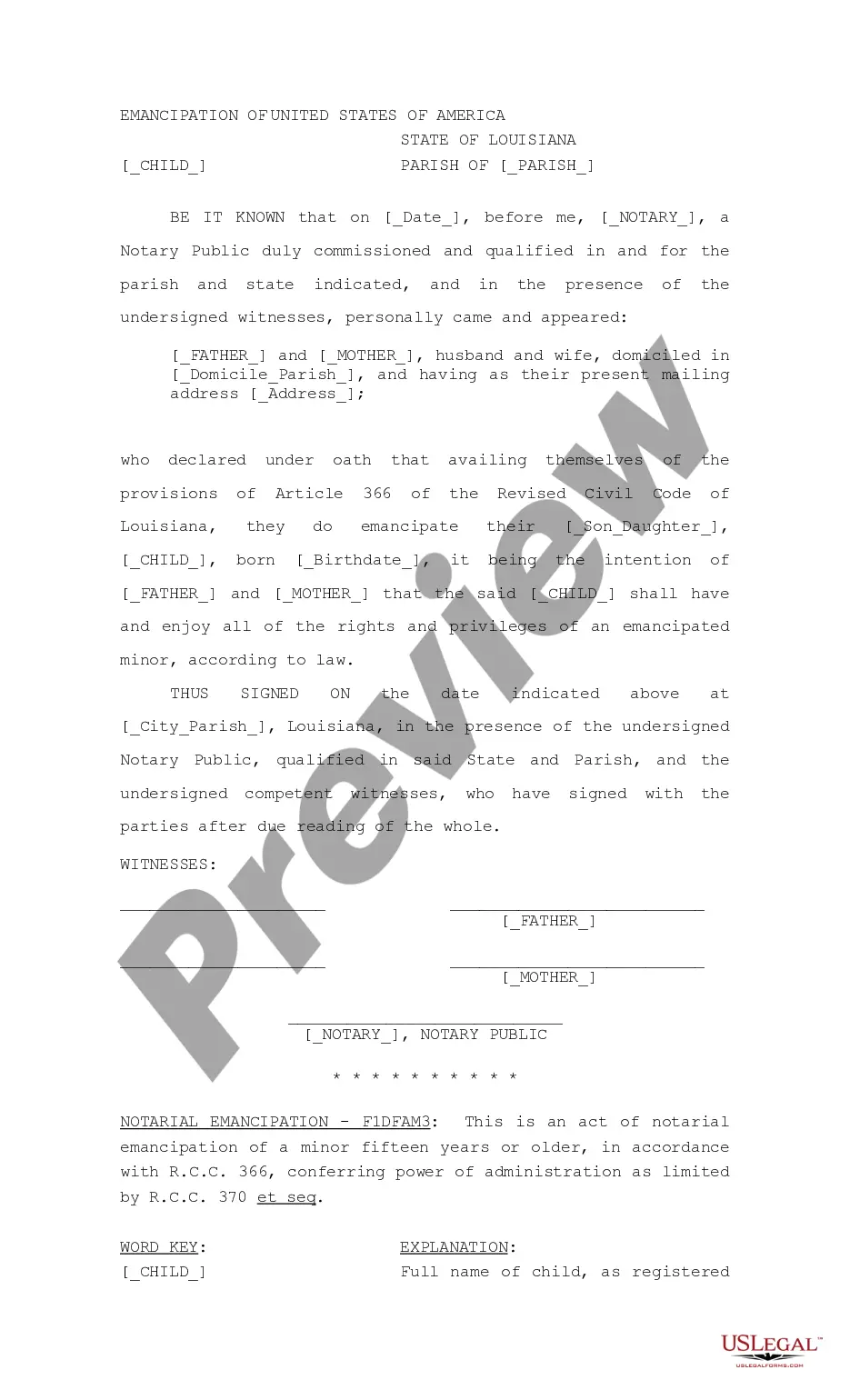

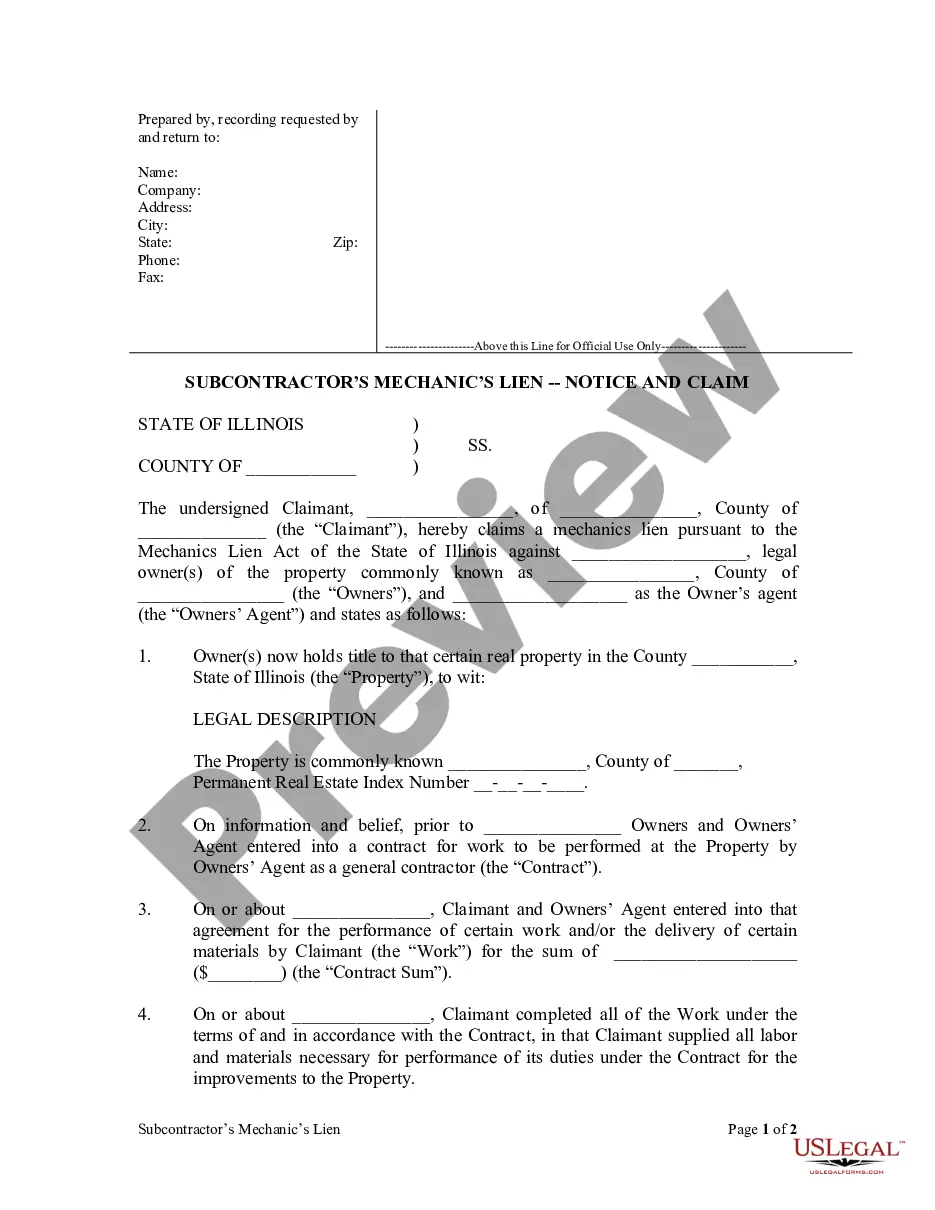

Use US Legal Forms to obtain a printable Sample Letter for Bringing Account Current. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most complete Forms library online and offers cost-effective and accurate templates for customers and legal professionals, and SMBs. The documents are categorized into state-based categories and a number of them can be previewed prior to being downloaded.

To download templates, customers must have a subscription and to log in to their account. Click Download next to any form you need and find it in My Forms.

For people who do not have a subscription, follow the following guidelines to easily find and download Sample Letter for Bringing Account Current:

- Check out to make sure you have the correct form with regards to the state it’s needed in.

- Review the form by looking through the description and by using the Preview feature.

- Click Buy Now if it is the document you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Use the Search engine if you want to get another document template.

US Legal Forms offers thousands of legal and tax samples and packages for business and personal needs, including Sample Letter for Bringing Account Current. Over three million users have already used our platform successfully. Select your subscription plan and get high-quality documents in just a few clicks.

Letter Bank Account Change Form popularity

Bringing Account Current Other Form Names

Sample Letter Account Form Document FAQ

Pay the Entire Past-Due Balance. DNY59 / Getty Images. Catch Up. Negotiate a Pay for Delete. Consolidate the Account. Settle the Account. File for Bankruptcy. Seek Consumer Credit Counseling.

