An Agreement for the Transfer of Assets to New, Controlled Corporation (Type D Reorganization) -- Split-off is a legal document outlining the terms and conditions for the transfer of assets from one corporation to a newly created, controlled corporation. This type of agreement is often used as part of a corporate reorganization, or ‘split-off’, when a company splits its operations into two or more businesses. The Agreement for the Transfer of Assets to New, Controlled Corporation (Type D Reorganization) -- Split-off typically covers the following points: -Details of the assets to be transferred, including any intellectual property rights -The date of transfer and the process for completion -Provisions for payment or other consideration in exchange for the assets -Obligations of the transferor and transferee corporations -Any covenants or warranties between the parties -Indemnification provisions -Restrictions on the transfer of assets -Restrictions on the use of the transferred assets Other types of Agreement for the Transfer of Assets to New, Controlled Corporation (Type D Reorganization) include Merger, Consolidation, and Stock Purchase.

Agreement for the Transfer of Assets to New, Controlled Corporation (Type D Reorganization) -- Split-off

Description

How to fill out Agreement For The Transfer Of Assets To New, Controlled Corporation (Type D Reorganization) -- Split-off?

How much time and resources do you often spend on composing official paperwork? There’s a greater opportunity to get such forms than hiring legal experts or spending hours browsing the web for an appropriate template. US Legal Forms is the leading online library that offers professionally drafted and verified state-specific legal documents for any purpose, including the Agreement for the Transfer of Assets to New, Controlled Corporation (Type D Reorganization) -- Split-off.

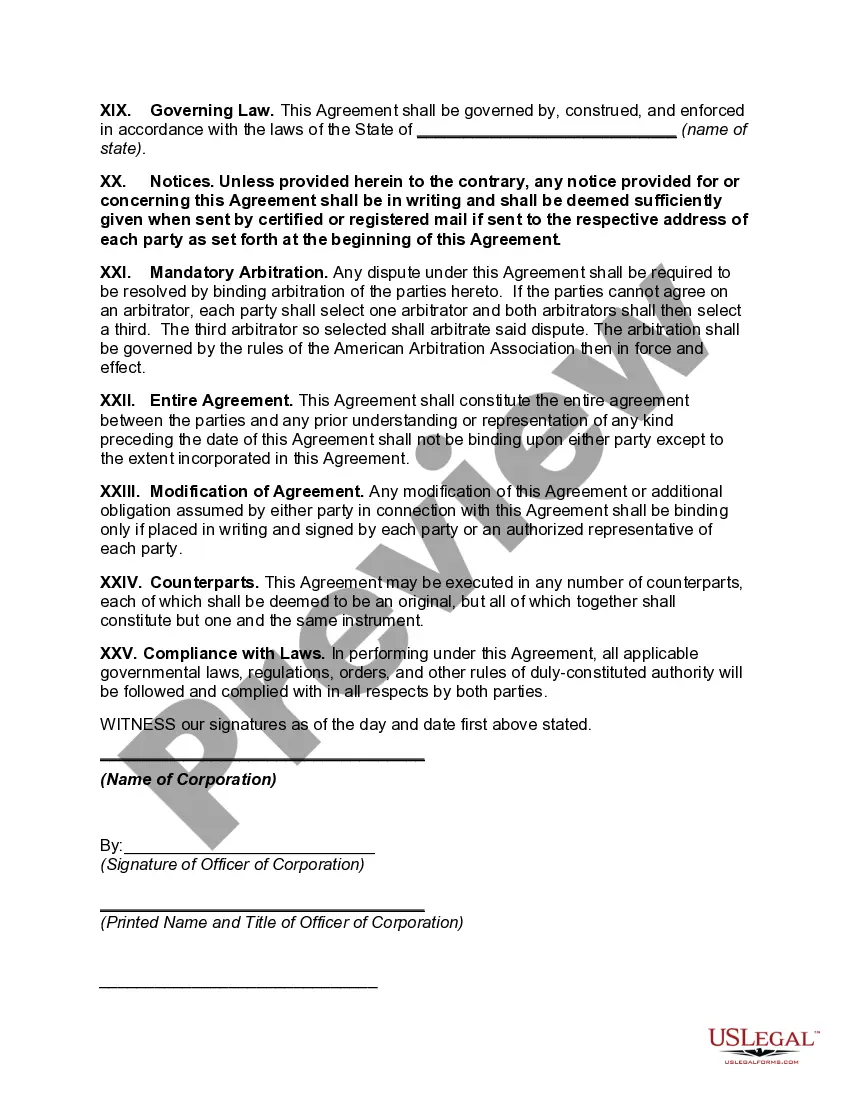

To obtain and complete an appropriate Agreement for the Transfer of Assets to New, Controlled Corporation (Type D Reorganization) -- Split-off template, adhere to these simple steps:

