Sample Letter for Request for IRS not to Off Set against Tax Refund

Description Example Of Hardship Letter

How to fill out Letter To Irs Sample?

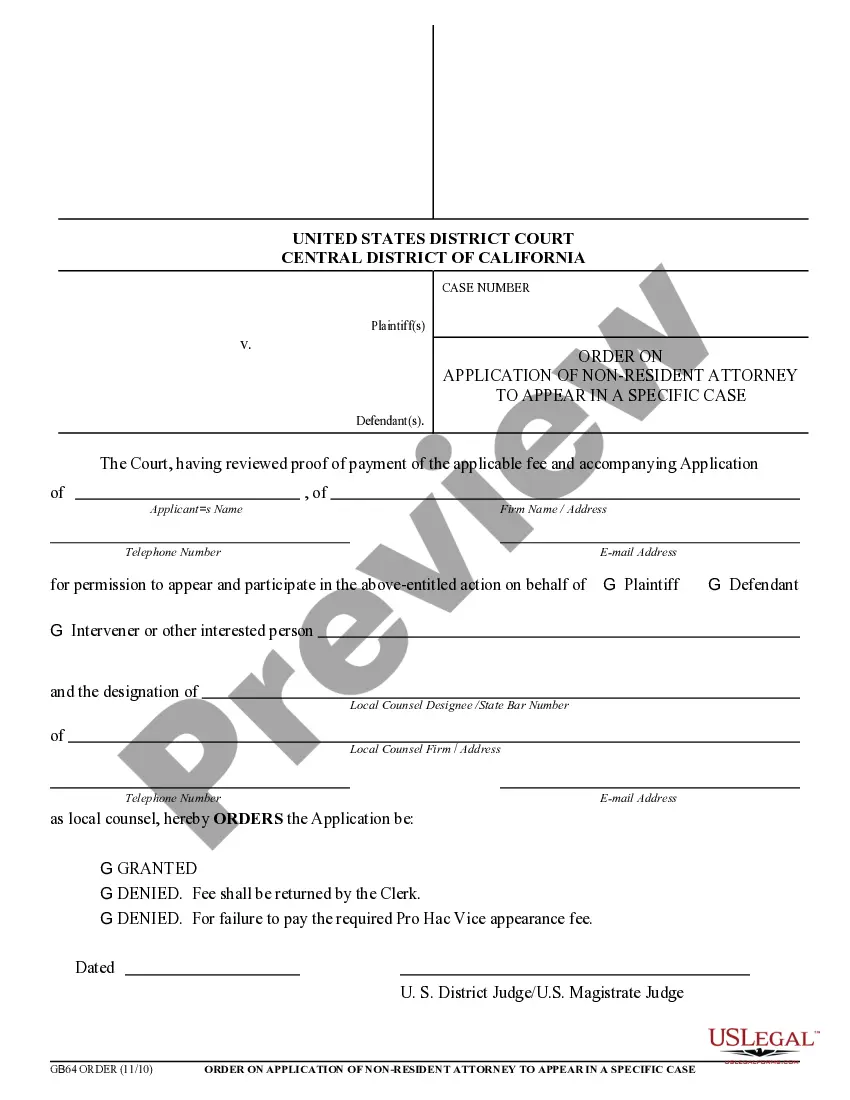

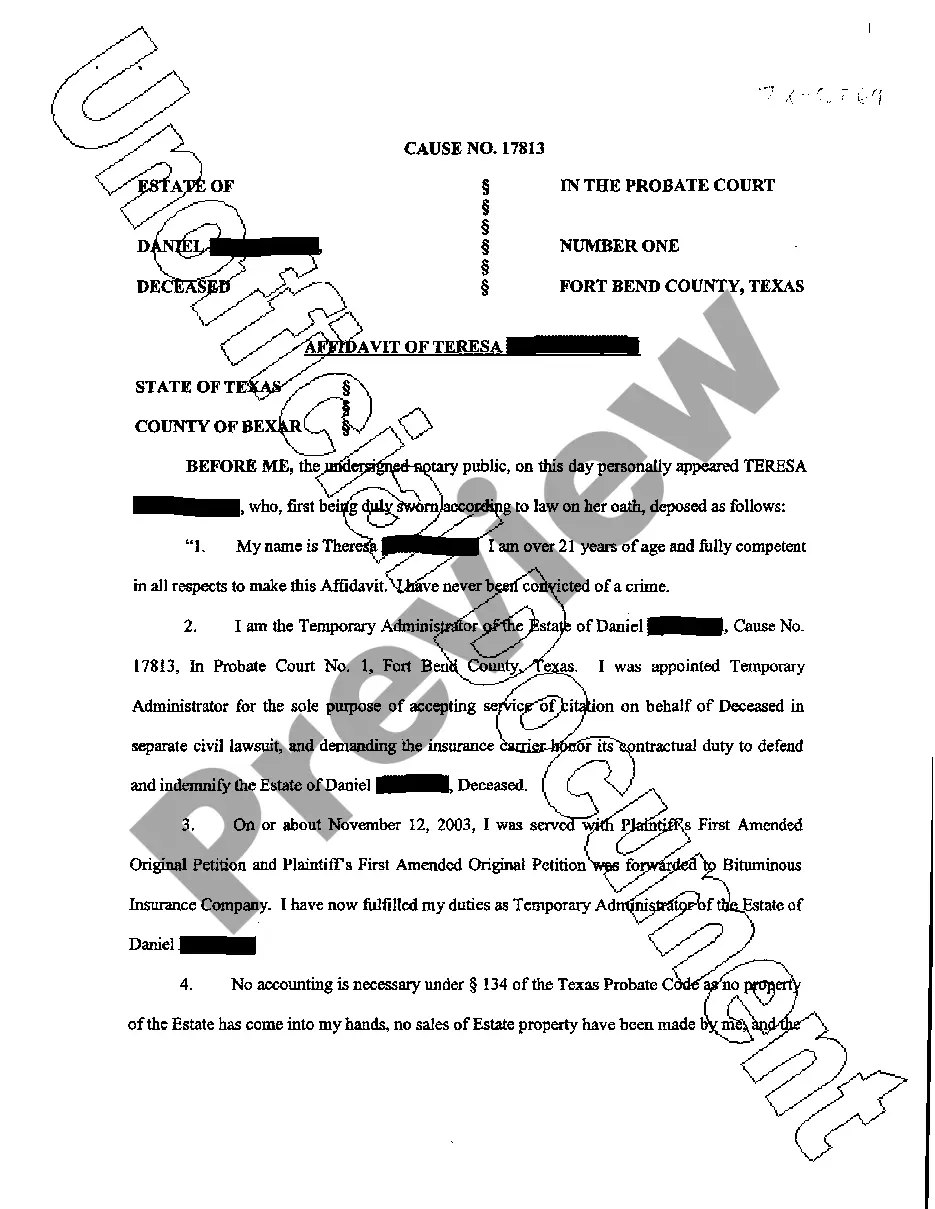

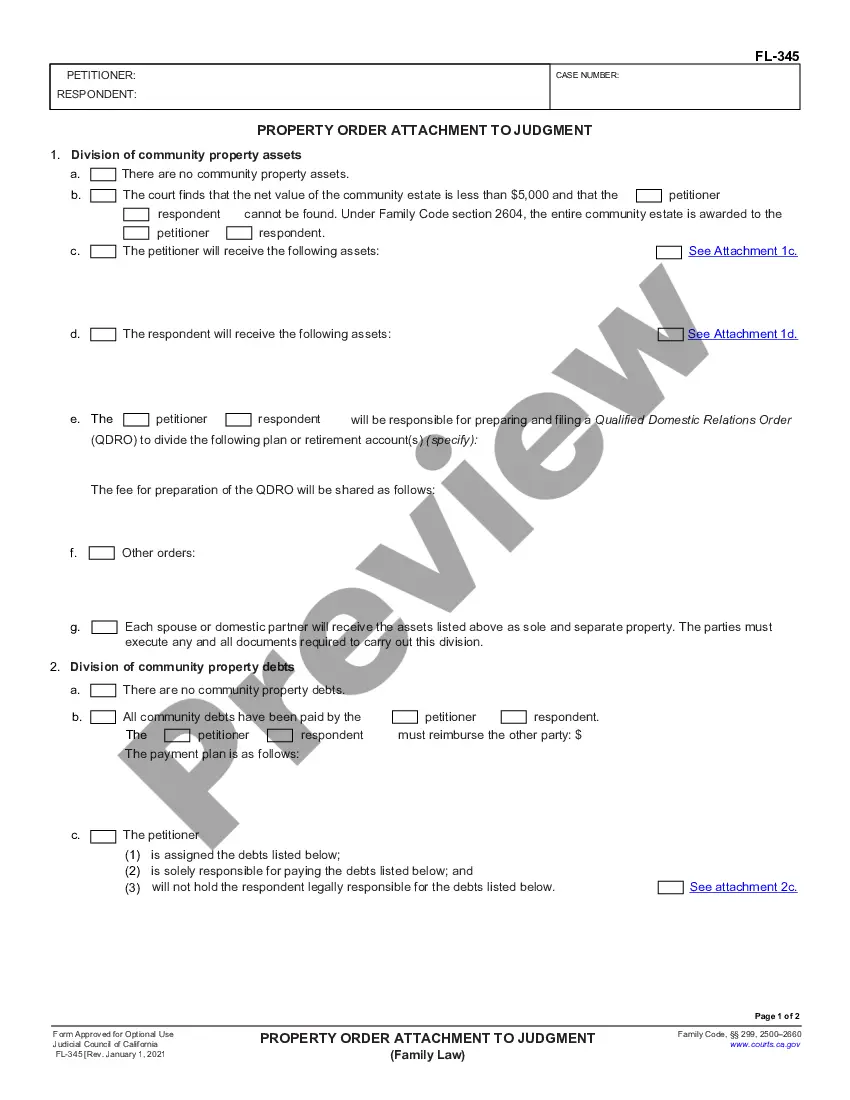

Use US Legal Forms to obtain a printable Sample Letter for Request for IRS not to Off Set against Tax Refund. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most complete Forms library on the web and provides affordable and accurate samples for customers and legal professionals, and SMBs. The templates are categorized into state-based categories and some of them might be previewed prior to being downloaded.

To download samples, customers need to have a subscription and to log in to their account. Hit Download next to any template you need and find it in My Forms.

For those who do not have a subscription, follow the tips below to easily find and download Sample Letter for Request for IRS not to Off Set against Tax Refund:

- Check to ensure that you get the correct form with regards to the state it is needed in.

- Review the form by looking through the description and using the Preview feature.

- Hit Buy Now if it’s the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Make use of the Search engine if you want to find another document template.