Create an accounts receivable aging report. Act quickly. Consider working out a payment plan. Send past-due notices and letters. Call in the cavalry.

If you've fallen behind on your credit card or loan payments, your lender may talk to you about "bringing your account current." That's another way of saying that you make a payment large enough to satisfy any past due balance that's accumulated since you made your last payment.

When a debtor stops paying and the number of days since the most recent payment reaches 120 days, the account is no longer considered current and the creditor is required to write-off the debt. This doesn't mean the debtor is no longer responsible for the loan or that the debt is forgiven.

A late payment, also known as a delinquency, will typically fall off your credit reports seven years from the original delinquency date. For example: If you had a 30-day late payment reported in June 2017 and bring the account current in July 2017, the late payment would drop off your reports in June 2024.

An indicator of stage of an invoice in relation to the payment. There are six different payment statuses: payment not submitted, payment submitted, payment authorized, payment in manual review, payment cleared and payment failed.

The account current is a summary statement detailing the financial performance of an individual insurance agent's business over a specified period.The account current is the basis for the paper trail as premiums paid by policyholders travel between insurance provider, agencies, and agents.

Re: What mean ( Pay status: current) if the account is closed. Current is what you want on accounts. If an account is marked "current" the baddies drop off at 7 years and continues to report as a positive TL.