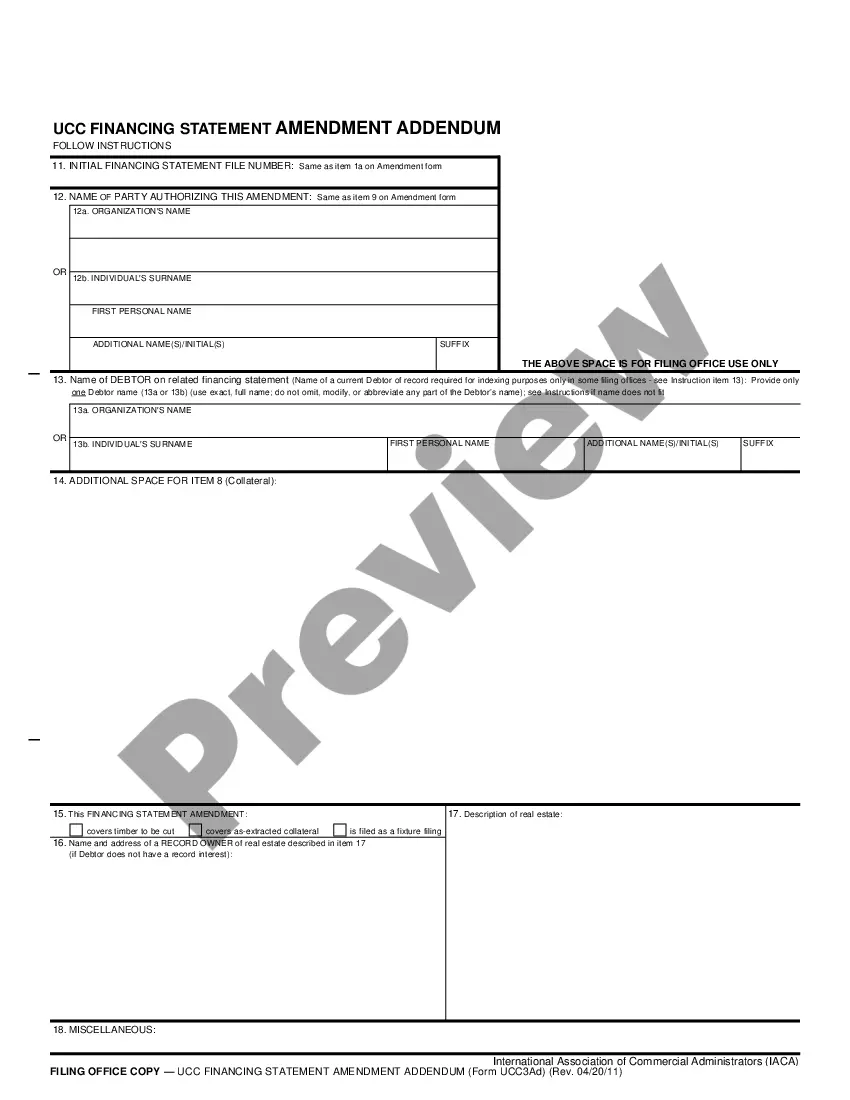

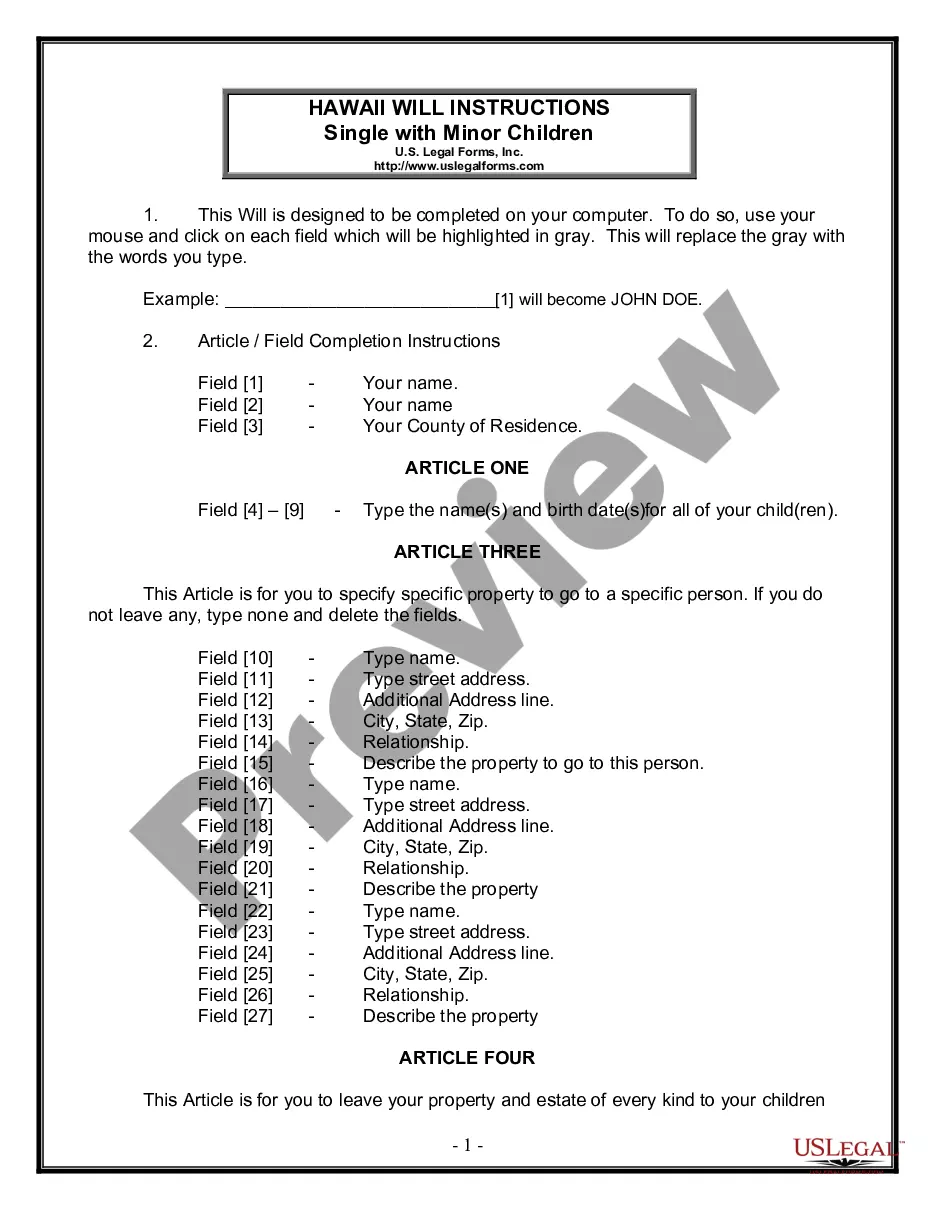

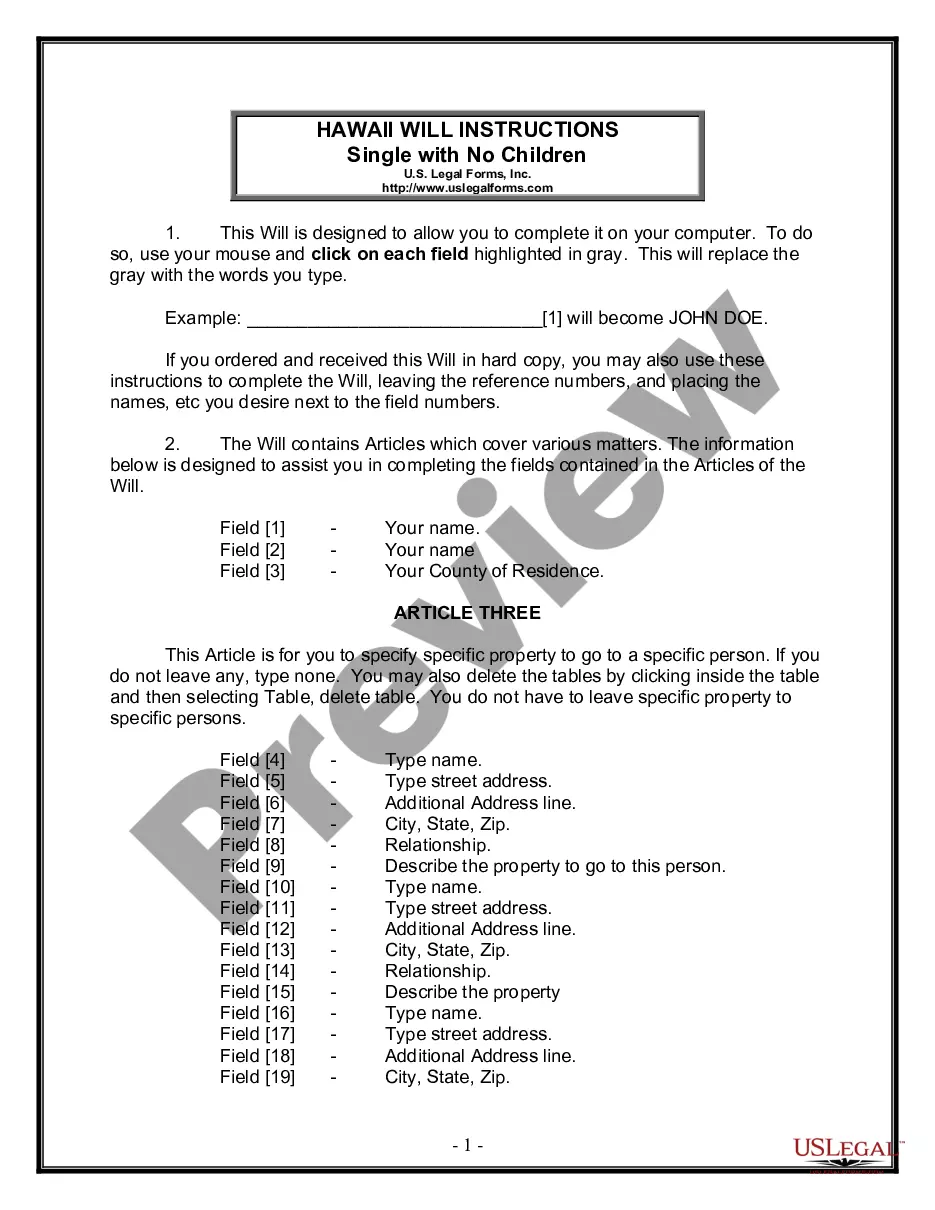

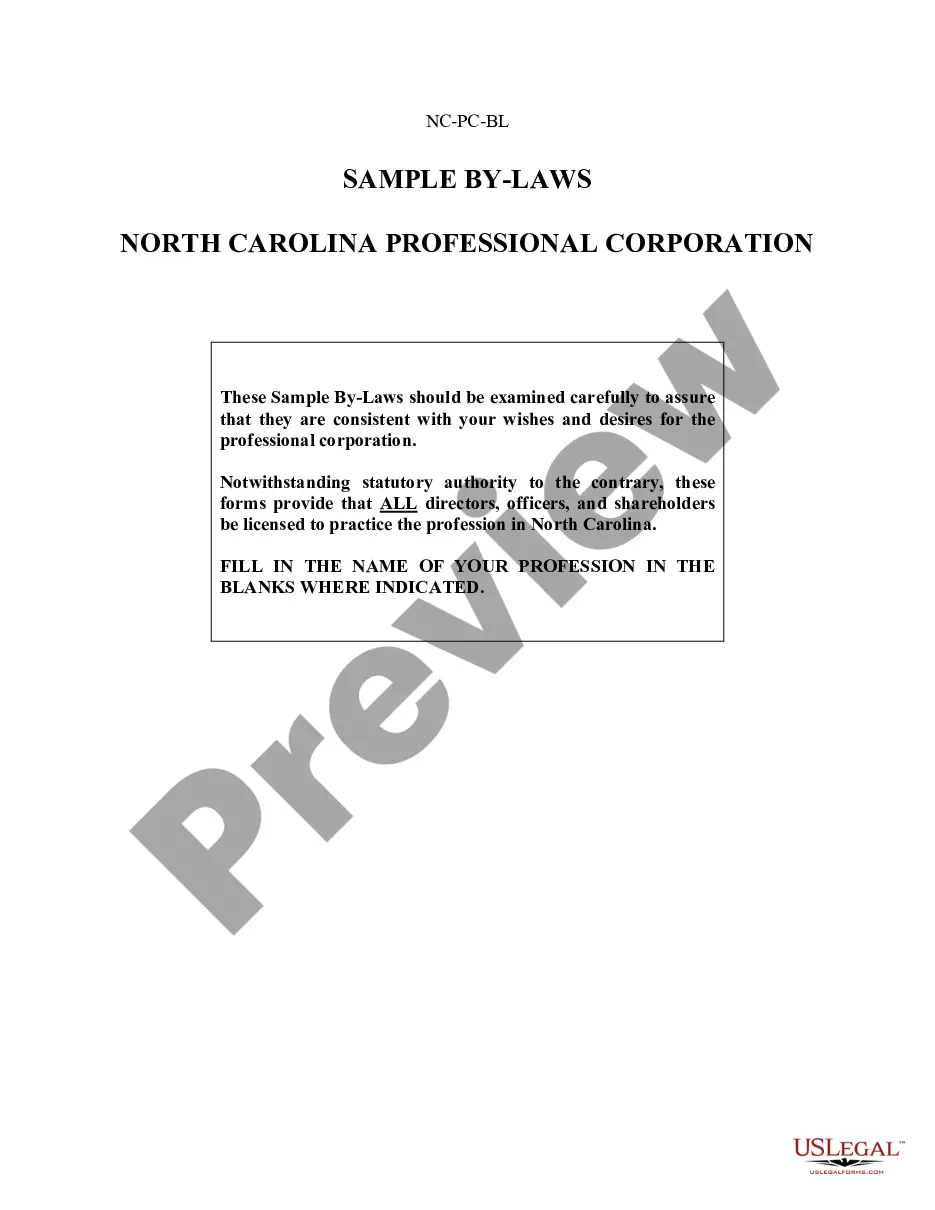

- Examine the form content to make sure it meets your state regulations. To do so, check the form description or utilize the Preview option.

- In case your legal template doesn’t meet your needs, find another one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Agreement for the Transfer of Assets to New, Controlled Corporation (Type D Reorganization) -- Split-off. Otherwise, proceed to the next steps.

- Click Buy now once you find the right document. Opt for the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is totally safe for that.