US Legal Forms provides a large number of legal and tax templates and packages for business and personal needs, including Sample Letter for Request for IRS not to Off Set against Tax Refund. Over three million users have already used our service successfully. Select your subscription plan and get high-quality documents in just a few clicks.

Tax Refund Letter Sample Form popularity

Types Of Irs Letters Other Form Names

Hardship Letter To Irs FAQ

You can contact the Treasury Offset Program at 800-304-3107 for more information. Avoiding or reversing a tax offset after you've been put on notice may not be an easy process, and there is no guarantee you will be successful in your efforts. But if you believe you have a good case, you should try.

Your name, address and a daytime telephone number. A statement that you want to appeal the IRS findings to the Office of Appeals. A copy of the letter you received that shows the proposed change(s) The tax period(s) or year(s) involved. A list of each proposed item with which you disagree.

Call the IRS toll-free at (800) 829-1040, any weekday between 7 a.m. and 7 p.m. In the case that the IRS already sent the payment, you will need to contact the financial institution. If the institution can get the funds, it will return the refund to the IRS.

IRS live phone assistance is extremely limited at this time. For Economic Impact Payment questions, call 800-919-9835.

IRS.gov Where's My Refund? The IRS2Go mobile app. IRS Refund Hotline 800-829-1954. Wait at least 21 days after electronically filing and six weeks after mailing your return to contact the IRS by phone.

IRS Hardship is for taxpayers not able to pay their back taxes. IRS Hardship will not remove the back taxes.You will still owe back taxes. Every year the IRS will mail you a reminder letter regarding taxes owed.

Find your contact to submit the request. Your refund was most likely offset by a guaranty agency or the U.S. Department of Education. Locate the form and check the requirements. Collect your documents and proof. Submit copies of the documents.

In order to qualify for a student loan tax offset hardship refund, you'll need to provide proof of serious financial hardship. Qualifying circumstances might include: You're currently homeless or without residence. You're permanently disabled.

If the IRS fails to make the properly requested OBR before assessment, the IRS can reverse the offset and pay the taxpayer the amount it would have paid based on the taxpayer's demonstrated hardship.