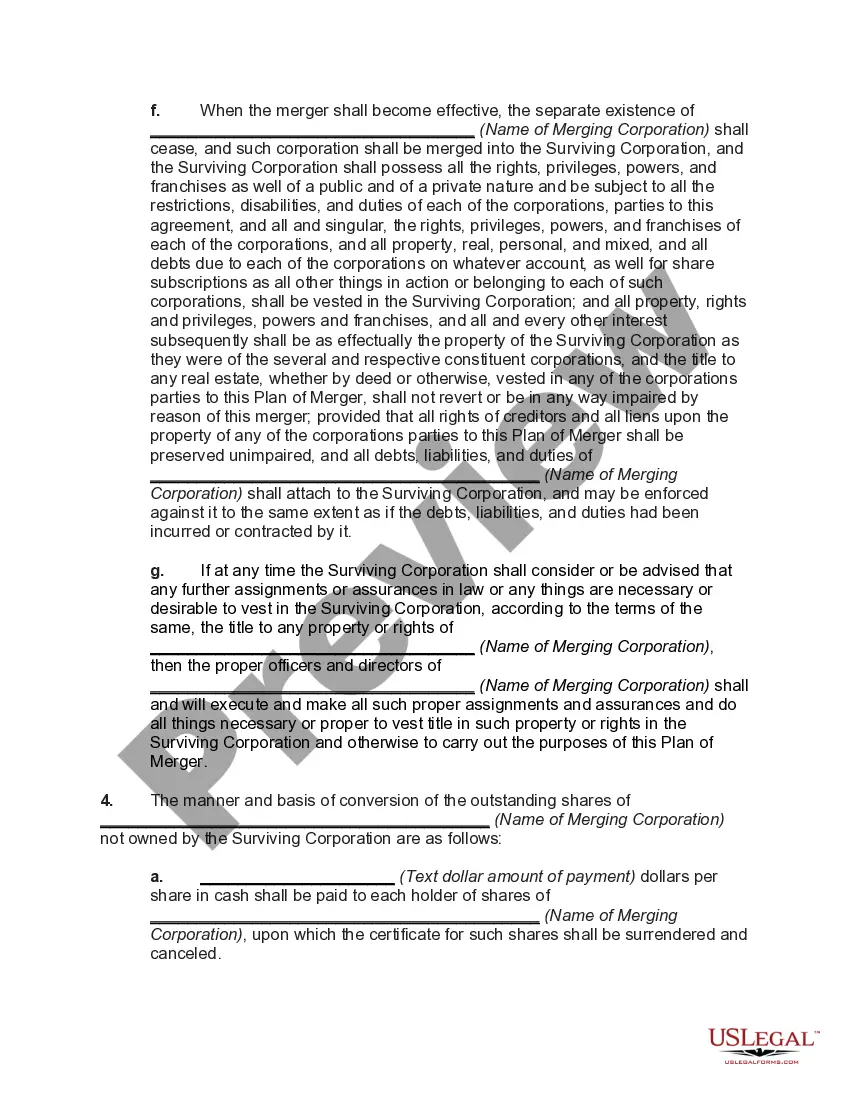

A Plan of Merger with Conversion of Outstanding Shares by Payment in Cash to Shareholders of Merging Corporation is an agreement between two companies whereby one company, the merging corporation, acquires the assets and liabilities of another company, the merging entity, in exchange for cash payments to the shareholders of the merging corporation. This type of merger is a common way for a large company to acquire a smaller company in order to increase its market share and expand its operations. There are two types of Plan of Merger with Conversion of Outstanding Shares by Payment in Cash to Shareholders of Merging Corporation. The first type is known as a stock-for-cash merger, which is an exchange of stock in the merging corporation for cash payments to its shareholders. The second type is known as a cash-for-stocks merger, which is an exchange of cash to the shareholders of the merging corporation in exchange for their shares. In both cases, the shareholders of the merging corporation receive payments in cash in exchange for their shares, and the merging corporation absorbs the assets and liabilities of the merging entity. Once the merger is complete, the merging corporation is the sole owner of the merged company and is responsible for its operations.

Plan of Merger with Conversion of Outstanding Shares by Payment in Cash to Shareholders of Merging Corporation