- Download your Agreement for the Transfer of Assets to New, Controlled Corporation (Type D Reorganization) -- Split-off on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously acquired documents that you securely store in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as frequently as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most trustworthy web solutions. Join us now!

Form popularity

FAQ

merger is when a company splits off one or more divisions to operate independently or be sold off. merger may take place for several reasons, including focusing on a company's core operations and spinning off less relevant business units, to raise capital, or to discourage a hostile takeover.

All cash reorganizations described in section 368(a)(1)(D) (All Cash D Reorganizations) were favored in part because they allowed a CFC to pay cash to its US parent corporation in exchange for the assets of a brother-sister CFC in a transaction that was entirely tax-free to the US parent.

A type A Reorganization is a tax-free merger or consolidation. Generally, in a merger, one corporation (the acquiring corporation) acquires the assets and assumes the liabilities of another corporation (the target corporation) in exchange for its stock.

Section 355 of the Internal Revenue Code (IRC) provides an exemption to these distribution rules, allowing a corporation to spin off or distribute shares of a subsidiary in a transaction that is tax-free to both shareholders and the parent company.

Overview. In a D reorganization, one corporation transfers all or part of its assets to another corporation. Immediately after the transfer, the transferring corporation or one or more of its shareholders must be in control of the corporation that acquired the assets.

A Type D reorganization involves a transfer of assets between corporations. Immediately after the transfer, the transferor corporation or its shareholders must be in control of the corporation to which the assets are transferred (Sec.

and acquisitive Dreorganizations are both ?asset? reorgani zations and are both acquisitive in nature. Thus, the tax analysis of both of these types of reorganizations is very similar. A difference, however, is that reorgani zations have the solely for voting stock requirement and Dreorganizations do not.