Description

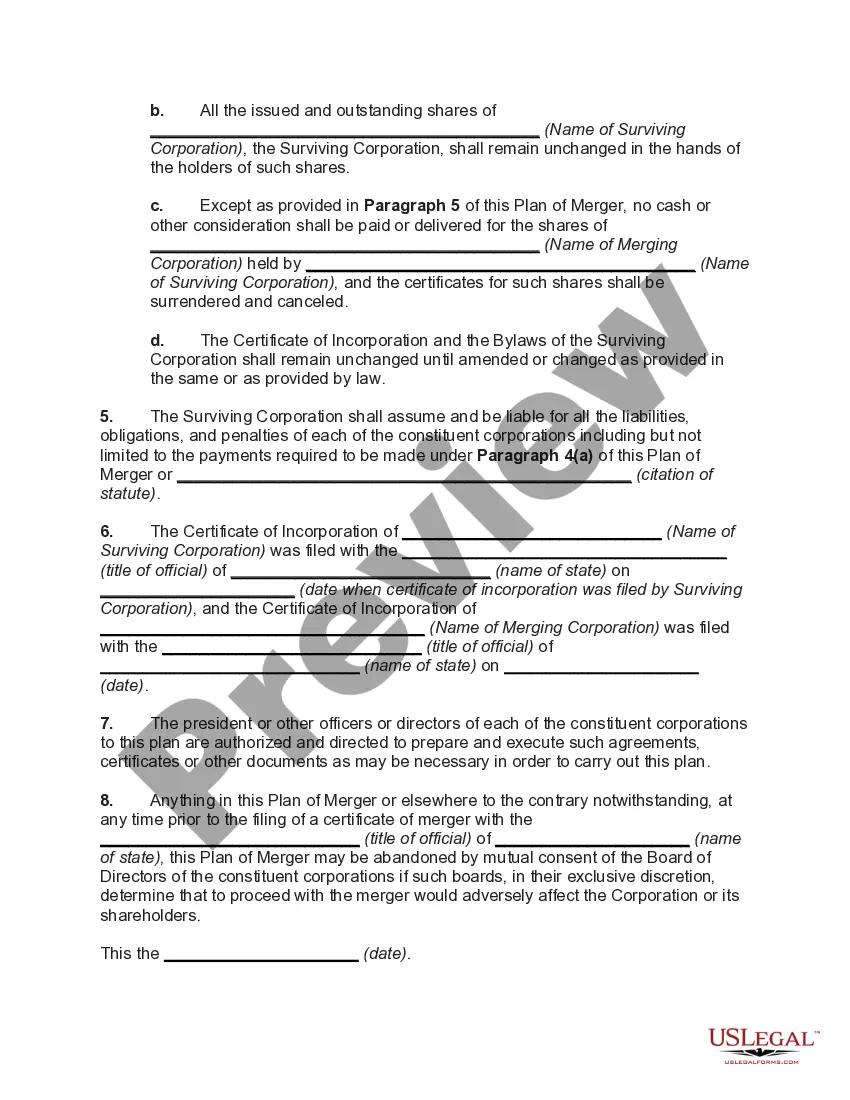

How to fill out Plan Of Merger With Conversion Of Outstanding Shares By Payment In Cash To Shareholders Of Merging Corporation?

If you’re looking for a way to properly prepare the Plan of Merger with Conversion of Outstanding Shares by Payment in Cash to Shareholders of Merging Corporation without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every private and business scenario. Every piece of paperwork you find on our online service is created in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Follow these simple instructions on how to acquire the ready-to-use Plan of Merger with Conversion of Outstanding Shares by Payment in Cash to Shareholders of Merging Corporation:

- Make sure the document you see on the page complies with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Enter the form name in the Search tab on the top of the page and choose your state from the list to locate an alternative template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Sign up for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your Plan of Merger with Conversion of Outstanding Shares by Payment in Cash to Shareholders of Merging Corporation and download it by clicking the appropriate button.

- Import your template to an online editor to complete and sign it quickly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Mergers involve two or more equals, while takeovers involve one larger company that takes over a smaller company. Mergers are always agreed upon using mutual consent, while acquisitions may or may not be friendly. Merged companies choose a new name, while acquired companies often use the parent company's name.

Purchase Mergers As the name suggests, this kind of merger occurs when one company purchases another company. The purchase is made with cash or through the issue of some kind of debt instrument. The sale is taxable, which attracts the acquiring companies, who enjoy the tax benefits.

Conversions are like mergers in that the converted entity has all the duties, debts, obligations, and resources as the old entity. The converted entity is deemed to have existed without interruption and will have the same formation date as the old entity with a new entity type or home state.

Horizontal Merger A merger occurring between companies in the same industry. Horizontal merger is a business consolidation that occurs between firms who operate in the same space, often as competitors offering the same good or service.

A prominent example of a vertical merger is the merger between eBay and PayPal. eBay provides a platform that allows people to sell items, while PayPal allows buyers to pay for these items. This kind of merger can greatly increase efficiency.

The three main types of mergers are: Horizontal. Vertical. Concentric.

An occasion when two or more companies join and where the buying company buys the other company's shares with cash, rather than exchanging them for its own shares: The company proposed a cash merger valued at $170 million with a manufacturer of industrial machine parts. Want to learn more?

Example #1 sells steel products, and PQR Ltd. sells steel at the retail level to individuals. In this example, there can be a horizontal merger between these two companies to create synergy and increase the revenues and market shares of the group.